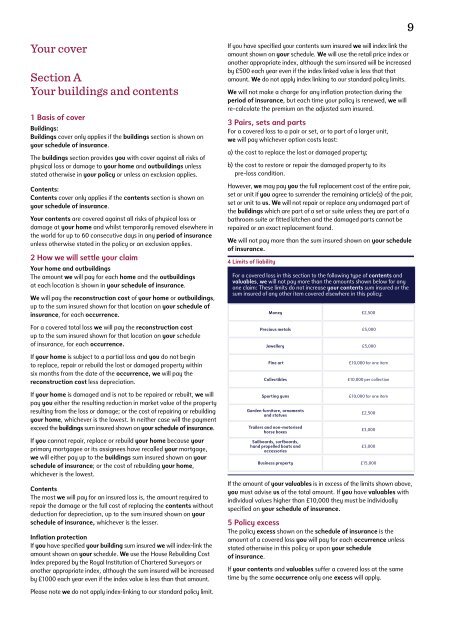

9Your coverSection AYour buildings and contents1 Basis of coverBuildings:Buildings cover only applies if <strong>the</strong> buildings section is shown onyour schedule of insurance.The buildings section provides you with cover against all risks ofphysical loss or damage to your home and outbuildings unlessstated o<strong>the</strong>rwise in your <strong>policy</strong> or unless an exclusion applies.Contents:Contents cover only applies if <strong>the</strong> contents section is shown onyour schedule of insurance.Your contents are covered against all risks of physical loss ordamage at your home and whilst temporarily removed elsewhere in<strong>the</strong> world for up to 60 consecutive days in any period of insuranceunless o<strong>the</strong>rwise stated in <strong>the</strong> <strong>policy</strong> or an exclusion applies.2 How we will settle your claimYour home and outbuildingsThe amount we will pay for each home and <strong>the</strong> outbuildingsat each location is shown in your schedule of insurance.We will pay <strong>the</strong> reconstruction cost of your home or outbuildings,up to <strong>the</strong> sum insured shown for that location on your schedule ofinsurance, for each occurrence.For a covered total loss we will pay <strong>the</strong> reconstruction costup to <strong>the</strong> sum insured shown for that location on your scheduleof insurance, for each occurrence.If your home is subject to a partial loss and you do not beginto replace, repair or rebuild <strong>the</strong> lost or damaged property withinsix months from <strong>the</strong> date of <strong>the</strong> occurrence, we will pay <strong>the</strong>reconstruction cost less depreciation.If your home is damaged and is not to be repaired or rebuilt, we willpay you ei<strong>the</strong>r <strong>the</strong> resulting reduction in market value of <strong>the</strong> propertyresulting from <strong>the</strong> loss or damage; or <strong>the</strong> cost of repairing or rebuildingyour home, whichever is <strong>the</strong> lowest. In nei<strong>the</strong>r case will <strong>the</strong> paymentexceed <strong>the</strong> buildings sum insured shown on your schedule of insurance.If you cannot repair, replace or rebuild your home because yourprimary mortgagee or its assignees have recalled your mortgage,we will ei<strong>the</strong>r pay up to <strong>the</strong> buildings sum insured shown on yourschedule of insurance; or <strong>the</strong> cost of rebuilding your home,whichever is <strong>the</strong> lowest.ContentsThe most we will pay for an insured loss is, <strong>the</strong> amount required torepair <strong>the</strong> damage or <strong>the</strong> full cost of replacing <strong>the</strong> contents withoutdeduction for depreciation, up to <strong>the</strong> sum insured shown on yourschedule of insurance, whichever is <strong>the</strong> lesser.Inflation protectionIf you have specified your building sum insured we will index-link <strong>the</strong>amount shown on your schedule. We use <strong>the</strong> House Rebuilding CostIndex prepared by <strong>the</strong> Royal Institution of Chartered Surveyors orano<strong>the</strong>r appropriate index, although <strong>the</strong> sum insured will be increasedby £1000 each year even if <strong>the</strong> index value is less than that amount.If you have specified your contents sum insured we will index link <strong>the</strong>amount shown on your schedule. We will use <strong>the</strong> retail price index orano<strong>the</strong>r appropriate index, although <strong>the</strong> sum insured will be increasedby £500 each year even if <strong>the</strong> index linked value is less that thatamount. We do not apply index linking to our standard <strong>policy</strong> limits.We will not make a charge for any inflation protection during <strong>the</strong>period of insurance, but each time your <strong>policy</strong> is renewed, we willre-calculate <strong>the</strong> premium on <strong>the</strong> adjusted sum insured.3 Pairs, sets and partsFor a covered loss to a pair or set, or to part of a larger unit,we will pay whichever option costs least:a) <strong>the</strong> cost to replace <strong>the</strong> lost or damaged property;b) <strong>the</strong> cost to restore or repair <strong>the</strong> damaged property to itspre-loss condition.However, we may pay you <strong>the</strong> full replacement cost of <strong>the</strong> entire pair,set or unit if you agree to surrender <strong>the</strong> remaining article(s) of <strong>the</strong> pair,set or unit to us. We will not repair or replace any undamaged part of<strong>the</strong> buildings which are part of a set or suite unless <strong>the</strong>y are part of abathroom suite or fitted kitchen and <strong>the</strong> damaged parts cannot berepaired or an exact replacement found.We will not pay more than <strong>the</strong> sum insured shown on your scheduleof insurance.4 Limits of liabilityFor a covered loss in this section to <strong>the</strong> following type of contents andvaluables, we will not pay more than <strong>the</strong> amounts shown below for anyone claim: These limits do not increase your contents sum insured or <strong>the</strong>sum insured of any o<strong>the</strong>r item covered elsewhere in this <strong>policy</strong>:Money £2,500Precious metals £5,000Jewellery £5,000Fine artCollectiblesSporting gunsGarden furniture, ornamentsand statuesTrailers and non-motorisedhorse boxesSailboards, surfboards,hand propelled boats andaccessories£10,000 for one item£10,000 per collection£10,000 for one item£2,500£3,000£3,000Business property £15,000If <strong>the</strong> amount of your valuables is in excess of <strong>the</strong> limits shown above,you must advise us of <strong>the</strong> total amount. If you have valuables withindividual values higher than £10,000 <strong>the</strong>y must be individuallyspecified on your schedule of insurance.5 Policy excessThe <strong>policy</strong> excess shown on <strong>the</strong> schedule of insurance is <strong>the</strong>amount of a covered loss you will pay for each occurrence unlessstated o<strong>the</strong>rwise in this <strong>policy</strong> or upon your scheduleof insurance.If your contents and valuables suffer a covered loss at <strong>the</strong> sametime by <strong>the</strong> same occurrence only one excess will apply.Please note we do not apply index-linking to our standard <strong>policy</strong> limit.

106 Additional benefitsThese benefits are provided in addition to <strong>the</strong> sum insured shown onyour schedule of insurance unless o<strong>the</strong>rwise stated. Your excessapplies to <strong>the</strong>se covers unless stated o<strong>the</strong>rwise. Cover is subject to<strong>the</strong> General exclusions (refer to page 24) and <strong>the</strong> Limits of Indemnityon page 9.If a loss is covered under more than one section of this <strong>policy</strong>, we willpay you under <strong>the</strong> section giving you <strong>the</strong> most cover, but not undermore than one section.Alternative accommodation expenses, loss of rent and increasedcost of workingIf a covered loss makes your main home noted on <strong>the</strong> schedule ofinsurance uninhabitable, we will cover your reasonable andnecessary costs for alternative accommodation which we haveagreed in advance with you.Payment will continue for <strong>the</strong> shortest reasonable amount of timenecessary to restore your home to a habitable condition or for youto permanently locate elsewhere up to a maximum of two years.Cover also includes reasonable alternative accommodation for yourdomestic pets and horses but only if <strong>the</strong> structure of your main homeitself (and not just its outbuildings) becomes uninhabitable.The maximum amount we will pay for one claim under this sectionwill not exceed ei<strong>the</strong>r <strong>the</strong> buildings or <strong>the</strong> contents sum insured,whichever is <strong>the</strong> greater, on your schedule of insurance.If we provide cover for <strong>the</strong> contents of <strong>the</strong> home, subject to yourclaim being valid, we will also cover <strong>the</strong> cost of temporarily storing<strong>the</strong> contents, when necessary in a professional storage facilityduring this period, providing that we have agreed with you to do soin advance. We will also cover <strong>the</strong> cost of transporting <strong>the</strong> contentsof your home to <strong>the</strong> alternative accommodation.Loss of rentIf a home or part of your home which is rented out to o<strong>the</strong>rs cannotbe lived in because of a covered loss, we will pay you <strong>the</strong> rent youwould have received. We will cover this loss of rent for <strong>the</strong> lesser of<strong>the</strong> following time periods:2 years from <strong>the</strong> date of <strong>the</strong> loss or;<strong>the</strong> reasonable amount of time it takes to repair or rebuild thatpart of <strong>the</strong> home which was rented out, or for you to relocate.We will also cover any rent you would still have to pay as a tenant,including ground rent if any home on your schedule of insurancecannot be lived in due to a covered loss under this <strong>policy</strong>.The maximum amount we will pay for one claim under this sectionwill not exceed <strong>the</strong> buildings or <strong>the</strong> contents sum insured,whichever is <strong>the</strong> greater, on your schedule of insurance.Increased cost of workingWe will pay you for <strong>the</strong> increased cost of carrying on your businessbased at your home caused only and directly;by loss or damage to your home or any o<strong>the</strong>r outbuildingor your contents covered by this <strong>policy</strong> or:<strong>the</strong> accidental failure in <strong>the</strong> supply of gas, water, electricity ortelephone service for more than 72 consecutive hours to yourhome or any outbuildings which are used for your businessduring <strong>the</strong> period of insurance.Cover will start from <strong>the</strong> date on which <strong>the</strong> loss or damage arises or<strong>the</strong> service interruption occurs. It will continue until you are able tostart work in your home or outbuilding within <strong>the</strong> grounds of yourhome but for no more than 12 consecutive months.The most we will pay for any one claim is £15,000. We will pay <strong>the</strong>extra necessary and reasonable costs you have to pay to continueyour business based at your home, less any savings which resultfrom <strong>the</strong> reduced costs and expenses during <strong>the</strong> time your workis interrupted.Buying or selling your homeWhere buildings cover is provided on your schedule of insurance,if you enter into a contract to sell your home, <strong>the</strong> purchaser shall beentitled to <strong>the</strong> benefit of cover under <strong>the</strong> terms of this <strong>policy</strong>. Thisapplies once <strong>the</strong> sale is completed in respect of loss or damageoccurring between <strong>the</strong> period of exchange of contracts (or <strong>the</strong> offerto purchase in Scotland) and <strong>the</strong> completion of <strong>the</strong> sale of <strong>the</strong>home providing <strong>the</strong> home is not insured by <strong>the</strong> purchaser or on<strong>the</strong>ir behalf.Extended contents coverIf, at <strong>the</strong> time of loss or damage, <strong>the</strong> market value of your contentshave increased beyond <strong>the</strong> sum insured on your schedule ofinsurance, we will pay up to 125% of <strong>the</strong> sum insured provided that:a walk through validation exercise has been undertaken by aprofessional valuer or appraiser to assess <strong>the</strong> overall value of yourcontents or you can submit a professional valuation to us which isno more than two years old.Your contents sum insured has to be increased from <strong>the</strong> date of <strong>the</strong>validation or valuation and <strong>the</strong> full additional premium paid for thiscover to operate.Construction materialsWhere buildings cover is provided on your schedule of insurancewe will cover up to £25,000 for works, materials and supplies ownedby you within <strong>the</strong> grounds of your home for use in <strong>the</strong> construction,alteration or repair of your home. You must inform us before <strong>the</strong>work proceeds if <strong>the</strong> total cost of <strong>the</strong> building work exceeds £25,000.These payments apply only to a covered loss and <strong>the</strong>y do notincrease <strong>the</strong> amount of cover for your home.Contents belonging to domestic staff and guestsWhere contents cover is provided on your schedule of insurance,we cover <strong>the</strong> contents belonging to your domestic staff whopermanently reside in your home and invited guests while <strong>the</strong>y areon <strong>the</strong> premises of any home named on your schedule ofinsurance. The maximum amount we will pay for loss or damage tojewellery or money owned by <strong>the</strong>m or items that are covered byo<strong>the</strong>r insurance is £1,000.Data replacementWhere contents cover is provided on your schedule of insurance,we will cover loss to personal or business data stored in yourcomputer at your home or a mobile telephone as a result of acovered loss. We will pay up to £5,000 for <strong>the</strong> replacement by anexternal professional person or body, of personal or business data.We do not cover <strong>the</strong> cost of remaking a file, disk, tape or similar.Emergency entriesWhere buildings cover is provided on your schedule of insurance,we will pay to repair damage to your home and areas oflandscaping caused when <strong>the</strong> emergency service need to accessyour home to combat an emergency.Essential alterationsWhere buildings cover is provided on your schedule of insurance,we will pay up to £10,000 in total for alterations to your home<strong>the</strong>reby allowing you to live unassisted following an accidentduring <strong>the</strong> period of insurance, resulting in <strong>the</strong> permanent loss oflimb(s), loss of eye(s) or hearing, which occurs during <strong>the</strong> periodof insurance.

![[PDF] NatWest Welcome Account](https://img.yumpu.com/50935011/1/124x260/pdf-natwest-welcome-account.jpg?quality=85)

![[PDF] NatWest Welcome Account](https://img.yumpu.com/50820486/1/123x260/pdf-natwest-welcome-account.jpg?quality=85)

![[PDF] Graduate Accounts Application Form - NatWest](https://img.yumpu.com/49773169/1/182x260/pdf-graduate-accounts-application-form-natwest.jpg?quality=85)