International Tax Aspects of Foreign Currency Transactions

International Tax Aspects of Foreign Currency Transactions

International Tax Aspects of Foreign Currency Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

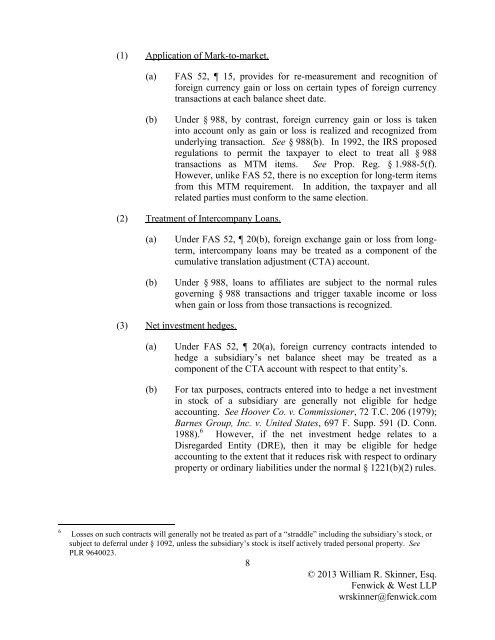

(1) Application <strong>of</strong> Mark-to-market.(a)(b)FAS 52, 15, provides for re-measurement and recognition <strong>of</strong>foreign currency gain or loss on certain types <strong>of</strong> foreign currencytransactions at each balance sheet date.Under § 988, by contrast, foreign currency gain or loss is takeninto account only as gain or loss is realized and recognized fromunderlying transaction. See § 988(b). In 1992, the IRS proposedregulations to permit the taxpayer to elect to treat all § 988transactions as MTM items. See Prop. Reg. § 1.988-5(f).However, unlike FAS 52, there is no exception for long-term itemsfrom this MTM requirement. In addition, the taxpayer and allrelated parties must conform to the same election.(2) Treatment <strong>of</strong> Intercompany Loans.(a)(b)Under FAS 52, 20(b), foreign exchange gain or loss from longterm,intercompany loans may be treated as a component <strong>of</strong> thecumulative translation adjustment (CTA) account.Under § 988, loans to affiliates are subject to the normal rulesgoverning § 988 transactions and trigger taxable income or losswhen gain or loss from those transactions is recognized.(3) Net investment hedges.(a)(b)Under FAS 52, 20(a), foreign currency contracts intended tohedge a subsidiary’s net balance sheet may be treated as acomponent <strong>of</strong> the CTA account with respect to that entity’s.For tax purposes, contracts entered into to hedge a net investmentin stock <strong>of</strong> a subsidiary are generally not eligible for hedgeaccounting. See Hoover Co. v. Commissioner, 72 T.C. 206 (1979);Barnes Group, Inc. v. United States, 697 F. Supp. 591 (D. Conn.1988). 6 However, if the net investment hedge relates to aDisregarded Entity (DRE), then it may be eligible for hedgeaccounting to the extent that it reduces risk with respect to ordinaryproperty or ordinary liabilities under the normal § 1221(b)(2) rules.6Losses on such contracts will generally not be treated as part <strong>of</strong> a “straddle” including the subsidiary’s stock, orsubject to deferral under § 1092, unless the subsidiary’s stock is itself actively traded personal property. SeePLR 9640023.8© 2013 William R. Skinner, Esq.Fenwick & West LLPwrskinner@fenwick.com