International Tax Aspects of Foreign Currency Transactions

International Tax Aspects of Foreign Currency Transactions

International Tax Aspects of Foreign Currency Transactions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

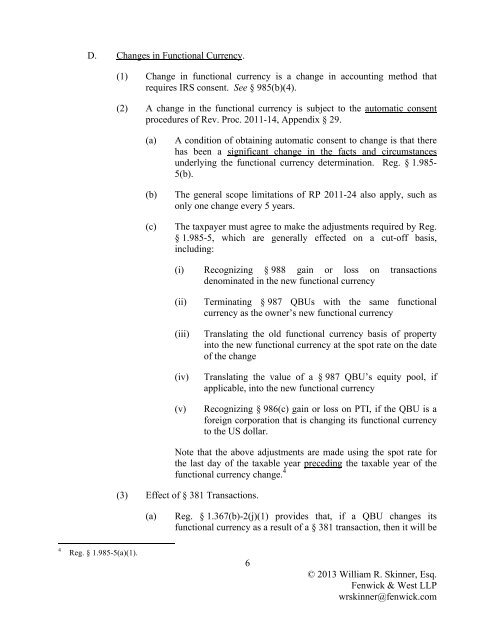

D. Changes in Functional <strong>Currency</strong>.(1) Change in functional currency is a change in accounting method thatrequires IRS consent. See § 985(b)(4).(2) A change in the functional currency is subject to the automatic consentprocedures <strong>of</strong> Rev. Proc. 2011-14, Appendix § 29.(a)(b)(c)A condition <strong>of</strong> obtaining automatic consent to change is that therehas been a significant change in the facts and circumstancesunderlying the functional currency determination. Reg. § 1.985-5(b).The general scope limitations <strong>of</strong> RP 2011-24 also apply, such asonly one change every 5 years.The taxpayer must agree to make the adjustments required by Reg.§ 1.985-5, which are generally effected on a cut-<strong>of</strong>f basis,including:(i) Recognizing § 988 gain or loss on transactionsdenominated in the new functional currency(ii)(iii)(iv)(v)Terminating § 987 QBUs with the same functionalcurrency as the owner’s new functional currencyTranslating the old functional currency basis <strong>of</strong> propertyinto the new functional currency at the spot rate on the date<strong>of</strong> the changeTranslating the value <strong>of</strong> a § 987 QBU’s equity pool, ifapplicable, into the new functional currencyRecognizing § 986(c) gain or loss on PTI, if the QBU is aforeign corporation that is changing its functional currencyto the US dollar.Note that the above adjustments are made using the spot rate forthe last day <strong>of</strong> the taxable year preceding the taxable year <strong>of</strong> thefunctional currency change. 4(3) Effect <strong>of</strong> § 381 <strong>Transactions</strong>.(a)Reg. § 1.367(b)-2(j)(1) provides that, if a QBU changes itsfunctional currency as a result <strong>of</strong> a § 381 transaction, then it will be4Reg. § 1.985-5(a)(1).6© 2013 William R. Skinner, Esq.Fenwick & West LLPwrskinner@fenwick.com