International Tax Aspects of Foreign Currency Transactions

International Tax Aspects of Foreign Currency Transactions

International Tax Aspects of Foreign Currency Transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

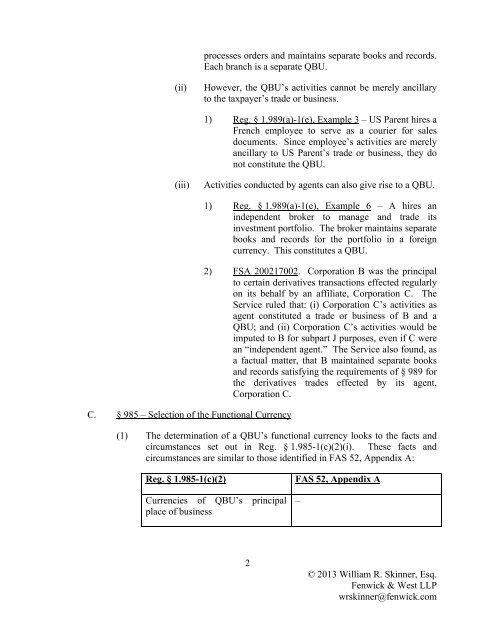

processes orders and maintains separate books and records.Each branch is a separate QBU.(ii)However, the QBU’s activities cannot be merely ancillaryto the taxpayer’s trade or business.1) Reg. § 1.989(a)-1(e), Example 3 – US Parent hires aFrench employee to serve as a courier for salesdocuments. Since employee’s activities are merelyancillary to US Parent’s trade or business, they donot constitute the QBU.(iii)Activities conducted by agents can also give rise to a QBU.C. § 985 – Selection <strong>of</strong> the Functional <strong>Currency</strong>1) Reg. § 1.989(a)-1(e), Example 6 – A hires anindependent broker to manage and trade itsinvestment portfolio. The broker maintains separatebooks and records for the portfolio in a foreigncurrency. This constitutes a QBU.2) FSA 200217002. Corporation B was the principalto certain derivatives transactions effected regularlyon its behalf by an affiliate, Corporation C. TheService ruled that: (i) Corporation C’s activities asagent constituted a trade or business <strong>of</strong> B and aQBU; and (ii) Corporation C’s activities would beimputed to B for subpart J purposes, even if C werean “independent agent.” The Service also found, asa factual matter, that B maintained separate booksand records satisfying the requirements <strong>of</strong> § 989 forthe derivatives trades effected by its agent,Corporation C.(1) The determination <strong>of</strong> a QBU’s functional currency looks to the facts andcircumstances set out in Reg. § 1.985-1(c)(2)(i). These facts andcircumstances are similar to those identified in FAS 52, Appendix A:Reg. § 1.985-1(c)(2)Currencies <strong>of</strong> QBU’s principalplace <strong>of</strong> businessFAS 52, Appendix A–2© 2013 William R. Skinner, Esq.Fenwick & West LLPwrskinner@fenwick.com