International Tax Aspects of Foreign Currency Transactions

International Tax Aspects of Foreign Currency Transactions

International Tax Aspects of Foreign Currency Transactions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

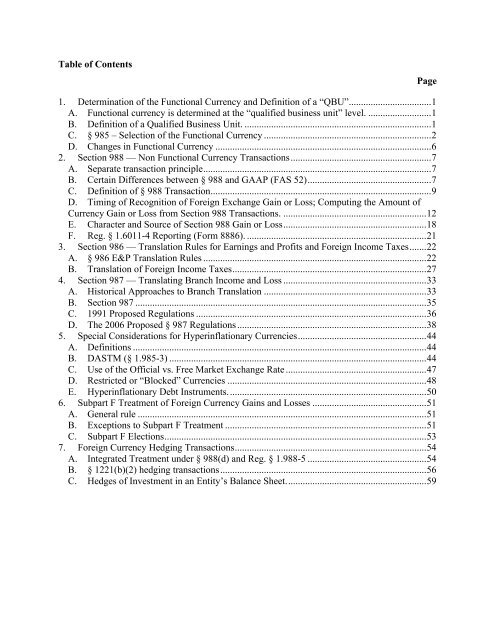

Table <strong>of</strong> ContentsPage1. Determination <strong>of</strong> the Functional <strong>Currency</strong> and Definition <strong>of</strong> a “QBU”..................................1 A. Functional currency is determined at the “qualified business unit” level. ..........................1 B. Definition <strong>of</strong> a Qualified Business Unit. .............................................................................1 C. § 985 – Selection <strong>of</strong> the Functional <strong>Currency</strong> .....................................................................2 D. Changes in Functional <strong>Currency</strong> .........................................................................................6 2. Section 988 — Non Functional <strong>Currency</strong> <strong>Transactions</strong>..........................................................7 A. Separate transaction principle..............................................................................................7 B. Certain Differences between § 988 and GAAP (FAS 52)...................................................7 C. Definition <strong>of</strong> § 988 Transaction...........................................................................................9 D. Timing <strong>of</strong> Recognition <strong>of</strong> <strong>Foreign</strong> Exchange Gain or Loss; Computing the Amount <strong>of</strong><strong>Currency</strong> Gain or Loss from Section 988 <strong>Transactions</strong>. ...........................................................12 E. Character and Source <strong>of</strong> Section 988 Gain or Loss...........................................................18 F. Reg. § 1.6011-4 Reporting (Form 8886). ..........................................................................21 3. Section 986 — Translation Rules for Earnings and Pr<strong>of</strong>its and <strong>Foreign</strong> Income <strong>Tax</strong>es.......22 A. § 986 E&P Translation Rules ............................................................................................22 B. Translation <strong>of</strong> <strong>Foreign</strong> Income <strong>Tax</strong>es................................................................................27 4. Section 987 — Translating Branch Income and Loss ...........................................................33 A. Historical Approaches to Branch Translation ...................................................................33 B. Section 987 ........................................................................................................................35 C. 1991 Proposed Regulations ...............................................................................................36 D. The 2006 Proposed § 987 Regulations ..............................................................................38 5. Special Considerations for Hyperinflationary Currencies.....................................................44 A. Definitions .........................................................................................................................44 B. DASTM (§ 1.985-3) ..........................................................................................................44 C. Use <strong>of</strong> the Official vs. Free Market Exchange Rate ..........................................................47 D. Restricted or “Blocked” Currencies ..................................................................................48 E. Hyperinflationary Debt Instruments..................................................................................50 6. Subpart F Treatment <strong>of</strong> <strong>Foreign</strong> <strong>Currency</strong> Gains and Losses ...............................................51 A. General rule .......................................................................................................................51 B. Exceptions to Subpart F Treatment ...................................................................................51 C. Subpart F Elections............................................................................................................53 7. <strong>Foreign</strong> <strong>Currency</strong> Hedging <strong>Transactions</strong>...............................................................................54 A. Integrated Treatment under § 988(d) and Reg. § 1.988-5 .................................................54 B. § 1221(b)(2) hedging transactions.....................................................................................56 C. Hedges <strong>of</strong> Investment in an Entity’s Balance Sheet..........................................................59