pace under the current market conditions, their weight in total assets at the end of 2011 being54% (2010: 56%).Investments in securities increased by more than 53% in 2011 as compared to the previousyear, due to the increase in liquidity levels and a lower demand for loans.Cash and placements with Banks increased by 7.9% as compared to the preceding year,whereas in 2010 they increased by 4.56% as compared to 2009.Against the background of the financial crisis, tangible and intangible assets registered a slightincrease as compared to 2010, similarly to the year 2010, which showed a slight 6% increase.As at 31 December 2011, debts amounted to lei 23,616,946, 20%higher as compared to theprevious year. This increase is mainly due to the higher volume of client resources, whichexceeded the level recorded in 2010 by 17%. In its turn, 2010 featured increases in debts of10.49% as compared to 2009, due to client resources which were 15.27% higher than in 2009.Borrowings from Banks and other financial institutions escalated by 63% comparatively to2010, whereas in 2010 they decreased by 26.25% versus 2009, due to a sound liquidity of theBank as a result of repeated disbursements made by NBR from the minimum compulsoryreserve and of a slower lending pace.The equity of the Group’s entities increased by 14% as compared to 2010, chiefly due to the19% share capital increase, while in 2010 it increased by 13.70% as compared to 2009, as aconsequence of the 32.66% share capital increase.The gross profit of the Group was 355,429 Th. Lei in 2011, on the increase by 124%comparatively to the preceding year, exclusively due to the diminishment of credit risk. In2010, the gross profit slightly outbalanced that of 2009, considering that 2010 continued topose great challenges to the global economy; the effects of the crisis, as well as the actionstaken by authorities to adjust to the new economic reality were felt within the communities.The operational income amounted to 1,489,713 Th. Lei, slightly falling below the 2010 level,mainly due to lower interest margins.The net interest income fell below the 2010 level by 6%, considering that 2010 continued topose great challenges to the global economy; the effects of the crisis, as well as the actiontaken by authorities to adjust to the new economic reality were felt within the communities.Net fee and commission income increased by 2% versus 2010, particularly because of thepositive evolution of the operating commissions from a larger number of transactions, whereas34

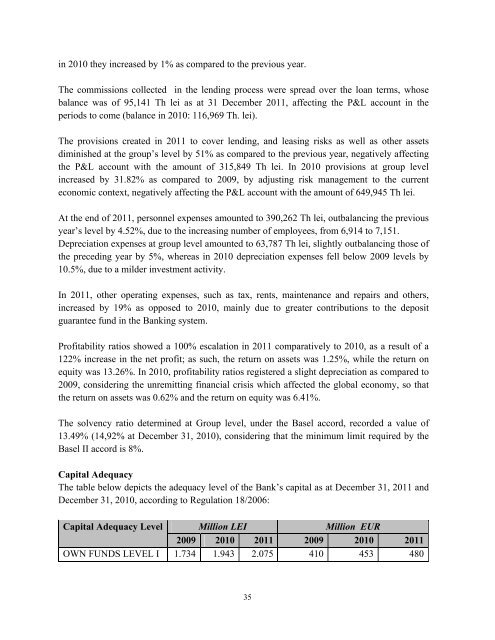

in 2010 they increased by 1% as compared to the previous year.The commissions collected in the lending process were spread over the loan terms, whosebalance was of 95,141 Th lei as at 31 December 2011, affecting the P&L account in theperiods to come (balance in 2010: 116,969 Th. lei).The provisions created in 2011 to cover lending, and leasing risks as well as other assetsdiminished at the group’s level by 51% as compared to the previous year, negatively affectingthe P&L account with the amount of 315,849 Th lei. In 2010 provisions at group levelincreased by 31.82% as compared to 2009, by adjusting risk management to the currenteconomic context, negatively affecting the P&L account with the amount of 649,945 Th lei.At the end of 2011, personnel expenses amounted to 390,262 Th lei, outbalancing the previousyear’s level by 4.52%, due to the increasing number of employees, from 6,914 to 7,151.Depreciation expenses at group level amounted to 63,787 Th lei, slightly outbalancing those ofthe preceding year by 5%, whereas in 2010 depreciation expenses fell below 2009 levels by10.5%, due to a milder investment activity.In 2011, other operating expenses, such as tax, rents, maintenance and repairs and others,increased by 19% as opposed to 2010, mainly due to greater contributions to the depositguarantee fund in the Banking system.Profitability ratios showed a 100% escalation in 2011 comparatively to 2010, as a result of a122% increase in the net profit; as such, the return on assets was 1.25%, while the return onequity was 13.26%. In 2010, profitability ratios registered a slight depreciation as compared to2009, considering the unremitting financial crisis which affected the global economy, so thatthe return on assets was 0.62% and the return on equity was 6.41%.The solvency ratio determined at Group level, under the Basel accord, recorded a value of13.49% (14,92% at December 31, 2010), considering that the minimum limit required by theBasel II accord is 8%.Capital AdequacyThe table below depicts the adequacy level of the Bank’s capital as at December 31, 2011 andDecember 31, 2010, according to Regulation 18/2006:Capital Adequacy Level Million LEI Million EUR2009 2010 2011 2009 2010 2011OWN FUNDS LEVEL I 1.734 1.943 2.075 410 453 48035

- Page 8: Interest expense -921,954 -897,963

- Page 11 and 12: Placements with banks 1,059,394 566

- Page 13 and 14: activities".B.16 To the extent know

- Page 15 and 16: Subject to the provisions laid down

- Page 17 and 18: (assuming that there is no conversi

- Page 19 and 20: after the close of the Pre-emptive

- Page 21: Tranche A Bonds to Tranche B Bonds.

- Page 24 and 25: “Lead Manager”,"Broker" or "BTS

- Page 26 and 27: estructuring, liquidation, dissolut

- Page 28 and 29: "PrimaryOffer Period""Reference Pag

- Page 30 and 31: I. REGISTRATION DOCUMENT1. LIABLE E

- Page 32 and 33: Distributable to:Equity holders of

- Page 36 and 37: OWN FUNDS LEVEL II 203 154 78 48 36

- Page 38 and 39: The table below presents the struct

- Page 40 and 41: 1-3 years 810,462 16%3-5 years 549,

- Page 42 and 43: macro-economical environment is sti

- Page 44 and 45: • creation and constant maintenan

- Page 46 and 47: Banca Transilvania’s strategy for

- Page 48 and 49: y a low level of liquidity. Further

- Page 50 and 51: investment will have on the potenti

- Page 53 and 54: 5. INFORMATION ABOUT THE ISSUERHist

- Page 55 and 56: solution. This client service appro

- Page 57 and 58: anches (I+II)CREDITCOOP 796,3 0,2 8

- Page 59 and 60: After temporary downward pressure o

- Page 61 and 62: company proposes financing solution

- Page 63 and 64: Until December 31, 2011 the units h

- Page 65 and 66: ORGANISATIONAL CHART OF BANCA TRANS

- Page 67 and 68: 8. INFORMATION ON TRENDS8.1. Statem

- Page 69 and 70: Mr. Peter Morris Franklin was born

- Page 71 and 72: Doca Nevenca ZorancaRelationsExecut

- Page 73 and 74: ecomes the Head of the Arbitration

- Page 75 and 76: • Providing means of open communi

- Page 77 and 78: Technical Committee for the Managem

- Page 79 and 80: manager for SME loans/ designated s

- Page 81 and 82: 11. MAIN SHAREHOLDERSAs at 30.12.20

- Page 83 and 84: LeiLeiInterest income 1.856.372 1.8

- Page 85 and 86:

LiabilitiesDeposits from banks 251.

- Page 87 and 88:

contributionDistribution to statuto

- Page 89 and 90:

Consolidated cash flow statementFor

- Page 91 and 92:

Less accrued interest -2.019 -3.588

- Page 93 and 94:

Tangible assets 275.174 266.586 1,0

- Page 95 and 96:

According to the Articles of Associ

- Page 97 and 98:

II. BONDS TERMS AND CONDITIONS1. BA

- Page 99 and 100:

The Bonds are direct, unconditional

- Page 101 and 102:

payments accrued and unpaid have be

- Page 103 and 104:

Agent to the Bondholders registered

- Page 105 and 106:

marketV d is the number of Shares t

- Page 107 and 108:

7. NoticesExcept as otherwise provi

- Page 109 and 110:

Bond Registry in accordance with th

- Page 111 and 112:

In accordance with the Agreement da

- Page 113 and 114:

Bank for the benefit of the Bondhol

- Page 115 and 116:

e returned to the subscribers in 10

- Page 117 and 118:

Bonds may be subscribed during the

- Page 119 and 120:

12. IFC• A copy of the Romanian L

- Page 121 and 122:

The Offer is considered successfull

- Page 123 and 124:

ANNEX 1Conditions of the Tranche A

- Page 125 and 126:

(i) the Tranche A Purchaser shall h

- Page 127 and 128:

In case of termination of the Tranc

- Page 129 and 130:

(xii) a Foreign Currency Maturity G

- Page 131 and 132:

agenda the election of the members

- Page 133 and 134:

(f) the creation, issue, sale, and

- Page 135:

ANNEX 4Conversion Notice FormTo:BAN