Oxford Catalysts Group PLC Annual Report and Accounts 2010

Oxford Catalysts Group PLC Annual Report and Accounts 2010

Oxford Catalysts Group PLC Annual Report and Accounts 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

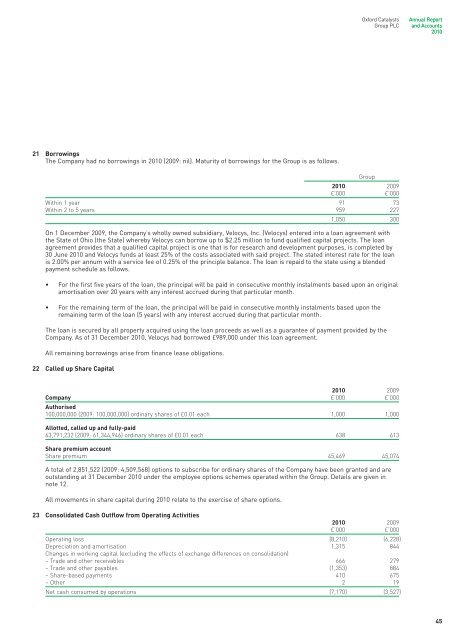

<strong>Oxford</strong> <strong>Catalysts</strong><strong>Group</strong> <strong>PLC</strong><strong>Annual</strong> <strong>Report</strong><strong>and</strong> <strong>Accounts</strong><strong>2010</strong>21 BorrowingsThe Company had no borrowings in <strong>2010</strong> (2009: nil). Maturity of borrowings for the <strong>Group</strong> is as follows.<strong>Group</strong><strong>2010</strong> 2009£’000 £’000Within 1 year 91 73Within 2 to 5 years 959 2271,050 300On 1 December 2009, the Company’s wholly owned subsidiary, Velocys, Inc. (Velocys) entered into a loan agreement withthe State of Ohio (the State) whereby Velocys can borrow up to $2.25 million to fund qualified capital projects. The loanagreement provides that a qualified capital project is one that is for research <strong>and</strong> development purposes, is completed by30 June <strong>2010</strong> <strong>and</strong> Velocys funds at least 25% of the costs associated with said project. The stated interest rate for the loanis 2.00% per annum with a service fee of 0.25% of the principle balance. The loan is repaid to the state using a blendedpayment schedule as follows.• For the first five years of the loan, the principal will be paid in consecutive monthly instalments based upon an originalamortisation over 20 years with any interest accrued during that particular month.• For the remaining term of the loan, the principal will be paid in consecutive monthly instalments based upon theremaining term of the loan (5 years) with any interest accrued during that particular month.The loan is secured by all property acquired using the loan proceeds as well as a guarantee of payment provided by theCompany. As of 31 December <strong>2010</strong>, Velocys had borrowed £989,000 under this loan agreement.All remaining borrowings arise from finance lease obligations.22 Called up Share Capital<strong>2010</strong> 2009Company £’000 £’000Authorised100,000,000 (2009: 100,000,000) ordinary shares of £0.01 each 1,000 1,000Allotted, called up <strong>and</strong> fully-paid63,791,232 (2009: 61,344,946) ordinary shares of £0.01 each 638 613Share premium accountShare premium 45,469 45,074A total of 2,851,522 (2009: 4,509,568) options to subscribe for ordinary shares of the Company have been granted <strong>and</strong> areoutst<strong>and</strong>ing at 31 December <strong>2010</strong> under the employee options schemes operated within the <strong>Group</strong>. Details are given innote 12.All movements in share capital during <strong>2010</strong> relate to the exercise of share options.23 Consolidated Cash Outflow from Operating Activities<strong>2010</strong> 2009£’000 £’000Operating loss (8,210) (6,228)Depreciation <strong>and</strong> amortisation 1,315 844Changes in working capital (excluding the effects of exchange differences on consolidation)– Trade <strong>and</strong> other receivables 666 279– Trade <strong>and</strong> other payables (1,353) 884– Share-based payments 410 675– Other 2 19Net cash consumed by operations (7,170) (3,527)45