ready willing - Darden Restaurants

ready willing - Darden Restaurants

ready willing - Darden Restaurants

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

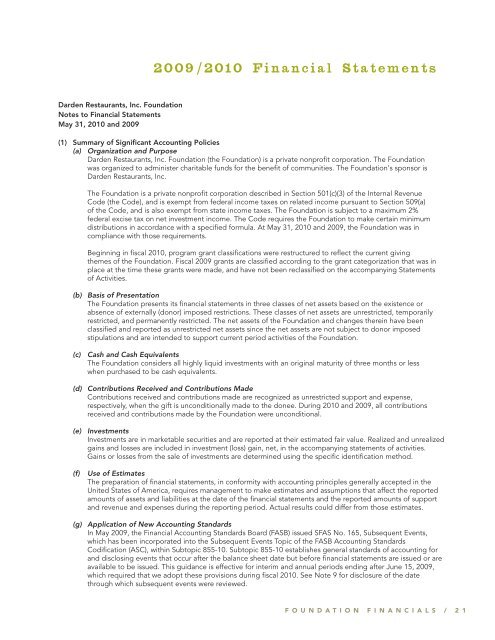

2009/2010 Financial Statements<strong>Darden</strong> <strong>Restaurants</strong>, Inc. FoundationNotes to Financial StatementsMay 31, 2010 and 2009(1) Summary of Significant Accounting Policies(a) Organization and Purpose<strong>Darden</strong> <strong>Restaurants</strong>, Inc. Foundation (the Foundation) is a private nonprofit corporation. The Foundationwas organized to administer charitable funds for the benefit of communities. The Foundation’s sponsor is<strong>Darden</strong> <strong>Restaurants</strong>, Inc.The Foundation is a private nonprofit corporation described in Section 501(c)(3) of the Internal RevenueCode (the Code), and is exempt from federal income taxes on related income pursuant to Section 509(a)of the Code, and is also exempt from state income taxes. The Foundation is subject to a maximum 2%federal excise tax on net investment income. The Code requires the Foundation to make certain minimumdistributions in accordance with a specified formula. At May 31, 2010 and 2009, the Foundation was incompliance with those requirements.Beginning in fiscal 2010, program grant classifications were restructured to reflect the current givingthemes of the Foundation. Fiscal 2009 grants are classified according to the grant categorization that was inplace at the time these grants were made, and have not been reclassified on the accompanying Statementsof Activities.(b)(c)(d)(e)(f)(g)Basis of PresentationThe Foundation presents its financial statements in three classes of net assets based on the existence orabsence of externally (donor) imposed restrictions. These classes of net assets are unrestricted, temporarilyrestricted, and permanently restricted. The net assets of the Foundation and changes therein have beenclassified and reported as unrestricted net assets since the net assets are not subject to donor imposedstipulations and are intended to support current period activities of the Foundation.Cash and Cash EquivalentsThe Foundation considers all highly liquid investments with an original maturity of three months or lesswhen purchased to be cash equivalents.Contributions Received and Contributions MadeContributions received and contributions made are recognized as unrestricted support and expense,respectively, when the gift is unconditionally made to the donee. During 2010 and 2009, all contributionsreceived and contributions made by the Foundation were unconditional.InvestmentsInvestments are in marketable securities and are reported at their estimated fair value. Realized and unrealizedgains and losses are included in investment (loss) gain, net, in the accompanying statements of activities.Gains or losses from the sale of investments are determined using the specific identification method.Use of EstimatesThe preparation of financial statements, in conformity with accounting principles generally accepted in theUnited States of America, requires management to make estimates and assumptions that affect the reportedamounts of assets and liabilities at the date of the financial statements and the reported amounts of supportand revenue and expenses during the reporting period. Actual results could differ from those estimates.Application of New Accounting StandardsIn May 2009, the Financial Accounting Standards Board (FASB) issued SFAS No. 165, Subsequent Events,which has been incorporated into the Subsequent Events Topic of the FASB Accounting StandardsCodification (ASC), within Subtopic 855-10. Subtopic 855-10 establishes general standards of accounting forand disclosing events that occur after the balance sheet date but before financial statements are issued or areavailable to be issued. This guidance is effective for interim and annual periods ending after June 15, 2009,which required that we adopt these provisions during fiscal 2010. See Note 9 for disclosure of the datethrough which subsequent events were reviewed.F O U N D A T I O N F I N A N C I A L S / 2 1