ready willing - Darden Restaurants

ready willing - Darden Restaurants

ready willing - Darden Restaurants

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

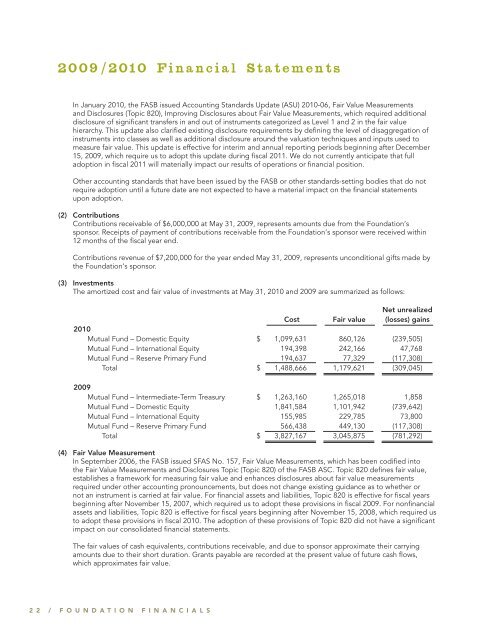

2009/2010 Financial StatementsIn January 2010, the FASB issued Accounting Standards Update (ASU) 2010-06, Fair Value Measurementsand Disclosures (Topic 820), Improving Disclosures about Fair Value Measurements, which required additionaldisclosure of significant transfers in and out of instruments categorized as Level 1 and 2 in the fair valuehierarchy. This update also clarified existing disclosure requirements by defining the level of disaggregation ofinstruments into classes as well as additional disclosure around the valuation techniques and inputs used tomeasure fair value. This update is effective for interim and annual reporting periods beginning after December15, 2009, which require us to adopt this update during fiscal 2011. We do not currently anticipate that fulladoption in fiscal 2011 will materially impact our results of operations or financial position.Other accounting standards that have been issued by the FASB or other standards-setting bodies that do notrequire adoption until a future date are not expected to have a material impact on the financial statementsupon adoption.(2) ContributionsContributions receivable of $6,000,000 at May 31, 2009, represents amounts due from the Foundation’ssponsor. Receipts of payment of contributions receivable from the Foundation’s sponsor were received within12 months of the fiscal year end.Contributions revenue of $7,200,000 for the year ended May 31, 2009, represents unconditional gifts made bythe Foundation’s sponsor.(3) InvestmentsThe amortized cost and fair value of investments at May 31, 2010 and 2009 are summarized as follows:Net unrealizedCost Fair value (losses) gains2010Mutual Fund – Domestic Equity $ 1,099,631 860,126 (239,505)Mutual Fund – International Equity 194,398 242,166 47,768Mutual Fund – Reserve Primary Fund 194,637 77,329 (117,308)Total $ 1,488,666 1,179,621 (309,045)2009Mutual Fund – Intermediate-Term Treasury $ 1,263,160 1,265,018 1,858Mutual Fund – Domestic Equity 1,841,584 1,101,942 (739,642)Mutual Fund – International Equity 155,985 229,785 73,800Mutual Fund – Reserve Primary Fund 566,438 449,130 (117,308)Total $ 3,827,167 3,045,875 (781,292)(4) Fair Value MeasurementIn September 2006, the FASB issued SFAS No. 157, Fair Value Measurements, which has been codified intothe Fair Value Measurements and Disclosures Topic (Topic 820) of the FASB ASC. Topic 820 defines fair value,establishes a framework for measuring fair value and enhances disclosures about fair value measurementsrequired under other accounting pronouncements, but does not change existing guidance as to whether ornot an instrument is carried at fair value. For financial assets and liabilities, Topic 820 is effective for fiscal yearsbeginning after November 15, 2007, which required us to adopt these provisions in fiscal 2009. For nonfinancialassets and liabilities, Topic 820 is effective for fiscal years beginning after November 15, 2008, which required usto adopt these provisions in fiscal 2010. The adoption of these provisions of Topic 820 did not have a significantimpact on our consolidated financial statements.The fair values of cash equivalents, contributions receivable, and due to sponsor approximate their carryingamounts due to their short duration. Grants payable are recorded at the present value of future cash flows,which approximates fair value.2 2 / F O U N D A T I O N F I N A N C I A L S