- Page 3 and 4: and is only directed at qualified i

- Page 5 and 6: Pending exercise of the call option

- Page 7 and 8: CONSENTS ..........................

- Page 9 and 10: History and Development of the Grou

- Page 11 and 12: Maintain focus on crop production:

- Page 13 and 14: Summary of Risk FactorsBefore inves

- Page 15 and 16: • Infrastructure in Russia and Uk

- Page 17 and 18: Capitalisation and Indebtedness of

- Page 19 and 20: (4) Pursuant to the terms of the De

- Page 21 and 22: Summary of Financial and Operating

- Page 23 and 24: Year ended 31 December2010 2009 200

- Page 25 and 26: THE OFFERThe CompanyThe OfferingOve

- Page 27 and 28: Until 20 July 2011 - Submission of

- Page 29 and 30: Securities codeManagersConsultantUn

- Page 31 and 32: Russia and Ukraine where climate co

- Page 33 and 34: collateral that secures its indebte

- Page 35 and 36: uckwheat products were subject to e

- Page 37 and 38: moratorium is lifted, the Group may

- Page 39 and 40: Financial Condition and Results of

- Page 41 and 42: As at 31 December 2010, out of appr

- Page 43: The Group may not be able to accura

- Page 47 and 48: Increased competition in the Russia

- Page 49 and 50: tensions in the region could negati

- Page 51 and 52: Weaknesses relating to the Russian

- Page 53 and 54: year preceding the year when the fi

- Page 55 and 56: year. The tax audits may also impos

- Page 57 and 58: ecome effective from 1 January 2011

- Page 59 and 60: The reversal of reform policies or

- Page 61 and 62: entity, under Russian law the party

- Page 63 and 64: government or rejection or reversal

- Page 65 and 66: elevant statement to that effect wi

- Page 67 and 68: Risks Relating to the SharesExercis

- Page 69 and 70: PERSONS RESPONSIBLEThis Prospectus

- Page 71 and 72: NO INCORPORATION OF WEBSITE INFORMA

- Page 73 and 74: PRESENTATION OF FINANCIAL AND OTHER

- Page 75 and 76: In this Prospectus, certain stateme

- Page 77 and 78: EXCHANGE RATE INFORMATIONThe Group

- Page 79 and 80: at least 25% of the Shares plus one

- Page 81 and 82: CAPITALISATION AND INDEBTEDNESS OF

- Page 83 and 84: (4) Pursuant to the terms of the De

- Page 85 and 86: Year ended 31 December2010 2009 200

- Page 87 and 88: and equipmentOperating profit/(loss

- Page 89 and 90: are applied equally to the reportab

- Page 91 and 92: the subsidiaries were originally ac

- Page 93 and 94: The Group’s current policy is gen

- Page 95 and 96:

The Group’s inability to export g

- Page 97 and 98:

also led to a decline in real dispo

- Page 99 and 100:

Agricultural produce harvested from

- Page 101 and 102:

subsidies and livestock subsidies.

- Page 103 and 104:

in respect of temporary differences

- Page 105 and 106:

Year ended 31 December2010 2009 Cha

- Page 107 and 108:

Sales(intonnes)Year ended 31 Decemb

- Page 109 and 110:

Year ended 31 December2010 2009 Cha

- Page 111 and 112:

million for the year ended 31 Decem

- Page 113 and 114:

The Russian operations accounted fo

- Page 115 and 116:

Due to more favourable currency exc

- Page 117 and 118:

expense. For the year ended 31 Dece

- Page 119 and 120:

Year ended 31 December2009 2008 Cha

- Page 121 and 122:

the remaining approximately 37.2% a

- Page 123 and 124:

The following table sets out a brea

- Page 125 and 126:

Russian operations recorded a 16.9%

- Page 127 and 128:

Year ended 31 December2009 2008 Cha

- Page 129 and 130:

Change in allowance for irrecoverab

- Page 131 and 132:

Ukrainian farm. The difference betw

- Page 133 and 134:

significant decrease in inventories

- Page 135 and 136:

For the year ended 31 DecemberNet i

- Page 137 and 138:

The principal sources of funding fo

- Page 139 and 140:

Minimum lease payments Present valu

- Page 141 and 142:

Agricultural products price riskThe

- Page 143 and 144:

2010CarryingamountContractualamount

- Page 145 and 146:

The table below summarises key macr

- Page 147 and 148:

The Global Agricultural MarketRenew

- Page 149 and 150:

Rising Life ExpectancyAverage life

- Page 151 and 152:

Global Production and Stock LevelsT

- Page 153 and 154:

World market prices for major food

- Page 155 and 156:

food-insecure people will not impro

- Page 157 and 158:

Poland 16 13World 4,884 1,381______

- Page 159 and 160:

or biofuel. Wheat is also planted t

- Page 161 and 162:

Agricultural yearBarley production

- Page 163 and 164:

Corn is the third largest fodder cr

- Page 165 and 166:

In Ukraine, strong demand and relat

- Page 167 and 168:

unemployment rate increased from 6.

- Page 169 and 170:

cadastral valuation of the leased l

- Page 171 and 172:

of Agricultural Product, Raw Materi

- Page 173 and 174:

State Price ControlPrice Control in

- Page 175 and 176:

According to the Ukrainian State Su

- Page 177 and 178:

The Group’s headquarters in Russi

- Page 179 and 180:

(“Russian Agricultural Bank”),

- Page 181 and 182:

BUSINESSOverviewThe Valinor Group i

- Page 183 and 184:

Optimal Product MixValinor has deve

- Page 185 and 186:

In addition, the Group plans to imp

- Page 187 and 188:

The Group’s current portfolio of

- Page 189 and 190:

Cypriot and non-Cypriot residents D

- Page 191 and 192:

• The Southern cluster, comprisin

- Page 193 and 194:

CountryTotallandundercontrol,haLand

- Page 195 and 196:

affected if its land lease agreemen

- Page 197 and 198:

52,000 hectares of new land and suc

- Page 199 and 200:

the biggest Russian and internation

- Page 201 and 202:

Oilseeds 1.7 1.7 1.6 1.8 2.0 1.4 2.

- Page 203 and 204:

The Group’s agronomists assess th

- Page 205 and 206:

ecomes the property of the lessor.

- Page 207 and 208:

the terms of transportation on an a

- Page 209 and 210:

Products sold (as a percentage of t

- Page 211 and 212:

Group introduces an in-house tradin

- Page 213 and 214:

costs. Historically, the Group has

- Page 215 and 216:

alance was applied to working capit

- Page 217 and 218:

(approximately USD 2,460,630 millio

- Page 219 and 220:

Placement AgreementThe Company has

- Page 221 and 222:

Russian and Ukrainian insurance ind

- Page 223 and 224:

Business and Industry - The Group d

- Page 225 and 226:

SHAREHOLDERSShareholdersThe below t

- Page 227 and 228:

Board of DirectorsMANAGEMENT AND CO

- Page 229 and 230:

Andrey Sizov, 35, is an independent

- Page 231 and 232:

Further Information on the Board of

- Page 233 and 234:

Board CommitteesIn addition to the

- Page 235 and 236:

NameEduard KurochkinAlexandr Lavrin

- Page 237 and 238:

RELATED PARTY TRANSACTIONSIn the or

- Page 239 and 240:

through the purchase of agricultura

- Page 241 and 242:

Loans to the GroupPrior to the Rest

- Page 243 and 244:

CERTAIN CYPRIOT AND POLISH SECURITI

- Page 245 and 246:

Pursuant to Article 4(2)(e) of the

- Page 247 and 248:

company listed on a regulated marke

- Page 249 and 250:

possible and in any event, within t

- Page 251 and 252:

Violation of the prohibition on the

- Page 253 and 254:

(r)holds at least 5%, 10%, 15%, 20%

- Page 255 and 256:

If a shareholder exceeds the 33% th

- Page 257 and 258:

Additionally, Article 75 of the Pol

- Page 259 and 260:

made in writing within three months

- Page 261 and 262:

(aa) publish, at the issuer’s or

- Page 263 and 264:

DESCRIPTION OF THE SHARESIntroducti

- Page 265 and 266:

• A right to pledge, charge, gran

- Page 267 and 268:

No distribution of dividends may be

- Page 269 and 270:

determine. Special meetings of shar

- Page 271 and 272:

appointed for holding the meeting,

- Page 273 and 274:

Director’s RemunerationThe shareh

- Page 275 and 276:

immovable property situated in Cypr

- Page 277 and 278:

Withholding TaxesNo withholding tax

- Page 279 and 280:

life interest centre) in Poland; or

- Page 281 and 282:

Notwithstanding the above, the Poli

- Page 283 and 284:

provision will come into effect on

- Page 285 and 286:

TERMS AND CONDITIONS OF THE OFFERIN

- Page 287 and 288:

announcement pursuant to section 27

- Page 289 and 290:

The final number of Offer Shares an

- Page 291 and 292:

The minimum allotment in the Offeri

- Page 293 and 294:

Investors should consider that sinc

- Page 295 and 296:

Stabilisation and the Over-Allotmen

- Page 297 and 298:

TRANSFER AND SELLING RESTRICTIONSNo

- Page 299 and 300:

CERTAIN DEFINITIONS“Adjusted EBIT

- Page 301 and 302:

“Offering Broker”“EBRD” The

- Page 303 and 304:

“Petrocommerce Bank”“Placemen

- Page 305 and 306:

“Valars Agro”“Valars Group”

- Page 307 and 308:

CONSENTSThe following parties, The

- Page 309 and 310:

Prospectus of Valinor Public Limite

- Page 311 and 312:

Clifford Chance, Janicka, Krużewsk

- Page 313 and 314:

Board of DirectorsValinor Public Li

- Page 315 and 316:

INDEPENDENT AUDITORSDeloitte Limite

- Page 317 and 318:

VALINOR PUBLIC LIMITEDAND ITS SUBSI

- Page 319 and 320:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 321 and 322:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 323 and 324:

INDEPENDENT AUDITORS’ REPORTTo th

- Page 325 and 326:

INDEPENDENT AUDITORS’ REPORT (CON

- Page 327 and 328:

VALINOR LIMITED AND ITS SUBSIDIARIE

- Page 329 and 330:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 331 and 332:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 333 and 334:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 335 and 336:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 337 and 338:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 339 and 340:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 341 and 342:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 343 and 344:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 345 and 346:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 347 and 348:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 349 and 350:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 351 and 352:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 353 and 354:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 355 and 356:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 357 and 358:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 359 and 360:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 361 and 362:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 363 and 364:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 365 and 366:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 367 and 368:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 369 and 370:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 371 and 372:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 373 and 374:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 375 and 376:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 377 and 378:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 379 and 380:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 381 and 382:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 383 and 384:

VALINOR PUBLIC LIMITED AND ITS SUBS

- Page 385 and 386:

RESPONSIBILITY STATEMENTThe Company

- Page 387 and 388:

RESPONSIBILITY STATEMENTThe Underwr

- Page 389 and 390:

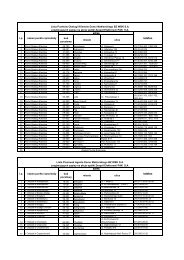

Name Address Date ofestablishmentRe

- Page 391 and 392:

Name Address Date ofestablishmentRe

- Page 393 and 394:

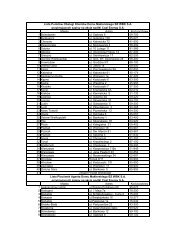

Name Address Date ofestablishmentRe

- Page 395 and 396:

Name Address Date ofestablishmentRe

- Page 397:

THE COMPANYValinor Public LimitedSt