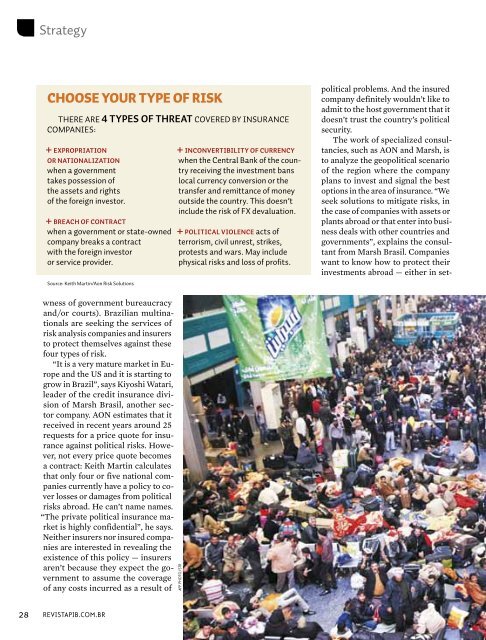

StrategyCHOOSE YOUR tYpE OF risKthere are 4 types of threat covered by insurancecompanies:+ EXPROPRIATIONOR NATIONALIZATIONwhen a governmenttakes possession ofthe assets and rightsof the foreign investor.+ BREACH OF CONTRACTwhen a government or state-ownedcompany breaks a contractwith the foreign investoror service provider.Source: Keith Martin/Aon Risk Solutions+ <strong>IN</strong>CONVERTIBILITY OF CURRENCYwhen the Central Bank of the countryreceiving the investment banslocal currency conversion or thetransfer and remittance of moneyoutside the country. This doesn’tinclude the risk of FX devaluation.+ POLiTICAl violence acts ofterrorism, civil unrest, strikes,protests and wars. May includephysical risks and loss of profits.political problems. And the insuredcompany definitely wouldn’t like toadmit to the host government that itdoesn’t trust the country’s politicalsecurity.The work of specialized consultancies,such as AON and Marsh, isto analyze the geopolitical scenarioof the region where the companyplans to invest and signal the bestoptions in the area of insurance. “Weseek solutions to mitigate risks, inthe case of companies with assets orplants abroad or that enter into businessdeals with other countries andgovernments”, explains the consultantfrom Marsh Brasil. Companieswant to know how to protect theirinvestments abroad — either in set-wness of government bureaucracyand/or courts). Brazilian multinationalsare seeking the services ofrisk analysis companies and insurersto protect themselves against thesefour types of risk.“It is a very mature market in Europeand the US and it is starting togrow in Brazil”, says Kiyoshi Watari,leader of the credit insurance divisionof Marsh Brasil, another sectorcompany. AON estimates that itreceived in recent years around 25requests for a price quote for insuranceagainst political risks. However,not every price quote becomesa contract: Keith Martin calculatesthat only four or five national companiescurrently have a policy to coverlosses or damages from politicalrisks abroad. He can’t name names.“The private political insurance marketis highly confidential”, he says.Neither insurers nor insured companiesare interested in revealing theexistence of this policy — insurersaren’t because they expect the governmentto assume the coverageof any costs incurred as a result ofAFP PHOTO/STR28 revistapib.com.br

Expatriatesretained atTripoli Airport:chaosiN tHE EYE OF tHE HURRiCANEWHEN GUSTAVO Guerra arrived inTripoli with his family, in 2009, arebellion against Kadafi seemedunthinkable. “At the start ofthe Arab Spring in Tunisia andEgypt, in 2011, we started to payattention”, he recalls. “No oneexpected that to happen in Libya;we thought the country was different.”But it wasn’t. When thefirst protests started in Benghazi,the second biggest city, Odebrechtdecided to remove, as a precaution,employee´s families. At that stage,Gustavo was head of Odebrecht inLibya, but his base was in Lisbon.“People didn’t realize just howpotentially serious the situationwas, and some were worried theirchildren who would miss school”,he says. It was a Friday in February,and the family members werewithdrawn on Sunday. That weekend,the situation took a quickturn for the worse. Forces loyalto Kadafi patrolled the streets,heavily armed, and dispersed anyprotest with aerial shots. Productsstarted to dry up on shelves, andthe opposition called for protestsin Tripoli on Monday – the first inthe capital city.In Lisbon, Gustavohad to change his ordersas tension in Tripoli grew.After the family membersleft, he also decided to removenon-core personnel.But the order was soonextended to all non-Libyanemployees. “Whenthe climate shifted to oneof preparing for a conflict,with guns on the streets,restricted movement inthe city and supply problems,we decided for a fullexit”, he explains.Some employeeswere grouped in lodgingsclose to the constructionsites. Others stayed in acondominium with watersupply, supermarkets andsecurity. The companyfollowed a previouslyelaborated withdrawalplan, but there were somesurprises: on the Sunday,day three of the crisis,commercial flights weresuspended and Tripoliairport became a chaos. “All theexpatriates were trying to fly out”,recalls Gustavo. “Policemen firedaerial shots at the airport.” Dueto the collapse of regular flights,Odebrecht chartered Boeing 747swaiting in Malta for authorizationto get off the ground. “Gettinga flight out of Tripoli was veryhard, as there were 300 or 400chartered planes arriving in thecountry”, he recalls. The supportof the Brazilian embassy ensuredthat permission was granted, and1,500 people left Tripoli on thesefl i g h t s .Fearing the airport would beclosed to even charter flights, thecenter of operations decided totransport the other employees ona chartered passenger ship in Italy.“We did all this in a matter of hours– speed is fundamental in thesemoments”, says Gustavo. Thecompany had the resources to payfor this removal process, otherwiseit wouldn’t have happened. “Atsuch times, everything is in cash”,he states. “The employee doesn’tescape by ship or get on a placeif he hasn’t got any money. “OnWednesday, the ship left Tripoliwith over 2,000 Odebrecht employeeson board. At the end of thedrama, all the company´s personnelarrived safely in Malta.Gustavo is currently executivedirector of Odebrecht for WestAfrica and Libya. Before facing theLibyan revolt, he received trainingin crisis management and elaboratingescape plans and workedin Angola, where he witnessed acivil war. “At a time of crisis, youhave to apply logic”, he says. “Youreally have to keep your cool.”revistapib.com.br 29