- Page 5 and 6:

Don LooserVice President forAcademi

- Page 7 and 8:

Required Courses Core (43 hrs Core;

- Page 9 and 10:

Orange and Blue Award / 50Church Ma

- Page 11 and 12:

Student Directory Information / 99T

- Page 13 and 14:

Fall, 2006September 1 .............

- Page 15 and 16:

Fall, 2007August 31 ...............

- Page 17:

Summer, 2008May 30 ................

- Page 20 and 21:

GENERAL INFORMATIONCHARACTERISTICSA

- Page 22 and 23:

History: Structure and Organization

- Page 24 and 25:

the University Apartments, the Memo

- Page 26 and 27:

Science Center, the Mabee Teaching

- Page 29:

Health InsuranceTo ensure that HBU

- Page 32 and 33:

Student Health ServicesThe purpose

- Page 35 and 36:

ADMISSIONSUniversity AdmissionsUnde

- Page 37 and 38:

mathematical reasoning sections or

- Page 39 and 40:

• An appropriate Smith College co

- Page 41 and 42:

5. Re-Entry AdmissionAny student wh

- Page 43 and 44:

cant has not completed more than tw

- Page 45 and 46:

International Student AdmissionAn i

- Page 47 and 48:

FINANCIAL SERVICESUndergraduate Tui

- Page 49 and 50:

ROOM AND BOARD:A meal plan is requi

- Page 51 and 52:

FINANCIAL AIDFinancial aid may be i

- Page 53 and 54:

State Student Incentive Grant (SSIG

- Page 55 and 56:

6. Sign a statement of educational

- Page 57:

Valedictorian ScholarshipsHBU honor

- Page 60 and 61:

ACADEMIC RESOURCESAcademic Advising

- Page 62 and 63:

Law School Advising TrackStudents p

- Page 64 and 65:

ACADEMIC POLICIES AND PROCEDURESAca

- Page 66 and 67:

admitted will be admitted on Academ

- Page 68 and 69:

credit does not apply to degree req

- Page 70 and 71:

Credit by Examination RequirementsC

- Page 72 and 73:

CREDIT APPROVED SEM. HRS. EQUIVALEN

- Page 74 and 75:

Cross-Listed CoursesCourses that ar

- Page 76 and 77:

Any new or currently enrolled stude

- Page 78 and 79:

Learning Disability AccommodationSt

- Page 80 and 81:

and the approval of the change by t

- Page 82 and 83:

pendent study. The seminar is desig

- Page 84 and 85:

Transfer CoursesStudents transferri

- Page 86 and 87:

Transcripts from non-regionally acc

- Page 88 and 89:

UNDERGRADUATE DEGREE PROGRAMAssocia

- Page 90 and 91:

3. Residence Requirement: The minim

- Page 92 and 93:

laboratory science are required for

- Page 94 and 95:

College/ProgramCollege ofArts andHu

- Page 96 and 97:

BACHELOR OF ARTS (BA)Required Cours

- Page 98 and 99:

BACHELOR OF MUSIC (BM)Minimum acade

- Page 101 and 102:

GRADUATE DEGREE PROGRAMProgram Poli

- Page 103 and 104:

Graduate Degree PlanBefore a gradua

- Page 105 and 106:

Time Limit on Length of ProgramRequ

- Page 107 and 108:

program may add PSYC, 6101, 6102, 6

- Page 109 and 110:

MASTER OF LIBERAL ARTSThe Master of

- Page 111 and 112:

COLLEGE OF ARTS AND HUMANITIESUnder

- Page 113 and 114:

Special RequirementsArt majors are

- Page 115 and 116:

Choose at least 8 upper level hrs f

- Page 117 and 118:

The Honors Program in ChristianityD

- Page 119 and 120:

Communication SystemsChoose 9 hrs f

- Page 121 and 122:

Broadcast Production Concentration

- Page 123 and 124:

History with Teacher CertificationH

- Page 125 and 126:

Political ScienceThe political scie

- Page 127 and 128:

Public RelationsCOMM 3334 Argumenta

- Page 129 and 130:

CreditsSmith College (see page 85)

- Page 131 and 132:

Select 6 or 9 * hrs from the follow

- Page 133 and 134:

English/Language Arts Teacher Certi

- Page 135 and 136:

Professional WritingThe professiona

- Page 137 and 138:

Senior SeminarsChoose 4 hrs from th

- Page 139 and 140:

To be certified to teach Spanish, c

- Page 141 and 142:

ENTRANCE EXAMS IN MUSICFRESHMEN AND

- Page 143 and 144:

may be taken three (3) times. If it

- Page 145 and 146:

Bachelor of Music (BM) - Performanc

- Page 147 and 148:

Required Courses 43MUTH 1312 Music

- Page 149 and 150:

The MATS is also designed to enable

- Page 151 and 152:

COLLEGE OF BUSINESS AND ECONOMICSUn

- Page 153 and 154:

Students electing this option must

- Page 155 and 156:

BA/BS International BusinessFaculty

- Page 157 and 158:

AccountingFaculty: Dr. Darlene Serr

- Page 159 and 160:

FinanceFaculty: Dr. Melissa Wiseman

- Page 161 and 162:

Graduate ProgramsMASTER OF ACCOUNTA

- Page 163 and 164:

CISM 6365 e-Business Concepts and S

- Page 165 and 166:

MASTER OF SCIENCE IN MANAGEMENTDire

- Page 167 and 168:

College of Business and Economics /

- Page 169 and 170:

MASTER OF SCIENCE IN HEALTH ADMINIS

- Page 171 and 172:

COLLEGE OF EDUCATION AND BEHAVIORAL

- Page 173 and 174:

Supplemental CertificationA supplem

- Page 175 and 176:

course which has EDUC 4301/4311/531

- Page 177 and 178: Fall student teaching, by the secon

- Page 179 and 180: CreditsSmith College (see page 85)

- Page 181 and 182: Interdisciplinary StudiesFaculty: D

- Page 183 and 184: Courses Required for Available Spec

- Page 185 and 186: Graduate ProgramsMASTER OF EDUCATIO

- Page 187 and 188: BILINGUAL EDUCATIONTo gain admissio

- Page 189 and 190: Curriculum and Instruction with All

- Page 191 and 192: The following courses must be compl

- Page 193 and 194: The following courses must be compl

- Page 195 and 196: already possess a graduate degree.

- Page 197 and 198: EDUCATIONAL ADMINISTRATIONTo earn t

- Page 199 and 200: OPTION 2A student who has above a 2

- Page 201 and 202: College of Education and Behavioral

- Page 203 and 204: COLLEGE OF NURSINGUndergraduate Pro

- Page 205 and 206: to the studies and on the economic

- Page 207 and 208: Degrees with DistinctionHonors at g

- Page 209 and 210: BSN PROGRAM REQUIREMENTSCreditsPrer

- Page 211 and 212: Advance Standing Credit 35When admi

- Page 213 and 214: COLLEGE OF SCIENCE AND MATHEMATICSU

- Page 215 and 216: CreditsBiology Requirements 31BIOL

- Page 217 and 218: CreditsInterdisciplinary Requiremen

- Page 219 and 220: Other MajorsComposite Science Major

- Page 221 and 222: *** HIST 2313, 2323 are recommended

- Page 223 and 224: Pre-Pharmacy ProgramDirector: Dr. S

- Page 225 and 226: Pre-Physician Assistant ProgramDire

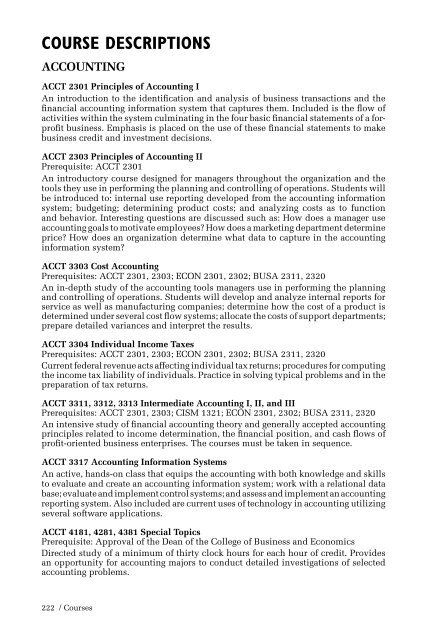

- Page 227: COURSE DESCRIPTIONS

- Page 231 and 232: ART 2232, 2242, 2252, 3232, 3242, 3

- Page 233 and 234: BIOCHEMISTRY-MOLECULAR BIOLOGYBCMB

- Page 235 and 236: BIOLOGYBIOL 1101, 1102, 1103 Patien

- Page 237 and 238: BIOL 3434 Ecology and Field Biology

- Page 239 and 240: BIOL 4433 EmbryologyPrerequisites:

- Page 241 and 242: BUSA 4301 International BusinessThi

- Page 243 and 244: CHEM 2416 General Chemistry IIPrere

- Page 245 and 246: CHRI 1323 New TestamentPrerequisite

- Page 247 and 248: CHRI 4292, 4293 Senior SeminarPrere

- Page 249 and 250: CHRI 6313 Pastoral Care and Spiritu

- Page 251 and 252: CISM 4181, 4281, 4381 Special Topic

- Page 253 and 254: COMM 3323 Communication TheoryPrere

- Page 255 and 256: ECON 3302 Economic Theory- Intermed

- Page 257 and 258: EDAD 6291 Internship in the Princip

- Page 259 and 260: EDBI 3336 Advanced Spanish Writing

- Page 261 and 262: EDBI 5350 Developing Literacy in th

- Page 263 and 264: EDRE 4301 Advanced Developmental Re

- Page 265 and 266: EDRE 5351 Emergent Literacy(Offered

- Page 267 and 268: EDSP 5336 Instructional Techniques

- Page 269 and 270: EDUC 4312 The School in U.S. Societ

- Page 271 and 272: EDUC 4396 Student Teaching in Secon

- Page 273 and 274: EDUC 5313 Curriculum and Instructio

- Page 275 and 276: EDUC 6307 Design of Print-Based Med

- Page 277 and 278: ENGL 2365 Masterworks: DramaPrerequ

- Page 279 and 280:

ENGL 3370 Hispanic LiteraturePrereq

- Page 281 and 282:

ENTR 3335 Financing New VenturesPre

- Page 283 and 284:

EPSY 6344 Educational Appraisal of

- Page 285 and 286:

FINA 6333 International FinancePrer

- Page 287 and 288:

FREN 3324 Advancing French Proficie

- Page 289 and 290:

GERM 2314, 2324 Continuing German P

- Page 291 and 292:

HADM 6340 Health Care Financial Man

- Page 293 and 294:

HIST 1324 World Civilization from 1

- Page 295 and 296:

HONORS PROGRAMHONR 4399 Senior Hono

- Page 297 and 298:

JOUR 2303 Newswriting for Mass Comm

- Page 299 and 300:

KINE 2336 Strategies and Principles

- Page 301 and 302:

KINE 4363 Sports SociologyPrerequis

- Page 303 and 304:

MATH 3310 Discrete MathPrerequisite

- Page 305 and 306:

MANAGEMENTMGMT 3305 Organization Be

- Page 307 and 308:

MGMT 5340 Internship: MBAPrerequisi

- Page 309 and 310:

MGMT 6334 Legal Challenges in HR Ma

- Page 311 and 312:

MGMT 6387 Benefits and PoliciesExam

- Page 313 and 314:

MKTG 6333 International Marketing S

- Page 315 and 316:

MLA 5345 FaulknerStudents read nove

- Page 317 and 318:

MLA 6312 The French EnlightenmentTh

- Page 319 and 320:

MLA 6377 Contemporary Art Movements

- Page 321 and 322:

MUAP 4244 Piano Pedagogy IISurvey o

- Page 323 and 324:

MUHL 2313, 2323 Music LiteraturePre

- Page 325 and 326:

MUPL 1113, 2113, 3113, 4113 Percuss

- Page 327 and 328:

MUSC 3322 A Survey of Early 20th Ce

- Page 329 and 330:

MUSC 4373 Advanced Instrumental Con

- Page 331 and 332:

NURS 2110/2210/3121 Clinical Prepar

- Page 333 and 334:

NURS 4101, 4203 Advanced Parent-Inf

- Page 335 and 336:

NURS 4434 Care of Childbearing Fami

- Page 337 and 338:

PHOT 3322 Photography II: The Darkr

- Page 339 and 340:

PHYS 3413 Modern Physics IPrerequis

- Page 341 and 342:

POLS 3348 American Political Though

- Page 343 and 344:

PSYC 3313 Human Growth and Developm

- Page 345 and 346:

PSYC 5313 Methods and Techniques in

- Page 347 and 348:

PSYC 6320 Research Techniques and P

- Page 349 and 350:

SOCI 4293 Senior Seminar in Sociolo

- Page 351 and 352:

SPAN 3314 Advancing Spanish Profici

- Page 353 and 354:

TELE 2103, 2104, 3102, 4102 Televis

- Page 355 and 356:

WRIT 3383 Advanced Grammar and Writ

- Page 357:

Courses / 351

- Page 360 and 361:

Course OfferedCourse Scheduling Fre

- Page 362 and 363:

Course OfferedCourse Scheduling Fre

- Page 364 and 365:

Course OfferedCourse Scheduling Fre

- Page 366 and 367:

Course OfferedCourse Scheduling Fre

- Page 368 and 369:

Course OfferedCourse Scheduling Fre

- Page 370 and 371:

Course OfferedCourse Scheduling Fre

- Page 372 and 373:

Course OfferedCourse Scheduling Fre

- Page 374 and 375:

Course OfferedCourse Scheduling Fre

- Page 376 and 377:

Course OfferedCourse Scheduling Fre

- Page 378 and 379:

Course OfferedCourse Scheduling Fre

- Page 380 and 381:

Course OfferedCourse Scheduling Fre

- Page 382 and 383:

Course OfferedCourse Scheduling Fre

- Page 384 and 385:

Course OfferedCourse Scheduling Fre

- Page 386 and 387:

Course OfferedCourse Scheduling Fre

- Page 388 and 389:

Course OfferedCourse Scheduling Fre

- Page 390 and 391:

Course OfferedCourse Scheduling Fre

- Page 392 and 393:

BOARD OF TRUSTEESMr. Ray Cox, Jr. .

- Page 394 and 395:

ADMINISTRATIVE OFFICERSDONALD W. LO

- Page 396 and 397:

FACULTY MEMBERS(Date indicates year

- Page 398 and 399:

GARY CLAY (1998)Professor in Educat

- Page 400 and 401:

ELOISE HUGHES (1996)Professor in Ed

- Page 402 and 403:

RENATA NERO (1998)Professor in Psyc

- Page 404 and 405:

PHYLLIS B. THOMPSON (1970)Professor

- Page 406 and 407:

400 / Faculty Members

- Page 408 and 409:

INDEXAcademic Advising ............

- Page 410 and 411:

FERPA - Family EducationalRights &

- Page 412:

Smith College Requirements ........