Return of Income Tax Withholding for Nonresident Sale of Real ...

Return of Income Tax Withholding for Nonresident Sale of Real ...

Return of Income Tax Withholding for Nonresident Sale of Real ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

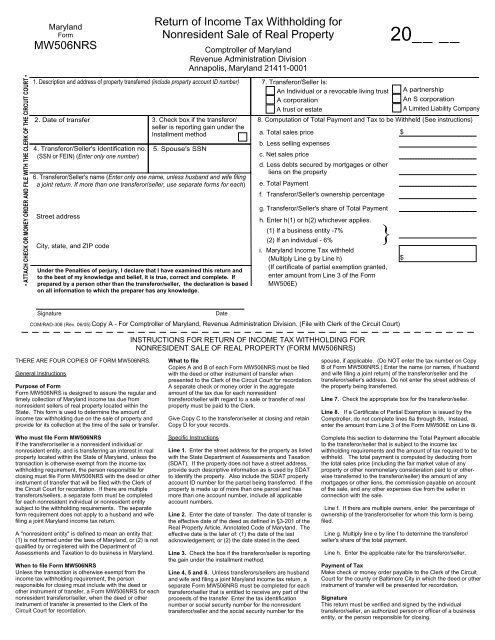

MarylandFormMW506NRS<strong>Return</strong> <strong>of</strong> <strong>Income</strong> <strong>Tax</strong> <strong>Withholding</strong> <strong>for</strong><strong>Nonresident</strong> <strong>Sale</strong> <strong>of</strong> <strong>Real</strong> PropertyComptroller <strong>of</strong> MarylandRevenue Administration DivisionAnnapolis, Maryland 21411-000120__ __• ATTACH CHECK OR MONEY ORDER AND FILE WITH THE CLERK OF THE CIRCUIT COURT •1. Description and address <strong>of</strong> property transferred (include property account ID number) 7. Transferor/Seller Is:An Individual or a revocable living trustA corporationA trust or estate2. Date <strong>of</strong> transfer 3. Check box if the transferor/seller is reporting gain under theInstallment method4. Transferor/Seller's Identification no.(SSN or FEIN) (Enter only one number)5. Spouse's SSN6. Transferor/Seller's name (Enter only one name, unless husband and wife filinga joint return. If more than one transferor/seller, use separate <strong>for</strong>ms <strong>for</strong> each)Street addressCity, state, and ZIP codeUnder the Penalties <strong>of</strong> perjury, I declare that I have examined this return andto the best <strong>of</strong> my knowledge and belief, it is true, correct and complete. Ifprepared by a person other than the transferor/seller, the declaration is basedon all in<strong>for</strong>mation to which the preparer has any knowledge.A partnershipAn S corporationA Limited Liability Company8. Computation <strong>of</strong> Total Payment and <strong>Tax</strong> to be Withheld (See instructions)a. Total sales priceb. Less selling expensesc. Net sales priced. Less debts secured by mortgages or otherliens on the propertye. Total Paymentf. Transferor/Seller's ownership percentageg. Transferor/Seller's share <strong>of</strong> Total Paymenth. Enter h(1) or h(2) whichever applies.(1) If a business entity -7%(2) If an individual - 6% }i. Maryland <strong>Income</strong> <strong>Tax</strong> withheld(Multiply Line g by Line h)(If certificate <strong>of</strong> partial exemption granted,enter amount from Line 3 <strong>of</strong> the FormMW506E)$$SignatureDateCOM/RAD-308 (Rev. 06/05) Copy A - For Comptroller <strong>of</strong> Maryland, Revenue Administration Division. (File with Clerk <strong>of</strong> the Circuit Court)-------------------------------------------INSTRUCTIONS FOR RETURN OF INCOME TAX WITHHOLDING FORNONRESIDENT SALE OF REAL PROPERTY (FORM MW506NRS)THERE ARE FOUR COPIES OF FORM MW506NRS.General InstructionsPurpose <strong>of</strong> FormForm MW506NRS is designed to assure the regular andtimely collection <strong>of</strong> Maryland income tax due fromnonresident sellers <strong>of</strong> real property located within theState. This <strong>for</strong>m is used to determine the amount <strong>of</strong>income tax withholding due on the sale <strong>of</strong> property andprovide <strong>for</strong> its collection at the time <strong>of</strong> the sale or transfer.Who must file Form MW506NRSIf the transferor/seller is a nonresident individual ornonresident entity, and is transferring an interest in realproperty located within the State <strong>of</strong> Maryland, unless thetransaction is otherwise exempt from the income taxwithholding requirement, the person responsible <strong>for</strong>closing must file Form MW506NRS with the deed or otherinstrument <strong>of</strong> transfer that will be filed with the Clerk <strong>of</strong>the Circuit Court <strong>for</strong> recordation. If there are multipletransferors/sellers, a separate <strong>for</strong>m must be completed<strong>for</strong> each nonresident individual or nonresident entitysubject to the withholding requirements. The separate<strong>for</strong>m requirement does not apply to a husband and wifefiling a joint Maryland income tax return.A "nonresident entity" is defined to mean an entity that:(1) is not <strong>for</strong>med under the laws <strong>of</strong> Maryland, or (2) is notqualified by or registered with the Department <strong>of</strong>Assessments and <strong>Tax</strong>ation to do business in Maryland.When to file Form MW506NRSUnless the transaction is otherwise exempt from theincome tax withholding requirement, the personresponsible <strong>for</strong> closing must include with the deed orother instrument <strong>of</strong> transfer, a Form MW506NRS <strong>for</strong> eachnonresident transferor/seller, when the deed or otherinstrument <strong>of</strong> transfer is presented to the Clerk <strong>of</strong> theCircuit Court <strong>for</strong> recordation.What to fileCopies A and B <strong>of</strong> each Form MW506NRS must be filedwith the deed or other instrument <strong>of</strong> transfer whenpresented to the Clerk <strong>of</strong> the Circuit Court <strong>for</strong> recordation.A separate check or money order in the aggregateamount <strong>of</strong> the tax due <strong>for</strong> each nonresidenttransferor/seller with regard to a sale or transfer <strong>of</strong> realproperty must be paid to the Clerk.Give Copy C to the transferor/seller at closing and retainCopy D <strong>for</strong> your records.Specific InstructionsLine 1. Enter the street address <strong>for</strong> the property as listedwith the State Department <strong>of</strong> Assessments and <strong>Tax</strong>ation(SDAT). If the property does not have a street address,provide such descriptive in<strong>for</strong>mation as is used by SDATto identify the property. Also include the SDAT propertyaccount ID number <strong>for</strong> the parcel being transferred. If theproperty is made up <strong>of</strong> more than one parcel and hasmore than one account number, include all applicableaccount numbers.Line 2. Enter the date <strong>of</strong> transfer. The date <strong>of</strong> transfer isthe effective date <strong>of</strong> the deed as defined in §3-201 <strong>of</strong> the<strong>Real</strong> Property Article, Annotated Code <strong>of</strong> Maryland. Theeffective date is the later <strong>of</strong>: (1) the date <strong>of</strong> the lastacknowledgement; or (2) the date stated in the deed.Line 3. Check the box if the transferor/seller is reportingthe gain under the installment method.Line 4, 5 and 6. Unless transferors/sellers are husbandand wife and filing a joint Maryland income tax return, aseparate Form MW506NRS must be completed <strong>for</strong> eachtransferor/seller that is entitled to receive any part <strong>of</strong> theproceeds <strong>of</strong> the transfer. Enter the tax identificationnumber or social security number <strong>for</strong> the nonresidenttransferor/seller and the social security number <strong>for</strong> thespouse, if applicable. (Do NOT enter the tax number on CopyB <strong>of</strong> Form MW506NRS.) Enter the name (or names, if husbandand wife filing a joint return) <strong>of</strong> the transferor/seller and thetransferor/seller's address. Do not enter the street address <strong>of</strong>the property being transferred.Line 7. Check the appropriate box <strong>for</strong> the transferor/seller.Line 8. If a Certificate <strong>of</strong> Partial Exemption is issued by theComptroller, do not complete lines 8a through 8h. Instead,enter the amount from Line 3 <strong>of</strong> the Form MW506E on Line 8i.Complete this section to determine the Total Payment allocableto the transferor/seller that is subject to the income taxwithholding requirements and the amount <strong>of</strong> tax required to bewithheld. The total payment is computed by deducting fromthe total sales price (including the fair market value <strong>of</strong> anyproperty or other nonmonetary consideration paid to or otherwisetransferred to the transferor/seller) the amount <strong>of</strong> anymortgages or other liens, the commission payable on account<strong>of</strong> the sale, and any other expenses due from the seller inconnection with the sale.Line f. If there are multiple owners, enter the percentage <strong>of</strong>ownership <strong>of</strong> the transferor/seller <strong>for</strong> whom this <strong>for</strong>m is beingfiled.Line g. Multiply line e by line f to determine the transferor/seller's share <strong>of</strong> the total payment.Line h. Enter the applicable rate <strong>for</strong> the transferor/seller.Payment <strong>of</strong> <strong>Tax</strong>Make check or money order payable to the Clerk <strong>of</strong> the CircuitCourt <strong>for</strong> the county or Baltimore City in which the deed or otherinstrument <strong>of</strong> transfer will be presented <strong>for</strong> recordation.SignatureThis return must be verified and signed by the individualtransferor/seller, an authorized person or <strong>of</strong>ficer <strong>of</strong> a businessentity, or the person responsible <strong>for</strong> closing.

MarylandFormMW506NRS<strong>Return</strong> <strong>of</strong> <strong>Income</strong> <strong>Tax</strong> <strong>Withholding</strong> <strong>for</strong><strong>Nonresident</strong> <strong>Sale</strong> <strong>of</strong> <strong>Real</strong> PropertyComptroller <strong>of</strong> MarylandRevenue Administration DivisionAnnapolis, Maryland 21411-000120__ __• FILE WITH THE CLERK OF THE CIRCUIT COURT •1. Description and address <strong>of</strong> property transferred (include property account ID number) 7. Transferor/Seller Is:An Individual or a revocable living trustA corporationA trust or estate2. Date <strong>of</strong> transfer• 4. Transferor/Seller's Identification no.(SSN or FEIN) (Enter only one number)• 5. Spouse's SSN6. Transferor/Seller's name (Enter only one name, unless husband and wife filinga joint return. If more than one transferor/seller, use separate <strong>for</strong>ms <strong>for</strong> each)Street addressCity, state, and ZIP codeCOM/RAD-308 (Rev. 06/05)Copy B - For Clerk <strong>of</strong> the Court.A partnershipAn S corporationA Limited Liability Company-------------------------------------------THERE ARE FOUR COPIES OF FORM MW506NRS.Purpose <strong>of</strong> FormForm MW506NRS is designed to assure the regular andtimely collection <strong>of</strong> Maryland income tax due fromnonresident sellers <strong>of</strong> real property located within theState. This <strong>for</strong>m is used to determine the amount <strong>of</strong>income tax withholding due on the sale <strong>of</strong> property andprovide <strong>for</strong> its collection at the time <strong>of</strong> the sale or transfer.What to fileA copy <strong>of</strong> each Copy A will be filed with FormMW508NRS on or be<strong>for</strong>e the 21st day <strong>of</strong> the monthfollowing the month in which the Form MW506NRS isfiled with the Clerk <strong>of</strong> the Circuit Court. The Clerk <strong>of</strong> theCircuit Court shall remit the <strong>for</strong>ms to the Comptroller <strong>of</strong>Maryland in accordance with the instructions <strong>for</strong> FormMW508NRS.3. Check box if the transferor/seller is reporting gain under theInstallment method8. Computation <strong>of</strong> Total Payment (See instructions)a. Total sales priceb. Less selling expensesc. Net sales priced. Less debts secured by mortgages or otherliens on the propertye. Total Paymentf. Transferor/Seller's ownership percentageg. Transferor/Seller's share <strong>of</strong> Total Paymenth. Enter h(1) or h(2) whichever applies.(1) If a business entity -7%(2) If an individual - 6% }i. Maryland <strong>Income</strong> <strong>Tax</strong> withheld(Multiply Line g by Line h)(If certificate <strong>of</strong> partial exemption granted,enter amount from Line 3 <strong>of</strong> the FormMW506E)Form is a full page. Do NOT cut along dashed line be<strong>for</strong>e filing.INSTRUCTIONS FOR RETURN OF INCOME TAX WITHHOLDING FORNONRESIDENT SALE OF REAL PROPERTY (FORM MW506NRS)$$

MarylandFormMW506NRS<strong>Return</strong> <strong>of</strong> <strong>Income</strong> <strong>Tax</strong> <strong>Withholding</strong> <strong>for</strong><strong>Nonresident</strong> <strong>Sale</strong> <strong>of</strong> <strong>Real</strong> PropertyComptroller <strong>of</strong> MarylandRevenue Administration DivisionAnnapolis, Maryland 21411-000120__ __• RETAIN AND KEEP WITH INCOME TAX RECORDS •1. Description and address <strong>of</strong> property transferred (include property account ID number) 7. Transferor/Seller Is:An Individual or a revocable living trustA corporationA trust or estate2. Date <strong>of</strong> transfer4. Transferor/Seller's Identification no.(SSN or FEIN) (Enter only one number)5. Spouse's SSN• 6. Transferor/Seller's name (Enter only one name, unless husband and wife filinga joint return. If more than one transferor/seller, use separate <strong>for</strong>ms <strong>for</strong> each)Street addressCity, state, and ZIP codeCOM/RAD-308 (Rev. 06/05)3. Check box if the transferor/seller is reporting gain under theInstallment methodCopy C - For Transferor/Seller (Records Copy).8. Computation <strong>of</strong> Total Payment (See instructions)a. Total sales priceb. Less selling expensesc. Net sales priced. Less debts secured by mortgages or otherliens on the propertye. Total Paymentf. Transferor/Seller's ownership percentageg. Transferor/Seller's share <strong>of</strong> Total Paymenth. Enter h(1) or h(2) whichever applies.(1) If a business entity -7%(2) If an individual - 6% }i. Maryland <strong>Income</strong> <strong>Tax</strong> withheld(Multiply Line g by Line h)(If certificate <strong>of</strong> partial exemption granted,enter amount from Line 3 <strong>of</strong> the FormMW506E)A partnershipAn S corporationA Limited Liability Company-------------------------------------------INSTRUCTIONS FOR RETURN OF INCOME TAX WITHHOLDING FORNONRESIDENT SALE OF REAL PROPERTY (FORM MW506NRS)$$General InstructionsPurpose <strong>of</strong> FormForm MW506NRS is designed to assure the regular andtimely collection <strong>of</strong> Maryland income tax due fromnonresident sellers <strong>of</strong> real property located within theState. This <strong>for</strong>m is used to determine the amount <strong>of</strong>income tax withholding due on the sale <strong>of</strong> property andprovide <strong>for</strong> its collection at the time <strong>of</strong> the sale or transfer.When to fileA nonresident individual or nonresident entity that sellsreal or personal property located in Maryland must file aMaryland income tax return. The appropriate income taxreturn must be filed <strong>for</strong> the year in which the transfer <strong>of</strong>the real property occurred. The due date <strong>for</strong> each incometax return type can be found in the instructions to thespecific income tax return.What to fileThe nonresident individual or nonresident entity must filethe appropriate Maryland income tax return <strong>for</strong> the year inwhich the transfer <strong>of</strong> the property occurred. Do NOTsubmit Copy C <strong>of</strong> the Form MW506NRS with the returnfiled with the Comptroller <strong>of</strong> Maryland. See the specificinstructions <strong>for</strong> the tax return being filed.Specific Instructions <strong>for</strong> Transferor/SellerHow to claim the tax withheldThe manner in which the income tax withheld is claimedby the nonresident individual or nonresident entitydepends on the type <strong>of</strong> Maryland income tax return youare required to file. Follow the specific instructions below.Claiming the income tax withheld in a manner or on a lineother than listed below may result in the withholding beingdenied.Individuals and Revocable Living Trusts<strong>Nonresident</strong> individuals are required to file a <strong>Nonresident</strong>Maryland <strong>Income</strong> <strong>Tax</strong> <strong>Return</strong> (Form 505). The income taxwithheld and reported on Line 8 <strong>of</strong> the Form MW506NRSmust be claimed as an estimated income tax payment(Line 44 on the 2005 Form 505).C CorporationsC Corporations are required to file a MarylandCorporation <strong>Income</strong> <strong>Tax</strong> <strong>Return</strong> (Form 500). The incometax withheld and reported on Line 8 <strong>of</strong> the FormMW506NRS must be claimed as an estimated incometax payment (Line 10a on the 2005 Form 500).S Corporations, Partnerships and Limited LiabilityCompaniesS corporations, partnerships and limited liabilitycompanies that elect to be treated as pass-throughentities must file a Maryland Pass-through Entity <strong>Income</strong><strong>Tax</strong> <strong>Return</strong> (Form 510). The income tax withheld andreported on Line 8 <strong>of</strong> the Form MW506NRS must beclaimed as an estimated income tax payment.This tax, and any other tax paid with the Form 510 mustbe allocated to the nonresident shareholders, partners ormembers and reported on a modified federal Schedule K-1 orMaryland statement. All tax allocated to a nonresidentshareholder, partner or member must be claimed as anonresident tax paid by S corporations, or other unincorporatedbusiness entities (Line 46 on the 2005 Form 505).Trusts and EstatesTrustees <strong>of</strong> trusts and personal representatives <strong>of</strong> estates arerequired to file a Maryland Fiduciary <strong>Income</strong> <strong>Tax</strong> <strong>Return</strong> (Form504) The income tax withheld and reported on Line 8 <strong>of</strong> theForm MW506NRS must be claimed as an estimated incometax payment.

MarylandFormMW506NRS<strong>Return</strong> <strong>of</strong> <strong>Income</strong> <strong>Tax</strong> <strong>Withholding</strong> <strong>for</strong><strong>Nonresident</strong> <strong>Sale</strong> <strong>of</strong> <strong>Real</strong> PropertyComptroller <strong>of</strong> MarylandRevenue Administration DivisionAnnapolis, Maryland 21411-000120__ __• RETAIN WITH SETTLEMENT FILE •1. Description and address <strong>of</strong> property transferred (include property account ID number) 7. Transferor/Seller Is:An Individual or a revocable living trustA corporationA trust or estate2. Date <strong>of</strong> transfer4. Transferor/Seller's Identification no.(SSN or FEIN) (Enter only one number)• 5. Spouse's SSN6. Transferor/Seller's name (Enter only one name, unless husband and wife filinga joint return. If more than one transferor/seller, use separate <strong>for</strong>ms <strong>for</strong> each)Street addressCity, state, and ZIP codeCOM/RAD-308 (Rev. 06/05)3. Check box if the transferor/seller is reporting gain under theInstallment methodCopy D - For Issuer.8. Computation <strong>of</strong> Total Payment (See instructions)a. Total sales priceb. Less selling expensesc. Net sales priced. Less debts secured by mortgages or otherliens on the propertye. Total Paymentf. Transferor/Seller's ownership percentageg. Transferor/Seller's share <strong>of</strong> Total Paymenth. Enter h(1) or h(2) whichever applies.(1) If a business entity -7%(2) If an individual - 6% }i. Maryland <strong>Income</strong> <strong>Tax</strong> withheld(Multiply Line g by Line h)(If certificate <strong>of</strong> partial exemption granted,enter amount from Line 3 <strong>of</strong> the FormMW506E)A partnershipAn S corporationA Limited Liability Company-------------------------------------------INSTRUCTIONS FOR RETURN OF INCOME TAX WITHHOLDING FORNONRESIDENT SALE OF REAL PROPERTY (FORM MW506NRS)$$THERE ARE FOUR COPIES OF FORM MW506NRS.General InstructionsPurpose <strong>of</strong> FormForm MW506NRS is designed to assure the regular andtimely collection <strong>of</strong> Maryland income tax due fromnonresident sellers <strong>of</strong> real property located within theState. This <strong>for</strong>m is used to determine the amount <strong>of</strong>income tax withholding due on the sale <strong>of</strong> property andprovide <strong>for</strong> its collection at the time <strong>of</strong> the sale or transfer.Who must file Form MW506NRSIf the transferor/seller is a nonresident individual or entity,and is transferring an interest in real property locatedwithin the State <strong>of</strong> Maryland, unless the transaction isotherwise exempt from the income tax withholdingrequirement, the person responsible <strong>for</strong> closing must fileForm MW506NRS with the deed or other instrument <strong>of</strong>transfer that will be filed with the Clerk <strong>of</strong> the Circuit Court<strong>for</strong> recordation. If there are multiple transferors/sellers, aseparate <strong>for</strong>m must be completed <strong>for</strong> each nonresidentindividual or nonresident entity subject to the withholdingrequirements. The separate <strong>for</strong>m requirement does notapply to a husband and wife filing a joint Maryland incometax return.When to file Form MW506NRSUnless the transaction is otherwise exempt from theincome tax withholding requirement, the personresponsible <strong>for</strong> closing must include with the deed orother instrument <strong>of</strong> transfer, a Form MW506NRS <strong>for</strong> eachnonresident transferor/seller, when the deed or otherinstrument <strong>of</strong> transfer is presented to the Clerk <strong>of</strong> theCircuit Court <strong>for</strong> recordation.What to fileCopies A and B <strong>of</strong> each Form MW506NRS must be filedwith the deed or other instrument <strong>of</strong> transfer whenpresented to the Clerk <strong>of</strong> the Circuit Court <strong>for</strong> recordation.A separate check or money order in the aggregateamount <strong>of</strong> the tax due <strong>for</strong> each nonresidenttransferor/seller with regard to a sale or transfer <strong>of</strong> realproperty must be paid to the Clerk.Give Copy C to the transferor/seller at closing and retainCopy D <strong>for</strong> your records.Specific InstructionsLine 1. Enter the street address <strong>for</strong> the property as listedwith the State Department <strong>of</strong> Assessments and <strong>Tax</strong>ation(SDAT). If the property does not have a street address,provide such descriptive in<strong>for</strong>mation as is used by SDATto identify the property. Also include the SDAT propertyaccount ID number <strong>for</strong> the parcel being transferred. If theproperty is made up <strong>of</strong> more than one parcel and hasmore than one account number, include all applicableaccount numbers.Line 2. Enter the date <strong>of</strong> transfer. The date <strong>of</strong> transfer isthe effective date <strong>of</strong> the deed as defined in §3-201 <strong>of</strong> the<strong>Real</strong> Property Article, Annotated Code <strong>of</strong> Maryland. Theeffective date is the later <strong>of</strong>: (1) the date <strong>of</strong> the lastacknowledgement; or (2) the date stated in the deed.Line 3. Check the box if the transferor/seller is reportingthe gain under the installment method.Line 4, 5 and 6. Unless transferors/sellers are husbandand wife and filing a joint Maryland income tax return, aseparate Form MW506NRS must be completed <strong>for</strong> eachtransferor/seller that is entitled to receive any part <strong>of</strong> theproceeds <strong>of</strong> the transfer. Enter the tax identificationnumber or social security number <strong>for</strong> the nonresidenttransferor/seller and the social security number <strong>for</strong> thespouse, if applicable. (Do NOT enter the tax number on CopyB <strong>of</strong> Form MW506NRS.) Enter the name (or names, if husbandand wife filing a joint return) <strong>of</strong> the transferor/seller and thetransferor/seller's address. Do not enter the street address <strong>of</strong>the property being transferred.Line 7. Check the appropriate box <strong>for</strong> the transferor/seller.Line 8. If a Certificate <strong>of</strong> Partial Exemption is issued by theComptroller, do not complete lines 8a through 8h. Instead,enter the amount from Line 3 <strong>of</strong> the Form MW506E on Line 8i.Complete this section to determine the Total Payment allocableto the transferor/seller that is subject to the income taxwithholding requirements and the amount <strong>of</strong> tax required to bewithheld. The total payment is computed by deducting fromthe total sales price (including the fair market value <strong>of</strong> anyproperty or other nonmonetary consideration paid or otherwisetransferred to the transferor/seller) the amount <strong>of</strong> anymortgages or other liens, the commission payable on account<strong>of</strong> the sale, and any other expenses due from the seller inconnection with the sale.Line f. If there are multiple owners, enter the percentage <strong>of</strong>ownership <strong>of</strong> the transferor/seller <strong>for</strong> whom this <strong>for</strong>m is beingfiled.Line g. Multiply line e by line f to determine the transferor/seller's share <strong>of</strong> the total payment.Line h. Enter the applicable rate <strong>for</strong> the transferor/seller.Payment <strong>of</strong> <strong>Tax</strong>Make check or money order payable to the Clerk <strong>of</strong> the CircuitCourt <strong>for</strong> the county or Baltimore City in which the deed or otherinstrument <strong>of</strong> transfer will be presented <strong>for</strong> recordation.