Inheritance Tax Return Nonresident Decedent (REV ... - FormSend

Inheritance Tax Return Nonresident Decedent (REV ... - FormSend

Inheritance Tax Return Nonresident Decedent (REV ... - FormSend

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

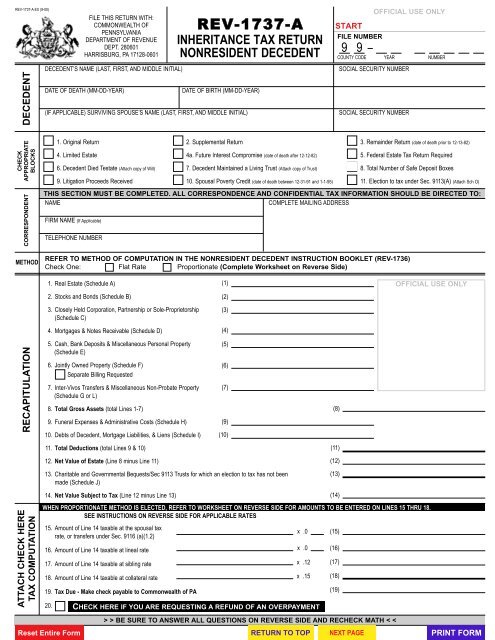

<strong>REV</strong>-1737-A EX (9-00)DECEDENTFILE THIS RETURN WITH:COMMONWEALTH OFPENNSYLVANIADEPARTMENT OF <strong>REV</strong>ENUEDEPT. 280601HARRISBURG, PA 17128-0601DECEDENT’S NAME (LAST, FIRST, AND MIDDLE INITIAL)DATE OF DEATH (MM-DD-YEAR)<strong>REV</strong>-1737-AINHERITANCE TAX RETURNNONRESIDENT DECEDENTDATE OF BIRTH (MM-DD-YEAR)(IF APPLICABLE) SURVIVING SPOUSE’S NAME (LAST, FIRST, AND MIDDLE INITIAL)OFFICIAL USE ONLYFILE NUMBER9 9COUNTY CODE YEAR NUMBERSOCIAL SECURITY NUMBERSOCIAL SECURITY NUMBERCHECKAPPROPRIATEBLOCKSCORRESPONDENTMETHOD1. Original <strong>Return</strong>4. Limited Estate6. <strong>Decedent</strong> Died Testate (Attach copy of Will)9. Litigation Proceeds ReceivedTHIS SECTION MUST BE COMPLETED. ALL CORRESPONDENCE AND CONFIDENTIAL TAX INFORMATION SHOULD BE DIRECTED TO:NAMECOMPLETE MAILING ADDRESSFIRM NAME (If Applicable)TELEPHONE NUMBER2. Supplemental <strong>Return</strong>4a. Future Interest Compromise (date of death after 12-12-82)7. <strong>Decedent</strong> Maintained a Living Trust (Attach copy of Trust)10. Spousal Poverty Credit (date of death between 12-31-91 and 1-1-95)REFER TO METHOD OF COMPUTATION IN THE NONRESIDENT DECEDENT INSTRUCTION BOOKLET (<strong>REV</strong>-1736)Check One: Flat Rate Proportionate (Complete Worksheet on Reverse Side)3. Remainder <strong>Return</strong> (date of death prior to 12-13-82)5. Federal Estate <strong>Tax</strong> <strong>Return</strong> Required8. Total Number of Safe Deposit Boxes11. Election to tax under Sec. 9113(A) (Attach Sch O)1. Real Estate (Schedule A)2. Stocks and Bonds (Schedule B)3. Closely Held Corporation, Partnership or Sole-Proprietorship(Schedule C)4. Mortgages & Notes Receivable (Schedule D)(1)(2)(3)(4)OFFICIAL USE ONLYRECAPITULATIONATTACH CHECK HERETAX COMPUTATION5. Cash, Bank Deposits & Miscellaneous Personal Property(Schedule E)6. Jointly Owned Property (Schedule F)(6)Separate Billing Requested7. Inter-Vivos Transfers & Miscellaneous Non-Probate Property (7)(Schedule G or L)8. Total Gross Assets (total Lines 1-7)(8)9. Funeral Expenses & Administrative Costs (Schedule H)10. Debts of <strong>Decedent</strong>, Mortgage Liabilities, & Liens (Schedule I)(9)(10)11. Total Deductions (total Lines 9 & 10)12. Net Value of Estate (Line 8 minus Line 11)13. Charitable and Governmental Bequests/Sec 9113 Trusts for which an election to tax has not been(11)(12)(13)made (Schedule J)14. Net Value Subject to <strong>Tax</strong> (Line 12 minus Line 13)(14)WHEN PROPORTIONATE METHOD IS ELECTED, REFER TO WORKSHEET ON <strong>REV</strong>ERSE SIDE FOR AMOUNTS TO BE ENTERED ON LINES 15 THRU 18.SEE INSTRUCTIONS ON <strong>REV</strong>ERSE SIDE FOR APPLICABLE RATES15. Amount of Line 14 taxable at the spousal taxrate, or transfers under Sec. 9116 (a)(1.2)16. Amount of Line 14 taxable at lineal rate17. Amount of Line 14 taxable at sibling rate18. Amount of Line 14 taxable at collateral rate19. <strong>Tax</strong> Due - Make check payable to Commonwealth of PAx .0x .0x .12x .15(15)(16)(17)(18)(19)20.CHECK HERE IF YOU ARE REQUESTING A REFUND OF AN OVERPAYMENT(5)> > BE SURE TO ANSWER ALL QUESTIONS ON <strong>REV</strong>ERSE SIDE AND RECHECK MATH <

<strong>Decedent</strong>’s Complete Address:STREET ADDRESSCITY STATE ZIP<strong>Tax</strong> Payments and Credits:1. <strong>Tax</strong> Due (Page 1 Line 19) (1)2. Credits/PaymentsA. Spousal Poverty CreditB. Prior PaymentsC. DiscountTotal Credits ( A + B + C ) (2)3. Interest/Penalty if applicableD. InterestE. PenaltyTotal Interest/Penalty ( D + E ) (3)4. If Line 2 is greater than Line 1 + Line 3, enter the difference.This is the OVERPAYMENT.Check box on Page 1 Line 20 to request a refund (4)5. If Line 1 + Line 3 is greater than Line 2, enter the difference.This is the TAX DUE. (5)A. Enter the interest on the tax due. (5A)B. Enter the total of Line 5 + 5A. This is the BALANCE DUE. (5B)Make checks payable to: COMMONWEALTH OF PENNSYLVANIAPROPORTIONATE METHOD WORKSHEET1. Total Pennsylvania real property and tangible personalproperty located in Pennsylvania................................................ (1)2. Total gross assets wherever situated (Page 1 Line 8) .............. (2)3. Proportion (Divide Line 1 by Line 2)........................................................................................(3)4. Total debts and deductions and amounts devised to charitableorganizations (Add Page 1 lines 11 and 13) .............................. (4)5. <strong>Tax</strong>able Estate as if a Pennsylvania resident(Subtract Line 4 from Line 2)...................................................... (5)6. Spousal transfers (for dates of death after 6-30-94), or transfers underSec. 9116 (a)(1.2) Amount <strong>Tax</strong>ableat % X Proportion (Line 3)...... X = (6)7. Amount <strong>Tax</strong>able at lineal rate XProportion (Line 3).............................. X = (7)8. Amount <strong>Tax</strong>able at sibling rate XProportion (Line 3).............................. X = (8)9. Amount <strong>Tax</strong>able at collateral rate XProportion (Line 3).............................. X = (9)The result of Lines 6 thru 9 are to be entered on Page 1 lines 15 thru 18 of the <strong>Tax</strong> Computation respectively.PLEASE ANSWER THE FOLLOWING QUESTIONS BY PLACING AN "X" IN THE APPROPRIATEBLOCKS IF THE PROPORTIONATE METHOD IS ELECTED OR IF PENNSYLVANIA REALTY ORTANGIBLE PERSONAL PROPERTY LOCATED IN PENNSYLVANIA WAS TRANSFERREDWITHIN ONE YEAR OF THE DEATH OF THE DECEDENT.1. Did decedent make a transfer and: Yes Noa. retain the use or income of the property transferred; ..............................................................b. retain the right to designate who shall use the property transferred or its income; ................c. retain a reversionary interest; or ..............................................................................................d. receive the promise for life of either payments, benefits or care? ..........................................2. If death occurred after December 12, 1982, did decedent transfer property within one yearof death without receiving adequate consideration? ....................................................................3. Did decedent own an "in trust for" or payable upon death bank account or security at hisor her death? ................................................................................................................................4. Did decedent own an Individual Retirement Account, annuity, or other non-probate propertywhich contains a beneficiary designation? ..........................................................................IF THE ANSWER TO ANY OF THE ABOVE QUESTIONS IS YES, YOU MUST COMPLETE SCHEDULE G ANDFILE IT AS PART OF THE RETURN.Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, itis true, correct and complete. Declaration of preparer other than the personal representative is based on all information of which preparer has any knowledge.SIGNATURE OF PERSON RESPONSIBLE FOR FILING RETURNADDRESSSIGNATURE OF PREPARER OTHER THAN REPRESENTATIVEADDRESSFor dates of death on or after July 1, 1994 and before January 1, 1995, the tax rate imposed on the net value of transfers to orfor the use of the surviving spouse is 3% [72 P.S. §9116 (a) (1.1) (i)].For dates of death on or after January 1, 1995, the tax rate imposed on the net value of transfers to or for the use of thesurviving spouse is 0% [72 P.S. §9116 (a) (1.1) (ii)]. The statute does not exempt a transfer to a surviving spouse from tax, andthe statutory requirements for disclosure of assets and filing a tax return are still applicable even if the surviving spouse is theonly beneficiary.For dates of death on or after July 1, 2000:The tax rate imposed on the net value of transfers from a deceased child twenty-one years of age or younger at death to or forthe use of a natural parent, an adoptive parent, or a stepparent of the child is 0% [72 P.S. §9116(a)(1.2)].The tax rate imposed on the net value of transfers to or for the use of the decedent’s lineal beneficiaries is 4.5%, except asnoted in 72 P.S. §9116 (a)(1.2) [72 P.S. §9116(a)(1)].The tax rate imposed on the net value of transfers to or for the use of the decedent’s siblings is 12% [72 P.S. §9116(a)(1.3)]. Asibling is defined, under Section 9102, as an individual who has at least one parent in common with the decedent, whether byblood or adoption.DATEDATE

<strong>REV</strong>-1737-1 EX + (9-00)COMMONWEALTH OF PENNSYLVANIADEPARTMENT OF <strong>REV</strong>ENUEDEPT. 280601HARRISBURG, PA 17128-0601NONRESIDENT DECEDENTAFFIDAVIT OF DOMICILEThis affidavit must be completed and sworn to by a person having personal knowledge of thesefacts, preferably by a surviving spouse or member of the decedent’s family.Name of <strong>Decedent</strong>Date of DeathLegal Address at Time of Death:Street Address City/Borough State Zip CodeThe following information is submitted in support of the statement that the above individual wasnot domiciled in the Commonwealth of Pennsylvania at the date of death.1. Names and addresses of the decedent’s surviving spouse and members of his/her immediate family:Name and relationship to decedentStreet Address City/Borough State Zip CodeName and relationship to decedentStreet Address City/Borough State Zip CodeName and relationship to decedentStreet Address City/Borough State Zip Code2. Did the decedent ever live in Pennsylvania? Yes NoIf yes, during what periods?3. Did the decedent spend time in Pennsylvania during the five years preceding death ? Yes NoIf yes, during what periods and at what address?4. What was the nature of decedent’s places of residence during the five years immediately preceding death?Indicate whether decedent resided in a house or apartment and whether it was rented or owned by the decedent, and/or whether decedent resided in ahotel or the home of relatives or friends.5. Was the decedent employed during the five years preceding death? Yes NoIf yes, list the name and address of employer(s).6. Did the decedent leave a will? Yes NoIf yes, state the court which admitted the will to probate, the date admitted, and attach a copy, including all codicils, and a certificate of issuance ofletters testamentary.7. If the decedent did not leave a will, has an administrator of his estate been appointed? Yes NoIf yes, state the court which appointed the administrator, the date of appointment, and attach a certificate of the issuance of letters of administration.8. At any time during the last five years did the decedent execute a will, a codicil, trust indenture, deed, mortgage, lease or any other document in whichthe decedent was described as a resident of Pennsylvania? Yes NoIf yes, describe such document.

NONRESIDENT DECEDENT AFFIDAVIT OF DOMICILE (continued) Page 29. Had the decedent paid a tax on income or on intangible property to any state, county, or municipality during the last five years?If yes, where and when was it paid? Yes No10. To what regional office of the Internal Revenue Service did the decedent forward his Federal Income <strong>Tax</strong> returns during the last five yearspreceding death?11. At the time of death, did the decedent own, individually or jointly, any interest in real property, including lease-holds or tangible personal propertylocated in Pennsylvania? Yes NoIf yes, describe the property in detail.12. In what business activities was the decedent engaged during the last five years preceding death?Indicate whether decedent was employed or otherwise engaged in business, and state the names and the addresses of the persons, firms or corporationswith which the decedent had such business affiliations. ( Except for employer listed in #5 )13. What is the estimated gross value of the decedent’s estate, wheresoever situated, exclusive of real property and tangible property located outsideof Pennsylvania?14. At the time of death, did the decedent own or operate an automobile? Yes NoIf yes, in which state was it registered?15. At the time of death, was the decedent a member of a church or any other organization ? Yes NoIf yes, provide the name and address of the church or any other organization.16. State the purpose or reason the decedent owned real property in Pennsylvania.17. Include any other information you wish to submit in support of the contention that the individual was not domiciled in Pennsylvania at the timeof death. If more space is needed, insert additional sheets of same size.Name of person completing affidavitRelationship to decedentStreet Address City State Zip CodeUnder penalties of perjury, I declare that based on my personal knowledge of the decedent, theinformation provided on this form is true, correct and complete.Signature of person completing affidavitDate