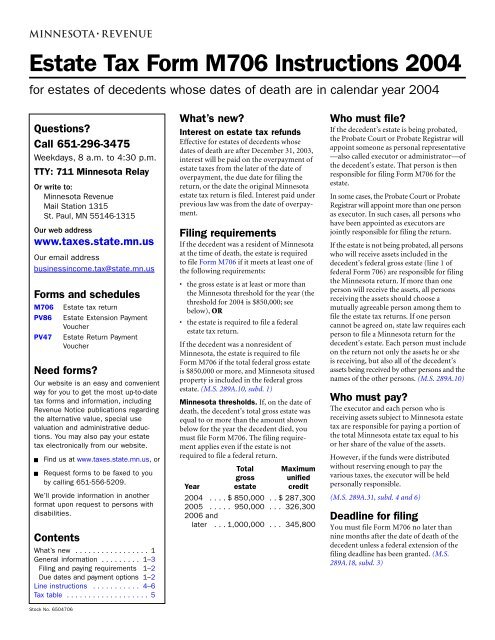

Estate Tax Form M706 Instructions 2004 - FormSend

Estate Tax Form M706 Instructions 2004 - FormSend

Estate Tax Form M706 Instructions 2004 - FormSend

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

General informationDeadline for payingThe Minnesota estate tax must be paid nolater than nine months after the date ofdeath of the decedent. However, it may bepossible to pay the tax in installments afterthis date if the estate meets the requirementsexplained in the section Paying tax in installmentson this page. (M.S. 289A.20, subd. 3)Extension of time to fileIf the Internal Revenue Service (IRS) grantsan extension of time to file the decedent’sfederal estate tax return, the federalextended filing due date automaticallyapplies to the Minnesota return. When youfile <strong>Form</strong> <strong>M706</strong>, attach a copy of the IRSdocument that grants the extension. Also, besure to indicate the approved federal filingextension due date on the front of yourMinnesota return.If you are not extending the time to file yourfederal return, you may request a six-monthextension for filing your Minnesota return.To request, you must send a letter explainingwhy the extension is needed and pay atleast 90 percent of the tax due. Mail yourrequest and payment to Minnesota <strong>Estate</strong><strong>Tax</strong>, Mail Station 5170, St. Paul, MN 55146-5170. You can assume your request has beenapproved if you do not hear from us within30 business days.The extension of time to file does not extendthe time in which you must pay the estatetax. To avoid penalties and interest, youmust pay your tax on or before the regulardue date (see Payment options above).If you made an extension payment, includethe amount you paid on line 12 of <strong>Form</strong><strong>M706</strong>. (M.S. 289A.19, subd. 4)Extension payment. <strong>Estate</strong> tax is due bythe regular due date, even if the return willbe filed under an extension. A late paymentpenalty and interest will be assessed on taxpaid after the regular due date, unless youreceived an extension to pay the federal tax,or you have properly elected under IRCsection 6166 or 6601 to pay tax in installments.In which case, a penalty will not be assessed.Paying tax in installmentsIf the Minnesota estate tax is $5,000 or moreand the IRS has granted the estate anextension of time to pay the federal estatetax for the purpose of paying the tax ininstallments, the estate may pay theMinnesota estate tax in installments if therequirements explained below are met.(M.S. 289A.30, subd. 2)Payment options<strong>Estate</strong> tax can be paid electronically or by check.Pay electronically• Go to our website at www.taxes.state.mn.us.• If you don’t have Internet access, call 1-800-570-3329.Both options are free and there is no need to register. Enter the decedent’sSocial Security number and follow the prompts for individuals to make anestate tax payment. You’ll need the decedent’s last name, date of birth,date of death and your bank routing and account numbers.To be timely, you must complete your transaction and receive a confirmationnumber on or before the due date for that payment. You may also set uppayments—up to 13 months in advance—when you pay electronically.If you are making one of theyou must mail your checkfollowing payments by check:with a completed <strong>Form</strong>:<strong>Tax</strong> return payment (taxes due with <strong>M706</strong>) . . . . . . . . . . . . PV47Extension payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . PV86Make your check payable to Minnesota Revenue.To be allowed to pay the Minnesota estatetax in installments, the executor mustnotify the commissioner in writing no laterthan nine months after the date of death ofthe decedent. The letter must indicate thatthe estate will pay the Minnesota estate taxin installments and the dates the paymentswill be made. The dates must be the sameas the dates on which the federal estate taxinstallments will be made.The installments on the total estate taxowed—not including interest owed—mustbe made in equal amounts.Even if you pay the tax in installments, youmust pay interest on any tax that remainsunpaid after nine months from the date ofdeath of the decedent. The rate of intereston each installment will be the interest ratein effect during that annual period. (M.S.289A.55, subd. 7)The amount of interest to include with eachinstallment must be figured separately.Follow the steps below to determine theinterest to include with each installment:1 Determine the number of days from thelast payment due date (return orinstallment) to date of payment orDecember 31, whichever is earlier.2 Divide step 1 by 366 (if <strong>2004</strong>) or 365 (if2005), and round to five decimal places.3 Multiply step 2 by the interest rate in effectfor that year (see Interest on page 3).4 Multiply step 3 by the tax still due.• If the due date is in the same year thatyou’re making your payment, stophere. The result in step 4 is the interestyou must include with your installment.• If your payment was due in one year andyou’re making the installment in thenext calendar year, continue with step 5.5 Determine the number of days fromJanuary 1 to date of payment.6 Divide step 5 by 366 (if <strong>2004</strong>) or 365 (if2005), and round to five decimal places.7 Multiply step 6 by the interest rate in effectfor that year (see Interest on page 3).8 Multiply step 7 by the tax still due.9 Add step 4 and step 8. This is the interestto include with your installment.If you fail to make an installment on time,you cannot continue to pay the tax ininstallments. Instead, you must pay —within 90 days from the date of the missedinstallment—the full amount of unpaidestate tax, a late payment penalty on theunpaid tax, plus interest.However, if you missed the installment datefor what you believe is a reasonable cause,write to the Commissioner of Revenueexplaining why the payment was late.You’ll be notified in writing whether youmay continue to pay Minnesota estate taxin installments. (M.S. 289A.30, subd. 2)2

General information (continued)PenaltiesLate payment. If you’re not paying estatetax in installments, a late payment penaltywill be assessed on any tax not paid by theregular due date—nine months after thedecedent’s date of death.The penalty is 6 percent of the unpaid tax. Ifyou file your return after the due date andyou do not pay the tax as reported on yourreturn, an additional 5 percent late paymentpenalty will be assessed on the unpaid tax.Late filing. If you file the return after theregular due date—or after the approvedextended due date—a late filing penaltywill be assessed on the unpaid tax.The penalty is 5 percent of the unpaid tax.An additional extended delinquencypenalty of 5 percent of the unpaid tax willbe assessed if the return is not filed within30 days after the department sends awritten demand.Failing to file with intent to evade taxor filing a false or fraudulent return. Apenalty of 50 percent of the tax due isadded to the tax. This penalty is in additionto any other penalties that may apply. (M.S.289A.60)Criminal penalties. If you willfully fail tofile a return in order to evade paying thetax, you could be charged with a grossmisdemeanor. If you file a fraudulentreturn in order to evade paying all or partof the tax, you could be charged with afelony. (M.S. 289A.63)Abatement of penaltiesIf circumstances beyond your controlprevented you from filing or paying yourtaxes on time, you may request an abatementof penalties. To request an abatement,send a letter to the department explainingthe specific events or circumstances thatprevented you from filing and/or paying ontime. Your abatement request must bemade within 60 days after the date youwere notified that a penalty has beenimposed. (M.S. 270.07, subd. 1)InterestInterest is calculated as simple interest andaccrues on unpaid tax and penaltiesbeginning nine months from the decedent’sdate of death. Interest will be charged evenif the deadline for filing the return has beenextended or the tax is being paid under aninstallment plan. The rate of interest maychange from year to year. (M.S. 270.75)The interest rate for <strong>2004</strong> and 2005 is 4percent. (M.S. 289A.55)Required informationInformation requested for filing estate tax isrequired under state law (M.S. 289A.10).You must attach the following to <strong>Form</strong> <strong>M706</strong>:• a completed copy of your federal <strong>Form</strong>706, including all federal schedules (Athrough U) that list an amount,• copies of the wills, property appraisals orsales documents, trust agreements,disclaimers, financial documents thatverify balances and/or stock or bondprices, etc., and• a copy of the death certificate.Other items you must attach to the returninclude:• a copy of the IRS’s extension approval, ifyou’re filing <strong>Form</strong> <strong>M706</strong> by the federalextended due date, or a copy of thedepartment’s approval if your request fora Minnesota extension was granted.• an itemized list of the gross values of thedecedent’s real and tangible personalproperty located outside Minnesota (if aresident estate) or in Minnesota (if anonresident estate). Also, include a list ofthe schedule and item number where eachproperty is listed in the decedent’s federalreturn.• a completed PV47 payment voucher, ifyou’re paying the tax due by check withthe <strong>Form</strong> <strong>M706</strong>.• a copy of the IRS approval document, ifyou’re paying the federal estate tax ininstallments.Use one of the mailing labels provided onpage 4 to mail your <strong>Form</strong> <strong>M706</strong> and allrequired attachments to the department. Ifyou choose not to use the label, mail yourforms to: Minnesota <strong>Estate</strong> <strong>Tax</strong>, MailStation 1315, St. Paul, MN 55146-1315.(M.S. 289A.10, subd. 2)Use of informationAll information you enter on the return isprivate under state law. It cannot be given toothers without your consent except to theIRS, other Minnesota state agencies andother state governments that are authorizedby law to receive the information and musttreat the information as private.The decedent’s Social Security number isrequired by M.S. 270.066. Although your—the executor’s—Social Security number isrequested on <strong>Form</strong> <strong>M706</strong>, you are notrequired to provide it. We ask for yourSocial Security number so the departmentcan correctly identify you, because you areresponsible for paying the estate tax if thetax is not paid from the estate’s assets.Reporting federal changesIf the IRS changes or audits the estate’sfederal tax or you amend the federal return,you must file an amended Minnesota estatetax return with the department. Theamended return is due no later than 180days after you are notified of the federalchanges or the date you filed the amendedfederal return.You must file an amended Minnesota returneven if the changes do not require you toamend the federal return. Complete a new<strong>Form</strong> <strong>M706</strong> with the appropriate amendedinformation, and check the box at the top ofthe form to indicate that it is an amendedreturn. You must attach to your <strong>Form</strong><strong>M706</strong>, a complete copy of the estate’samended federal return or the correctionnotice you received from the IRS.If there are no changes made to the federalreturn, the IRS will generally issue the estatean “<strong>Estate</strong> <strong>Tax</strong> Closing Letter.” If youreceived a closing letter, submit a copy tothe department so the estate’s file can beclosed. (M.S. 289A.38, subd. 7)If you fail to report the federal changeswithin 180 days as required, a 10 percentpenalty will be assessed on any additionaltax. (M.S. 289A.60, subd. 24)Refund of Minnesota taxIf you overpaid tax or the circumstances ofthe estate have changed since the Minnesotareturn was filed and you believe all or aportion of the tax already paid should berefunded, complete a new <strong>Form</strong> <strong>M706</strong> andcheck the box to show it is an amendedreturn. Be sure to enter on line 12 any tax,penalty and interest you’ve already paid. Online 17 enter the refund amount.The estate will be paid interest on theamount refunded. (M.S. 289A.50)Income tax return forestatesIf the estate’s assets generate $600 or moreof Minnesota gross income, you must file<strong>Form</strong> M2, Income <strong>Tax</strong> Return for <strong>Estate</strong>s andTrusts, with the department.<strong>Form</strong> M2 corresponds to the federal <strong>Form</strong>1041, United States Income <strong>Tax</strong> Return for<strong>Estate</strong>s and Trusts, and is due April 15 or the15th day of the fourth month following theend of the tax year.3

Federal 706 worksheet instructionsYou must first complete afederal 706 worksheetEven though you may have completedfederal <strong>Form</strong> 706, United States <strong>Estate</strong> (andGeneration-Skipping Transfer) <strong>Tax</strong> Return,you must also complete lines 1 through 12on a separate federal <strong>Form</strong> 706 (Rev. August2002) using the federal law in effect prior tothe changes enacted in 2001. This separateform will be used as a worksheet todetermine your Minnesota estate tax.When you complete your federal 706worksheet, use the following instructions:Lines 1 through 5: Determine the amounts toenter on these lines using the federal 2002instructions.Line 6: Use Table A (at right) and theamount on line 5 of your federal 706worksheet to determine the federal tentativetax to enter on line 6.Lines 7 and 8: Determine the amounts toenter on these lines using the federal 2002instructions.Line 9: Enter $287,300. This is the maximumunified credit for dates of death in<strong>2004</strong>.Lines 10 through 12: Determine the amountsto enter on these lines using the federal 2002instructions.If you use a software package, be sure toverify that the appropriate table amount online 6 and the correct maximum unifiedcredit amount on line 9 are used.You must attach to your <strong>Form</strong> <strong>M706</strong> thefederal 706 worksheet and all requiredschedules that list an amount.Table A —Use to determine line 6 of federal 706 worksheetIf line 5 of your federal706 worksheet is:but subtract multiplyover not over from line 5 result by and add$ 0 . . . $ 10,000 . . . . . . . . .$ 0 . . . . 18% . . . . . . . . . . $ 010,000 . . . . 20,000 . . . . . . 10,000 . . . . 20% . . . . . . . . 1,80020,000 . . . . 40,000 . . . . . . . 20,000 . . . . 22% . . . . . . . . 3,80040,000 . . . . 60,000 . . . . . . . 40,000 . . . . 24% . . . . . . . . 8,20060,000 . . . . 80,000 . . . . . . . 60,000 . . . . 26% . . . . . . . 13,00080,000 . . . 100,000 . . . . . . . 80,000 . . . . 28% . . . . . . . 18,200100,000 . . . 150,000 . . . . . . 100,000 . . . . 30% . . . . . . . 23,800150,000 . . . 250,000 . . . . . . 150,000 . . . . 32% . . . . . . . 38,800250,000 . . . 500,000 . . . . . . 250,000 . . . . 34% . . . . . . . 70,800500,000 . . . 750,000 . . . . . .500,000 . . . . 37% . . . . . . 155,800750,000 . . 1,000,000 . . . . . . 750,000 . . . . 39% . . . . . . 248,3001,000,000 . . 1,250,000 . . . . 1,000,000 . . . . 41% . . . . . . 345,8001,250,000 . . 1,500,000 . . . . 1,250,000 . . . . 43% . . . . . . 448,3001,500,000 . . 2,000,000 . . . . 1,500,000 . . . . 45% . . . . . . 555,8002,000,000 . . 2,500,000 . . . . 2,000,000 . . . . 49% . . . . . . 780,8002,500,000 . . 3,000,000 . . . . 2,500,000 . . . . 53% . . . . 1,025,8003,000,000 . . — — — — . . . . 3,000,000 . . . . 55% . . . . 1,290,800Enter the result on line 6 of your federal 706 worksheet.Use a mailing labelUse one of these mailing labels on your own envelope to mail your <strong>Form</strong> <strong>M706</strong> and copies of the estate’s federal return, requiredschedules and death certificate. (Cut on the dotted line and tape to your envelope.)Mail Station 1315St. Paul, MN 55146-1315Mail Station 1315St. Paul, MN 55146-13154

Line instructionsYou will need your federal 706worksheet to complete your<strong>Form</strong> <strong>M706</strong>.See page 4 for details.Executor(s)Enter the name, address and Social Securitynumber of the appointed executor in thedesignated area on <strong>Form</strong> <strong>M706</strong>.If more than one executor was appointedby the Probate Court or Probate Registrar,you must attach a separate sheet of paperlisting all of the other appointed executors’names, addresses and Social Securitynumbers.All appointed executors must sign thecompleted <strong>Form</strong> <strong>M706</strong>.<strong>Estate</strong>s of Minnesotaresidents—Lines 1–6Line 1Tentative Minnesota estate taxTo determine the amount to enter on line 1of your <strong>Form</strong> <strong>M706</strong>, follow the steps below:1 Federal taxable estate (fromline 3 of your federal 706worksheet) . . . . . . . . . . . . . .2 Minimum amount . . . . . . .3 Adjusted taxable estate(subtract step 2 fromstep 1) . . . . . . . . . . . . . . . . . .4 Using the result fromstep 3 and Table B at right,determine the amount toenter here . . . . . . . . . . . . . . .5 Gross estate tax (fromline 8 of your federal 706worksheet) . . . . . . . . . . . . . .6 Maximum unified credit(from line 9 of your federal706 worksheet) . . . . . . . . . .7 Subtract step 6 from step 5 .8 Enter the amount fromstep 4 or step 7, whicheveris less. Also enter thisamount on line 1 of your<strong>Form</strong> <strong>M706</strong> . . . . . . . . . . . . .$60,000$287,300If you want to verify your calculation, usethe estate tax calculator available atwww.taxes.state.mn.us. To access, youmust have Microsoft Excel installed onyour computer.Line 2Gross value of property in other statesFrom the federal estate tax return, add thegross values of each item of the decedent’sreal and tangible personal property locatedin other states. Include the total on line 2.<strong>Estate</strong>s of nonresidents ofMinnesota—Lines 7–11Line 7Tentative Minnesota estate taxDetermine the amount to enter on line 7 byfollowing the steps provided in the line 1instructions. Enter the amount from step 8on line 7 of your <strong>Form</strong> <strong>M706</strong>.Line 8Gross value of property in MinnesotaFrom the federal estate tax return, add thegross values of each item of the decedent’sreal and tangible personal property locatedin Minnesota. Enter the total on line 8.All estates—Lines 12–18Line 12Payments previously madeIf—before you filed this return—you paidMinnesota estate tax, enter the amountyou’ve already paid, including any extensionpayment made electronically or whenfiling a PV86 payment voucher.Table B—Use to determine step 4 of the line 1 worksheetIf step 3 of the line 1worksheet is:subtract multiplyat least but less than from step 3 result by and add$ 0 . . . $ 40,000 . . . . . . . . .$ 0 . . . . . . . . . . . . . . . . . $ 040,000 . . . . 90,000 . . . . . . 40,000 . . . . . 0.8% . . . . . . . . . 090,000 . . . 140,000 . . . . . . . 90,000 . . . . . 1.6% . . . . . . . 400140,000 . . . 240,000 . . . . . .140,000 . . . . . 2.4% . . . . . 1,200240,000 . . . 440,000 . . . . . .240,000 . . . . . 3.2% . . . . . 3,600440,000 . . . 640,000 . . . . . .440,000 . . . . . 4.0% . . . . 10,000640,000 . . . 840,000 . . . . . .640,000 . . . . . 4.8% . . . . 18,000840,000 . . 1,040,000 . . . . . . 840,000 . . . . . 5.6% . . . . 27,6001,040,000 . . 1,540,000 . . . . 1,040,000 . . . . . 6.4% . . . . 38,8001,540,000 . . 2,040,000 . . . . 1,540,000 . . . . . 7.2% . . . . 70,8002,040,000 . . 2,540,000 . . . . 2,040,000 . . . . . 8.0% . . . 106,8002,540,000 . . 3,040,000 . . . . 2,540,000 . . . . . 8.8% . . . 146,8003,040,000 . . 3,540,000 . . . . 3,040,000 . . . . . 9.6% . . . 190,8003,540,000 . . 4,040,000 . . . . 3,540,000 . . . . 10.4% . . . 238,8004,040,000 . . 5,040,000 . . . . 4,040,000 . . . . 11.2% . . . 290,8005,040,000 . . 6,040,000 . . . . 5,040,000 . . . . 12.0% . . . 402,8006,040,000 . . 7,040,000 . . . . 6,040,000 . . . . 12.8% . . . 522,8007,040,000 . . 8,040,000 . . . . 7,040,000 . . . . 13.6% . . . 650,8008,040,000 . . 9,040,000 . . . . 8,040,000 . . . . 14.4% . . . 786,8009,040,000 . 10,040,000 . . . . 9,040,000 . . . . 15.2% . . . 930,80010,040,000 — — — — . . . 10,040,000 . . . . 16.0% . . 1,082,800Enter the result on step 4 of the line 1 worksheet.5

Line instructions (continued)Line 14PenaltiesThe regular due date for filing the Minnesotareturn and paying the total estate taxowed is nine months after the decedent’sdate of death. If the return is filed or the taxis paid after the due date—unless you’repaying estate tax in installments—the estateis subject to penalties.Late payment. A penalty is due if youdon’t pay the total tax by the regular duedate. The penalty is 6 percent of the unpaidtax.If you file your return after the due dateand you don’t pay the tax as reported onyour return, an additional 5 percentpenalty is due on the unpaid tax.Late filing. If you file after the regular duedate—or after the approved extended duedate—and you owe tax, you must pay anadditional penalty for filing late. The latefiling penalty is 5 percent of the unpaid tax.Extended delinquency. An additionalpenalty is due if the return is not filedwithin 30 days after the department sends awritten demand. The penalty is 5 percent ofthe tax not paid prior to the demand.(M.S. 289A.60)Line 15InterestYou must pay interest on any unpaid taxand penalty from the regular due date untilthe total is paid. Interest accrues even if thedeadline for filing the return or paying thetax has been extended or the estate tax isbeing paid in installments.The rate of interest may change from yearto year. (M.S. 270.75)To determine the interest to enter on line15, complete the worksheet on the back of<strong>Form</strong> <strong>M706</strong> or, if you’re paying aninstallment, see the section Paying tax ininstallments on page 2.(M.S. 289A.55)Line 16Amount dueIf the estate owes Minnesota estate tax,penalty or interest, you may pay theamount electronically or by check. SeePayment options on page 2.Line 18Installment paymentsIf you’re paying the federal estate tax ininstallments and you wish to pay theMinnesota estate tax in installments, checkthe box on line 18.You must attach to <strong>Form</strong> <strong>M706</strong> a copy ofthe document you received from the IRSapproving your federal installmentpayment plan.Signature of the executorThe executor of the estate must sign thecompleted <strong>Form</strong> <strong>M706</strong>. (M.S. 289A.10,subd. 1)If more than one executor was appointedby the Probate Court or Probate Registrar,all appointed executors must sign the form.If you wish to grant power of attorney tosomeone, you must complete the power ofattorney form on the back of <strong>Form</strong> <strong>M706</strong>and check the box after your signature. <strong>Form</strong>ore details, see the next section.Power of AttorneyIf you’re the executor or personal representativeof the decedent’s estate, you maydesignate another person to act on yourbehalf or perform any act you can performwith respect to the estate tax on thedecedent’s estate when dealing with thedepartment. This is done by grantingpower of attorney to the person.The department is prohibited by law fromdisclosing any information it may have inits records about the decedent’s estateexcept to persons who have been grantedpower of attorney and to the decedent’sheirs, next of kin or person who holds aninterest in any of the decedent’s property.If you wish, you may complete the sectionon the back of <strong>Form</strong> <strong>M706</strong> to grant powerof attorney to someone. You may selectsome or all of the specific powers providedfor purposes of dealing with the departmentor grant whatever powers you wish atthe bottom of the form.Stop writing checksPay electronically!It’s Secure, Easy, Convenient, Freewww.taxes.state.mn.us6