Defense Counsel Journal - International Association of Defense ...

Defense Counsel Journal - International Association of Defense ...

Defense Counsel Journal - International Association of Defense ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

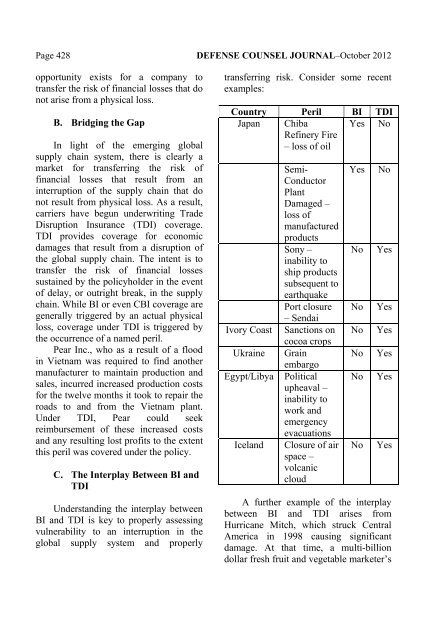

Page 428 DEFENSE COUNSEL JOURNAL–October 2012opportunity exists for a company totransfer the risk <strong>of</strong> financial losses that donot arise from a physical loss.B. Bridging the GapIn light <strong>of</strong> the emerging globalsupply chain system, there is clearly amarket for transferring the risk <strong>of</strong>financial losses that result from aninterruption <strong>of</strong> the supply chain that donot result from physical loss. As a result,carriers have begun underwriting TradeDisruption Insurance (TDI) coverage.TDI provides coverage for economicdamages that result from a disruption <strong>of</strong>the global supply chain. The intent is totransfer the risk <strong>of</strong> financial lossessustained by the policyholder in the event<strong>of</strong> delay, or outright break, in the supplychain. While BI or even CBI coverage aregenerally triggered by an actual physicalloss, coverage under TDI is triggered bythe occurrence <strong>of</strong> a named peril.Pear Inc., who as a result <strong>of</strong> a floodin Vietnam was required to find anothermanufacturer to maintain production andsales, incurred increased production costsfor the twelve months it took to repair theroads to and from the Vietnam plant.Under TDI, Pear could seekreimbursement <strong>of</strong> these increased costsand any resulting lost pr<strong>of</strong>its to the extentthis peril was covered under the policy.C. The Interplay Between BI andTDIUnderstanding the interplay betweenBI and TDI is key to properly assessingvulnerability to an interruption in theglobal supply system and properlytransferring risk. Consider some recentexamples:Country Peril BI TDIJapan ChibaRefinery Fire– loss <strong>of</strong> oilYes NoIvory CoastUkraineEgypt/LibyaIcelandSemi-ConductorPlantDamaged –loss <strong>of</strong>manufacturedproductsSony –inability toship productssubsequent toearthquakePort closure– SendaiSanctions oncocoa cropsGrainembargoPoliticalupheaval –inability towork andemergencyevacuationsClosure <strong>of</strong> airspace –volcaniccloudYesNoNoNoNoNoNoNoYesYesYesYesYesYesA further example <strong>of</strong> the interplaybetween BI and TDI arises fromHurricane Mitch, which struck CentralAmerica in 1998 causing significantdamage. At that time, a multi-billiondollar fresh fruit and vegetable marketer’s