Satjaporn Tungsong Solution to Problem Set #1 1. Suppose you want

Satjaporn Tungsong Solution to Problem Set #1 1. Suppose you want

Satjaporn Tungsong Solution to Problem Set #1 1. Suppose you want

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

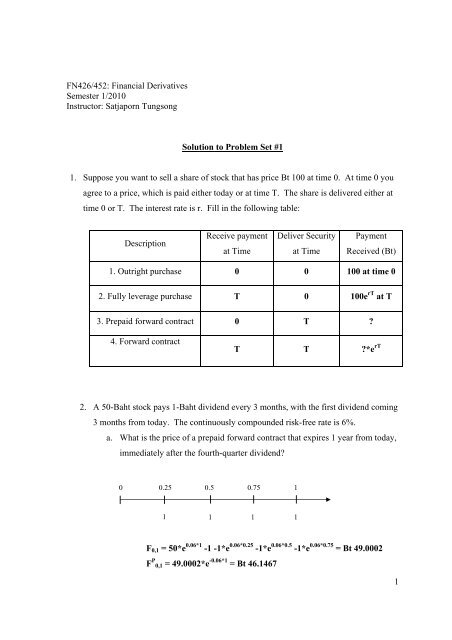

FN426/452: Financial DerivativesSemester 1/2010Instruc<strong>to</strong>r: <strong>Satjaporn</strong> <strong>Tungsong</strong><strong>Solution</strong> <strong>to</strong> <strong>Problem</strong> <strong>Set</strong> <strong>#1</strong><strong>1.</strong> <strong>Suppose</strong> <strong>you</strong> <strong>want</strong> <strong>to</strong> sell a share of s<strong>to</strong>ck that has price Bt 100 at time 0. At time 0 <strong>you</strong>agree <strong>to</strong> a price, which is paid either <strong>to</strong>day or at time T. The share is delivered either attime 0 or T. The interest rate is r. Fill in the following table:DescriptionReceive paymentat TimeDeliver Securityat TimePaymentReceived (Bt)<strong>1.</strong> Outright purchase 0 0 100 at time 02. Fully leverage purchase T 0 100e rT at T3. Prepaid forward contract 0 T ?4. Forward contractT T ?*e rT2. A 50-Baht s<strong>to</strong>ck pays 1-Baht dividend every 3 months, with the first dividend coming3 months from <strong>to</strong>day. The continuously compounded risk-free rate is 6%.a. What is the price of a prepaid forward contract that expires 1 year from <strong>to</strong>day,immediately after the fourth-quarter dividend?0 0.25 0.5 0.75 11 1 1 1F 0,1 = 50*e 0.06*1 -1 -1*e 0.06*0.25 -1*e 0.06*0.5 -1*e 0.06*0.75 = Bt 49.0002F P 0,1 = 49.0002*e -0.06*1 = Bt 46.14671

. What is the price of a forward contract that expires at the same time?F 0,1 = 50*e 0.06*1 -1 -1*e 0.06*0.25 -1*e 0.06*0.5 -1*e 0.06*0.75 = Bt 49.00023. A 50-Baht s<strong>to</strong>ck pays an 8% continuous dividend. The continuously compoundedrisk-free rate is 6%.a. What is the price of a prepaid forward contract that expires 1 year from <strong>to</strong>day?F P 0,1 = 50*e -0.08*1 = Bt 46.1558b. What is the price of a forward contract that expires at the same time?F 0,T = S 0 * e (r-δ)TF 0,1 = 50*e (0.06-0.08)*1 = Bt 49.00994. <strong>Suppose</strong> the s<strong>to</strong>ck price is BHT 35 and the continuously compounded interest rate is5%.a. What is the 6-month forward price, assuming dividends are zero?Bt 35.886b. If the 6-month forward price is BHT 35.50, what is the annualized continuousdividend yield?F 0,T = S 0 * e (r-δ)T35.50 = 35* e (0.05-δ)*0.5δ = 0.0216 = 2.16%5. <strong>Suppose</strong> <strong>you</strong> are a market-maker in S&R index forward contracts. The S&R indexspot price is 1100, the risk-free rate is 5%, and the dividend yield on the index is 0.a. What is the no-arbitrage forward price for delivery in 9 months?1142.02b. <strong>Suppose</strong> a cus<strong>to</strong>mer wishes <strong>to</strong> enter a short index futures position. If <strong>you</strong> takethe opposite position, demonstrate how <strong>you</strong> would hedge <strong>you</strong>r resulting longposition using the index and borrowing or lending.Description Today In 9 monthsLong forward, resulting from 0 S T - F 0,T2

cus<strong>to</strong>mer purchaseSell short the index S 0 - S TLend + S 0 , the proceeds from - S 0 S 0 *e rTshort-sellingTotal 0 S 0 *e rT - F 0,TWith the numbers given in the problem:Description Today In 9 monthsLong forward, resulting from 0 S T - 1,142.02cus<strong>to</strong>mer purchaseSell short the index 1,100 - S TLend + S 0 , the proceeds fromshort-selling- 1,100 1,100*e 0.5*0.75=1,142.02Total 0 0We have perfect hedge.c. <strong>Suppose</strong> a cus<strong>to</strong>mer wishes <strong>to</strong> enter a long index futures position. If <strong>you</strong> takethe opposite position, demonstrate how <strong>you</strong> would hedge <strong>you</strong>r resulting shortposition using the index and borrowing or lending.6. The S&R index spot price is 1100, the risk-free rate is 5%, and the continuousdividend yield on the index is 2%.a. <strong>Suppose</strong> <strong>you</strong> observe a 6-month forward price of 1120. What arbitrage would<strong>you</strong> undertake?The forward price implied from cost-of-carry model isF 0,0.5 = S 0 *e (r-δ)T = 1,10<strong>1.</strong>652Thus, the forward in the market is <strong>to</strong>o expensive. To make arbitrageprofit, <strong>you</strong> sell the forward at 1,120 and borrow S 0 *e -δT =1,100*e 0.02*0.5 =1,10<strong>1.</strong>101 <strong>to</strong> buy a fraction of the index in the spot market.TransactionTime 0Cash flowsTime T3

Borrow S 0 *e -δT 1,10<strong>1.</strong>101 -1,10<strong>1.</strong>101* e (0.05-0.02)*0.5= -1,117.75Buy s<strong>to</strong>ck -1,10<strong>1.</strong>101 S TShort forward 0 1,120- S TTotal 0 2.25b. <strong>Suppose</strong> <strong>you</strong> observe a 6-month forward price of 1100. What arbitrage would<strong>you</strong> undertake?7. <strong>Suppose</strong> the SET50 index futures price is currently 500. You wish <strong>to</strong> purchase 10futures contracts on margin.a. What is the notional value of <strong>you</strong>r position?= 500*1000*10 = Bt 5,000,000b. Assuming a 10% initial margin, what is the value of the initial margin?= 0.1* 5,000,000 = Bt 500,000c. <strong>Suppose</strong> <strong>you</strong> earn a continuously compounded rate of 6% on <strong>you</strong>r marginbalance, <strong>you</strong>r position is marked <strong>to</strong> market weekly, and the maintenancemargin is 80% of the initial margin. What is the greatest SET50 index futuresprice 1 week from <strong>to</strong>day at which <strong>you</strong> receive a margin call?You earn interest on Bt 500,000 in the first weekYour balance at the end of the first week is500,000*e (0.06*7/52) + (gain or loss on futures price*1000*10)= 504,054.81 + *1000*10*(S 1 -500)You will receive a margin call if <strong>you</strong>r balance falls below0.8*500,000 = 400,000Thus, 400,000 = 504,054.81 + *1000*10*(S 1 -500)S 1 = 489.598. <strong>Suppose</strong> the SET50 index is 800, and that the dividend yield is 0. You are anarbitrageur with a continuously compounded borrowing rate of 5.5% and acontinuously compounded lending rate of 5%.4

a. <strong>Suppose</strong> there are no transaction fees, show that a cash-and-carry arbitrage isnot profitable if the forward price is less than 845.23<strong>Suppose</strong> the forward contract will mature in 1 year. The theoreticalforward price is F 0,T = S 0 *e rTHighest possible forward price = 800*e 0.055*1 = 845.2325Lowest possible forward price = 800*e 0.05*1 = 84<strong>1.</strong>0169Cash-and-carry arbitrage refers <strong>to</strong> an arbitrage transaction in which <strong>you</strong>buy the underlying asset using the proceeds from the sale of forward (buy spot,sell forward). Cash-and-carry is profitable when the actual forward price isabove the theoretical forward price. Therefore, the actual forward price has <strong>to</strong>be higher than 845.2325 <strong>to</strong> make a cash-and-carry profit.b. <strong>Suppose</strong> there are no transaction fees, show that a reverse cash-and-carryarbitrage is not profitable if the forward price is greater than 84<strong>1.</strong>02.Reverse cash-and-carry arbitrage refers <strong>to</strong> an arbitrage transaction inwhich <strong>you</strong> sell the underlying asset and use the proceeds <strong>to</strong> buy the forward (sellspot, buy forward). Reverse cash-and-carry is profitable when the actualforward price is below the theoretical forward price. Therefore, the actualforward price has <strong>to</strong> be lower than 84<strong>1.</strong>0169 <strong>to</strong> make a reverse cash-and-carryprofit.9. (Bonus) <strong>Suppose</strong> the SET50 currently has a level of 875. The continuouslycompounded return on a 1-year T-bill is 4.75%. You wish <strong>to</strong> hedge an $800,000portfolio that has a beta of <strong>1.</strong>0 and a correlation of <strong>1.</strong>0 with the SET50.a. What is a 1-year futures price for the SET50 assuming no dividends?917.57b. How many SET50 futures contract should <strong>you</strong> short <strong>to</strong> hedge <strong>you</strong>r portfolio?What return do <strong>you</strong> expect on the hedged portfolio?5

Short 3.65714 contracts <strong>to</strong> hedge <strong>you</strong>r portfolio. The return <strong>you</strong> canexpect is the risk-free rate. Because if <strong>you</strong> perfectly hedge the positionand <strong>you</strong>r portfolio is now a risk-less investment.<strong>1.</strong> (Bonus) Synthetic ReplicationVerify that going long a forward contract and lending the present value of the forwardprice creates a payoff of one share of s<strong>to</strong>ck when:a. The s<strong>to</strong>ck pays no dividends.b. The s<strong>to</strong>ck pays discrete dividendsc. The s<strong>to</strong>ck pays continuous dividends.<strong>Solution</strong> already given in class1<strong>1.</strong> ใชขอมูลราคาของ zero-coupon bonds ในตารางขางลางตอบคําถามขอ <strong>1.</strong>1 และ <strong>1.</strong>2Days <strong>to</strong> MaturityZero-Coupon BondPrice90 0.99009180 0.97943270 0.96525360 0.952381<strong>1.</strong>1 จงหาอัตราดอกเบี้ยสําหรับ synthetic FRA loan ที่มีอายุ 90 วัน โดยสัญญาเริ่มตนในวันที่ 90 และเติมคําตอบในตารางที่กําหนดใหหมายเหตุ: synthetic FRA loan คือ การซื้อ zero-coupon bonds ที่จะครบกําหนดในเวลา t+s บวกกับการขาย zero-coupon bonds ที่จะครบกําหนดในเวลา t6

0 (90, 180)r 0 (t, t+s)r 0 (90, 270)r 0 (90, 360)1<strong>1.</strong>2 จงหาอัตราดอกเบี้ยสําหรับ synthetic FRA loan ที่มีอายุ 180 วัน โดยสัญญาเริ่มตนในวันที่ 1801<strong>1.</strong>3 หากคุณเปนผูจัดการธนาคารและมีคูสัญญาคือลูกคาที่เปนผูใหกู (คุณเปนผูกู) คุณซื้อสัญญา FRAเพื่อล็อคอัตราดอกเบี้ยไวสําหรับเงินกูจํานวน 10 ลานดอลลาร โดยสัญญาเริ่มในวันที่ 270 และครบกําหนดในอีก 90 วันหลังจากนั้น คุณจะ hedge สถานะของคุณไดอยางไรTo hedge, <strong>you</strong> go long on the FRA and buy/sell zero coupon bonds as shownbelow:12. ผูกูวางแผนกูเงิน 100 ลานดอลลาร โดยเริ่มตนในอีก 60 วันขางหนา และครบกําหนดในอีก 150 วันหลังจากนั้น ขณะนี้ Implied forward rate (อัตราดอกเบี้ยของสัญญา FRA) สําหรับชวงระยะเวลา 150 วัน เทากับ2.5% โดยที่ดอกเบี้ยที่แทจริงในชวงที่มีการกูยืมอาจจะเปลื่ยนแปลงเปน 2.2% หรือ 2.8%12.1 หากในอีก 60 วัน อัตราดอกเบี้ยเปน 2.8% ผูกูจะตองจายเทาไรถาสัญญา FRA มีการหักลางสถานะในวันที่ 60 และ ผูกูจะตองจายเทาไรถาสัญญา FRA มีการหักลางสถานะในวันที่ 2107

เนื่องจากผูกูไดประโยชนหากดอกเบี้ยเพิ่มขึ้น ดังนั้นหากมีการหักลางสถานะในวันที่ 60 ผูกูไดรับเงินหากมีการหักลางสถานะในวันที่ 210 ผูกูไดรับเงิน12.2 หากในอีก 60 วัน อัตราดอกเบี้ยเปน 2.2% ผูกูจะตองจายเทาไรถาสัญญา FRA มีการหักลางสถานะในวันที่ 60 และ ผูกูจะตองจายเทาไรถาสัญญา FRA มีการหักลางสถานะในวันที่ 210ผูกูเสียประโยชนหากดอกเบี้ยลดลง ดังนั้นหากมีการหักลางสถานะในวันที่ 60 ผูกูตองจายเงิน= (0.022-0.025)/(1+0.022) * 100,000,000 = -$293,542.07หากมีการหักลางสถานะในวันที่ 210 ผูกูตองจายเงิน= (0.022-0.025) * 100,000,000 = -$300,00013. T-bill ที่มีวันครบกําหนดเทากับ 90 วัน และมี face value เทากับ $1,000,000 อัตราดอกเบี้ย (discountyield) ของ T-bill นี้เทากับ 8.75% จงหาราคาของ T-bill นี้Price = Face*[1 - DR*(t/360)]= $1,000,000*(1-0.0875*(90/360))= $978,125.0014. หาก price index ของ T-bill เทากับ 88.70 จงหาอัตราดอกเบี้ย (discount yield) ของ T-bill นี้ และหากคุณซื้อ T-bill futures ในราคาเทากับ price index นั่นคือ 88.70 และไมนาน price index เพิ่มขึ้นเปน88.90 ถามวา ทานไดกําไรหรือขาดทุน คิดเปนมูลคาเทาไรDR= [Face - P]/[Face*(360/t)]= (100-88.7)/(100*(360/90))= 2.825% per 90 days or 1<strong>1.</strong>3% per yearหากซื้อมาราคา 88.70 และราคาปจจุบันเทากับ 88.90 จะไดกําไร (88.90-88.70)/88.70 = 0.2255%8

15. June T-bill futures มี index value เทากับ 92.80 และ September T-bill futures มี index valueเทากับ 93.00 จงหา implied interest rate ในชวงเดือนมิถุนายนถึงเดือนกันยายน92.80/93 – 1 = -0.22%16. <strong>Suppose</strong> <strong>you</strong> observe the following zero-coupon bond prices per $1 of maturity payment:0.96154 (1-year), 0.91573 (2-year), 0.87630 (3-year), 0.87630 (4-year), 0.77611 (5-year). For each maturity year compute the zero-coupon bond yields (effective annualand continuously compounded), the par coupon rate, and the 1-year implied forwardrate.17. Using the information in question 16, find the price of a 5-year coupon bond that has apar payment of $1,000.00 and annual coupon payments of $60.00.คูณกระแสเงินสดจากคูปองในแตละงวดและเงินตนดวยราคาของ zero-coupon bond ที่เหมาะสม จะไดราคาหุนกูเทากับ $1,037.252818. <strong>Suppose</strong> that in order <strong>to</strong> hedge interest rate risk on <strong>you</strong>r borrowing, <strong>you</strong> enter in<strong>to</strong> anFRA that will guarantee a 6% effective annual interest rate for 1 year on $500,000.00.On the day <strong>you</strong> borrow the $500,000.00, the actual interst rate is 5%. Determine thedollar settlement of the FRA:18.1 If settlement occurs on the date the loan is initiated18.2 If settlement occurs on the date the loan is repaid<strong>Solution</strong>:9

19. What is the yield <strong>to</strong> maturity of the 10-year zero coupon bond with a face value of $100and current price $69.20205?P 0 = Face*e -rT$69.20205 = 100*e (-r*10)-r = (1/10)ln(69.20205/100)r = -(1/10)ln(69.20205/100)r = 3.6814%20. <strong>Suppose</strong> that oil forward prices for 1 year, 2 years, and 3 years are $20, $21, and $22.The 1-year effective annual interest rate is 6%, the 2-year interest rate is 6.5%, and the 3-year interest rate is 7%.20.1 What is the 3-year swap price?The present value of the cost per 3 barrels based on the forward price is:The swap price per barrel is:10

20.2 What is the price of a 2-year swap beginning in one year? (That is, the firstswap settlement will be in 2 years and the second in 3 years.)The present value of the cost per 2 barrels based on the forward price is:The swap price per barrel is:2<strong>1.</strong> Consider the same 3-year oil swap in question 20. <strong>Suppose</strong> a dealer is paying the fixedprice and receive floating. What position in oil forward contracts will hedge oil pricerisk in this position? Verify that the present value of the lock-in net ash flows is zero.<strong>Solution</strong>:22. Consider the same 3-year swap in question 20. <strong>Suppose</strong> <strong>you</strong> are a dealer who is payingthe fixed oil price and receive the floating price. <strong>Suppose</strong> that <strong>you</strong> enter in<strong>to</strong> the swapand immediately thereafter all interest rates rise 50 basis points but oil forward prices areunchanged. What happens <strong>to</strong> the value of <strong>you</strong>r swap position? What if interest rates fall50 basis points? What hedging instrument would have protected <strong>you</strong> against interest raterisk in this position?11

<strong>Solution</strong>:ใชขอมูลในตารางขางลางตอบคําถามขอ 23-30Quarter 1 2 3 4 5 6 7 8Oil forwardpriceGas swappriceZero-couponbond priceEurodenominatedzero-couponbond price21 2<strong>1.</strong>1 20.8 20.5 20.2 20 19.9 19.82.25 2.42 2.35 2.24 2.23 2.28 2.26 2.20.9852 .9701 .9546 .9388 .9231 .9075 .8919 .8763.9913 .9825 .9735 .9643 .9551 .9459 .9367 .927412

Euro forwardprice ($/€).9056 .9115 .9178 .9244 .9312 .9381 .9452 .9524กําหนดใหอัตราแลกเปลี่ยน ณ เวลาปจจุบันเทากับ $/€ 0.923. <strong>Suppose</strong> the effective quarterly interest rate is <strong>1.</strong>5%, what are the per-barrel swap pricesfor 4-quarter and 8-quarter oil swaps? What is the <strong>to</strong>tal cost of prepaid 4- and 8-quarterswaps?<strong>Solution</strong>:13

24. Construct the set of swap prices for oil for 1 through 8 quarters.25. What is the swap price of a 4-quarter oil swap with the first settlement occurring in thethird quarter?<strong>Solution</strong>:26. Using the zero-coupon bond prices and oil forward prices in the table provided above,what is the price of an 8-period swap for which two barrels of oil are delivered in evennumberedquarters and one barrel of oil in odd-numbered quarters?<strong>Solution</strong>:27. Using the zero-coupon bond prices and oil forward prices in the table provided above,what are the gas forward prices for each of the 8 quarters?14

<strong>Solution</strong>:28. What is the fixed rate in a 5-quarter interest rate swap with the first settlement in quarter2?<strong>Solution</strong>:29. What is the fixed rate in a 4-quarter interest rate swap? What is the fixed rate in an 8-quarter interest rate swap?15

<strong>Solution</strong>:30. What are the euro-denominated fixed rates for 4- and 8-quarter swaps?<strong>Solution</strong>:16