QR financial report 2008/09 - Queensland Rail

QR financial report 2008/09 - Queensland Rail

QR financial report 2008/09 - Queensland Rail

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

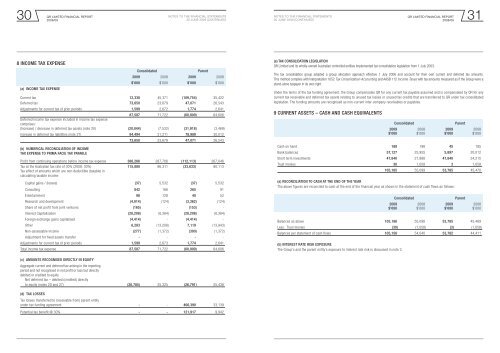

<strong>QR</strong> LIMITED Financial REPORTNotes to the <strong>financial</strong> statementsNotes to the <strong>financial</strong> statements<strong>QR</strong> LIMITED Financial REPORT30 31<strong>2008</strong>/<strong>09</strong>30 June 20<strong>09</strong> (continued)30 June 20<strong>09</strong> (continued)<strong>2008</strong>/<strong>09</strong>8 Income tax expense(a) Income tax expenseConsolidatedParent20<strong>09</strong> <strong>2008</strong> 20<strong>09</strong> <strong>2008</strong>$’000 $’000 $’000 $’000Current tax 12,338 45,371 (1<strong>09</strong>,754) 35,422Deferred tax 73,650 23,679 47,071 26,543Adjustments for current tax of prior periods 1,599 2,672 1,774 2,64187,587 71,722 (60,9<strong>09</strong>) 64,606Deferred income tax expense included in income tax expensecomprises:(Increase) / decrease in deferred tax assets (note 20) (20,844) (7,532) (31,918) (3,469)Increase in deferred tax liabilities (note 27) 94,494 31,211 78,989 30,012(b) Numerical reconciliation of incometax expense to prima facie tax payable73,650 23,679 47,071 26,543Profit from continuing operations before income tax expense 386,266 287,706 (112,113) 267,046Tax at the Australian tax rate of 30% (<strong>2008</strong>: 30%) 115,880 86,311 (33,633) 80,113Tax effect of amounts which are non-deductible (taxable) incalculating taxable income:Capital gains / (losses) (37) 5,532 (37) 5,532Consulting 842 166 265 91Entertainment 98 128 40 52Research and development (4,014) (124) (3,362) (124)Share of net profit from joint ventures (165) - (153) -Interest Capitalisation (28,208) (8,384) (28,208) (8,384)Foreign exchange gains capitalised (4,414) - (4,414) -Other 6,283 (13,208) 7,119 (13,943)Non-assessable income (277) (1,372) (300) (1,372)Adjustment for fixed assets transfer - - - -Adjustments for current tax of prior periods 1,599 2,673 1,774 2,641Total income tax expense 87,587 71,722 (60,9<strong>09</strong>) 64,606(e) Tax consolidation legislation<strong>QR</strong> Limited and its wholly-owned Australian controlled entities implemented tax consolidation legislation from 1 July 2003.The tax consolidation group adopted a group allocation approach effective 1 July 2006 and account for their own current and deferred tax amounts.This method complies with Interpretation 1052 Tax Consolidation Accounting and AASB 112 Income Taxes with tax amounts measured as if the Group were astand-alone taxpayer in its own right.Under the terms of the tax funding agreement, the Group compensates <strong>QR</strong> for any current tax payable assumed and is compensated by <strong>QR</strong> for anycurrent tax receivable and deferred tax assets relating to unused tax losses or unused tax credits that are transferred to <strong>QR</strong> under tax consolidatedlegislation. The funding amounts are recognised as non-current inter-company receivables or payables.9 Current assets – Cash and cash equivalentsConsolidatedParent20<strong>09</strong> <strong>2008</strong> 20<strong>09</strong> <strong>2008</strong>$’000 $’000 $’000 $’000Cash on hand 188 198 45 185Bank balances 57,127 25,955 5,897 20,012Short term investments 47,840 27,888 47,840 24,215Trust monies 30 1,058 3 1,058105,185 55,<strong>09</strong>9 53,785 45,470(a) Reconciliation to cash at the end of the yearThe above figures are reconciled to cash at the end of the <strong>financial</strong> year as shown in the statement of cash flows as follows:ConsolidatedParent20<strong>09</strong> <strong>2008</strong> 20<strong>09</strong> <strong>2008</strong>$’000 $’000 $’000 $’000Balances as above 105,186 55,<strong>09</strong>8 53,785 45,469Less: Trust monies (30) (1,058) (3) (1,058)Balances per statement of cash flows 105,156 54,040 53,782 44,411(b) Interest rate risk exposureThe Group’s and the parent entity’s exposure to interest rate risk is discussed in note 2.(c) Amounts recognised directly in equityAggregate current and deferred tax arising in the <strong>report</strong>ingperiod and not recognised in net profit or loss but directlydebited or credited to equityNet deferred tax – debited (credited) directlyto equity (notes 20 and 27) (26,785) 25,325 (26,791) 25,438(d) Tax lossesTax losses transferred to (receivable from) parent entityunder tax funding agreement - - 406,390 33,139Potential tax benefit @ 30% - - 121,917 9,942