QR financial report 2008/09 - Queensland Rail

QR financial report 2008/09 - Queensland Rail

QR financial report 2008/09 - Queensland Rail

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

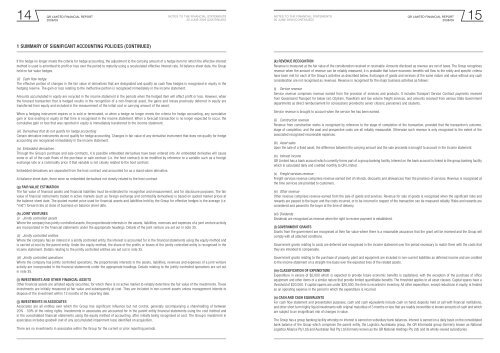

<strong>QR</strong> LIMITED Financial REPORTNotes to the <strong>financial</strong> statementsNotes to the <strong>financial</strong> statements<strong>QR</strong> LIMITED Financial REPORT14 15<strong>2008</strong>/<strong>09</strong>30 June 20<strong>09</strong> (continued)30 June 20<strong>09</strong> (continued)<strong>2008</strong>/<strong>09</strong>1 Summary of significant accounting policies (Continued)If the hedge no longer meets the criteria for hedge accounting, the adjustment to the carrying amount of a hedge item for which the effective interestmethod is used is amortised to profit or loss over the period to maturity using a recalculated effective interest rate. At balance sheet date, the Groupheld no fair value hedges.(ii) Cash flow hedgeThe effective portion of changes in the fair value of derivatives that are designated and qualify as cash flow hedges is recognised in equity in thehedging reserve. The gain or loss relating to the ineffective portion is recognised immediately in the income statement.Amounts accumulated in equity are recycled in the income statement in the periods when the hedged item will affect profit or loss. However, whenthe forecast transaction that is hedged results in the recognition of a non-<strong>financial</strong> asset, the gains and losses previously deferred in equity aretransferred from equity and included in the measurement of the initial cost or carrying amount of the asset.When a hedging instrument expires or is sold or terminated, or when a hedge no longer meets the criteria for hedge accounting, any cumulativegain or loss existing in equity at that time is recognised in the income statement. When a forecast transaction is no longer expected to occur, thecumulative gain or loss that was <strong>report</strong>ed in equity is immediately transferred to the income statement.(iii) Derivatives that do not qualify for hedge accountingCertain derivative instruments do not qualify for hedge accounting. Changes in fair value of any derivative instrument that does not qualify for hedgeaccounting are recognised immediately in the income statement.(iv) Embedded derivativesThrough the Group’s purchase and sale contracts, it is possible embedded derivatives have been entered into. An embedded derivative will causesome or all of the cash flows of the purchase or sale contract (i.e. the host contract) to be modified by reference to a variable such as a foreignexchange rate or a commodity price if that variable is not closely related to the host contract.Embedded derivatives are separated from the host contract and accounted for as a stand-alone derivative.At balance sheet date, there were no embedded derivatives not closely related to the host contract.(g) Fair value estimationThe fair value of <strong>financial</strong> assets and <strong>financial</strong> liabilities must be estimated for recognition and measurement, and for disclosure purposes. The fairvalue of <strong>financial</strong> instruments traded in active markets (such as foreign exchange and commodity derivatives) is based on quoted market prices atthe balance sheet date. The quoted market price used for <strong>financial</strong> assets and liabilities held by the Group for effective hedges is the average (i.e.“mid”) forward rate at close of business on balance sheet date.(h) Joint ventures(i) Jointly controlled assetsWhere the company has jointly controlled assets, the proportionate interests in the assets, liabilities, revenues and expenses of a joint venture activityare incorporated in the <strong>financial</strong> statements under the appropriate headings. Details of the joint venture are set out in note 35.(ii) Jointly controlled entitiesWhere the company has an interest in a jointly controlled entity, the interest is accounted for in the <strong>financial</strong> statements using the equity method andis carried at cost by the parent entity. Under the equity method, the share of the profits or losses of the jointly controlled entity is recognised in theincome statement. Details relating to the jointly controlled entities are set out in note 35.(iii) Jointly controlled operationsWhere the company has jointly controlled operations, the proportionate interests in the assets, liabilities, revenues and expenses of a joint ventureactivity are incorporated in the <strong>financial</strong> statements under the appropriate headings. Details relating to the jointly controlled operations are set outin note 35.(i) Investments and other <strong>financial</strong> assetsOther <strong>financial</strong> assets are unlisted equity securities, for which there is no active market to reliably determine the fair value of the investments. Theseinvestments are initially measured at fair value and subsequently at cost. They are included in non-current assets unless management intends todispose of the investment within 12 months of the <strong>report</strong>ing date.(j) Investments in associatesAssociates are all entities over which the Group has significant influence but not control, generally accompanying a shareholding of between20% - 50% of the voting rights. Investments in associates are accounted for in the parent entity <strong>financial</strong> statements using the cost method andin the consolidated <strong>financial</strong> statements using the equity method of accounting, after initially being recognised at cost. The Group’s investment inassociates includes goodwill (net of any accumulated impairment loss) identified on acquisition.There are no investments in associates within the Group for the current or prior <strong>report</strong>ing periods.(k) Revenue recognitionRevenue is measured at the fair value of the consideration received or receivable. Amounts disclosed as revenue are net of taxes. The Group recognisesrevenue when the amount of revenue can be reliably measured, it is probable that future economic benefits will flow to the entity and specific criteriahave been met for each of the Group’s activities as described below. Exchanges of goods and services of the same nature and value without any cashconsideration are not recognised as revenues. Revenue is recognised for the major business activities as follows:(i) Service revenueService revenue comprises revenue earned from the provision of services and products. It includes Transport Service Contract payments receivedfrom <strong>Queensland</strong> Transport for below rail, Citytrain, Traveltrain and low volume freight services, and amounts received from various State Governmentdepartments as direct reimbursement for concessions provided to senior citizens, pensioners and students.Service revenue is brought to account when the service fee has been earned.(ii) Construction revenueRevenue from construction works is recognised by reference to the stage of completion of the transaction, provided that the transaction’s outcome,stage of completion, and the past and prospective costs are all reliably measurable. Otherwise such revenue is only recognised to the extent of theassociated recognised recoverable expenses.(iii) Asset salesUpon the sale of a fixed asset, the difference between the carrying amount and the sale proceeds is brought to account in the income statement.(iv) Interest income<strong>QR</strong> Limited has a bank account which currently forms part of a group banking facility. Interest on the bank account is linked to the group banking facilitywhich is calculated daily and credited monthly to <strong>QR</strong> Limited.(v) Freight services revenueFreight services revenue comprises revenue earned (net of refunds, discounts and allowances) from the provision of services. Revenue is recognised atthe time services are provided to customers.(vi) Other revenueOther revenue comprises revenue earned from the sale of goods and services. Revenue for sale of goods is recognised when the significant risks andrewards are passed to the buyer and the costs incurred, or to be incurred in respect of the transaction can be measured reliably. Risks and rewards areconsidered and passed to the buyer at the time of delivery.(vii) DividendsDividends are recognised as revenue when the right to receive payment is established.(l) Government grantsGrants from the government are recognised at their fair value where there is a reasonable assurance that the grant will be received and the Group willcomply with all attached conditions.Government grants relating to costs are deferred and recognised in the income statement over the period necessary to match them with the costs thatthey are intended to compensate.Government grants relating to the purchase of property, plant and equipment are included in non-current liabilities as deferred income and are creditedto the income statement on a straight-line basis over the expected lives of the related assets.(m) Classification of expenditureExpenditure in excess of $2,000 which is expected to provide future economic benefits is capitalised, with the exception of the purchase of officeequipment and other items of a similar nature that provide limited quantifiable benefits. The threshold applies to all asset classes. Capital spares have athreshold of $20,000. If capital spares are under $20,000, the item is recorded in inventory. All other expenditure, except reductions in equity, is treatedas an operating expense in the period in which the expenditure is incurred.(n) Cash and cash equivalentsFor cash flow statement and presentation purposes, cash and cash equivalents include cash on hand, deposits held at call with <strong>financial</strong> institutions,and other short term highly liquid investments with original maturities of 3 months or less that are readily convertible to known amounts of cash and whichare subject to an insignificant risk of changes in value.The Group has a group banking facility whereby no interest is earned on subsidiary bank balances. Interest is earned on a daily basis on the consolidatedbank balance of the Group which comprises the parent entity, the Logistics Australasia group, the <strong>QR</strong> Intermodal group (formerly known as NationalLogistics Alliance Pty Ltd) and Australian <strong>Rail</strong> Pty Ltd (formerly known as the <strong>QR</strong> National Holdings Pty Ltd) and its wholly-owned subsidiaries.