Lean Hogs Hedge Model and Crush Margin Calculator

Lean Hogs Hedge Model and Crush Margin Calculator

Lean Hogs Hedge Model and Crush Margin Calculator

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

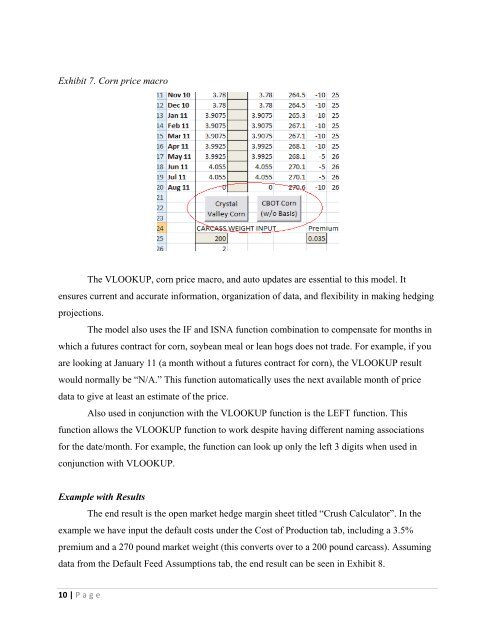

Exhibit 7. Corn price macroThe VLOOKUP, corn price macro, <strong>and</strong> auto updates are essential to this model. Itensures current <strong>and</strong> accurate information, organization of data, <strong>and</strong> flexibility in making hedgingprojections.The model also uses the IF <strong>and</strong> ISNA function combination to compensate for months inwhich a futures contract for corn, soybean meal or lean hogs does not trade. For example, if youare looking at January 11 (a month without a futures contract for corn), the VLOOKUP resultwould normally be “N/A.” This function automatically uses the next available month of pricedata to give at least an estimate of the price.Also used in conjunction with the VLOOKUP function is the LEFT function. Thisfunction allows the VLOOKUP function to work despite having different naming associationsfor the date/month. For example, the function can look up only the left 3 digits when used inconjunction with VLOOKUP.Example with ResultsThe end result is the open market hedge margin sheet titled “<strong>Crush</strong> <strong>Calculator</strong>”. In theexample we have input the default costs under the Cost of Production tab, including a 3.5%premium <strong>and</strong> a 270 pound market weight (this converts over to a 200 pound carcass). Assumingdata from the Default Feed Assumptions tab, the end result can be seen in Exhibit 8.10 | P age

![Publications Since 2000[1].docx](https://img.yumpu.com/30237513/1/190x245/publications-since-20001docx.jpg?quality=85)