DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DUNDEE</strong> <strong>INTERNATIONAL</strong> 2011 Third Quarter Report<br />

OUR RESOURCES AND FINANCIAL CONDITION<br />

Investment properties<br />

The fair value of our investment property portfolio at September 30, 2011, was $1,011 million, representing a<br />

weighted average capitalization rate (“Cap Rate”) of 8.3%.<br />

Fair values were determined using the discounted cash flow method. The discounted cash flow method<br />

discounts the expected future cash flows, generally over a term of ten years, and using discount rates and<br />

terminal capitalization rates specific to each property.<br />

Building improvements<br />

Building improvements represent investments made in our rental properties to ensure our buildings are<br />

operating at an optimal level. We currently have several improvement projects in the planning stages and did<br />

not incur any costs during the quarter.<br />

Initial direct leasing costs and lease incentives<br />

Initial direct leasing costs include leasing fees and related costs, and broker commissions incurred in negotiating<br />

and arranging tenant leases. Lease incentives include costs incurred to make leasehold improvements to tenant<br />

spaces and cash allowances. Initial direct leasing costs and lease incentives are dependent on asset type, lease<br />

terminations and expiries, the mix of new leasing activity compared to renewals, portfolio growth and general<br />

market conditions. Short-term leases generally have lower costs than long-term leases.<br />

For the period from August 3, 2011 to September 30, 2011, we leased or renewed approximately 99,000 square<br />

feet of space for which we incurred $929 of leasing costs.<br />

Commitments and contingencies<br />

We are contingently liable with respect to litigation and claims that may arise from time to time. In the opinion<br />

of management, any liability that may arise from such contingencies would not have a material adverse effect<br />

on our consolidated financial statements.<br />

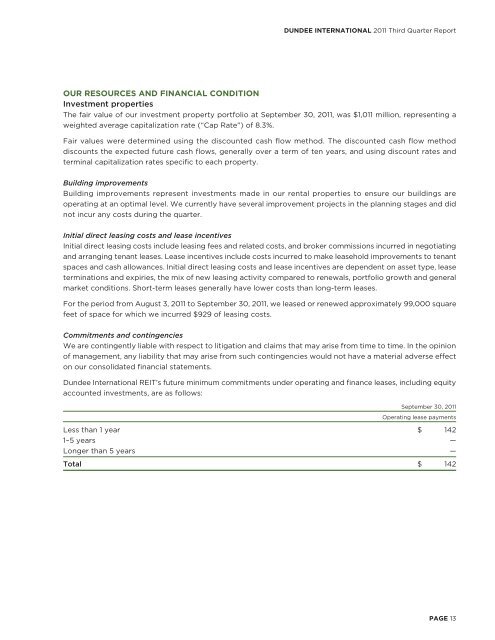

Dundee International <strong>REIT</strong>’s future minimum commitments under operating and finance leases, including equity<br />

accounted investments, are as follows:<br />

September 30, 2011<br />

Operating lease payments<br />

Less than 1 year $ 142<br />

1–5 years —<br />

Longer than 5 years —<br />

Total $ 142<br />

PAGE 13