DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DUNDEE</strong> <strong>INTERNATIONAL</strong> 2011 Third Quarter Report<br />

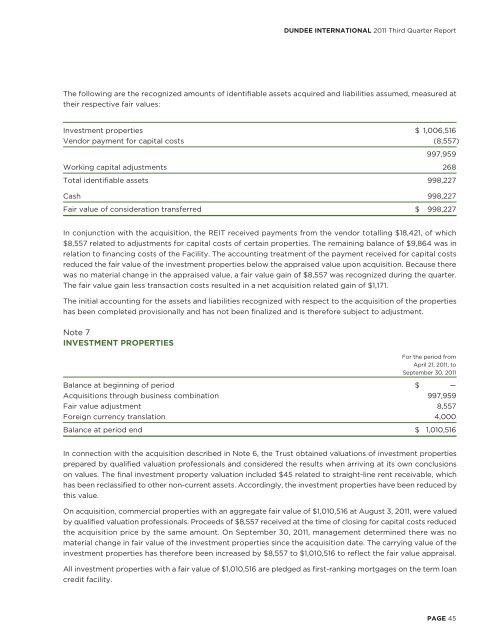

The following are the recognized amounts of identifiable assets acquired and liabilities assumed, measured at<br />

their respective fair values:<br />

Investment properties $ 1,006,516<br />

Vendor payment for capital costs (8,557)<br />

997,959<br />

Working capital adjustments 268<br />

Total identifiable assets 998,227<br />

Cash 998,227<br />

Fair value of consideration transferred $ 998,227<br />

In conjunction with the acquisition, the <strong>REIT</strong> received payments from the vendor totalling $18,421, of which<br />

$8,557 related to adjustments for capital costs of certain properties. The remaining balance of $9,864 was in<br />

relation to financing costs of the Facility. The accounting treatment of the payment received for capital costs<br />

reduced the fair value of the investment properties below the appraised value upon acquisition. Because there<br />

was no material change in the appraised value, a fair value gain of $8,557 was recognized during the quarter.<br />

The fair value gain less transaction costs resulted in a net acquisition related gain of $1,171.<br />

The initial accounting for the assets and liabilities recognized with respect to the acquisition of the properties<br />

has been completed provisionally and has not been finalized and is therefore subject to adjustment.<br />

Note 7<br />

INVESTMENT PROPERTIES<br />

For the period from<br />

April 21, 2011, to<br />

September 30, 2011<br />

Balance at beginning of period $ —<br />

Acquisitions through business combination 997,959<br />

Fair value adjustment 8,557<br />

Foreign currency translation 4,000<br />

Balance at period end $ 1,010,516<br />

In connection with the acquisition described in Note 6, the Trust obtained valuations of investment properties<br />

prepared by qualified valuation professionals and considered the results when arriving at its own conclusions<br />

on values. The final investment property valuation included $45 related to straight-line rent receivable, which<br />

has been reclassified to other non-current assets. Accordingly, the investment properties have been reduced by<br />

this value.<br />

On acquisition, commercial properties with an aggregate fair value of $1,010,516 at August 3, 2011, were valued<br />

by qualified valuation professionals. Proceeds of $8,557 received at the time of closing for capital costs reduced<br />

the acquisition price by the same amount. On September 30, 2011, management determined there was no<br />

material change in fair value of the investment properties since the acquisition date. The carrying value of the<br />

investment properties has therefore been increased by $8,557 to $1,010,516 to reflect the fair value appraisal.<br />

All investment properties with a fair value of $1,010,516 are pledged as first-ranking mortgages on the term loan<br />

credit facility.<br />

PAGE 45