DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

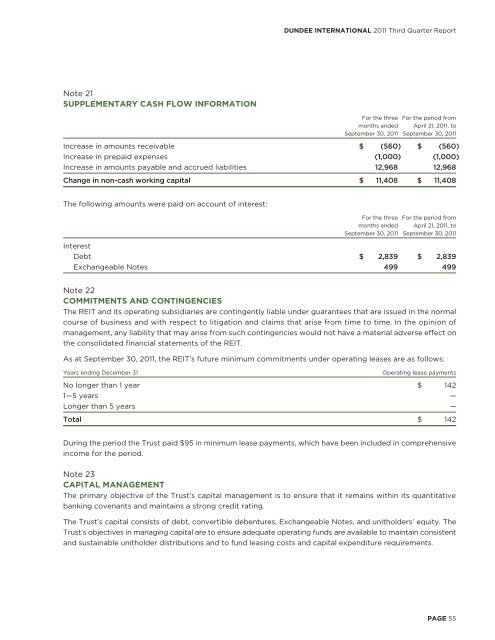

Note 21<br />

SUPPLEMENTARY CASH FLOW INFORMATION<br />

<strong>DUNDEE</strong> <strong>INTERNATIONAL</strong> 2011 Third Quarter Report<br />

For the three For the period from<br />

months ended April 21, 2011, to<br />

September 30, 2011 September 30, 2011<br />

Increase in amounts receivable $ (560) $ (560)<br />

Increase in prepaid expenses (1,000) (1,000)<br />

Increase in amounts payable and accrued liabilities 12,968 12,968<br />

Change in non-cash working capital $ 11,408 $ 11,408<br />

The following amounts were paid on account of interest:<br />

For the three For the period from<br />

months ended April 21, 2011, to<br />

September 30, 2011 September 30, 2011<br />

Interest<br />

Debt $ 2,839 $ 2,839<br />

Exchangeable Notes 499 499<br />

Note 22<br />

COMMITMENTS AND CONTINGENCIES<br />

The <strong>REIT</strong> and its operating subsidiaries are contingently liable under guarantees that are issued in the normal<br />

course of business and with respect to litigation and claims that arise from time to time. In the opinion of<br />

management, any liability that may arise from such contingencies would not have a material adverse effect on<br />

the consolidated financial statements of the <strong>REIT</strong>.<br />

As at September 30, 2011, the <strong>REIT</strong>’s future minimum commitments under operating leases are as follows:<br />

Years ending December 31 Operating lease payments<br />

No longer than 1 year $ 142<br />

1—5 years —<br />

Longer than 5 years —<br />

Total $ 142<br />

During the period the Trust paid $95 in minimum lease payments, which have been included in comprehensive<br />

income for the period.<br />

Note 23<br />

CAPITAL MANAGEMENT<br />

The primary objective of the Trust’s capital management is to ensure that it remains within its quantitative<br />

banking covenants and maintains a strong credit rating.<br />

The Trust’s capital consists of debt, convertible debentures, Exchangeable Notes, and unitholders’ equity. The<br />

Trust’s objectives in managing capital are to ensure adequate operating funds are available to maintain consistent<br />

and sustainable unitholder distributions and to fund leasing costs and capital expenditure requirements.<br />

PAGE 55