DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DUNDEE</strong> <strong>INTERNATIONAL</strong> 2011 Third Quarter Report<br />

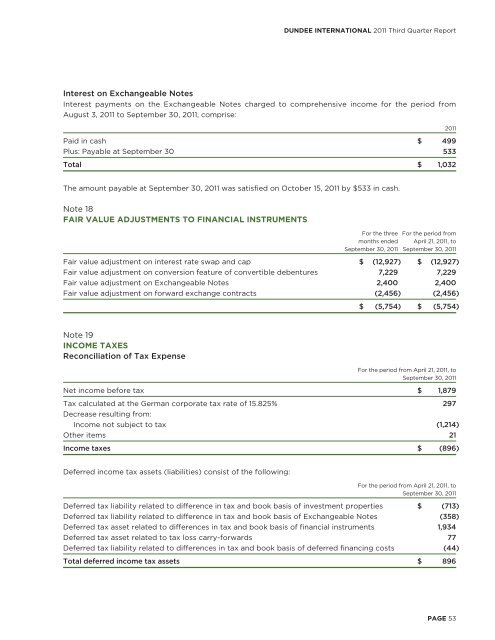

Interest on Exchangeable Notes<br />

Interest payments on the Exchangeable Notes charged to comprehensive income for the period from<br />

August 3, 2011 to September 30, 2011, comprise:<br />

Paid in cash $ 499<br />

Plus: Payable at September 30 533<br />

Total $ 1,032<br />

The amount payable at September 30, 2011 was satisfied on October 15, 2011 by $533 in cash.<br />

Note 18<br />

FAIR VALUE ADJUSTMENTS TO FINANCIAL INSTRUMENTS<br />

2011<br />

For the three For the period from<br />

months ended April 21, 2011, to<br />

September 30, 2011 September 30, 2011<br />

Fair value adjustment on interest rate swap and cap $ (12,927) $ (12,927)<br />

Fair value adjustment on conversion feature of convertible debentures 7,229 7,229<br />

Fair value adjustment on Exchangeable Notes 2,400 2,400<br />

Fair value adjustment on forward exchange contracts (2,456) (2,456)<br />

Note 19<br />

INCOME TAXES<br />

Reconciliation of Tax Expense<br />

$ (5,754) $ (5,754)<br />

For the period from April 21, 2011, to<br />

September 30, 2011<br />

Net income before tax $ 1,879<br />

Tax calculated at the German corporate tax rate of 15.825% 297<br />

Decrease resulting from:<br />

Income not subject to tax (1,214)<br />

Other items 21<br />

Income taxes $ (896)<br />

Deferred income tax assets (liabilities) consist of the following:<br />

For the period from April 21, 2011, to<br />

September 30, 2011<br />

Deferred tax liability related to difference in tax and book basis of investment properties $ (713)<br />

Deferred tax liability related to difference in tax and book basis of Exchangeable Notes (358)<br />

Deferred tax asset related to differences in tax and book basis of financial instruments 1,934<br />

Deferred tax asset related to tax loss carry-forwards 77<br />

Deferred tax liability related to differences in tax and book basis of deferred financing costs (44)<br />

Total deferred income tax assets $ 896<br />

PAGE 53