DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

DUNDEE INTERNATIONAL REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

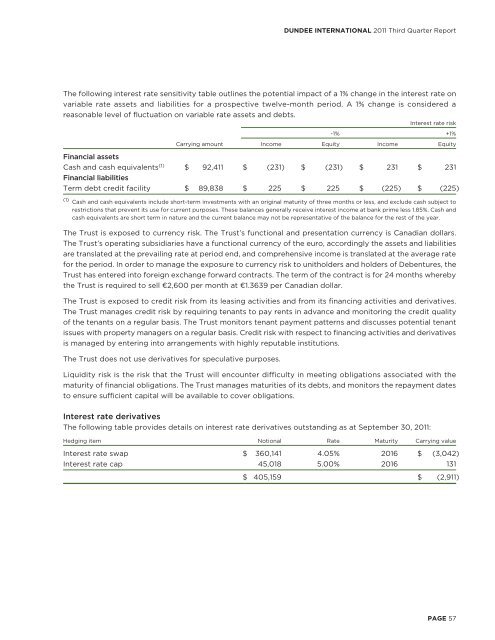

The following interest rate sensitivity table outlines the potential impact of a 1% change in the interest rate on<br />

variable rate assets and liabilities for a prospective twelve-month period. A 1% change is considered a<br />

reasonable level of fluctuation on variable rate assets and debts.<br />

Interest rate risk<br />

-1% +1%<br />

Carrying amount Income Equity Income Equity<br />

Financial assets<br />

Cash and cash equivalents (1) $ 92,411 $ (231) $ (231) $ 231 $ 231<br />

Financial liabilities<br />

Term debt credit facility $ 89,838 $ 225 $ 225 $ (225) $ (225)<br />

(1) Cash and cash equivalents include short-term investments with an original maturity of three months or less, and exclude cash subject to<br />

restrictions that prevent its use for current purposes. These balances generally receive interest income at bank prime less 1.85%. Cash and<br />

cash equivalents are short term in nature and the current balance may not be representative of the balance for the rest of the year.<br />

The Trust is exposed to currency risk. The Trust’s functional and presentation currency is Canadian dollars.<br />

The Trust’s operating subsidiaries have a functional currency of the euro, accordingly the assets and liabilities<br />

are translated at the prevailing rate at period end, and comprehensive income is translated at the average rate<br />

for the period. In order to manage the exposure to currency risk to unitholders and holders of Debentures, the<br />

Trust has entered into foreign exchange forward contracts. The term of the contract is for 24 months whereby<br />

the Trust is required to sell €2,600 per month at €1.3639 per Canadian dollar.<br />

The Trust is exposed to credit risk from its leasing activities and from its financing activities and derivatives.<br />

The Trust manages credit risk by requiring tenants to pay rents in advance and monitoring the credit quality<br />

of the tenants on a regular basis. The Trust monitors tenant payment patterns and discusses potential tenant<br />

issues with property managers on a regular basis. Credit risk with respect to financing activities and derivatives<br />

is managed by entering into arrangements with highly reputable institutions.<br />

The Trust does not use derivatives for speculative purposes.<br />

<strong>DUNDEE</strong> <strong>INTERNATIONAL</strong> 2011 Third Quarter Report<br />

Liquidity risk is the risk that the Trust will encounter difficulty in meeting obligations associated with the<br />

maturity of financial obligations. The Trust manages maturities of its debts, and monitors the repayment dates<br />

to ensure sufficient capital will be available to cover obligations.<br />

Interest rate derivatives<br />

The following table provides details on interest rate derivatives outstanding as at September 30, 2011:<br />

Hedging item Notional Rate Maturity Carrying value<br />

Interest rate swap $ 360,141 4.05% 2016 $ (3,042)<br />

Interest rate cap 45,018 5.00% 2016 131<br />

$ 405,159 $ (2,911)<br />

PAGE 57