Annual Report and Accounts 2010-11 - Manchester Airport

Annual Report and Accounts 2010-11 - Manchester Airport

Annual Report and Accounts 2010-11 - Manchester Airport

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

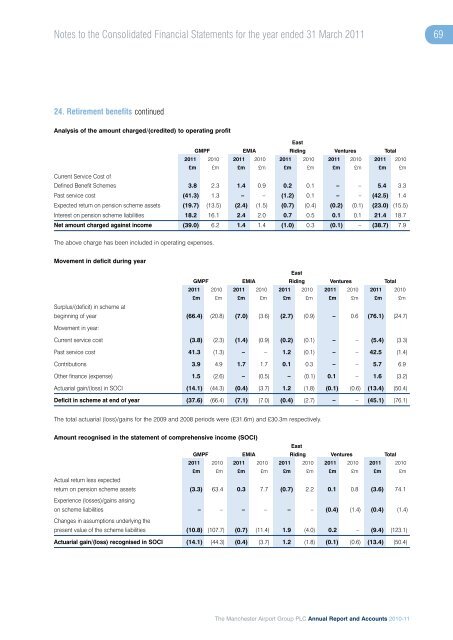

Notes to the Consolidated Financial Statements for the year ended 31 March 20<strong>11</strong>6924. Retirement benefits continuedAnalysis of the amount charged/(credited) to operating profitEastGMPF EMIA Riding Ventures Total20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong>£m £m £m £m £m £m £m £m £m £mCurrent Service Cost ofDefined Benefit Schemes 3.8 2.3 1.4 0.9 0.2 0.1 – – 5.4 3.3Past service cost (41.3) 1.3 – – (1.2) 0.1 – – (42.5) 1.4Expected return on pension scheme assets (19.7) (13.5) (2.4) (1.5) (0.7) (0.4) (0.2) (0.1) (23.0) (15.5)Interest on pension scheme liabilities 18.2 16.1 2.4 2.0 0.7 0.5 0.1 0.1 21.4 18.7Net amount charged against income (39.0) 6.2 1.4 1.4 (1.0) 0.3 (0.1) – (38.7) 7.9The above charge has been included in operating expenses.Movement in deficit during yearEastGMPF EMIA Riding Ventures Total20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong>£m £m £m £m £m £m £m £m £m £mSurplus/(deficit) in scheme atbeginning of year (66.4) (20.8) (7.0) (3.6) (2.7) (0.9) – 0.6 (76.1) (24.7)Movement in year:Current service cost (3.8) (2.3) (1.4) (0.9) (0.2) (0.1) – – (5.4) (3.3)Past service cost 41.3 (1.3) – – 1.2 (0.1) – – 42.5 (1.4)Contributions 3.9 4.9 1.7 1.7 0.1 0.3 – – 5.7 6.9Other finance (expense) 1.5 (2.6) – (0.5) – (0.1) 0.1 – 1.6 (3.2)Actuarial gain/(loss) in SOCI (14.1) (44.3) (0.4) (3.7) 1.2 (1.8) (0.1) (0.6) (13.4) (50.4)Deficit in scheme at end of year (37.6) (66.4) (7.1) (7.0) (0.4) (2.7) – – (45.1) (76.1)The total actuarial (loss)/gains for the 2009 <strong>and</strong> 2008 periods were (£31.6m) <strong>and</strong> £30.3m respectively.Amount recognised in the statement of comprehensive income (SOCI)EastGMPF EMIA Riding Ventures Total20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong>£m £m £m £m £m £m £m £m £m £mActual return less expectedreturn on pension scheme assets (3.3) 63.4 0.3 7.7 (0.7) 2.2 0.1 0.8 (3.6) 74.1Experience (losses)/gains arisingon scheme liabilities – – – – – – (0.4) (1.4) (0.4) (1.4)Changes in assumptions underlying thepresent value of the scheme liabilities (10.8) (107.7) (0.7) (<strong>11</strong>.4) 1.9 (4.0) 0.2 – (9.4) (123.1)Actuarial gain/(loss) recognised in SOCI (14.1) (44.3) (0.4) (3.7) 1.2 (1.8) (0.1) (0.6) (13.4) (50.4)The <strong>Manchester</strong> <strong>Airport</strong> Group PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2010</strong>-<strong>11</strong>