Exceptions from Subsection 55(2) - CCH Canadian

Exceptions from Subsection 55(2) - CCH Canadian

Exceptions from Subsection 55(2) - CCH Canadian

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

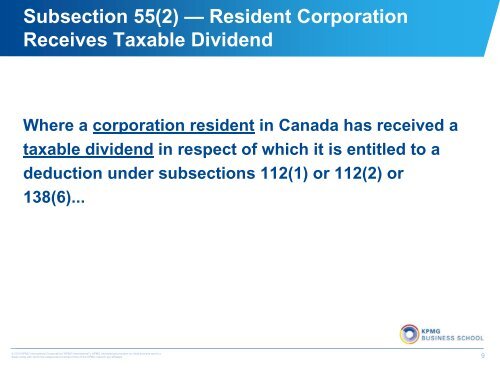

<strong>Subsection</strong> <strong>55</strong>(2) — Resident CorporationReceives Taxable DividendWhere a corporation resident in Canada has received ataxable dividend in respect of which it is entitled to adeduction under subsections 112(1) or 112(2) or138(6)...© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is aSwiss entity with which the independent member firms of the KPMG network are affiliated 9