Annual Report for 2006/07 - Metro Tasmania

Annual Report for 2006/07 - Metro Tasmania

Annual Report for 2006/07 - Metro Tasmania

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

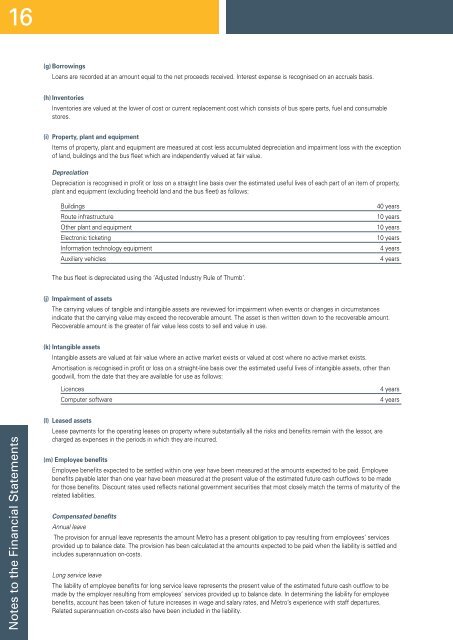

16(g) BorrowingsLoans are recorded at an amount equal to the net proceeds received. Interest expense is recognised on an accruals basis.(h) InventoriesInventories are valued at the lower of cost or current replacement cost which consists of bus spare parts, fuel and consumablestores.(i) Property, plant and equipmentItems of property, plant and equipment are measured at cost less accumulated depreciation and impairment loss with the exceptionof land, buildings and the bus fleet which are independently valued at fair value.DepreciationDepreciation is recognised in profit or loss on a straight line basis over the estimated useful lives of each part of an item of property,plant and equipment (excluding freehold land and the bus fleet) as follows:BuildingsRoute infrastructureOther plant and equipmentElectronic ticketingIn<strong>for</strong>mation technology equipmentAuxiliary vehicles40 years10 years10 years10 years4 years4 yearsThe bus fleet is depreciated using the ‘Adjusted Industry Rule of Thumb’.(j) Impairment of assetsThe carrying values of tangible and intangible assets are reviewed <strong>for</strong> impairment when events or changes in circumstancesindicate that the carrying value may exceed the recoverable amount. The asset is then written down to the recoverable amount.Recoverable amount is the greater of fair value less costs to sell and value in use.(k) Intangible assetsIntangible assets are valued at fair value where an active market exists or valued at cost where no active market exists.Amortisation is recognised in profit or loss on a straight-line basis over the estimated useful lives of intangible assets, other thangoodwill, from the date that they are available <strong>for</strong> use as follows:LicencesComputer software4 years4 yearsNotes to the Financial Statements(l) Leased assetsLease payments <strong>for</strong> the operating leases on property where substantially all the risks and benefits remain with the lessor, arecharged as expenses in the periods in which they are incurred.(m) Employee benefitsEmployee benefits expected to be settled within one year have been measured at the amounts expected to be paid. Employeebenefits payable later than one year have been measured at the present value of the estimated future cash outflows to be made<strong>for</strong> those benefits. Discount rates used reflects national government securities that most closely match the terms of maturity of therelated liabilities.Compensated benefits<strong>Annual</strong> leaveThe provision <strong>for</strong> annual leave represents the amount <strong>Metro</strong> has a present obligation to pay resulting from employees’ servicesprovided up to balance date. The provision has been calculated at the amounts expected to be paid when the liability is settled andincludes superannuation on-costs.Long service leaveThe liability of employee benefits <strong>for</strong> long service leave represents the present value of the estimated future cash outflow to bemade by the employer resulting from employees’ services provided up to balance date. In determining the liability <strong>for</strong> employeebenefits, account has been taken of future increases in wage and salary rates, and <strong>Metro</strong>’s experience with staff departures.Related superannuation on-costs also have been included in the liability.