Annual Report for 2006/07 - Metro Tasmania

Annual Report for 2006/07 - Metro Tasmania

Annual Report for 2006/07 - Metro Tasmania

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

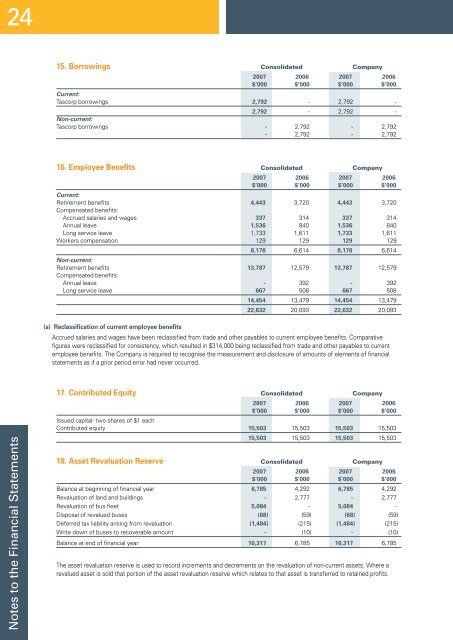

2415. Borrowings Consolidated Company20<strong>07</strong> <strong>2006</strong> 20<strong>07</strong> <strong>2006</strong>$’000 $’000 $’000 $’000Current:Tascorp borrowings 2,792 - 2,792 -2,792 - 2,792 -Non-current:Tascorp borrowings - 2,792 - 2,792- 2,792 - 2,79216. Employee Benefits Consolidated Company20<strong>07</strong> <strong>2006</strong> 20<strong>07</strong> <strong>2006</strong>$’000 $’000 $’000 $’000Current:Retirement benefits 4,443 3,720 4,443 3,720Compensated benefits:Accrued salaries and wages 337 314 337 314<strong>Annual</strong> leave 1,536 840 1,536 840Long service leave 1,733 1,611 1,733 1,611Workers compensation 129 129 129 1298,178 6,614 8,178 6,614Non-current:Retirement benefits 13,787 12,579 13,787 12,579Compensated benefits:<strong>Annual</strong> leave - 392 - 392Long service leave 667 508 667 508(a) Reclassification of current employee benefits14,454 13,479 14,454 13,47922,632 20,093 22,632 20,093Accrued salaries and wages have been reclassified from trade and other payables to current employee benefits. Comparativefigures were reclassified <strong>for</strong> consistency, which resulted in $314,000 being reclassified from trade and other payables to currentemployee benefits. The Company is required to recognise the measurement and disclosure of amounts of elements of financialstatements as if a prior period error had never occurred.Notes to the Financial Statements17. Contributed Equity Consolidated Company20<strong>07</strong> <strong>2006</strong> 20<strong>07</strong> <strong>2006</strong>$’000 $’000 $’000 $’000Issued capital- two shares of $1 eachContributed equity 15,503 15,503 15,503 15,50315,503 15,503 15,503 15,50318. Asset Revaluation Reserve Consolidated Company20<strong>07</strong> <strong>2006</strong> 20<strong>07</strong> <strong>2006</strong>$’000 $’000 $’000 $’000Balance at beginning of financial year 6,785 4,292 6,785 4,292Revaluation of land and buildings - 2,777 - 2,777Revaluation of bus fleet 5,084 - 5,084 -Disposal of revalued buses (68) (59) (68) (59)Deferred tax liability arising from revaluation (1,484) (215) (1,484) (215)Write down of buses to recoverable amount - (10) - (10)Balance at end of financial year 10,317 6,785 10,317 6,785The asset revaluation reserve is used to record increments and decrements on the revaluation of non-current assets. Where arevalued asset is sold that portion of the asset revaluation reserve which relates to that asset is transferred to retained profits.