Annual Report for 2006/07 - Metro Tasmania

Annual Report for 2006/07 - Metro Tasmania

Annual Report for 2006/07 - Metro Tasmania

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

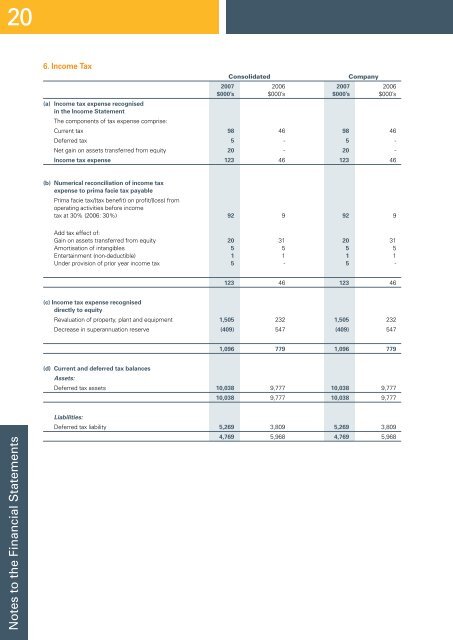

206. Income Tax(a) Income tax expense recognisedin the Income StatementThe components of tax expense comprise:ConsolidatedCompany20<strong>07</strong> <strong>2006</strong> 20<strong>07</strong> <strong>2006</strong>$000’s $000’s $000’s $000’sCurrent tax 98 46 98 46Deferred tax 5 - 5 -Net gain on assets transferred from equity 20 - 20 -Income tax expense 123 46 123 46(b) Numerical reconciliation of income taxexpense to prima facie tax payablePrima facie tax/(tax benefit) on profit/(loss) fromoperating activities be<strong>for</strong>e incometax at 30% (<strong>2006</strong>: 30%) 92 9 92 9Add tax effect of:Gain on assets transferred from equity 20 31 20 31Amortisation of intangibles 5 5 5 5Entertainment (non-deductible) 1 1 1 1Under provision of prior year income tax 5 - 5 -123 46 123 46(c) Income tax expense recogniseddirectly to equityRevaluation of property, plant and equipment 1,505 232 1,505 232Decrease in superannuation reserve (409) 547 (409) 5471,096 779 1,096 779(d) Current and deferred tax balancesAssets:Deferred tax assets 10,038 9,777 10,038 9,77710,038 9,777 10,038 9,777Notes to the Financial StatementsLiabilities:Deferred tax liability 5,269 3,809 5,269 3,8094,769 5,968 4,769 5,968