You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2007</strong> <strong>Annual</strong> <strong>Report</strong> – Explanatory Notes<br />

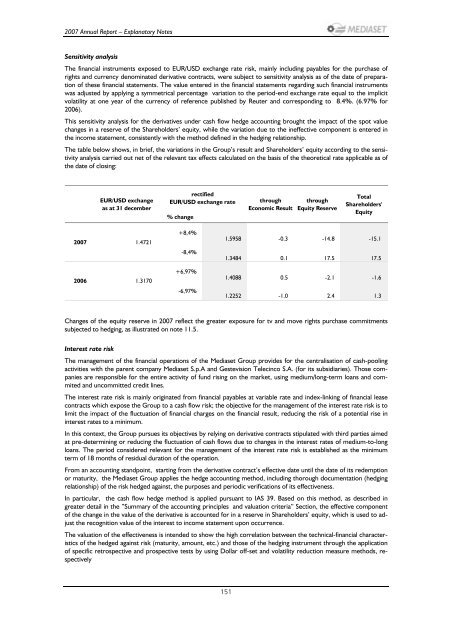

Sensitivity analysis<br />

The financial instruments exposed to EUR/USD exchange rate risk, mainly including payables for the purchase of<br />

rights and currency denominated derivative contracts, were subject to sensitivity analysis as of the date of preparation<br />

of these financial statements. The value entered in the financial statements regarding such financial instruments<br />

was adjusted by applying a symmetrical percentage variation to the period-end exchange rate equal to the implicit<br />

volatility at one year of the currency of reference published by Reuter and corresponding to 8.4%. (6.97% for<br />

2006).<br />

This sensitivity analysis for the derivatives under cash flow hedge accounting brought the impact of the spot value<br />

changes in a reserve of the Shareholders’ equity, while the variation due to the ineffective component is entered in<br />

the income statement, consistently with the method defined in the hedging relationship.<br />

The table below shows, in brief, the variations in the Group’s result and Shareholders’ equity according to the sensitivity<br />

analysis carried out net of the relevant tax effects calculated on the basis of the theoretical rate applicable as of<br />

the date of closing:<br />

EUR/USD exchange<br />

as at 31 december<br />

<strong>2007</strong> 1.4721<br />

2006 1.3170<br />

rectified<br />

EUR/USD exchange rate<br />

% change<br />

+8,4%<br />

-8,4%<br />

+6,97%<br />

-6,97%<br />

through<br />

Economic Result<br />

through<br />

Equity Reserve<br />

Total<br />

Shareholders'<br />

Equity<br />

1.5958 -0.3 -14.8 -15.1<br />

1.3484 0.1 17.5 17.5<br />

1.4088 0.5 -2.1 -1.6<br />

1.2252 -1.0 2.4 1.3<br />

Changes of the equity reserve in <strong>2007</strong> reflect the greater exposure for tv and move rights purchase commitments<br />

subjected to hedging, as illustrated on note 11.5.<br />

Interest rate risk<br />

The management of the financial operations of the Mediaset Group provides for the centralisation of cash-pooling<br />

activities with the parent company Mediaset S.p.A and Gestevision Telecinco S.A. (for its subsidiaries). Those companies<br />

are responsible for the entire activity of fund rising on the market, using medium/long-term loans and commited<br />

and uncommitted credit lines.<br />

The interest rate risk is mainly originated from financial payables at variable rate and index-linking of financial lease<br />

contracts which expose the Group to a cash flow risk; the objective for the management of the interest rate risk is to<br />

limit the impact of the fluctuation of financial charges on the financial result, reducing the risk of a potential rise in<br />

interest rates to a minimum.<br />

In this context, the Group pursues its objectives by relying on derivative contracts stipulated with third parties aimed<br />

at pre-determining or reducing the fluctuation of cash flows due to changes in the interest rates of medium-to-long<br />

loans. The period considered relevant for the management of the interest rate risk is established as the minimum<br />

term of 18 months of residual duration of the operation.<br />

From an accounting standpoint, starting from the derivative contract’s effective date until the date of its redemption<br />

or maturity, the Mediaset Group applies the hedge accounting method, including thorough documentation (hedging<br />

relationship) of the risk hedged against, the purposes and periodic verifications of its effectiveness.<br />

In particular, the cash flow hedge method is applied pursuant to IAS 39. Based on this method, as described in<br />

greater detail in the ”Summary of the accounting principles and valuation criteria” Section, the effective component<br />

of the change in the value of the derivative is accounted for in a reserve in Shareholders’ equity, which is used to adjust<br />

the recognition value of the interest to income statement upon occurrence.<br />

The valuation of the effectiveness is intended to show the high correlation between the technical-financial characteristics<br />

of the hedged against risk (maturity, amount, etc.) and those of the hedging instrument through the application<br />

of specific retrospective and prospective tests by using Dollar off-set and volatility reduction measure methods, respectively<br />

151