Tourism Planning Taskforce Report - Western Australian Planning ...

Tourism Planning Taskforce Report - Western Australian Planning ...

Tourism Planning Taskforce Report - Western Australian Planning ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

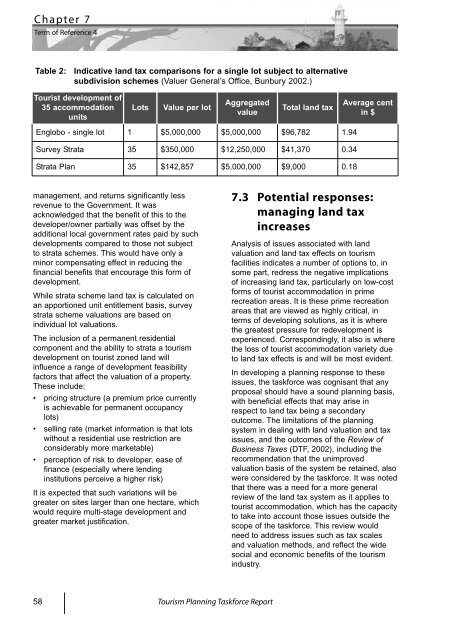

Chapter 7Term of Reference 4Table 2:Indicative land tax comparisons for a single lot subject to alternativesubdivision schemes (Valuer General’s Office, Bunbury 2002.)Tourist development of35 accommodationunitsLotsValue per lotAggregatedvalueTotal land taxAverage centin $Englobo - single lot 1$5,000,000$5,000,000$96,7821.94Survey Strata 35$350,000$12,250,000$41,3700.34Strata Plan 35$142,857$5,000,000$9,0000.18management, and returns significantly lessrevenue to the Government. It wasacknowledged that the benefit of this to thedeveloper/owner partially was offset by theadditional local government rates paid by suchdevelopments compared to those not subjectto strata schemes. This would have only aminor compensating effect in reducing thefinancial benefits that encourage this form ofdevelopment.While strata scheme land tax is calculated onan apportioned unit entitlement basis, surveystrata scheme valuations are based onindividual lot valuations.The inclusion of a permanent residentialcomponent and the ability to strata a tourismdevelopment on tourist zoned land willinfluence a range of development feasibilityfactors that affect the valuation of a property.These include:• pricing structure (a premium price currentlyis achievable for permanent occupancylots)• selling rate (market information is that lotswithout a residential use restriction areconsiderably more marketable)• perception of risk to developer, ease offinance (especially where lendinginstitutions perceive a higher risk)It is expected that such variations will begreater on sites larger than one hectare, whichwould require multi-stage development andgreater market justification.7.3 Potential responses:managing land taxincreasesAnalysis of issues associated with landvaluation and land tax effects on tourismfacilities indicates a number of options to, insome part, redress the negative implicationsof increasing land tax, particularly on low-costforms of tourist accommodation in primerecreation areas. It is these prime recreationareas that are viewed as highly critical, interms of developing solutions, as it is wherethe greatest pressure for redevelopment isexperienced. Correspondingly, it also is wherethe loss of tourist accommodation variety dueto land tax effects is and will be most evident.In developing a planning response to theseissues, the taskforce was cognisant that anyproposal should have a sound planning basis,with beneficial effects that may arise inrespect to land tax being a secondaryoutcome. The limitations of the planningsystem in dealing with land valuation and taxissues, and the outcomes of the Review ofBusiness Taxes (DTF, 2002), including therecommendation that the unimprovedvaluation basis of the system be retained, alsowere considered by the taskforce. It was notedthat there was a need for a more generalreview of the land tax system as it applies totourist accommodation, which has the capacityto take into account those issues outside thescope of the taskforce. This review wouldneed to address issues such as tax scalesand valuation methods, and reflect the widesocial and economic benefits of the tourismindustry.58 <strong>Tourism</strong> <strong>Planning</strong> <strong>Taskforce</strong> <strong>Report</strong>