â rsrapport Nycomed - Takeda Pharmaceuticals International GmbH

â rsrapport Nycomed - Takeda Pharmaceuticals International GmbH

â rsrapport Nycomed - Takeda Pharmaceuticals International GmbH

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CONTENT ANNUAL REPORT3 This is <strong>Nycomed</strong> Holding A/S4 Key figures5 Chairman's report7 Chief Executive Officer's report11 Shareholders12 Board of Directors14 ManagementBusiness Description<strong>Nycomed</strong> Markets16 - Nordic / CIS19 - Western Europe21 - Central Europe23 - <strong>International</strong> Sales24 Main Products30 Product Origination - business developmentand in-licensing31 Product Origination - development33 Manufacturing Operations34 Quality AssuranceAccounts35 Chief Financial Officer's report39 Management endorsement40 Auditor's report41 Accounting principlesConsolidated accounts45 - Profit and loss statement46 - Balance sheet48 - NotesParent Company54 - Profit and loss statement55 - Balance sheet57 - Notes61 Cashflow statement62 Overview of subsidiaries64 Group structureSubsidiaries address list

THIS IS NYCOMED HOLDING A/S<strong>Nycomed</strong> Holding A/S was a dormant company until May 14th, 1999. At thatdate, investors represented by Nordic Capital III Limited subscribed for 68.9%(DKK 571 million including premium) and <strong>Nycomed</strong> Amersham Benelux BV subscribedfor 31.1% (DKK 257 million including premium) of the share capital of<strong>Nycomed</strong> Holding A/S.<strong>Nycomed</strong> Holding A/S directly and indirectly acquired all companies and assetsof the <strong>Nycomed</strong> Pharma division owned by <strong>Nycomed</strong> Amersham plc. The purchaseswere financed with external debt of DKK 2,712 million, a loan from<strong>Nycomed</strong> Amersham plc of DKK 509 million and the subscribed equity of DKK828 million. The total financing exceeded the acquisition of shares by DKK 723million, which was used to replace external debt in the acquired companies.The new <strong>Nycomed</strong> group (hereafter ”<strong>Nycomed</strong>”) sources, manufactures and marketspharmaceuticals and consumer health products. <strong>Nycomed</strong>'s revenues in2000 amounted to DKK 3,429 million. Earnings before interest, taxes, depreciationand amortization were DKK 680 million, an increase of 23.2 % over the fullyear 1999. Operating profit was DKK 293 million. The total number of employeeswas 2,372 at 31 st December 2000.The calcium portfolio is <strong>Nycomed</strong>’s largest product. Xefo ® (lornoxicam),TachoComb ® , Pantoprazole, Gutron ® and Kestine ® are other international key products.<strong>Nycomed</strong> has sales organisations in the Nordic countries, Benelux, Austria,Germany, Switzerland, Greece, CIS, the Baltic States and China. Sales in otherimportant markets are made through partners.–3–

KEY FIGURESDKK million 2000 1999 *)Net turnover 3,429 1,902Operating result 293 94Result before tax -57 - 55Net result -43 - 57Total assets 5,256 5,383Shareholder's equity 685 756Share capital 10 10DKK million 2000 1999 *)Return on net turnover 8.5 4.9Return on total assets 5.6 1.7Equity ratio 13.0 14.0Number of employees as of 31 st December 2000 2,372 2,240*) Key figures for the Group in 1999 include operations for a period of sevenmonths.Definition of key figures:Return on net turnoverOperating result x 100Net turnoverReturn on total assetsOperating result x 100Total assetsEquity ratioShareholder's equity x 100Total assets–4–

CHAIRMAN`s REPORTYear 2000 was <strong>Nycomed</strong>'s first full year as an independent company followingthe separation from <strong>Nycomed</strong> Amersham. As a whole, the year was both veryeventful and successful with almost all objectives met. The strategy developed atthe time of the separation was followed during last year and is clearly still valid.The overriding strategy of <strong>Nycomed</strong> is to become a leading marketing driven pharmaceuticalcompany in Northern and Eastern Europe with branded pharmaceuticalsand consumer health products. Strengthening the Nordic presence is amajor goal within this strategy. In order to achieve this objective, a number ofwell-defined objectives have been set for the next three years;• <strong>Nycomed</strong> to be positioned as the leading independent market driven companyin our targeted markets• A strong product portfolio to be established through in-licensing deals andinternal projects• Merger and acquisition activities in the area of product lines and geographicalcoverage shall be carried outBecause of the size of their operations, the pharmaceutical mega-companies thatare being formed through mergers will almost certainly have to focus strongly onblockbuster products with an international potential. They will find it very difficultboth to deal with smaller products and to have local strategies, e.g. for genericsand over the counter (OTC) products. This creates an opportunity for companieslike <strong>Nycomed</strong> with a regional strategy. A good example is the anti-histamineKestine ® , which <strong>Nycomed</strong> recently took over from Aventis Behring <strong>GmbH</strong>. TheBoard is very satisfied with all the in-licensing deals that have been accomplishedso far.<strong>Nycomed</strong>'s headquarters are to be fully consolidated in Roskilde in 2001, andwe believe the company has come very far in becoming an integrated companyin a relatively short period of time. The <strong>International</strong> Product Development functionis already located in Roskilde, and a major project is ongoing to restructurethe Nordic manufacturing structure. All these activities support the overall objectives.<strong>Nycomed</strong> will increase its ability and potential as an efficient and strongorganisation - a preferred partner in its territories.–5–

CHAIRMAN`s REPORTThe Board is very satisfied with the work the <strong>Nycomed</strong> organisation has accomplishedin 2000 and would like to thank them for their contributions and wish forcontinued success in the coming years.Toni Weitzberg, Chairman–6–

CHIEF EXECUTIVE OFFICER´s REPORTAfter the establishment of the new <strong>Nycomed</strong> group in May 1999, a comprehensivestrategy and business plan has been established to develop <strong>Nycomed</strong> to aleading marketing franchise in Northern and Eastern Europe within branded pharmaceuticalsand consumer health products. Strengthening the Nordic presenceis a major objective in this strategy. 2000 was the first full year as a separatecompany, and we have been able to show both good financial results and the abilityto comply with our ambitious strategy.The success storiesIn February, the Diagnostics division was sold to Axis-Shield plc for approximatelyDKK 229 million. Finding a future home for Diagnostics was part of the longtermstrategy and was necessary to allow us to focus fully on our core business.Diagnostics became part of a company that could better enhance and utilise itsfull potential. The released capital was invested into the core pharmaceuticalactivities.The Institutional Business was a small, but historically integrated part of<strong>Nycomed</strong> in Norway. They were marketing and selling consumer products withinthe segment frozen cakes, bread, pastries etc. to institutions. Obviously also notpart of our core business, the division was sold to the French companyNeuhauser.An important event early in 2000 was our Swedish subsidiary's OTC registrationfor its proton pump inhibitor Pantoloc ® . This allowed us to be ahead of major competitorson the Swedish market with an OTC proton pump inhibitor. A large directto-consumermedia campaign was performed.As part of the strategic focus on the Nordic area, a pan Nordic Marketing andSales organisation was implemented in April. From this date, we have treated theNordic market as one, with pan Nordic managers responsible for branded Rx,OTC and Consumer Health products respectively. This has proven to be valuableand has already shown good results - an agreement with Almirall-ProdesfarmaS.A. (APF) was signed for the marketing rights to the antihistamine productKestine ® in the Nordic markets.–7–

CHIEF EXECUTIVE OFFICER´s REPORTA licence agreement with Neurim <strong>Pharmaceuticals</strong> (1991) Ltd. regarding themelatonin product Circadin ® has also been signed. The product is currently in theregistration process and is expected to be launched in most of our marketsduring 2002.Sales of our key product CalciChew ® have developed well during the year both inour home markets and in the export business. To support the growing demandfor CalciChew ® , we are investing heavily in the production plant in Asker for thisproduct portfolio.Dealing with issuesIn April, the level of GMO soya in some Nutrilett ® dietary products was found tobe higher than acceptable by the Norwegian legislation, which differs from the EUlegislation. The issue was firmly managed through a quick, temporary withdrawalfrom the market. An improved version was promised before the summer, and thischallenge was successfully met. A market research done at the time of therelaunch also showed that the Nutrilett ® brand had taken no harm from the incident.The BSE syndrome has been a growing concern in Europe, and reached newlevels in 2000 with the first BSE case found in Germany. This is also a concernin <strong>Nycomed</strong> as raw material of bovine origin is used in many pharmaceutical products.A recent EU directive demanded proof of the use of non-risk material, witha tight deadline. <strong>Nycomed</strong> provided the necessary proofs within this deadline andwe are thus in compliance with the EU regulations. Already in 1998 we issued aformal BSE policy internally that is now part of our Quality Manual.The tough decisionsOne of the major objectives in our strategy is cost containment, which necessitatesmajor restructuring activities in the organisation. Also efficiency and betterutilisation of the workforce brought about some major restructuring activities lastyear.–8–

CHIEF EXECUTIVE OFFICER´s REPORTAn announcement was made to consolidate the head office in Roskilde withintwo years, in order to have the management group assembled at one site whenpreparing for an initial public offering of <strong>Nycomed</strong>.The announcement to consolidate the <strong>International</strong> Product Development (IPD) inRoskilde was made in February, and the task was completed by September. Thedepartment was earlier split with one Norwegian and one Danish part, whichmade it difficult to reach into critical mass in each department and also incurredsubstantial travelling costs between the sites. The consolidation has been successful,and the dynamic organisation with approximately 115 persons is nowwell established in Roskilde.The project to restructure our Nordic manufacturing structure is the exercise thatis most profoundly changing our organisation. The project was initiated in April,and in August, the Board of Directors approved a plan, which involved• a DKK 100 million upgrade of the plant in Asker, Norway, to support our largestproduct CalciChew ®• a closedown of the factory in Oslo• the possible sale of our plants at Elverum, Norway, and Helseholmen,Denmark.A project organisation has been formed to manage the implementation until itscompletion late 2002. The restructuring includes a reduction of the workforce inNorway of about 200 persons within this period. The operations staff in Oslo andAsker affected by these changes have been granted appropriate compensationpackages and bonus programs.Looking forwardThe financial performance for the year ended considerably above expectationsand also above the original long-term plan both in terms of revenue and profit.To pursue the strategy statement of developing <strong>Nycomed</strong> as a leading marketingfranchise in Northern and Eastern Europe, the year 2000 was concluded with amajor investment in Finland. Discussions with Leiras Oy (Schering AG) resultedin the establishment of a jointly owned company to be named Oy Leiras FinlandAb (agreement signed 9 th January 2001). The company will consist of <strong>Nycomed</strong>'sFinnish business, Oy <strong>Nycomed</strong> Ab, and Leiras' domestic business. The companywill benefit from Leiras’ traditionally strong position on the Finnish market and–9–

CHIEF EXECUTIVE OFFICER´s REPORTfrom <strong>Nycomed</strong>’s strong product sourcing activities in the Nordic region. Oy LeirasFinland Ab will be the fifth largest pharmaceutical company in Finland, and wehave high expectations for this joint venture in the future.Recognising that we are leaving a successful year behind us, we are already wellinto the challenges of 2001, well equipped with the best possible intellectualcapital and with great enthusiasm to pursue our strategy.Håkan Björklund, CEO–10–

SHAREHOLDERSThe following shareholders hold shares with a face value of at least 5% of theshare capital:<strong>Nycomed</strong> Amersham Benelux BV, Eindhoven, HollandNordic Capital III Alpha, L.P., Jersey, Channel IslandsNordic Capital III Beta, L.P., Jersey, Channel IslandsInvestment AB Bure, Göteborg, SwedenAllmänna Pensionsfonden Sjätte Fondstyrelsen, Göteborg, Sweden–11–

BOARD OF DIRECTORS1092865131171241 Toni Weitzberg is the Chairman of the Board of Directors. He holds an MBA degree from theUniversity of Wisconsin and has lately, before he joined Nordic Capital in 2000, been Senior VicePresident Europe in Pharmacia & Upjohn, overall responsible for their European sites and MarketCompanies in Europe, Middle East, Africa and former Eastern Europe. He was also a member ofthe Corporate Management Group. He is also currently on the Board of Directors for theKarolinska Institute in Stockholm, Synphora AB and Biora AB.2 Robert Andreen holds a PhD degree in Business economics. Before joining Nordic Capital in1990, he held the position as head of the Merger & Acquisitions Department in SvenskaHandelsbanken. He is also currently on the Board of Directors for Wilson Logistics Group,Mölnlycke Health Care, Elmo-Calf AB, Ahlsell Holding AB and Pulsen AB.3 Håkan Björklund is the CEO of <strong>Nycomed</strong> Holding A/S. He holds a PhD degree in neuroscienceresearch from the Karolinska Institute in Stockholm. Before joining <strong>Nycomed</strong> in 1999, he heldthe position of Regional Director in Astra, responsible for sales and marketing in the NordicRegion, UK, Ireland, the Netherlands, Eastern Europe, Greece, and South Africa. He is also currentlya member of the Board of Directors for Perbio Science AB.4 Conny Ditlevsen is an elected employee representative from <strong>Nycomed</strong> Danmark A/S. Sheholds the position of Manager of Organisation & HRD.5 Jorunn Gaarder is an elected employee representative from <strong>Nycomed</strong> Pharma AS, theNorwegian subsidiary. She holds the position of secretary for the Nordic Consumer Health division.6 Lars Ingelmark is Senior Vice President and head of Life Science Ventures, Sixth SwedishNational Pension Fund. He is also chairman of the Board of Directors of Svensk Våtmarksfondand member of the Board of Directors of Biora AB, Capio AB, Karo Bio AB, A Carlsson ResearchAB, A+ Science Invest AB, Innoventus Uppsala Life Science AB, Karolinska Investment Fund KB,Medicon Valley Management AB and Mölnlycke Health Care AB.–12–

BOARD OF DIRECTORSMichael A Stevens is Corporate Development Director for <strong>Nycomed</strong> Amersham plc. He is aFellow of the Chartered Institute of Management Accountants and before <strong>Nycomed</strong> Amersham,he was Director of <strong>International</strong> Finance at Gedeon Richter Ltd in Hungary and Group CorporatePlanning Director in Wellcome plc.7 Fredrik Strömholm holds an MSc. Degree in Economics from the Stockholm School ofEconomics. Previously a director of Nordic Capital, he is now an Executive Director of GoldmanSachs <strong>International</strong>, Stockholm.8 Bo Söderberg has an MSc. Degree in Economics from Stockholm School of Economics.Before joining Nordic Capital in 1997, he held the position as President and CEO ofFöreningsbanken AB. He is currently also on the Board of Directors of Hilding Anders AB andNybron Flooring <strong>International</strong> S/A.9 Runar Bjørklund is the CFO of <strong>Nycomed</strong> Holding A/S and is also a deputy member of theBoard of Directors.10 Kristoffer Melinder joined Nordic Capital in 1998 and is also a deputy member of the Boardof directors.11 Theresa Comiskey Olsen is General Counsel and Company Secretary of <strong>Nycomed</strong> HoldingA/S.12AB.Mark Bulmer is an observer on the Board of Directors from Skandinaviska Enskilda Banken–13–

MANAGEMENTThe management group in <strong>Nycomed</strong> Holding A/S consists of directors of corporatefunctions and divisions residing with the main office in Roskilde, Denmark,and also Regional Directors representing different geographical Market areas inEurope.CEOHumanResourcesPR &InformationIn-licensingQualityAssuranceBusinessDevelopmentMarketing & SalesCountry ManagementInt. ProductDevelopmentOperationsFinance & Adm.Nordic / CISWestern EuropeCentral Europe<strong>International</strong> /ExportNorwayDenmarkSwedenFinlandCISBalticBelgiumThe NetherlandsFranceAustriaSwitzerlandGermanyExportGreeceChinaHåkan BjörklundCEORunar BjørklundCFOStig RoswallSenior Vice President Quality AssuranceCharles DepasseSenior Vice President Operations–14–

MANAGEMENTAxel SørensenSenior Vice President In-LicensingKerstin ValinderSenior Vice PresidentBusiness DevelopmentPetter HomdrumSenior Vice PresidentMarketing & Sales Nordic/CISMarc KeysersSenior Vice PresidentMarketing & Sales Western EuropeAndreas PfeilerSenior Vice PresidentMarketing & Sales Central EuropeKnud LyngeSenior Vice President <strong>International</strong> SalesThor-Björn ConradsonSenior Vice President<strong>International</strong> Product DevelopmentHans Jacob BrinchmannSenior Vice President Human Resources(From 17 th of April 2001 the position willbe held by Hans Arvid Danielsson)–15–

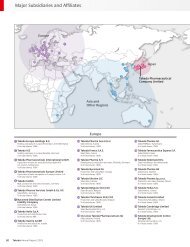

BUSINESS DESCRIPTIONNYCOMED MARKETSNORDIC / CISThe Nordic Region consists of Scandinavia, Finland and the three Baltic countries.In 2000 the Nordic region generated a revenue of DKK 1,361 million, anincrease of 7% compared to 1999. Today <strong>Nycomed</strong> is ranked as number 10 inthe pharmaceutical industry in the region. The strategic objective is to becomeone of the top 5 over the next 3-5 years through organic growth as well asthrough in-licensing of new products and acquisitions.<strong>Nycomed</strong> holds a leading market position in Denmark and Norway, within bothprescription and non-prescription pharmaceuticals. Through its close links withcustomers, regulatory authorities, and the medical profession, <strong>Nycomed</strong> is in agood position to launch new products and develop the existing product portfolio.Sweden represents an important market for <strong>Nycomed</strong> and the Company has successfullydeveloped this market organically over the last few years with doubledigitgrowth. Historically, the business has focused solely on the prescriptionmarket but it is now also well positioned to grow in the OTC business segment.The Nordic region is organised into five business areas; Branded Rx, BrandedPharmacy, Consumer Health, Portfolio and Finland & the Baltic states.100Finland/Baltic279Branded Rx541Portfolio292Branded Pharmacy151Consumer HealthRevenue split by Business Area in the Nordic region (DKK million).–16–

BUSINESS DESCRIPTIONNYCOMED MARKETSNORDIC / CISBranded Rx includes the marketing & sale of prescription only pharmaceuticals,mainly to prescribing MDs and hospitals. Only products receiving product specificpromotion and / or support are included in the business area. The growth inrevenues in 2000 was 16%.Branded Pharmacy includes the marketing & sale of OTC and non-registered productssold through pharmacies only. The products are promoted towards thefinal consumer as well as supported through point-of-sale activities and pharmacychain key account activities. The growth in revenues in 2000 was 7%.Consumer Health includes the marketing & sale of health care related productsthrough other channels than the pharmacy. The products are primarily promotedto the consumer, with the trade being an important stakeholder. The growth inrevenues in 2000 was 18%.Portfolio includes the unbranded, often generic portfolio of products not receivingproduct specific promotion support. Maintenance marketing activities will occur,mainly of a relationship nature, as well as tender competition activities. The productportfolio in this business will continuously be evaluated for product pruningand de-listing. The Portfolio Business area had a decrease in revenues in 2000of 1%.Finland & the Baltic states are currently organised on a country basis as a consequenceof small domestic organisations. Both Finland and the Baltic countrieshave been showing very rapid growth in revenues. The growth in 2000 was 68%for Finland and 31% for the Baltic countries. With the Joint Venture agreementwith Leiras Oy, we have suddenly grown substantially in size in Finland. If progressis according to plan, Finland is likely to be included in the pan NordicMarketing and Sales organisation in 2003.–17–

BUSINESS DESCRIPTIONNYCOMED MARKETSNORDIC / CISCIS<strong>Nycomed</strong> was one of the first Western pharmaceutical companies to establish alocal presence in the former Soviet Union. Today, we hold a leading position inthese countries, and are very well positioned to take advantage of the mediumand long-term growth expected in these markets. <strong>Nycomed</strong> holds a top five positionamong the international pharmaceutical companies in the CIS and was alsoNo.1 in “perceived value” in a COMCON-PHARMA research conducted in Russiain 1999. Total sales growth in CIS was 27% compared to 1999. With more than200 employees, <strong>Nycomed</strong> is represented in each of the former Soviet republicsand operates in more than 35 cities and surrounding areas.–18–

BUSINESS DESCRIPTIONNYCOMED MARKETSWESTERN EUROPE<strong>Nycomed</strong>’s presence in Western Europe is concentrated to Belgium and Holland,and with a more limited presence in France. In Belgium <strong>Nycomed</strong> operatesthrough a number of marketing companies detailing pharmaceutical products,both prescription and OTC, towards general practitioners and specialists. Threeteams visit general practitioners and two teams call upon specialists and hospitals.The target groups are gastro-enterologists, internists, cardiologists, rheumatologists,orthopaedics, urologists, endocrinologists and psychiatrists. Twoother teams market OTC-products to pharmacies. In Holland, two teams detailpharmaceutical products to general practitioners supported by one team callingupon specialists like rheumatologists, orthopaedics, neurologists and urologists.Separately, one team markets OTC-products to pharmacies and drug stores.With this organisation in place, <strong>Nycomed</strong> is equipped to launch basically any productboth in Belgium and Holland and promote them actively to doctors, pharmaciesand the general public.Both in Belgium and in Holland, the company has a well-balanced portfolio of prescriptionmedications promoted to doctors and an OTC-portfolio which is sold inpharmacies and drug stores, and marketed through established distributionchannels as well as to the general public. The strategy has been focused on buildingan up-to-date and well-balanced portfolio of both prescription and OTC-drugs.Consequently, the portfolio has been gradually updated and older, non-profitableproducts have been de-listed. New products with good profitability and sufficientlyhigh sales potential have been launched. Each of the major products in thecompany’s portfolio is performing on top in its therapeutic class.The highlight of 2000 was the launch of Zurcale ® 20mg in Belgium on October1st. By obtaining reimbursement approval for the 20mg formulation, <strong>Nycomed</strong>obtained access to the market for chronic treatment of oesophagitis. The Belgianmarket for proton pump inhibitors amounts to DKK 667 million, growing at anannual rate of 20%.In Holland the major event was the launch of new formulations of <strong>Nycomed</strong>’sTramadol under the brand name Tramagetic ® .–19–

BUSINESS DESCRIPTIONNYCOMED MARKETSWESTERN EUROPE<strong>Nycomed</strong> became market leader both in Holland and in Belgium in the calciummarket with the chewable calcium and calcium D3 combination products underthe brand names Calci-Chew ® and Steocar ® / Steovit D3 ® . The calcium marketboth in Holland and in Belgium has been constantly growing with an average yearlygrowth rate of 10%.SALES 2000 1999/2000PRODUCTS (DKK million) % +/-Pantozol ® / Zurcale ® 41 + 37 %Asaflow ® 48 + 14 %Brexine ® 45 + 2 %CalciChew ® / Steocar ® / Steovit D3 ® 38 + 20 %–20–

BUSINESS DESCRIPTIONNYCOMED MARKETSCENTRAL EUROPEIn 2000, the German speaking countries Austria, Germany and Switzerland wereorganised under one region, called Central Europe. Although there are differencesbetween the three countries, both in terms of the <strong>Nycomed</strong> product portfolioand the depth of market penetration, there has been, for the first time, a concertedeffort made in 2000 to optimise the synergies that do exist. These synergiesare characterised by similar prescription habits, the same medical education,a shared language and by opinion leaders who are recognised across borders.The Marketing & Sales organisation in Austria ended its business year with a netsales increase of 24% compared to the previous year. The main drivers behindthis strong growth were Pantoprazole (Zurcal ® ) and TachoComb ® . ForTachoComb ® , <strong>Nycomed</strong>'s market-share in the fibrin glue market has alreadyreached 45%. For the indications where TachoComb ® may be used, it has alreadyreached 90%. Another important contributor to the sales growth was a rangeof generic anaesthetic products, which in a short period reached a market-shareof approximately 60%. The year 2000 also proved that <strong>Nycomed</strong> Austria couldsuccessfully grow in the OTC segment, which ended the year with a net salesincrease of 42% compared to 1999.The year 2000 was the first business year in which <strong>Nycomed</strong> had its own organisationin Germany. Currently, sales representatives in Germany are required tofocus on hospital products. The small GP sales force also works with a few selectedkey customers in order to keep the two main products Actovegin ® and Gutron ®in the German market. The hospital sales force was also increased in order togive full market coverage. This has already had a positive impact on the sales ofTachoComb ® . Total sales growth in Germany was 26% compared to 1999.In Switzerland the subsidiary continued its impressive growth, primarily driven bythe key products, Pantoprazole and Calcium D 3. Total sales growth in Switzerlandwas 28% compared to 1999.–21–

BUSINESS DESCRIPTIONNYCOMED MARKETSCENTRAL EUROPEAn additional important business segment for <strong>Nycomed</strong> Central Europe is thecontract manufacturing business in Austria. <strong>Nycomed</strong> is not a contract manufacturerper se, however, existing spare capacity in chemical production and secondaryproduction (sterile ampoules and vials) is utilised by taking in productionorders from third parties. The main customers are the Aventis group and theNovartis group.SALES 2000 1999/2000PRODUCTS (DKK million) % +/-Zurcal ® 86 41%CalciumD3 26 73%TachoComb ® 75 7%–22–

BUSINESS DESCRIPTIONNYCOMED MARKETSINTERNATIONAL SALES<strong>Nycomed</strong>’s <strong>International</strong> Sales business segment covers a variety of markets onall continents. It works mainly with medium sized and smaller pharmaceuticalcompanies on a country by country basis. Sales of our products are influencedby the priority, focus and effort put on these by our partners. In 2000, the totalgrowth rate was 24% compared to 1999.Sales of CalciChew ® in the UK continued to grow in 2000, and CalciChew ® nowhas a market share of more than 70%. CalciChew ® also kept its position in Francewith a market share of almost 35%. Proamatine ® (Gutron ® ) showed steady growthin the USA throughout the year. Sales of TachoComb ® in Japan continued to growin 2000, (launched April 1999) and the market share at the end of the year wasapproximately 17%. Xefo ® was launched in many markets both within and outsideEurope. The product was registered in Japan in December with a plannedlaunch date of March 2001.Two important contracts were also signed in 2000. The first was an agreementmade with <strong>Nycomed</strong> Imaging governing the CalciChew ® license in China and theother was an agreement made with CeNeS <strong>Pharmaceuticals</strong> plc for the distributionrights for Xefo ® in the UK.SALES 2000PRODUCTS (DKK million) MAIN MARKET(s)CalciChew ® 166 UK, France, Spain and GermanyGutron ® 83 USA and JapanTachoComb ® 55 JapanActovegin ® 48 China and JapanXefo ® 30 Several markets (introduced 1999/2000)–23–

BUSINESS DESCRIPTIONMAIN PRODUCTSC®alcichew<strong>Nycomed</strong>’s calcium portfolio is by far the company's largest product in salesturnover terms. <strong>Nycomed</strong> has developed a wide range of calcium and vitamin Dchewable tablets. The tablets are sold as both prescription and OTC products inmore than 20 countries under various trademarks, of which CalciChew ® is themost frequently used. Within this segment, calcium tablets from <strong>Nycomed</strong> aremarket leaders in the Nordic countries, the UK and France. Product features likeeasy-to-chew, good taste and documented clinical benefits have greatly contributedto this success.The majority of osteoporosis patients are still not receiving calcium to preventfractures. Thus the untapped market potential is huge, with <strong>Nycomed</strong>'s supplyand marketing capabilities well in position to further expand the calcium business.In order to support and sustain growth, <strong>Nycomed</strong> has formed a virtual strategicbusiness unit for the total calcium operation. <strong>Nycomed</strong>'s calcium portfoliois positioned towards the medical segment of the market. A successful positionin this segment is based on medical claims and data and since the future successis dependent on such clinical data, there is strong participation from the inhouseproduct development department in the calcium team.Sales 1999Sales 2000DKK 270 millionDKK 332 million(+22.7% from 1999)–24–

BUSINESS DESCRIPTIONMAIN PRODUCTSPantoloc ® /Zurcale ®Pantoprazole is a Proton Pump Inhibitor for the treatment of patients with acidrelated diseases, e.g. peptic ulcers. The product produces very fast symptomaticrelief and optimal healing rates. It offers several advantages, like very smalltablets that are easy to swallow, fast pain relief and lack of interaction with coadministereddrugs.The product is introduced in all of <strong>Nycomed</strong>’s major markets, but under the differenttrademarks Pantoloc ® , Pantozol ® and Zurcal ® / Zurcale ® . The product is copromotedwith Byk Nederland under the Pantozol ® trademark in Holland. InBelgium, Austria, Switzerland and Greece, the product is co-marketed under<strong>Nycomed</strong>'s trademark Zurcal ® / Zurcale ® . In Denmark and Sweden, the productis launched on an exclusive basis under Byk Gulden’s international brand name,Pantoloc ® .Sales 1999Sales 2000DKK 147 millionDKK 200 million(+35.9% from 1999)–25–

BUSINESS DESCRIPTIONMAIN PRODUCTSTachoComb ®TachoComb ® combines two different approaches to control bleeding and othersurgical complications. The liquid "fibrin glue" was developed in the 1980s forclinical use and when combined with the use of solid patches or fleeces made ofabsorbable biological materials, the foundation of TachoComb ® was laid.<strong>Nycomed</strong>'s exclusive know-how in combining these two principles has resulted inan easy-to-handle product for our customers. The manufacturing process itself isvery complex, and <strong>Nycomed</strong> is the only company which has launched it successfully.TachoComb ® is registered in 35 countries. The target customers ofTachoComb ® are hospital-based surgeons, gynaecologists, urologists, surgicalassistants etc.Sales 1999Sales 2000DKK 90 millionDKK 133 million(+48.8% from 1999)–26–

BUSINESS DESCRIPTIONMAIN PRODUCTS®Xefo ® is a non-steroidal anti-inflammatory drug (NSAID) with potent analgesic(pain relieving) properties. These are two different qualities that make Xefo ®appropriate for both rheuma and pain indications. Clinical studies have shownthat Xefo ® is as efficacious as morphine and other opioids in standard dosesfor post-operative pain. However, Xefo ® has a far better side effect profile thanopioids, which is a major advantage in, for example, ambulatory surgery.Xefo ® is currently marketed in Denmark, Sweden, Germany, UK, Austria,Greece, Portugal, Spain, Bulgaria, Russia, the three Baltic countries and SouthAfrica. Xefo ® will soon be marketed in Italy, Japan and possibly other markets.In addition, <strong>Nycomed</strong> has obtained a marketing authorisation for the product inmany other countries, and several companies report an interest in in-licensingXefo ® .<strong>Nycomed</strong> has followed Xefo ® from the discovery of the compound in Austria inthe 1970s and conducted many pre-clinical and clinical studies before Xefo ®was approved by the health authorities.Sales 1999Sales 2000DKK 38 millionDKK 53 million(+41.3% from 1999)–27–

BUSINESS DESCRIPTIONMAIN PRODUCTS<strong>Nycomed</strong> has recently taken over the marketing of Kestine ® in the Nordic countries,with sales of about DKK 37 million per year in the market.Kestine ® is a modern, non-sedating antihistamine pharmaceutical, used mainlyagainst allergy. Kestine ® was developed by Almirall-Prodesfarma S.A. (APF), oneof the largest pharmaceutical companies in Spain, where it was first launched in1990. Kestine ® has been marketed in the Nordic markets since 1995.<strong>Nycomed</strong> is working to have Kestine ®near future.registered with an OTC variant within the–28–

BUSINESS DESCRIPTIONMAIN PRODUCTSIn early 2001 <strong>Nycomed</strong> took over the marketing of Curosurf ® in the Nordic markets,Germany, Netherlands, Austria and Switzerland. Curosurf ® has existingannual sales in the <strong>Nycomed</strong> territory of about DKK 42 million and is the marketleader in Europe within its market segment.Curosurf ® is prescribed for prematurely born infants to prevent respiratory distress,a condition that will lead to death unless effectively treated. Curosurf ® isa lung surfactant developed by Chiesi Farmaceutici S.p.A. in Italy, where it wasfirst launched in 1992. It is sold in more than 30 countries worldwide.–29–

BUSINESS DESCRIPTIONPRODUCT ORIGINATION - BUSINESS DEVELOPMENTAND IN-LICENSING<strong>Nycomed</strong>’s strategy is to in-license products and to pursue possible objects foracquisitions. The departments for business development and in-licensing arededicated to these tasks.We have said that we need to grow in Sweden and Finland. These are hard territoriesto do business development in, as there are few players on the market andeven fewer for sale. Sometimes a merger between large companies is helpful.When companies grow bigger, they need to focus on the main markets and mainproducts, and both product and division divestments might be the result. Our inlicensingof Kestine ® for the Nordic markets was a good example of such anevent.The joint venture established by Leiras Oy (Schering AG) and <strong>Nycomed</strong> will giveus the position as number five on the Finnish market. Many functions within<strong>Nycomed</strong> were involved in the process leading to this important fulfilment of<strong>Nycomed</strong>’s strategy.Many products are investigated by <strong>Nycomed</strong>’s in-licensing department, but onlya few make it to an in-licensing contract. They must fit the overall strategy andalso the regional needs and product portfolios to be of interest. In addition to thecommercial assessment, candidate products are also evaluated from a medicaland regulatory perspective. The in-licensing function works in close co-operationwith the <strong>International</strong> Product Development department, as candidate productsmight not be ready for marketing yet. Clinical trials might still be needed, andintellectual rights, registration files etc. are thoroughly examined.–30–

BUSINESS DESCRIPTIONPRODUCT ORIGINATION - DEVELOPMENTAn important decision forum within <strong>Nycomed</strong> is the Product Council that evaluates,prioritises and decides on the product portfolio. A large part of the portfoliois, and will continue to be in-licensed products. This coincides with <strong>Nycomed</strong>'sstrategy of being a preferred business partner in the Nordic territory. Anotherimportant part of the portfolio contains products resulting from in-house development.<strong>International</strong> Product Development (IPD) comprises five functions• <strong>International</strong> Medical Affairs• <strong>International</strong> Drug Regulatory Affairs• Intellectual Property Rights• Pharmaceutical Development• Project ManagementThe total IPD staff is approximately 115 people. IPD focus on teamwork basedon strong and competent line functions and cross-functional co-operation. Allmajor development projects are organised in this way.After having been divided on four sites in Austria, Denmark and Norway, IPD wasconsolidated by September 1 st on one site, Roskilde in Denmark. This has enableda more efficient utilisation of the total, combined resource and facilitation of“the learning organisation”.The overall role and responsibility of IPD is to be customer oriented and providesufficient resources and expertise to ensure• professional evaluation of in-licensing and business development opportunitiesas well as in-house generated ideas• quality support as requested to Operations, Marketing & Sales and out-licensing• efficient management of defined international projects /product developmentactivities, including responsibilities for project leadership, clinical developmentfrom phase I and onwards, pharmaceutical development, patent strategiesand regulatory strategies• adequate support to secure regulatory compliance and maintenance of<strong>Nycomed</strong>’s products/projects–31–

BUSINESS DESCRIPTIONPRODUCT ORIGINATION - DEVELOPMENTIPD is involved in development activities for <strong>Nycomed</strong>’s prioritised products, e.g.CalciChew ® , TachoComb ® , Pantoprazole, Xefo ® and Gutron ® , and in evaluation anddevelopment of future products with commercial potential. Finally, IPD is responsiblefor some major "technical" activities such as a cross-functional electronicdocument management system project and the implementation of MedDRA – aglobal medical dictionary that in the near future will be used by the HealthAuthorities.Achievements 2000• 3 in-house generated ideas in development• 11 in-licensed products in development• 2 international products developed and launched–32–

BUSINESS DESCRIPTIONMANUFACTURING OPERATIONSThe Board decision to go ahead with the restructuring of the group's Nordicmanufacturing organisation and the initiation of the implementation phase, wereevents that profoundly occupied the Nordic manufacturing organisation in 2000.The decision to restructure was made in line with the group's strategy to adaptto the rapidly changing pharmaceutical market. Moreover, there is an increasingdemand for our largest product CalciChew ® , while some other more traditionalproduct volumes are stabilising. Together with overall price pressure, these constitutethe major driving forces behind the decision. Pursuant to the decision, theexisting manufacturing facility in Asker, Norway is being upgraded and renovatedto be a state-of-the-art streamlined calcium facility. An investment of more thanDKK 100 million has been approved, with upgrading to take place over the nextcouple of years. The Oslo plant is gradually being closed down with the productscurrently manufactured there being transferred to other <strong>Nycomed</strong> operations oroutsourced. A partner is being sought to take over the Elverum plant in Norwayand will be sought to take over the Helseholmen plant in Denmark. Restructuringwill resolve in a reduced workforce in Norway of about 200 individuals.In 2000 we also focused on the development of an operations strategy for thefuture. Our customers must be serviced with products at the right time, at theright price and of the right quality. As our customers have no interest in wherethe products are produced, we are organising manufacturing according to theseprinciples. The most difficult task will be to reduce the complexity of our presentmanufacturing structure and also to separate the production of consumer productsfrom the production of pharmaceuticals. A 10-point action programme hasbeen defined to fulfil the overall strategy.Product pruning is an ongoing activity that supports the above-mentioned actions.Based on an Activity Based Costing tool, the least profitable products orproduct families are being de-listed on the Danish and Norwegian markets andthose markets which are covered by <strong>International</strong> Sales.–33–

BUSINESS DESCRIPTIONQUALITY ASSURANCE<strong>Nycomed</strong> has always kept a strong focus on quality, compliance with relevantregulations and quality improvements. Goals and objectives to fulfil the QualityMission and Vision have been developed and form the <strong>Nycomed</strong> Quality Strategy.To support this, the Quality Planning Cycle approach was introduced late 1999.On the basis of a GXP compliance report (regulatory practices, e.g. GMP GoodManufacturing Practices), development of local and international quality plansare carried out.<strong>Nycomed</strong>'s Quality goals are to• assure regulatory compliance continuum in all regulated areas• assure awareness of and consideration for regulations, guidelines and trends• support and stress the importance of compliance through our quality guidelinesfor all our subsidiaries, distributors and agentsValidation is a constant focus and improvement area in <strong>Nycomed</strong>, including runninga validated and GXP compliant SAP R/3 system.In addition to the regular quality control procedures of the materials and products,quality is also assured through Quality Audits, with 72 audits being performedon partners and vendors during 2000. A substantial number of selfinspectionsand Corporate QA audits were conducted in addition. The number ofrecalls was seven, and none of these were of the most severe classification.–34–

ACCOUNTSCHIEF FINANCIAL OFFICER`s REPORTResult of the yearThe year 2000 was <strong>Nycomed</strong>’s first full year as an independent company.Consequently no direct comparison can be made between the results for 2000and 1999. However, proforma results for the 1999 full year have been preparedfor the <strong>Nycomed</strong> group and references to these figures are made below, in orderto help explain the development of <strong>Nycomed</strong>’s financial performance.The operating result for 2000 increased by 15.4% to DKK 293 million, comparedto 1999 on a full year basis, even though the 1999 result includes amortisationof intangible fixed assets for a seven month period only. The operating result for2000 before interest, depreciation and amortization (EBITDA) increased by23.2% to DKK 680 million when compared to the full year 1999. Additionally, theoperating result for 2000 was negatively impacted by approximately DKK 20 millioncompared to 1999 due to the sale of the Diagnostics division in February2000.To summarise, the financial results for 2000 have exceeded expectations andare very satisfactory.Net turnoverNet turnover increased by 7.6% to DKK 3,428 million. The growth in sales wasaffected by both the sale of the Diagnostics division which had a negative impactof DKK 136 million and the establishment of a separate legal entity in Germanywhich had a positive impact of approximately DKK 70 million. Excluding these twostructural changes, net turnover increased by 9.4% or approximately DKK 310million.The sales increase was spread over almost all markets in which <strong>Nycomed</strong> operatesand was mainly driven by key products such as CalciChew ® , Pantoloc ® /Zurcale ® and Tachocomb ® .–35–

ACCOUNTSCHIEF FINANCIAL OFFICER`s REPORTOperating costTotal operating cost increased by 6.9% to DKK 3,135 million. Excluding both theamortization of intangible fixed assets which were included for seven monthsonly in 1999, and the effect of the divestiture of the Diagnostics division, thecost increase was 8.8%.Cost of sales increased by only 1.4% to DKK 1,650 million, versus an increasein net turnover of 7.6%. Consequently the gross profit margin increased from49.0% to 51.9%. The main driver was tighter cost controls including the utilisationof indirect production cost being kept at the same level as 1999, despitehigher sales and one time production costs related to the restructuring of operations.Sales and marketing expenses increased by 22.7% to DKK 1,148 million.However, this amount includes the amortization of intangible fixed assets, whichwere included for seven months only in 1999. The increase in sales and marketingexpenses excluding amortization was only 15.2%, of which 6.8% were incrementalexpenses related to the new subsidiary in Germany. The remaining increaseof 8.4% is consistent with a level of expenditure required to achieve the strategicgoal of strengthening <strong>Nycomed</strong>’s position as a leading marketing company.Research and development expenses together with administration expenseswere kept at the same level as 1999.Total employee costs have increased by 7.7% to DKK 912 million while the averagenumber of employees increased by 2.9% to 2,306 during 2000. The differenceswere mainly due to the acquisition of the German subsidiary with 45 additionalemployees, the divestiture of the Diagnostics division and continuinggrowth in Eastern Europe, including CIS.Depreciation and amortization of fixed assets increased by 29.8% to DKK387million, as only seven months amortization of intangible fixed assets wereincluded in 1999. Amortization of intangible fixed assets in 2000 was DKK 249million.–36–

ACCOUNTSCHIEF FINANCIAL OFFICER`s REPORTRestructuring expensesOne of the outcomes of the project to restructure the Nordic production structurewas the decision to close down the factory in Oslo. Based on a detailed implementationplan, a restructuring cost of DKK 120 million was provided for in theprofit and loss account for 2000. The restructuring cost relates to employeecosts, building rent, fixed assets and consultant fees.Financial items and taxNet financial expenses in 2000 were DKK 231 million compared to DKK 148 millionin seven months of 1999. Recalculated on a full year basis, net financialitems were reduced by DKK 33 million from 1999 to 2000 as a consequence ofcontinuing positive cash flows during both 1999 and 2000.The debt portfolio is denominated in various currencies matching to a largeextent the overall revenue split. 60% of total debt is fixed rate debt with maturitySeptember 2002, 18% is fixed until May 2009, with the remainder being floatingrate debt.A total of DKK 196 million was repaid on long term debt in 2000 of which DKK152 million were scheduled repayments. Total scheduled repayments for 2001are DKK 137 million.<strong>Nycomed</strong> hedges 100% of all currency risk related to balance sheet items exceptequity. In addition 75 – 100% of expected 12 months rolling cash flow is hedged.The tax income for the year was DKK 14 million due to a negative result beforetax of DKK 57 million. The tax income is effected by a reduction of the Danishtax rate from 32% to 30%, effective from January 1 st 2001, which resulted in atotal positive effect on deferred tax of DKK 32 million. This is offset by the amortizationof DKK 53 million goodwill which is not deductible for tax purposes andwhich consequently has a negative impact on the effective tax rate. Excludingthese two items the tax expense would have been DKK 18 million from a negativeresult before tax of DKK 4 million. The main reason for the tax expense wereadjustments related to prior years and expenses not deductible for tax purposes.–37–

ACCOUNTSCHIEF FINANCIAL OFFICER`s REPORTCash flowDuring 2000 operating activities resulted in a positive cash flow of DKK 504 million.This amount included a onetime payment of DKK 145 million from a partnercompensating royalty payments for the years 2001 – 2005. Working capitalincreased by DKK 35 million due to the increase in net turnover.Total cash proceeds from the divestiture of the Diagnostics division were DKK229 million, which were partly used for extraordinary repayments of DKK 44 millionon loans, compared to the original repayment scheme.Investments in fixed assets were DKK 139 million of which DKK 46 million relatedto distribution agreements concerning products such as Kestine ® .New capital amounting to DKK 31 million was issued during 2000 to finance theoperation of the new German subsidiary.The total positive cash flow generated in 2000 was DKK 443 million.Expectations to result for year 2001For the year 2001, continued growth in sales of the Groups key products isexpected to continue. This and the ongoing rationalisation of the product portfolioand production structure, are expected to yield double digit growth in the operatingresult and consequently a positive net result for the year.Profit distributionThe negative result of the year of DKK 43 million is proposed to be offset againstthe share premium account included in shareholder's equity.–38–

MANAGEMENT ENDORSEMENTRoskilde 15 th February 2001Board of managementHåkan BjörklundCEORunar BjørklundCFOBoard of DirectorsToni Weitzberg Robert Andreen Lars IngelmarkChairmanFredrik Strømholm Michael A Stevens Bo SøderbergConny DitlevsenJorunn Gaarder–39–

ACCOUNTSAUDITOR`s REPORT–40–

ACCOUNTSACCOUNTING PRINCIPLESThe parent company and consolidated financial statements for 2000 have beenprepared in accordance with The Danish Company Accounts Act, the Company’sarticles of association and generally accepted Danish accounting principles appliedon a basis consistent with that of the preceding year.ConsolidationThe consolidated financial statements cover the parent company and subsidiaries,where the parent company directly or indirectly holds more than 50% of theshares or otherwise has a dominant influence.The consolidated financial statements include companies shown in the groupcompany overview on page 62 and 63.The consolidated financial statements are prepared at the basis of audited financialstatements for the parent company and the subsidiaries by adding up uniformitems and eliminating group internal items and gains. At the consolidation,the book value of investments in subsidiaries in the parent company is eliminatedagainst the shareholder's equity of the subsidiaries. The result of subsidiariesacquired during the year is included in the profit and loss statement from thedate of acquisition. Goodwill from acquisition of subsidiaries is calculated at thedate of acquisition as the difference between the purchase price of the sharesand the shareholder's equity of the acquired company, after having made fairmarket value adjustment of the individual assets and liabilities at the date ofacquisition.For consolidation purposes, the profit and loss statements of foreign subsidiariesare converted to Danish kroner using average exchange rates for the year, andassets and liabilities are converted using exchange rates at the end of the year.Exchange rate differences from conversion to Danish kroner are posted to theshareholder's equity.Profit and loss statementIncome and expenses:Income from sale is recognised in the profit and loss statement when invoiced.Full matching of income and expenses is made.–41–

ACCOUNTSACCOUNTING PRINCIPLESThe result in subsidiaries and associated companies:The result before tax in subsidiaries and associated companies includes the proportionalshare of the results before tax in the subsidiaries and associated companiesafter elimination of any internal gains and amortization of goodwill. Theproportional share of tax expenses in the subsidiaries and associated companiesis included in the item ”Income tax expenses”.Research and development expenses:Research and development expenses are taken to the profit and loss statementwhen incurred.Income tax expenses:Income tax expenses are allocated to the relevant accounting year.Deferred tax comprises all timing differences between tax and accounting depreciationand accounting provisions, which will be tax deductible in later years.Income tax expenses are calculated in accordance with current tax laws and taxrates. Deferred tax in Denmark is calculated at the basis of a tax rate of 30%.Balance sheetIntangible fixed assets:Goodwill and patent and rights are stated at cost less accumulated amortization.Amortization is made on a straight line basis over the expected useful lifetime –assessed individually – however, the maximum amortization period is 15 yearsfor goodwill and 10 years for patents and rights.Goodwill is included in investments in subsidiaries.Tangible fixed assets:Tangible fixed assets are stated at cost adding revaluations, if any, less straightline depreciation.Depreciation is calculated at the basis of the following expected useful lifetimes:- Buildings 25 - 33 years- Other tangible fixed assets 3 - 10 years–42–

ACCOUNTSACCOUNTING PRINCIPLESPurchases below DKK 10,000 are expensed in the profit and loss statement.On disposal of a tangible fixed asset the cost and related accumulated depreciationare removed from the accounts and the net amount, less any proceeds, istaken to the consolidated profit and loss account.Financial fixed assets:Investments in subsidiaries and associated companies are stated at the bookedequity of the companies less group internal gains on inventory and includingremaining excess values from acquisition.Other financial fixed assets are stated at cost less write-downs, if any.Inventory:Raw materials, purchased semi-finished products and finished products are statedat weighted average purchase prices. Manufactured finished and semi-finishedproducts are valued at cost including raw materials and semi-finished productsat cost and adding production overhead cost.Products, where the expected sales price less any remaining production cost andsales cost (net realisation value) is lower than the purchase price or cost price,are written down to the net realisation value.Goods for resale are stated at purchase price or net realisation value, if lower.Securities:Securities are stated at the lower of purchase price and market value at balancesheet date. Any unrealised losses are expensed under financial expenses.Transactions in foreign currency:Receivables and debt in foreign currency are converted to Danish kroner atexchange rates at the end of the year.Realised and unrealised exchange losses and gains are included in the profit andloss statement under financial income and expenses.Forward contracts serving as hedging of future cash flows are not recognised inthe profit and loss statement until realisation of the hedged transaction.–43–

ACCOUNTSACCOUNTING PRINCIPLESReceivables:Receivables are stated after provision for potential losses.Pension commitments:Provision for uncovered pension commitments is made on the basis of actuariallycalculated statements and the cost charged to the consolidated profit andloss account.Cash flow statement of the groupThe cash flow statement shows the cash flow of the group for the year and thenet cash position by the end of the year. The cash flow is divided into threeparts: operating activities, investments and financing.The cash flow statement is presented on the basis of result before tax.Net cash comprises cash, short-term securities and short-term bank debt.Cash flow from operating activities is calculated as result before tax adjustedfor non-cash items, minus an increase of or plus a decrease of working capitalless paid taxes.Working capital comprises current assets, excluding items included in net cash,and current liabilities, excluding items included in net cash, and mortgage debt,taxes and dividend.Cash flow from investments comprises purchase and sale of fixed assets includinginvestments in companies. The purchase prices are stated at acquisitionvalue including rights and goodwill.Cash flow from financing comprises payments to and from shareholders, raisingand repayment of mortgage debt and other long-term debt and current liabilities,which are not included in working capital or net cash.–44–

ACCOUNTSCONSOLIDATED PROFIT AND LOSS STATEMENTNote 2000 1998/99(000)DKK(000)DKK7 months1 Net turnover 3,428,631 1,901,8402+3 Cost of sales - 1,650,122 - 994,384GROSS PROFIT 1,778,509 907,4562+3 Sales and marketing expenses - 1,148,326 - 606,5762+3 Research and development expenses - 58,465 - 39,9492+3 Administration expenses - 294,484 - 173,601Other operating income 15,919 6,259OPERATING RESULT 293,153 93,589Restructuring expenses - 119,519 0RESULT BEFORE FINANCIAL ITEMS AND TAX 173,634 93,589Financial income 36,716 62,557Financial expenses - 267,828 - 210,776RESULT BEFORE TAX - 57,478 -54,6304 Income tax expenses 14,268 - 2,439NET RESULT - 43,210 -57,069–45–

ACCOUNTSCONSOLIDATED BALANCE SHEETNote ASSETS31.12.00 31.12.99(000)DKK(000)DKKGoodwill 658,537 860,393Patents and rights 1,458,537 1,623,1765 Total intangible fixed assets 2,117,074 2,483,569Land and buildings 537,391 601,853Machinery and equipment 238,156 287,077Other tangible fixed assets 156,567 160,621Leasehold improvements 3,495 4,113Assets under construction 12,165 11,4216 Total tangible fixed assets 947,774 1,065,085Investments in associated companies 0 6,648Other investments in shares 1,231 11,302Other receivables 13,832 2,1337 Total financial fixed assets 15,063 20,083TOTAL FIXED ASSETS 3,079,911 3,568,737Finished goods and goods for resale 432,815 479,926Raw materials and semi-finished goods 238,396 249,565Prepayments for goods 19,754 3,496Total inventory 690,965 732,987Trade receivables 543,356 533,0204 Income tax receivables 0 23,270Other receivables 135,406 130,9108 Prepayments and accrued income 30,239 34,616Total receivables 709,001 721,816Securities 17,292 18,247Cash 759,072 340,789TOTAL CURRENT ASSETS 2,176,330 1,813,839TOTAL ASSETS 5,256,241 5,382,576–46–

ACCOUNTSCONSOLIDATED BALANCE SHEETNote LIABILITIES 31.12.00 31.12.99(000)DKK(000)DKKShare capital 10,010 10,000Share premium 675,427 745,680Retained earnings 0 09 TOTAL SHAREHOLDER´S EQUITY 685,437 755,680Pension commitments 86,396 82,6164 Deferred tax 481,583 595,116Other provisions 110,186 1,794TOTAL PROVISIONS FOR LIABILITIES ANDCHARGES 678,165 679,526Financial institutions 2,320,740 2,567,361Mortgage debt 5,424 8,217Other long term debt 562,982 500,22610 Total long term debt 2,889,146 3,075,80410 Repayment of long term debt 136,912 156,452Financial institutions 51,351 76,912Trade payables 256,154 270,2494 Income tax payables 57,867 0Other debt 355,977 367,95311 Deferred income 145,232 0Total current liabilities 1,003,493 871,566TOTAL LIABILITIES 3,892,639 3,947,370TOTAL SHAREHOLDERS’ EQUITY ANDLIABILITIES 5,256,241 5,382,57612 Contingent liabilities, guarantee commitments etc.13 Foreign currency and interest rate risks–47–

ACCOUNTSCONSOLIDATED ACCOUNTS NOTES1. Net turnover.2000 1998/99(000)DKK(000)DKK7 monthsNet turnover of the group can be allocated as follows:Denmark 529,427 303,673Europe 2,316,447 1,369,429Overseas 582,757 228,738Total 3,428,631 1,901,8402. Employee relationsSalaries and wages etc. are included in the totalexpenses of the group with the following amounts:Employee salaries and wages 746,492 418,779Pension expenses 47,617 27,482Other expenses for social security 118,296 64,156Total 912,405 510,417Which includes compensation to managementand Board of Directors of the parent company:Management 5,280 1,488Board of Directors 0 0Total 5,280 1,488Average number of employees 2,306 2,2403. Depreciation of fixed assetsThe depreciation of fixed assets is included in the totalexpenses of the group with the following amounts:Cost of sales 82,132 62,037Sales and marketing expenses 258,971 152,648Research and development expenses 3,232 2,652Administration expenses 42,183 14,838Total 386,518 232,175–48–

ACCOUNTSCONSOLIDATED ACCOUNTS NOTES4. Income tax expenses2000 1998/99(000)DKK(000)DKK7 monthsAccrued income tax for the year - 104,344 7,289Adjustment of deferred tax for the year 90,059 - 9,328Adjustment opening balance (accrued tax) - 7,199 34,926Adjustment opening balance (deferred tax) 3,288 - 35,326Adjustment of deferred tax due to change ofDanish tax rate from 32% to 30% 32,464 0Total 14,268 - 2,439Accrued income tax / income tax receivable:Accrued beginning of year - 23,270 0Accrued income tax in acquired subsidiaries 0 53,851Foreign currency conversion effect 417 - 2,177Paid income taxes during the year - 30,823 - 32,729Adjustment opening balance 7,199 - 34,926Accrued income tax for the year 104,344 - 7,289Accrued 31. December 57,867 - 23,270Deferred tax:Provision beginning of year 595,116 0Adjustment related to deferred tax inacquired subsidiaries in 1999 10,197 0Deferred tax in acquired subsidiaries 0 547,326Foreign currency conversion effect 2,081 3,136Adjustment opening balance - 3,288 35,326Adjustment for the year - 90,059 9,328Adjustment of deferred tax due to changeof Danish tax rate from 32% to 30% - 32,464 0Provision 31. December 481,583 595,116Deferred tax relates to patent and rights, buildings,other fixed assets, inventory and provisions.–49–

ACCOUNTSCONSOLIDATED ACCOUNTS NOTES5. Intangible fixed assetsGoodwillPatentsandrightsCost beginning of year 895,207 2,044,340Adjustment related to acquisition ofsubsidiaries in 1999 - 149,171 0Foreign currency conversion effect 0 - 3,764Additions in the year 0 31,389Retirements in the year 0 - 8,576Transfers 0 75Cost 31.12.00 746,036 2,063,464Depreciation beginning of year 34,814 421,164Additions from acquisition of subsidiaries 0 0Foreign currency conversion effect 0 - 3,627Depreciation for the year 52,685 195,893Retirements in the year 0 - 8,503Depreciation 31.12.00 87,499 604,927Book value 31.12.00 658,537 1,458,5376. Tangible fixed assetsLand Machinery Other Leasehold Assetsand and tang. Improve- underbuildings equipment assets ments construct.Cost beginning of year 871,258 855,392 351,506 17,865 11,421Foreign currencyconversion effect - 4,264 - 4,346 - 2,947 0 - 67Additions in the year 9,296 17,589 55,825 421 9,374Retirements in the year - 47,633 - 59,503 - 40,318 - 1,085 0Transfers 317 5,729 2,313 129 - 8,563Cost 31.12.00 828,974 814,861 366,379 17,330 12,165Depreciationbeginning of year 269,405 568,315 190,885 13,752 0Foreign currencyconversion effect - 482 - 2,698 - 717 0 0Depreciation for the year 29,746 52,816 54,210 1,168 0Retirements in the year - 7,086 - 41,728 - 34,566 - 1,085 0Depreciation 31.12.00 291,583 576,705 209,812 13,835 0Book value 31.12.00 537,391 238,156 156,567 3,495 12,165Total official assessment of Danish property with a book value of DKK 223,400 thousand isDKK 211,000 thousand at the annual assessment made at 1. January 2000.–50–

ACCOUNTSCONSOLIDATED ACCOUNTS NOTES7. Financial fixed assetsInvestments Other Otherin associated investments receicompaniesin shares vablesCost beginning of year 6,648 11,302 2,133Additions from acquisition of subsidiaries 0 - 9,681 0Foreign currency conversion effect 0 - 390 0Additions in the year 0 0 11,699Retirements in the year - 6,648 0 0Cost 31.12.00 0 1,231 13,832Value adjustment beginning of year 0 0 0Result before tax 0 0 0Foreign currency conversion effect 0 0 0Value adjustment 31.12.00 0 0 0Book value 31.12.00 0 1,231 13,8328. Prepayments and accrued income2000 1998/99(000)DKK(000)DKKThis item includes unrealised foreign currency losseson loans in foreign currency which serves as hedgingof future cash flow in foreign currency 28,423 32,4699. Shareholder’s equityShareholder’s equity at founding of company 755,680 500Capital increase 31,102 813,544Adjustment of goodwill - 30,279 0Currency effect from conversion of foreignsubsidiaries - 27,856 - 1,295Net result - 43,210 - 57,069Shareholder’s equity 31. December 685,437 755,68010. Long term debtTotal long term debt due more than 5 years after thebalance sheet date 1,691,825 2,037,78311. Deferred incomePayment from partner compensating royalty paymentsfor the years 2001 - 2005 145,232 0–51–

ACCOUNTSCONSOLIDATED ACCOUNTS NOTES2000 1998/99(000)DKK(000)DKK12. Contingent liabilities, guaranteecommitments etc.Total rental and lease commitments of the group are 150,000 109,000Rental and lease contracts are irredeemable of upto 5 years.Guarantee commitments are 10,000 10,000GUARANTEES, PLEDGES AND SECURITIESCONCERNING LONG TERM DEBT TOFINANCIAL INSTITUTIONSTotal debt to financial institutions covered bythe guarantees etc. 2,454,528 2,717,229The following group companies have fully or partlyguaranteed, jointly and severally, for payment of thestated debt to financial institutions<strong>Nycomed</strong> Holding A/S<strong>Nycomed</strong> Danmark A/S<strong>Nycomed</strong> Pharma Holding AS<strong>Nycomed</strong> Pharma AS<strong>Nycomed</strong> Austria <strong>GmbH</strong><strong>Nycomed</strong> Christiaens BV<strong>Nycomed</strong> Christiaens SAShares in the following subsidiaries have been pledged<strong>Nycomed</strong> Danmark A/S<strong>Nycomed</strong> Pharma Holding AS<strong>Nycomed</strong> Pharma AS<strong>Nycomed</strong> Austria <strong>GmbH</strong><strong>Nycomed</strong> Christiaens BV<strong>Nycomed</strong> Christiaens SAPledge of tangible fixed assetsLand and buildings in Denmark – max. pledgeDKK 80,000 thousand 223,400 232,237Land and buildings and associated machineryetc. in Norway – max. pledge 2,000,000 tNOK 288,401 369,984Total book value of pledged tangible fixed assets 511,801 602,218Securities etc. given in current assetInventory in Norway – max. pledge 1,000,000 tNOK 159,716 219,009Receivables in Norway – no max. limit 175,451 157,743Deposits on specific bank accounts in<strong>Nycomed</strong> Holding AS and<strong>Nycomed</strong> Pharma Holding AS – no max. limit 65,024 119,266Total book value of securities etc. givenin current assets 400,191 496,018–52–

ACCOUNTSCONSOLIDATED ACCOUNTS NOTES13. Foreign currency and interest rate risksThe NYCOMED group has a policy to hedge fluctuationsin exchange rates and interest rates. As part of thestrategy foreign currency is purchased and sold viaforward contracts and swap contracts are entered intoin order to replace loans with floating interest rateswith loans with fixed interest rates. Forward contractsin foreign currency are entered into to hedge receivablesand debt as well as cash flows in foreign currency.Bank loans raised in connection with the establishmentof the group have partly been converted to foreigncurrency in order to serve as a hedge of future cashflows in foreign currency. 2000 1998/99FORWARD CONTRACTS IN FOREIGNCURENCY 31. DECEMBER VALUED IN DKK(000)DKK(000)DKKPurchase of foreign currencyEUR 603,812 0NOK 89,619 97,014USD 40,104 98,369CHF 16,711 0Total purchase of foreign currency 750,246 195,383Sale of foreign currencyUSD 207,737 0EUR 85,828 129,111JPY 34,900 7,224SEK 21,972 33,063GRD 6,164 29,642CHF 0 11,595Total sale of foreign currency 356,601 210,635Exchange rate adjustment of forward contracts servingas hedge of future cash flow in foreign currency, whichis not included in the profit and loss statement(gain/loss) 7,594 - 6,934LONG TERM BANK LOANS IN FOREIGNCURRENCY 31. DECEMBER VALUED IN DKKEUR 912,494 1,088,264NOK 385,034 412,747JPY 354,232 386,664SEK 225,603 244,975USD 145,392 140,676CHF 136,620 136,395Total long term bank loans in foreign currency 2,159,375 2,409,721Exchange rate adjustment of bank loans serving ashedge of future cash flow in foreign currency includedin prepayments, ref. note 8 (loss) - 28,423 - 32,469–53–

ACCOUNTSPARENT COMPANY PROFIT AND LOSS STATEMENTNote 2000 1998/99(000)DKK(000)DKK7 monthsGROSS PROFIT 0 01 Administration expenses - 15,987 - 6,537OPERATING PROFIT - 15,987 - 6,5374 Share of result before tax in subsidiaries 5,032 - 19,0682 Financial income 2,443 2,3972 Financial expenses - 48,966 - 31,422RESULT BEFORE TAX - 57,478 - 54,6303 Income tax expenses 14,268 - 2,439NET RESULT - 43,210 - 57,069–54–

ACCOUNTSPARENT COMPANY BALANCE SHEETNoteASSETS31.12.00 31.12.99(000)DKK(000)DKKInvestments in subsidiaries 1,288,711 1,326,0824 Financial fixed assets 1,288,711 1,326,082TOTAL FIXED ASSETS 1,288,711 1,326,0825 Receivables from affiliated entities 8,542 78,8806 Other receivables 8,636 46,555Prepayments and accrued income 0 421Total receivables 17,178 125,856Cash 30,298 21,040TOTAL CURRENT ASSETS 47,476 146,896TOTAL ASSETS 1,336,187 1,472,978–55–

ACCOUNTSPARENT COMPANY BALANCE SHEETNoteLIABILITIES31.12.00 31.12.99(000)DKK(000)DKKShare capital 10,010 10,000Share premium 675,427 744,680Retained earnings 0 07 TOTAL SHAREHOLDER’S EQUITY 685,437 755,680Financial institutions 0 27,291Other long term debt 562,982 500,2268 Total long term debt 562,982 527,5178 Repayment of long term debt 0 150,103Trade payables 307 9,1369 Payables to affiliated entities 73,923 010 Other debt 13,538 30,542Total current liabilities 87,768 189,781TOTAL LIABILITIES 650,750 717,298TOTAL SHAREHOLDER’S EQUITY AND LIABILITIES 1,336,187 1,472,97811 Contingent liabilities, guarantee commitments etc.12 Auditor’s remuneration–56–

ACCOUNTSPARENT COMPANY ACCOUNTS NOTES1. Employee relations2000 1998/99(000)DKK(000)DKK7 monthsSalaries and wages etc. are included in the totalexpenses of the group with the following amounts:Employee salaries and wages 5,278 575Pension 0 0Other expenses for social security 2 0Total 5,280 575Which includes compensation to managementand Board of Directors of the parent company:Management 5,280 575Board of Directors 0 0Total 5,280 575Average number of employees 1 12. Financial itemsFinancial incomeInterest income, banks 127 932Interest income, affiliated entities 2,316 0Foreign exchange gain 0 1,465Total 2,443 2,397Financial expensesInterest expenses, banks 3,992 6,096Interest expenses, affiliated entities 533 0Interest expenses, other long term debt 43,109 25,326Foreign exchange loss 1,332 0Total 48,966 31,4223. Income tax expensesParent company:Accrued income tax expenses for the year 0 0Adjustment of deferred tax for the year 0 00 0Subsidiaries:Income tax expenses for the year 14,268 - 2,43914,268 - 2,439Income tax expenses 14,268 - 2,439The parent company has not paid any income taxesduring the year.–57–

ACCOUNTSPARENT COMPANY ACCOUNTS NOTES4. Investments in subsidiaries2000 1998/99(000)DKK(000)DKK7 monthsCosts beginning of year 1,348,884 0Additions in the year 1,464 1,348,884Retirements in the year 0 0Costs 31. December 1,350,348 1,348,884Value adjustments beginning of year - 22,802 0Adjustment of goodwill - 30,279 0Foreign currency conversion effect - 27,856 - 1,295Result before tax 5,032 - 19,068Income tax expenses 14,268 - 2,439Dividend for the year 0 0Value adjustment 31. December - 61,637 - 22,802Book value 31. December 1,288,711 1,326,082Company Domicile Share of equity<strong>Nycomed</strong> Danmark A/S Roskilde, Denmark 100 %5. Receivables from affiliated entities<strong>Nycomed</strong> Danmark A/S, Danmark 8,542 13,979<strong>Nycomed</strong> Pharma AS, Norge 0 64,901Total 8,542 78,8806. Other receivablesReceivable from <strong>Nycomed</strong> Amersham plc. inconnection with adjustment of purchase pricefor shares in <strong>Nycomed</strong> Danmark A/S 8,636 46,555–58–

ACCOUNTSPARENT COMPANY ACCOUNTS NOTES7. Shareholder’s equity2000 1998/99(000)DKK(000)DKK7 monthsShare capitalShare capital beginning of the year 10,000 500Capital increase 10 9,50010,010 10,000Share premiumShare premium beginning of the year 745,680 0Share premium from capital increase in the year 31,092 804,044Transferred from retained earnings - 101,345 - 58,364675,427 745,680Retained earningsRetained earnings beginning of the year 0 0Adjustment of goodwill -30,279 0Foreign currency conversion effect foreign subsidiaries - 27,856 - 1,295Transferred from profit distribution - 43,210 -57,069Transferred to share premium 101,345 58,3640 0Total shareholder’s equity 685,437 755,680The share capital comprises 1,001,001 sharesof DKK 108. Long term debtFinancial institutions 0 177,394Other long term debt 562,982 500,226Total debt 562,982 677,620Repayment in 2001 0 150,103Long term debt 562,982 527,517Total long term debt due more than 5 years after thebalance sheet date 562,982 500,2269. Payables to affiliated entities<strong>Nycomed</strong> Amersham plc, England 71,973 0<strong>Nycomed</strong> Pharma Holding AS, Norway 1,669 0<strong>Nycomed</strong> Danmark A/S 281 0Total 73,923 0–59–

ACCOUNTSPARENT COMPANY ACCOUNTS NOTES2000 1998/99(000)DKK(000)DKK10. Other debtPayments related to warrant arrangement formanagement team members in group companies 7,241 4,129Accrued employee taxes, VAT etc. - 7 185Holiday allowances 521 72Accrued interest 5,783 26,156Total 13,538 30,54211. Contingent liabilities, guarenteecommitments etc.GUARANTEES, PLEDGES AND SECURITIESCONCERNING LONG TERM DEBT TOFINANCIAL INSTITUTIONSTotal debt to financial institutions covered by theguarantees etc. 2,454,528 2,717,229<strong>Nycomed</strong> Holding A/S have guaranteed, jointly andseverally, for payment of the stated debt to financialinstitutions.Shares in the following subsidiaries have beenpledged<strong>Nycomed</strong> Danmark A/S<strong>Nycomed</strong> Pharma Holding AS<strong>Nycomed</strong> Pharma AS<strong>Nycomed</strong> Austria <strong>GmbH</strong><strong>Nycomed</strong> Christiaens BV<strong>Nycomed</strong> Christiaens SA<strong>Nycomed</strong> Holding A/S have given security in depositon specific bank account with book value of 0 012. Auditors’ remunerationRemuneration to auditors of the parentcompany:Audit 63 50Other services 51 77Total 114 127–60–

ACCOUNTSCASHFLOW STATEMENT2000 1998/99(000)DKK(000)DKKCash flow from operating activitiesResult before tax - 57,478 - 54,630Depreciation, provisions and foreign exchangedifferences etc. 481,586 230,684Total 424,108 176,054Change in inventory and receivables - 13,345 14,341Change in payables and other debt 123,851 131,233Paid income taxes - 30,823 - 31,729Total cash flow from operating activities 503,791 288,899* Proceeds from sale of business activities 249,136 0Cash flow from investments:Investments in fixed assets:Intangible fixed assets - 46,322 - 1,117Tangible fixed assets - 80,967 - 46,064Financial fixed assets - 11,699 - 42Total cash flow from investments - 138,988 - 47,223Cash flow from financing:Shareholder´s financing:Proceeds from issuance of share capital 31,102 0External financing:Change in mortgage debt - 6,307 - 8,014Change in long term bank debt - 195,845 - 121Total cash flow from financing - 171,050 - 8,135Cash flow for the year 442,889 233,541Net cash beginning of the year 282,124 48,583Net cash 31. December 725,013 282,124Net cash 31. DecemberCash 759,072 340,789Securities 17,292 18,247Short term bank debt - 51,351 - 76,912Total 725,013 282,124* Proceeds from sale of business activitiesIntangible fixed assets 161,393 0Tangible fixed assets 52,611 0Inventory 35,132 0Total 249,136 0–61–

ACCOUNTSOVERVIEW OF SUBSIDIARIESParent companyNominalShare capitalShareof equityNYCOMED HOLDING A/S, Roskilde, Denmark DKK 10.0 million -Subsidiaries<strong>Nycomed</strong> Danmark A/S, Roskilde, Denmark DKK 800.0 million 100 %SubsidiariesNettopharma, Roskilde, Denmark DKK 9.3 million 100 %<strong>Nycomed</strong> Consumer A/S, Roskilde, Denmark DKK 4.0 million 100 %<strong>Nycomed</strong> Pharma <strong>GmbH</strong>, Germany EUR 0.5 million 100 %<strong>Nycomed</strong> Christiaens B.V., Holland NLG 29.656 million 100 %SubsidiariesChristiaens B.V., Holland NLG 0.040 million 100 %APIC B.V., Holland NLG 0.035 million 100 %Sandipro B.V., Holland NLG 0.100 million 100 %Christiaens <strong>GmbH</strong>., Germany DEM 0.050 million 100 %Christiaens Pharma N.V., Belgium BEF 1.250 million 100 %Silochemie B.V., Holland NLG 0.040 million 100 %Sandipro N.V., Belgium BEF 1.250 million 100 %Centrapharm N.V., Belgium BEF 11.000 million 100 %Exel Pharma N.V., Belgium BEF 1.250 million 100 %DEP B.V.B.A., Belgium BEF 0.75 million 100 %<strong>Nycomed</strong> Christiaens N.V., Belgium BEF 225 million 100 %Subsidiaries<strong>Nycomed</strong> Austria <strong>GmbH</strong>, Austria ATS 131.0 million 100 %Subsidiaries<strong>Nycomed</strong> AG, Switzerland CHF 0.5 million 100 %<strong>Nycomed</strong> Hellas SA, Greece GRD 50.0 million 100 %<strong>Nycomed</strong> East EuropeMarketing Service G.m.b.H., Austria ATS 0.5 million 100 %<strong>Nycomed</strong> Hungaria KFT, Hungaria HUF 1.0 million 100 %Chemisch Pharmazeutische Forschungs<strong>GmbH</strong>., Austria ATS 0.5 million 100 %<strong>Nycomed</strong> Spol S.R.O., Czeck CZK 0.1 million 100 %* Linz Roberts Inc./USA. USD 0.005 million 50 %<strong>Nycomed</strong> A/O Moskau, Russia RUR 50.0 million 100 %Dynapharm <strong>GmbH</strong>., Austria ATS 0.5 million 100 %<strong>Nycomed</strong> Distribution Center T.O.O.,Moscow USD 0.04 million 100 %<strong>Nycomed</strong> Bratislava, Slovakia CZK 0.1 million 100 %* <strong>Nycomed</strong> Siberia RUR 24.0 million 80 %* The companies have been excluded from consolidation, ref. Danish CompanyAccounts Act § 2b, as they are of immaterial importance for a true and fair viewof the consolidated accounts.–62–

ACCOUNTSOVERVIEW OF SUBSIDIARIESNominalShare capitalShareof equity<strong>Nycomed</strong> Pharma Holding AS, Norway NOK 92.0 million 100 %Subsidiaries<strong>Nycomed</strong> Pharma AS, Norway NOK 38.4 million 100 %Subsidiaries<strong>Nycomed</strong> AB, Sweden SEK 2.0 million 100 %<strong>Nycomed</strong> BV, Holland NLG 0.050 million 100 %<strong>Nycomed</strong> SEFA A/S, Estonia EEK 2.2 million 100 %<strong>Nycomed</strong> Eesti A/S, Estonia EEK 0.875 million 100 %OY <strong>Nycomed</strong> AB, Finland FIM 0.3 million 100 %–63–