â rsrapport Nycomed - Takeda Pharmaceuticals International GmbH

â rsrapport Nycomed - Takeda Pharmaceuticals International GmbH

â rsrapport Nycomed - Takeda Pharmaceuticals International GmbH

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

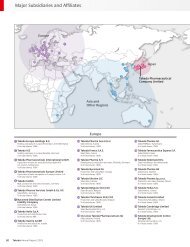

ACCOUNTSACCOUNTING PRINCIPLESThe parent company and consolidated financial statements for 2000 have beenprepared in accordance with The Danish Company Accounts Act, the Company’sarticles of association and generally accepted Danish accounting principles appliedon a basis consistent with that of the preceding year.ConsolidationThe consolidated financial statements cover the parent company and subsidiaries,where the parent company directly or indirectly holds more than 50% of theshares or otherwise has a dominant influence.The consolidated financial statements include companies shown in the groupcompany overview on page 62 and 63.The consolidated financial statements are prepared at the basis of audited financialstatements for the parent company and the subsidiaries by adding up uniformitems and eliminating group internal items and gains. At the consolidation,the book value of investments in subsidiaries in the parent company is eliminatedagainst the shareholder's equity of the subsidiaries. The result of subsidiariesacquired during the year is included in the profit and loss statement from thedate of acquisition. Goodwill from acquisition of subsidiaries is calculated at thedate of acquisition as the difference between the purchase price of the sharesand the shareholder's equity of the acquired company, after having made fairmarket value adjustment of the individual assets and liabilities at the date ofacquisition.For consolidation purposes, the profit and loss statements of foreign subsidiariesare converted to Danish kroner using average exchange rates for the year, andassets and liabilities are converted using exchange rates at the end of the year.Exchange rate differences from conversion to Danish kroner are posted to theshareholder's equity.Profit and loss statementIncome and expenses:Income from sale is recognised in the profit and loss statement when invoiced.Full matching of income and expenses is made.–41–