PDF Download - Deutsche Bahn AG

PDF Download - Deutsche Bahn AG

PDF Download - Deutsche Bahn AG

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

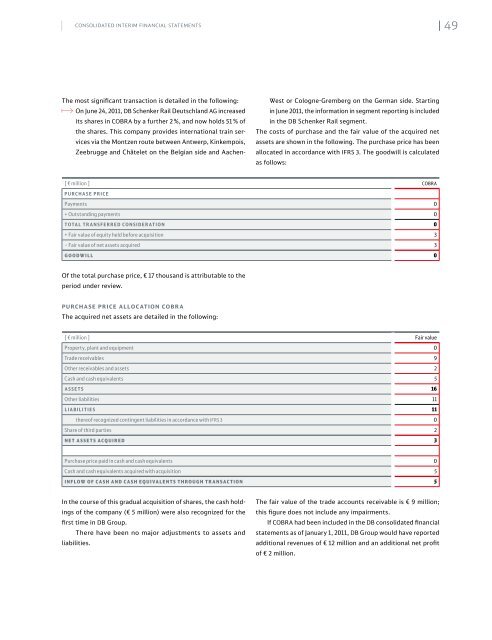

| | Consolidated Interim Financial Statements49The most significant transaction is detailed in the following:aaOn June 24, 2011, DB Schenker Rail Deutschland <strong>AG</strong> increasedits shares in COBRA by a further 2 %, and now holds 51 % ofthe shares. This company provides international train servicesvia the Montzen route between Antwerp, Kinkempois,Zeebrugge and Châtelet on the Belgian side and Aachen-West or Cologne-Gremberg on the German side. Startingin June 2011, the information in segment reporting is includedin the DB Schenker Rail segment.The costs of purchase and the fair value of the acquired netassets are shown in the following. The purchase price has beenallocated in accordance with IFRS 3. The goodwill is calculatedas follows:[ € million ] COBRApurchase pricePayments 0+ Outstanding payments 0Total transferred consideration 0+ Fair value of equity held before acquisition 3– Fair value of net assets acquired 3goodwill 0Of the total purchase price, € 17 thousand is attributable to theperiod under review.PURCHASE PRICE ALLOCATION COBRAThe acquired net assets are detailed in the following:[ € million ] Fair valueProperty, plant and equipment 0Trade receivables 9Other receivables and assets 2Cash and cash equivalents 5assets 16Other liabilities 11liabilities 11thereof recognized contingent liabilities in accordance with IFRS 3 0Share of third parties 2net assets acquired 3Purchase price paid in cash and cash equivalents 0Cash and cash equivalents acquired with acquisition 5inflow of cash and cash equivalents through transaction 5In the course of this gradual acquisition of shares, the cash holdingsof the company (€ 5 million) were also recognized for thefirst time in DB Group.There have been no major adjustments to assets andliabilities.The fair value of the trade accounts receivable is € 9 million;this figure does not include any impairments.If COBRA had been included in the DB consolidated financialstatements as of January 1, 2011, DB Group would have reportedadditional revenues of € 12 million and an additional net profitof € 2 million.