something to smile about? - Euromoney Institutional Investor PLC

something to smile about? - Euromoney Institutional Investor PLC

something to smile about? - Euromoney Institutional Investor PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

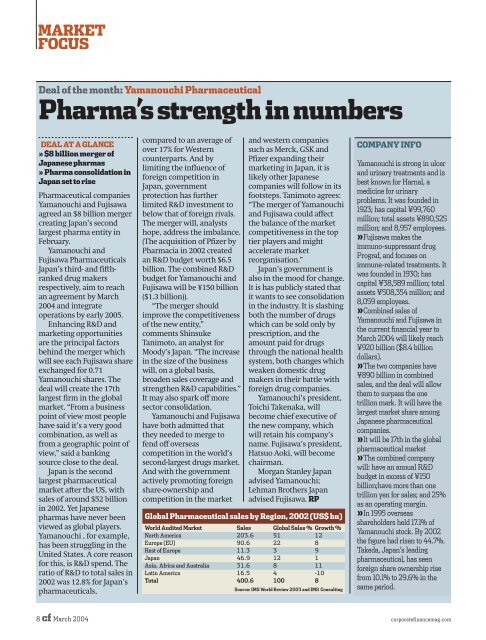

MARKETFOCUSDeal of the month: Yamanouchi PharmaceuticalPharma’s strength in numbersDEAL AT A GLANCE» $8 billion merger ofJapanese pharmas» Pharma consolidation inJapan set <strong>to</strong> risePharmaceutical companiesYamanouchi and Fujisawaagreed an $8 billion mergercreating Japan’s secondlargest pharma entity inFebruary.Yamanouchi andFujisawa PharmaceuticalsJapan’s third- and fifthrankeddrug makersrespectively, aim <strong>to</strong> reachan agreement by March2004 and integrateoperations by early 2005.Enhancing R&D andmarketing opportunitiesare the principal fac<strong>to</strong>rsbehind the merger whichwill see each Fujisawa shareexchanged for 0.71Yamanouchi shares. Thedeal will create the 17thlargest firm in the globalmarket. “From a businesspoint of view most peoplehave said it’s a very goodcombination, as well asfrom a geographic point ofview,” said a bankingsource close <strong>to</strong> the deal.Japan is the secondlargest pharmaceuticalmarket after the US, withsales of around $52 billionin 2002. Yet Japanesepharmas have never beenviewed as global players.Yamanouchi , for example,has been struggling in theUnited States. A core reasonfor this, is R&D spend. Theratio of R&D <strong>to</strong> <strong>to</strong>tal sales in2002 was 12.8% for Japan’spharmaceuticals,compared <strong>to</strong> an average ofover 17% for Westerncounterparts. And bylimiting the influence offoreign competition inJapan, governmentprotection has furtherlimited R&D investment <strong>to</strong>below that of foreign rivals.The merger will, analystshope, address the imbalance.(The acquisition of Pfizer byPharmacia in 2002 createdan R&D budget worth $6.5billion. The combined R&Dbudget for Yamanouchi andFujisawa will be ¥150 billion($1.3 billion)).“The merger shouldimprove the competitivenessof the new entity,”comments ShinsukeTanimo<strong>to</strong>, an analyst forMoody’s Japan. “The increasein the size of the businesswill, on a global basis,broaden sales coverage andstrengthen R&D capabilities.”It may also spark off moresec<strong>to</strong>r consolidation.Yamanouchi and Fujisawahave both admitted thatthey needed <strong>to</strong> merge <strong>to</strong>fend off overseascompetition in the world’ssecond-largest drugs market.And with the governmentactively promoting foreignshare-ownership andcompetition in the marketand western companiessuch as Merck, GSK andPfizer expanding theirmarketing in Japan, it islikely other Japanesecompanies will follow in itsfootsteps. Tanimo<strong>to</strong> agrees:“The merger of Yamanouchiand Fujisawa could affectthe balance of the marketcompetitiveness in the <strong>to</strong>ptier players and mightaccelerate marketreorganisation.”Japan’s government isalso in the mood for change.It is has publicly stated thatit wants <strong>to</strong> see consolidationin the industry. It is slashingboth the number of drugswhich can be sold only byprescription, and theamount paid for drugsthrough the national healthsystem, both changes whichweaken domestic drugmakers in their battle withforeign drug companies.Yamanouchi’s president,Toichi Takenaka, willbecome chief executive ofthe new company, whichwill retain his company’sname. Fujisawa’s president,Hatsuo Aoki, will becomechairman.Morgan Stanley Japanadvised Yamanouchi;Lehman Brothers Japanadvised Fujisawa. RPGlobal Pharmaceutical sales by Region, 2002 (US$ bn)World Audited Market Sales Global Sales % Growth %North America 203.6 51 12Europe (EU) 90.6 22 8Rest of Europe 11.3 3 9Japan 46.9 12 1Asia, Africa and Australia 31.6 8 11Latin America 16.5 4 -10Total 400.6 100 8Source: IMS World Review 2003 and IMS ConsultingCOMPANY INFOYamanouchi is strong in ulcerand urinary treatments and isbest known for Harnal, amedicine for urinaryproblems. It was founded in1923; has capital ¥99,760million; <strong>to</strong>tal assets ¥890,525million; and 8,957 employees.»Fujisawa makes theimmuno-suppressant drugPrograf, and focuses onimmune-related treatments. Itwas founded in 1930; hascapital ¥38,589 million; <strong>to</strong>talassets ¥508,354 million; and8,059 employees.»Combined sales ofYamanouchi and Fujisawa inthe current financial year <strong>to</strong>March 2004 will likely reach¥920 billion ($8.4 billiondollars).»The two companies have¥890 billion in combinedsales, and the deal will allowthem <strong>to</strong> surpass the onetrillion mark. It will have thelargest market share amongJapanese pharmaceuticalcompanies.»It will be 17th in the globalpharmaceutical market»The combined companywill: have an annual R&Dbudget in excess of ¥150billion;have more than onetrillion yen for sales; and 25%as an operating margin.»In 1995 overseasshareholders held 17.1% ofYamanouchi s<strong>to</strong>ck. By 2002the figure had risen <strong>to</strong> 44.7%.Takeda, Japan’s leadingpharmaceutical, has seenforeign share ownership risefrom 10.1% <strong>to</strong> 29.6% in thesame period.8 cf March 2004 corporatefinancemag.com