Unique Hotel & Resorts Limited - Dhaka Stock Exchange

Unique Hotel & Resorts Limited - Dhaka Stock Exchange

Unique Hotel & Resorts Limited - Dhaka Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

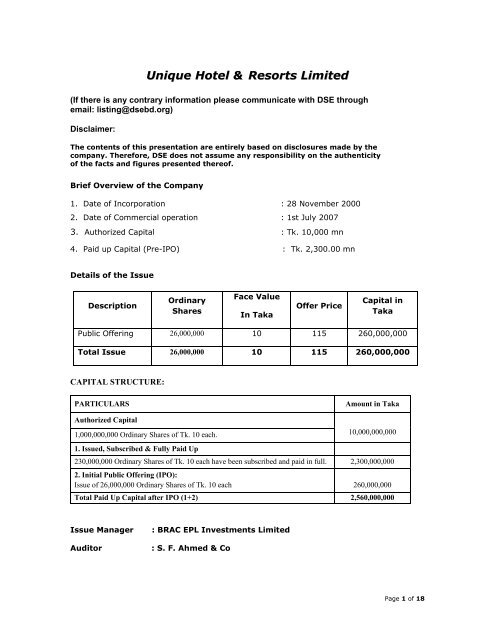

<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong>(If there is any contrary information please communicate with DSE throughemail: listing@dsebd.org)Disclaimer:The contents of this presentation are entirely based on disclosures made by thecompany. Therefore, DSE does not assume any responsibility on the authenticityof the facts and figures presented thereof.Brief Overview of the Company1. Date of Incorporation : 28 November 20002. Date of Commercial operation : 1st July 20073. Authorized Capital : Tk. 10,000 mn4. Paid up Capital (Pre-IPO) : Tk. 2,300.00 mnDetails of the IssueDescriptionOrdinarySharesFace ValueIn TakaOffer PriceCapital inTakaPublic Offering 26,000,000 10 115 260,000,000Total Issue 26,000,000 10 115 260,000,000CAPITAL STRUCTURE:PARTICULARSAmount in TakaAuthorized Capital1,000,000,000 Ordinary Shares of Tk. 10 each. 10,000,000,0001. Issued, Subscribed & Fully Paid Up230,000,000 Ordinary Shares of Tk. 10 each have been subscribed and paid in full. 2,300,000,0002. Initial Public Offering (IPO):Issue of 26,000,000 Ordinary Shares of Tk. 10 each 260,000,000Total Paid Up Capital after IPO (1+2) 2,560,000,000Issue ManagerAuditor: BRAC EPL Investments <strong>Limited</strong>: S. F. Ahmed & CoPage 1 of 18

<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong>Company at a glanceCompany Profile<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong>: An Overview<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong> (UHRL), a sister concern of “<strong>Unique</strong> Group”, wasincorporated in Bangladesh as a Public <strong>Limited</strong> Company on 28 November 2000 underthe Companies Act, 1994. UHRL’s vision is to be the pioneer in leading world-class hotelmanagement and offering the most efficient customer service in Bangladesh and thesubcontinent’s hospitality industry. Under the execution of a Management Agreementwith Westin Asia Management Co. (a fully-owned subsidiary of Starwood <strong>Hotel</strong> and<strong>Resorts</strong> Worldwide Inc.), <strong>Unique</strong> <strong>Hotel</strong> is operating with the brand name, resources andtechnical expertise. The management contract was initially executed between BorakTravels (Pvt.) <strong>Limited</strong> and Westin Asia Management Co. on 17 December 1999. Thiscontract was transferred in the name of <strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong> through anovation agreement on October 2, 2002.<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> Ltd. started its commercial operation from 1 st July 2007. Atpresent, the company’s authorized capital stands at Tk. 10 Billion (Ten Billion) and paidupcapital stands at Tk. 2.3 billion.The Management of the Westin <strong>Dhaka</strong>: Starwood <strong>Hotel</strong>s & <strong>Resorts</strong> Worldwide <strong>Limited</strong>Starwood <strong>Hotel</strong>s & <strong>Resorts</strong> Worldwide <strong>Limited</strong> is one of the world’s largest and leadinghotel and leisure companies with 1,041 properties in 100 countries around the world. Itwas incorporated in 1980 under the laws of Maryland and has its principal executiveoffices in White Plains, NY. The group currently employs 145,000 people at both itsmanaged and owned properties and conducts hotel and leisure business both directlyand through subsidiaries. Starwood’s brand names include St. Regis, The LuxuryCollection, W, Westin, Le Meridien, Sheraton, Four Points, Aloft, Element etc.Through its brands, it is well represented in most major markets around the world. AtDecember 31, 2010 Starwood’s hotel portfolio included own leased, managed andfranchised hotels totaling 1,027 hotels with approximately 302,000 rooms inapproximately 100 countries. The group’s revenue and earnings are derived primarilyfrom hotel operations, which include management and other fees earned from hotels itmanages pursuant to its management contracts, the receipt of franchise and other feesand the operation of their owned hotels. Its hotel business emphasizes the globaloperation of hotels and resorts primarily in the luxury and upscale segment of thelodging industry.* Includes wholly owned, majority owned and leased hotels.Number of PropertiesRoomsManaged and unconsolidated joint venture hotels 463 159,200Franchised hotels 502 121,400Owned hotels* 62 21,100Vacation ownership resorts and residential properties 14 7,000Total properties 1,041 308,700Page 2 of 18

Starwood’s operations are in geographically diverse locations around the world. Thefollowing tables reflect its hotel ownership by type of revenue source and geographicalpresence by major geographic area as of December 31, 2010:Number of PropertiesRoomsNorth America 551 175,800Europe, Africa and the Middle East 247 61,300Asia Pacific 181 58,500Latin America 62 13,100Total 1,041 308,700Starwood has implemented a strategy of increasing focus on the management andfranchise business. In furtherance of this strategy, since 2006, it has sold 62 hotels forapproximately US$ 5.3 billion. As a result, it’s primary business objective is to maximizeearnings and cash flow by increasing the number of hotel management contracts andfranchise agreements; disposing of non-core hotels and “trophy” assets that may besold at significant premiums. Starwood plans to meet these objectives by leveraging itsglobal assets, broad customer base and other resources and by taking advantage of itsscale to reduce costs.a. Services of the companyWESTIN HOTEL has 241 rooms of different categories including Presidential Suitefeaturing the Heavenly Bed to meet the requirements of its diversified range of guests.There are 203 Standard Rooms of approximately 380 sqft area; 37 Suites equivalent to2-3 standard rooms; and 1 Presidential Suit of 1,411 sqft in size with a hall and state ofart facilities. Other facilities include:• Italian Cuisine “Prego” Restaurant at Level 23 along with Show Kitchen whichnourishes the spirit with rich colors, flavors, aromas and true taste of Italy in atranquil and exquisite impression• Sate of Art Business Centre with Board Room offering 24-hour services ofprinting, copying, self-service PC and wireless internet;• Executive Lounge at Level 21 for VIP guests ;• Quality Westin Standard Bakery Facility for guests/customers;• State of Art separate Male and Female Health Club featuring top-of-the-linefitness equipment including cardiovascular equipment, weight machine, steamroom, jacuzzi and sauna and SPA package of two-hour everyday with the offer of15% discount on further treatments booked on the same day;• <strong>Unique</strong> Design SPA swimming pool at Level 5 which is temperature controlled;• Ballroom Pre-Function/Meeting Space for 700 people with state-of the-art audiovisualequipment, non-smoking event facilities and new generation setup forevents in modern ;• Shopping Arcade of 1,600 sqft. with the facility of cash machine and currencyexchange and also nearby shopping facilities such as Nandan, BashudharaShopping Mall, Aarong and Shoppers World;• Babysitting services, Westin Kids Club Amenities and Kids Pool to offer the kids ajoyous atmospherePage 3 of 18

• Facility of Luggage storage and safe deposit boxes• Wireless Internet Facility accessible from all guest rooms and lobby and highspeedinternet access throughout the hotel;• In-house Valet Laundry Facility for guests/customers;• Car Parking for 600 vehicles to accommodate for meetings and events andLimousine service;• Seven Lifts and two Escalators for guests/customers providing the guests with theopportunity to avoid waiting in lines.Products/service that accounts for more than 10% of the company’s total revenue(As per audited accounts)SL Particulars Amount (BDT) % Amount (BDT) %No. as on June 30, 2011 Contribution as on Dec 31, 2010 Contribution1 Rooms 485,778,073 53.36% 805,039,208 51.95%2 Food and Beverage 337,031,259 37.02% 581,435,183 37.52%3 Minor Operating Department (MOD) 26,592,601 2.92% 51,911,706 3.35%4 Space Rental 22,541,809 2.48% 31,879,616 2.06%5 Others 38,367,491 4.21% 79,403,590 5.12%Total 910,311,233 100.00% 1,549,669,303 100.00%a. Breakdown of Estimated expenses for IPOI. Issue Management & Corporate Advisory Fee BDT 20,000,000.00II. Underwriting Commission: 0.2% on the 50% of public offer. The details of thefloatation cost for the IPO is given below:Particulars Rate Amount (BDT)Issue Management Fee Fixed 20,000,000Underwriting Fee 0.20% on BDT 1,495.0 million 2,990,000Bankers' to the Issue Fee 0.10% on the fund to be collected 2,990,000Regulatory Fee:SEC Application Fee Fixed 10,000SEC Consent Fee 0.15% on the issue size 4,485,000<strong>Stock</strong> <strong>Exchange</strong> Fees:DSE Application Fee Fixed 5,000Listing Fee DSE & CSE0.25% on first BDT 100 million0.15% on the rest amount9,170,000Annual Listing Fee_ DSE & CSE Above BDT 1000 million paid up capital 200,000CDBL related expenses:Total CDBL Fee 1,350,000Post Issue Expenses Approximate 22,609,000Total 63,609,000The Project implementation is as follows starting from 2010 to 2014 as follows:Implementation schedule:WESTIN 2LE MERIDIENLUXURY COLLECTION(FIVE STAR CUM COMMERCIAL(FIVE STAR CUM COMMERCIAL(UPPER FIVE STAR CUMPage 4 of 18

& PARKING COMPLEXGULSHAN, DHAKACOMPLEX)BANANI, DHAKACOMMERCIAL COMPLEX)GULSHAN AVENUE, DHAKA1234Worksequence andDurationSuperstructure WorkPilling Work(dependingupon soilcriteria)EarthExcavationfor foundation5 Bracing Work6789Erection ofBasement slab1 to 7Superstructure WorkErection of allverticalmemberErection ofLevel 1 toLevel 30 slab1095days335days75days200days60days240days650days600days630daysNov’11-Nov‘14Nov’11-Sep‘14Nov’11-Jan ‘12Jan’12-Aug’ 12Mar-12Apr-12Feb-12Sep-12Mar-12Nov-13Mar-12Nov-13Mar-12Dec-13WorkSequence andDurationSuperstructureWorkErection of allvertical memberErection ofLevel 12 toLevel 30 Slab600days220days200days200days430days200days200days200days300daysJul’10Mar‘12Aug’10Mar‘11Aug’10Febr‘11Jan’11-Aug ‘11Mar-11Apr-11Feb-11Sep-11Mar-11Nov-12Mar-11Nov-12Mar-11Dec-12WorkSequenceandDurationSubStructureWorkPillingWork(dependingupon soilcriteria)EarthExcavationforfoundationBracingWorkErection ofBasementslab 1 to 8SuperstructureWorkErection ofall verticalmemberErection ofLevel 1 toLevel 24slab1095days335days75days200days60days240days650days600days630daysNov’11-Sep‘14Nov’11-Jan ‘12Jan’12-Aug ‘12Mar-12Apr-12Feb-12Sep-12Mar-12Nov-13Mar-12Nov-13Mar-12Dec-13Sep-12Jan-14Customer providing 10% or more revenuesThe company’s products or services are sold to various customers. However, no singlecustomer provides 10% or more of the company’s revenue.Production/Service rendering capacity and current utilizationSl. No. Production Description Capacity( Room per year)Utilization in Percentage duringthe period ended June 30, 20111 Guest Rooms 42,535 80.37%a. Directors’ ParticularsSl.No.NameAge(Years)Experience(Years)PositionNominated byPeriod ofNomination1 Ms. Salina Ali 52 30 ChairpersonPage 5 of 18

2 Mr. Mohd. Noor Ali 57 32ManagingDirector3 Mr. Neaz Ahmed 56 31 Director4Mr. Gazi Md. ShakhawatHossain41 20 Director5 Mr. M. H. Chowdhury 68 41 Director* Until further informationBorak Real Estate(Pvt.) Ltd.<strong>Unique</strong> Eastern(Pvt.) Ltd.Borak Travels(Pvt.) Ltd.***Sl.No.NamePositionDate of first becomingDirectorDate of Expiration ofCurrent Term1 Ms. Salina Ali Chairperson November 28, 2000 -2 Mr. Mohd. Noor Ali Managing Director November 28, 2000 -345Mr. Neaz Ahmed(Nominated by Borak RealEstate (Pvt.) Ltd.)Mr. Gazi Md. ShakhawatHossain(Nominated by <strong>Unique</strong>Eastern (Pvt.) Ltd.)Mr. M. H. Chowdhury(Nominated by BorakTravels (Pvt.) Ltd.)Director June 28, 2010 10 th AGM in 2011Director November 28, 2000 11 th AGM in 2012Director November 28, 2000 10 th AGM in 2011b. Directors Involvement in Other CompaniesSl.No.Name Name of company where the director is involved Position in that company<strong>Unique</strong> Group of Companies Ltd<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> LtdBorak Real Estate (Pvt) Ltd1Ms. Salina Ali(Chairperson)<strong>Unique</strong> Ceramic Industries (Pvt) LtdBorak Travels (Pvt) LtdChairperson<strong>Unique</strong> Eastern (Pvt) Ltd<strong>Unique</strong> Property Development Ltd2 Mr. Mohd. Noor Ali(Managing Director)<strong>Unique</strong> Share Management Ltd<strong>Unique</strong> Group of Companies Ltd<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> LtdBorak Real Estate (Pvt) Ltd<strong>Unique</strong> Ceramic Industries (Pvt) Ltd.Borak Travels (Pvt) Ltd.<strong>Unique</strong> Eastern (Pvt) Ltd.Managing DirectorPage 6 of 18

<strong>Unique</strong> Property Development Ltd.<strong>Unique</strong> Share Management Ltd.<strong>Unique</strong> Shakti Ltd.<strong>Unique</strong> Vocational Training Centre Ltd.Eastern Bank Ltd.Chairman3Mr. M. H. Chowdhury(Director Nominated byBorak Travels (Pvt.) Ltd.)<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> Ltd.National Housing Finance and Investment Ltd.Director4Mr. Gazi Md. ShakhawatHossain(Director Nominated by<strong>Unique</strong> Eastern (Pvt.) Ltd.)<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> Ltd.Eastern Bank Ltd.Purnima Construction (Pvt.) Ltd.Bay Hill <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong>DirectorManaging DirectorChairman5Mr. Neaz Ahmed(Director Nominated byBorak Real Estate (Pvt.) Ltd.)<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> Ltd.Directorc. Family Relationship among Directors and Top Five OfficersMr. Mohd. Noor Ali (Managing Director) and Ms. Salina Ali (Chairperson) are husbandand wife. There are no other family relationships among the directors and top fiveofficers of the company.Ownership of the Company’s SecuritiesSlName of the Shareholders Address StatusNo.1. Borak Real Estate (Pvt.) Ltd.51/B, Kemal Ataturk Avenue, Banani,<strong>Dhaka</strong>-1213.Number ofShares% of TotalShareholdingShareholder 54,917,390 23.88%2. Borak Travels (Pvt.) Ltd. -Do- Shareholder 12,250,380 5.33%3. <strong>Unique</strong> Eastern (Pvt.) Ltd. -Do- Shareholder 19,100,380 8.30%4. Mr. Mohd. Noor Ali House# 13, Road# 63, Gulshan-02. <strong>Dhaka</strong>.ManagingDirector14,400,620 6.26%5. Mrs. Salina Ali -Do- Chairperson 13,947,880 6.06%6. Ms. Nabila Ali -Do- Shareholder 11,400,120 4.96%7. Ms. Nadiha Ali -Do- Shareholder 11,400,120 4.96%8. Ms. Nadila Ali -Do- Shareholder 11,400,120 4.96%9. Md. Showkat Ali ChowdhuryJ.M.Paradise (2 nd Floor), 22, Momin Road,Chittagong.Shareholder 3,000,000 1.30%10. Crescent <strong>Limited</strong> 7/A Shantibagh (Rajarbagh). <strong>Dhaka</strong> Shareholder 6,250,000 2.72%11. Shore Cap. Holdings Ltd.12. Mehmood Equities Ltd.13. Absolute Return Ltd.14. Humayun Kabir15. Mohammed YounusBSEC Bhaban, Level-4, 102 Kazi NazrulIslam Avenue, <strong>Dhaka</strong>.Spring Garden B-03, House#13,Road#133/A, Gulshan-2. <strong>Dhaka</strong>.House#08, Road#04, Mirpur Road,Dhanmondi, <strong>Dhaka</strong>.67, Naya Palton, City Heart Building (5 thfloor), <strong>Dhaka</strong>.House#47, Flate#3C, Road#05, Dhanmondi,<strong>Dhaka</strong>.Shareholder 8,000,000 3.48%Shareholder 1,000,000 0.43%Shareholder 1,600,000 0.70%Shareholder 400,000 0.17%Shareholder 1,000,000 0.43%Page 7 of 18

16.17.Advent Equity ManagementLtd.Innovative CapitalManagement Ltd.House#08, Road#04, Mirpur Road,Dhanmondi, <strong>Dhaka</strong>.BSEC Bhaban, Level-4, Mirpur Road,<strong>Dhaka</strong>.Shareholder 3,000,000 1.30%Shareholder 2,329,700 1.01%18.Anannya Development (Pvt.)Ltd.51/B Kemal Ataturk Avenue, Banani, <strong>Dhaka</strong> Shareholder 11,200,000 4.87%19.Purnima Construction (Pvt.)Ltd.51/B Kemal Ataturk Avenue, Banani, <strong>Dhaka</strong> Shareholder 11,200,000 4.87%20. 445other Persons* Shareholder 32,203,290 14.00%* None of the 464 shareholders hold 5% or more shares in the company’s paid up capital.Shareholding by the Directors of the Company:Name of the Directors Status Number of Shares % of Total ShareholdingMr. Mohd. Noor Ali Sponsor & Managing Director 14,400,620 6.26%Ms. Salina Ali Sponsor & Chairperson 13,947,880 6.06%Mr. M. H. Chowdhury Director (Nominated by Borak Travels (Pvt.) Ltd.) Nil NilMr. Gazi Md.Shakhawat HossainDirector (Nominated by <strong>Unique</strong> Eastern (Pvt.) Ltd.) Nil NilMr. Neaz Ahmed Director (Nominated by Borak Real Estate (Pvt.) Ltd.) Nil NilShareholding by the Officers of the Company:Sl. No. Name AddressThe numberof Shares% of totalShareholding1 Ahmed Ullah House # 04, Road # 5, Block G-1, Mirpur-2, <strong>Dhaka</strong> 400 0.0002%2 Md. Israfil Islamil 41/9-B Hazi Afsaruddin lane, Zigatola, <strong>Dhaka</strong> 600 0.0003%3 A.K.M Asadul Ismail4 Abu Ahamed5 Md. Rezaul karim67Mosharaf HossainMominDaize Sabita RaniMandal8 Syeda Reshma AkhterHouse M- 81, Lane-18, Purbachal sarak, uttarBadda, <strong>Dhaka</strong>House#10, Word#8, Road#8, Swadhinata Sarani,<strong>Dhaka</strong>H # 99, Lan # 03, DAG # 228, South Azampur,Uttaram <strong>Dhaka</strong>-1230Vill: Madan Khali, P.O- Churain, P.S- Srinagar,Dist-Munshigong1,000 0.0004%400 0.0002%5,600 0.0024%800 0.0003%KA-142, Joarshahara, Khilkhet, P.S –Badda, <strong>Dhaka</strong> 800 0.0003%The Westin <strong>Dhaka</strong>, Plot #1 CWN(B) Road # 45,Gulshan-2 Gulshan-21,000 0.0004%9 Nahid Sultana 9 Omar Ali Lane, West Rampura, <strong>Dhaka</strong> 200 0.0001%10 Sheikh Asma 560, Nayatola, Moghbazar, <strong>Dhaka</strong>-1217 400 0.0002%11 Md. Abdul Ahad12Muhammad Masudpervez khanIncome Auditor, The Westin <strong>Dhaka</strong>, Plot #1CWN(B) Road # 45, Gulshan-23,000 0.0013%KA-68 kuril, P.O- Khilkhet, Badda, <strong>Dhaka</strong>-1229 2,400 0.0010%13 Mohammad Abu Naser 572 North Shahjahanpur (3 rd floor), <strong>Dhaka</strong> 200 0.0001%14 Runa Akhter15 Muhammad Mohashin16Md. AshrafuzzamanpathanHouse # 62, (3 rd floor), Block # J, Road # 12, SouthBanasree(Goran Project), <strong>Dhaka</strong>461/A(4 th floor)south kafrul, <strong>Dhaka</strong> Cantt. <strong>Dhaka</strong>-12062,500 0.0011%400 0.0002%1044, Shahjadpur, <strong>Dhaka</strong>-1212 400 0.0002%17 Soniya Sohawi khanSafety & Security officer, The Westin <strong>Dhaka</strong>, Plot -1, CWN(B) Road # 45, Gulshan-2, <strong>Dhaka</strong>-1212200 0.0001%18 Md. AlamgirShop # 122, Holand Shopping Center, MiddleBaddah, Gulshan, <strong>Dhaka</strong>-1212600 0.0003%19 Md. Mohi uddin 1/G, 5/11, Mirpur , <strong>Dhaka</strong>-1216 200 0.0001%Page 8 of 18

20Md. Aminul IslamSharif21 Md. Towhidul Hassan22 Suborna Simontinee2324Md. Mizanur RahmanChowdhuryMuhammed TawsifAhmedFerdousi House, 1034 Dattapara, Tongi, Gazipur,1700Safety & Security Office, The Westin <strong>Dhaka</strong>, Plot -1, CWN(B) Road # 45, Gulshan-2, <strong>Dhaka</strong>-121221/B, Nikunja, Road-01, Nikunja-02, Khilkhet,<strong>Dhaka</strong>-1229The Westin <strong>Dhaka</strong>, Plot #1 CWN(B) Road # 45,Gulshan-2House # 9, Road # 5, Block # C, Mirpur-6, <strong>Dhaka</strong>-1216400 0.0002%200 0.0001%200 0.0001%5,000 0.0022%800 0.0003%25 Chinmoy Halder Kha-19/D, Beparipara, Khilkhet, <strong>Dhaka</strong>-1229 800 0.0003%26Muhammad Abul House # 11, Road # 08, Nikunja-02, <strong>Dhaka</strong>-1229 orKalam Talukdar Ap-Cha(17) Mohakhali, <strong>Dhaka</strong>800 0.0003%27 Mohd. Rezaul KarimDag # 1323, Solmaid, Vatara, Gulshan-2, <strong>Dhaka</strong>-12122,600 0.0011%28 Md. Ashraful AlamHouse#9, Avenue#1, Block-B, Mirpur-10, <strong>Dhaka</strong>-1216200 0.0001%29 Mohiul Islam KhanMain Gulshan Avenue, Plot#1, CWN(B) Road#45,Gulshan-2, <strong>Dhaka</strong>2,400 0.0010%30 Syed Ishtiak Ahmed32 Dilu Road, Regency Apartment, Flat# B-5,Eskaton, <strong>Dhaka</strong>200 0.0001%31 Md. Rafiqul IslamThe Westin <strong>Dhaka</strong>, Plot #1 CWN(B) Road # 45,Gulshan-23,200 0.0014%32Mohammad Nazrulislam1326 Vatara More, Badda, Gulshan, <strong>Dhaka</strong> 2,200 0.0010%33Md. Mashiur RahmanRazibMelody Homes, Flat#E-3, 62B Boro Mogh Bazar 1,000 0.0004%34 Touhid Ahammed 12/C, 12/29, Mirpur, <strong>Dhaka</strong>-1216 600 0.0003%35 Khorshed Alam 796, Ibrahimpur, <strong>Dhaka</strong> Cantonement, <strong>Dhaka</strong>-1206 2,800 0.0012%36 Mafuza Khatun House # 05, Road # 9, Sector-3, Uttara, <strong>Dhaka</strong>-1230 3,400 0.0015%37 Md. Tarequr RahmanHouse # 06, Road # 8/A, Sector-10, Uttara, <strong>Dhaka</strong>-1230400 0.0002%38 Tapash Mazumder65 uttar Dhanmondi, Flat # -3, Hosan Villa,Kalabagan, <strong>Dhaka</strong>-12056,000 0.0026%39 Md. Anamul Hoque 51/B Kemal Attaturk Avenue, Banani, <strong>Dhaka</strong> 600 0.0003%40 Mahbubul AlamUCIL, 51/B, Kemal Ataturk Avenue Banani, <strong>Dhaka</strong>-12131,000 0.0004%41 Md. Habib UllahHouse # 81, Road # 18, Purbachal(Nama) UttarBdda, <strong>Dhaka</strong>-1212400 0.0002%42 Elizabeth DewriHouse # 149/Ja, Mohakhali Wirelessgate, Gulshan,<strong>Dhaka</strong>-12123,000 0.0013%43 Hamida Akter 124/B East Raja bazar, <strong>Dhaka</strong>-1215 1,200 0.0005%44Ronie TheotiniusGomes10/D, Indira Road, <strong>Dhaka</strong>-1215 400 0.0002%45 Dipankar Das 1367, CDA Avenue CTG. 600 0.0003%46Chowdhury ArifaKhatun147/4, 3rd Floor, South Jatrabari, <strong>Dhaka</strong>-1204 4,000 0.0017%47 Mohammad Abdul Jalil 51/B, Kemal Ataturk Avenue, Banani, <strong>Dhaka</strong>-1213 3,000 0.0013%48 Mohd. Yeahia BMET Project, Kalachandpur, Gulshan-2, <strong>Dhaka</strong> 600 0.0003%49 Md. IsmailU.V.T.C 100 Shah kabir Mazar Road, Azampur,Uttara, <strong>Dhaka</strong>--12301,500 0.0007%50 Md. Shahidul Islam Flat # B-4, House-1, Road-36, Gulshan, <strong>Dhaka</strong> 2,500 0.0011%51Md. Abu BakarSiddiqueHazi Mahal, 1/8 Mirbugh (Noyatola) <strong>Dhaka</strong>-1217 2,500 0.0011%52 Mohd. Ismail Hawlader House # 13, Road # 63, Gulshan-2, <strong>Dhaka</strong> 800 0.0003%53 Md. Shaha Alam13 Gha Progati Saroni, Shahjadpur, Gulshan, <strong>Dhaka</strong>-12123,750 0.0016%54 Md. Mofazzal Hossain 8 A/14 Rajarbagh, Bashaboo, <strong>Dhaka</strong>-1214 200 0.0001%55Jishu TarafderFlat#4B, House#74, Road#4, Block-B, Niketon,Gulshan-1, <strong>Dhaka</strong>1,000 0.0004%Total 81,350 0.0354%Page 9 of 18

Performance at a Glance:ParticularsOperatingRevenue31.12.200631.12.200731.12.200831.12.200931.12.2010Tk. in millionPage 10 of 1830.06.201115.03 308.79 1,078.75 1,223.24 1,549.67 910.31Growth - 1955.08% 249.35% 13.39% 26.69% -Cost of Sales 11.32 171.85 327.56 295.85 339.09 180.69Growth - 1418.10% 90.61% -9.68% 14.62% -Gross Profit 3.71 136.94 751.19 927.39 1,210.58 729.62Growth - 3595.43% 448.55% 23.46% 30.54% -Administrative& Other Expense0.52 84.41 274.65 286.09 325.08 185.72Growth - 15987.70% 225.38% 4.17% 13.63% -EBIT/OperatingProfit3.18 52.53 476.54 641.30 885.50 543.90Growth - 1551.36% 807.18% 34.57% 38.08% -Head OfficeExpenses- 28.10 127.76 122.43 214.83 105.99Growth - - 354.66% -4.17% 75.47% -InterestIncome/(Expense)- - -336.64 -142 75.09 156.99Growth - - - -57.82% -152.88% -Gain/(Loss)on disposal of- - - - 355.64 -3.03sharesOther income 0.59 0.52 47.46 53.12 114.41 98.24Profit Before Tax 3.77 24.95 59.60 429.99 1,215.81 690.11Growth - 561.79% 138.82% 621.50% 182.76% -Provision For Taxon Capital Gain on - - - - 7.13 -Sale of SharesProvision ForIncome Tax1.51 - - - - -Net Profit AfterTax2.26 24.95 59.60 429.99 1,208.68 690.11Growth - 1003.84% 138.82% 621.50% 181.10% -Dividend paid onPreference Share- - - 18.00 16.20 17.68Net Profit AfterTax & Dividend2.26 24.95 59.60 411.99 1,192.48 672.43Growth - 1003.84% 138.82% 591.30% 189.45% -RevaluationSurplus of Fixed - - - 4,653.82 5,533.10 8,765.79AssetsTotalComprehensive 2.26 24.95 59.60 5,065.81 2,035.98 3,905.12IncomeGrowth - 1103.84% 238.82% 8500.26% 40.19% -Total Assets 2,851.74 3,868.53 4,077.20 9,262.91 15,543.88 19,413.64Growth - 35.66% 5.39% 127.19% 67.81% -

Paid Up Capital1,100,000,0001,100,000,0001,100,000,0002,000,000,0002,300,000,0002,300,000,000Growth - - - - - -NAV per share 100.51 102.70 10.48 35.60 60.65 77.62NAV per share(WithoutRevaluation100.51 102.70 10.48 12.33 36.59 39.51Reserve)EPS 0.20 0.22 0.51 2.06 5.52 2.92Net Asset Value 1,105.63 1,129.69 1,153.28 7,119.10 13,949.08 17,853.65No. of Shares 11,000,000 11,000,000 110,000,000 200,000,000 230,000,000 230,000,000IPO - - - - - 26,000,000Post IPO Numberof shares- - - - - 256,000,000ROE 0.20% 2.15% 5.22% 9.96% 11.32% 4.23%ROA 0.10% 0.72% 1.50% 6.45% 9.75% 3.95%Face Value PerShare100.00 100.00 10.00 10.00 10.00 10.00Gross ProfitMargin24.66% 44.35% 69.64% 75.81% 78.12% 80.15%Operating ProfitMargin21.17% 17.01% 44.17% 52.43% 57.14% 59.75%Net Profit Margin 15.06% 7.79% 5.52% 35.15% 78.00% 75.81%Asset TurnoverRatio0.01 0.09 0.27 0.18 0.12 0.10Equity Multiplier 2.58 3.42 3.54 1.30 1.11 1.09Time InterestEarned Ratio- - 1.18 3.38 31.14 14.69Debt to EquityRatio1.57 1.88 1.72 0.18 0.03 0.03Current Ratio 18.18 0.28 0.42 1.18 3.94 4.45Quick Ratio 17.34 0.22 0.33 1.11 3.88 4.37Page 11 of 18

Tangible Assets per Share and Net Asset Value per Share(As per audited accounts)Particulars: 30.06.2011 31.12.2010A.1 Non Current Assets 14,746,085,659 11,150,682,820Construction Work in Progress (Le Meridien) 832,727,250 582,624,000Property, Plant and Equipment 13,913,358,409 10,568,058,820A.2 Current Assets 4,667,558,797 4,393,196,348Inventories 80,947,789 71,179,103Investment in Shares 3,712,207,154 2,032,719,643Accounts Receivable 81,930,631 68,158,502Advances, Deposits and Prepayments 317,190,391 1,336,041,861Other Receivables 6,168,603 5,757,402Fixed Deposit Receipts with Banks 95,056,199 79,777,343Cash and Cash Equivalents 374,058,030 799,562,494A.3 Total Assets (A.1+A.2) 19,413,644,456 15,543,879,168B.1 Less: Current Liabilities 1,049,750,727 1,114,851,412Current portion of long term loan 61,338,000 122,676,00012% Redeemable Preference Share Capital 15,000,000 15,000,000Short Term Loan 35,061,921 193,893,182Due to Operator and its affiliates 46,991,374 49,706,696Accounts Payable 24,260,346 51,144,088Other Payables 867,099,086 682,431,446B.2 Long Term Liabilities 510,245,887 479,950,444Non-current portion of secured term loan 420,245,887 374,950,44412% Redeemable Preference Share Capital 90,000,000 105,000,000B.3 Total Liabilities (B.1+B.2) 1,559,996,614 1,594,801,856C Net Tangible Assets (A.3-B.3) 17,853,647,842 13,949,077,312D. Number of Shares 230,000,000 200,000,000E. Net Tangible Asset Value per Shares (C/D) 77.62 60.65Determination of Offering Price• Since inception of the Westin <strong>Dhaka</strong>, the five star hotel of <strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong><strong>Limited</strong> became the market leader with 27% market share in June 2010. Atpresent occupancy rate of Westin is 81%. Considering the worldwide customerbase of Starwood, its international standard service and increased efficiency, theoccupancy rate is expected to grow at an average rate of 2% every year over thenext six years.Page 12 of 18

• Starting full commercial operation from the last quarter of 2007, the companymaintained high growth rate in profitability. Besides the operation of Westin, thecompany is going to construct three more five star hotels and commercialcomplex in the premier locations in <strong>Dhaka</strong> under the management of Starwood<strong>Hotel</strong> & <strong>Resorts</strong>. All the three five star hotels will be joint venture projects withBorak Real Estate (Pvt.) <strong>Limited</strong>.• The hospitality sector is an emerging industry and the demand for five star hotelsin the country is increasing at a higher rate than the supply. Besides, thecountry’s GDP growth in FY 2010 is projected at 6% and in FY 2011 at 6.3%which is expected to continue over the next years given the strong domesticdemand supported by accommodative fiscal and monetary policy. <strong>Unique</strong> <strong>Hotel</strong> &<strong>Resorts</strong> <strong>Limited</strong> achieved cumulative growth of 208% in revenue and 283% in netprofit from 2005 to 2009.Justification of the offering price:The offer price of the shares of <strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong> to be issued has been setat BDT 115/- per share including a premium of BDT 105/- per share. The justification ofthe offering price has been made based on the value derived using trading comparables-Price to Book Value (P/B) and Price to Earnings (P/E) multiples. Price to Earnings andPrice to Book Value comparables have been taken to estimate a theoretical fair price thatgives good indication of market demand for the shares of the company.The average price derived from the valuation is as follows:1. Price based on P/B MultipleParticulars:30.06.2011(BDT)Shareholders' EquityOrdinary Share Capital 2,300,000,000Share Premium Account 4,494,008,924Tax Holiday Reserve 944,219,701Revaluation Surplus 8,765,787,078Retained Earnings 1,349,632,139A. Total Shareholders' Equity 17,853,647,842B. Number of Shares 230,000,000Book Value per Shares (C/D) 77.62P/B MultiplePrice Based on Book Value per share 232.86Book Value based price per share at 3x P/B multiple derives at BDT 232.86.As the company is heavily capital intensive, the net asset value/book value basedvaluation is a better indicator to determine fair price of the company. Last five yearsBook Value per share (BVPS) of the company was as follows:2006 2007 2008 2009 2010BVPS (BDT) 10.05 10.27 10.48 35.60 60.65Growth in BVPS 0.21% 2.18% 2.09% 239.51% 70.38%Growth in Fixed Assets 68.14% 37.81% -0.33% 124.20% 35.22%3xPage 13 of 18

Even during the half year as on June 30, 2011, the BVPS has grown 28% and fixedassets at 32.24% from those of last year ending December 31, 2010. The company hasacquired land in <strong>Dhaka</strong> and Kuakata for expansion of its business, and it has alreadystarted construction of <strong>Hotel</strong> Le meridien which has also added to its assets. Consideringthe growth rate of its fixed assets as well as in capital, the forward P/B multiple at theprice BDT 232.86 will be much lower than 3x. Therefore, we believe that 3x P/B multipleis justified for determining fair price of the company.2. Price based on P/E MultipleParticulars:Dec 31, 2011(Annualised)Earnings Per Share (EPS) 5.85PE Multiple15xPrice Based on PE multiple 87.75Price based on annualized EPS for the year ending December 31, 2011 at a forward PEmultiple of 15x is BDT 87.75.We have taken 15x PE multiple as standard which is lower than the average market PEmultiple from January to June, 2011 of DSE to estimate the fair price for the shares ofUHRL. The sectoral PE multiple of the similar industry listed with the emerging markets,especially southeast Asia – Bombay <strong>Stock</strong> <strong>Exchange</strong> (BSE), India and Colombo <strong>Stock</strong><strong>Exchange</strong> (CSE), Sri Lanka are also much higher than the 15x that we have taken. Thesectoral PE for hospitality industry in the BSE and CSE as on September 6, 2011:Name of <strong>Exchange</strong> Country Name of Sector Companies Listed PE RatioColombo <strong>Stock</strong> <strong>Exchange</strong> Sri Lanka <strong>Hotel</strong> & Tourism 32 34.9xBombay <strong>Stock</strong> <strong>Exchange</strong> India <strong>Hotel</strong>s 44 30.51xAverage 32.71xTherefore, we believe 15x PE multiple is justified to derive fair price for the shares of thecompany.3. Price based on Sectoral P/B multiple<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong> operates in the hospitality sector. The sector is named astravel and leisure sector at <strong>Dhaka</strong> <strong>Stock</strong> <strong>Exchange</strong> (DSE). The sctoral P/B and P/Emultiple is as follows:Companies under Travel &Leisure IndustryLast 1 years’average Price*EPS P/E BVPS P/BUnited Airways 53.11 1.49 36 11.54 4.6* The average price has been taken from September 1, 2010 to August 31, 2011.Particulars:Book Value per Share (BVPS)As on 30 th June 2011 (BDT) 77.62Sectoral P/B Multiple 4.6xPrice Based on Book Value per share (BDT) 357.05Page 14 of 18

4. Price based on Sectoral P/E multipleParticulars:Earnings per Share (BVPS)Dec 31, 2011(Annualised) (BDT) 5.85Sectoral P/E Multiple36xPrice Based on Book Value per share 210.60Determination of issue price based on the above Methods:Tk. Weight Tk.Value based on Price to Book Value (P/BV) Multiple 232.86 0.40 93.14Value based on Price to Earnings (P/E) Multiple 87.75 0.40 35.10Value based on Sectoral Price to Book Value (P/B) Multiple 357.05 0.10 35.71Value based on Sectoral Price to Earnings (P/E) Multiple 210.60 0.10 21.06Weighted Average Price per share 185.01Valuation based on 3x P/B multiple and earning based valuation, i.e. price based on 15xP/E multiple has been considered as the key valuation methods to estimate fair price ofthe shares of UHRL. Therefore, these two valuation methods have been assigned equalhighest weights. The secondary valuation methods -the pricing based on sectoral tradingmultiples has been used to indicate the demand for the shares of travel and leisuresector in Bangladesh capital market. Hence, the valuations based on sectoral tradingmultiples have been assigned lowest equal weights as the company plans to issue sharesat a discounted price than the prevailing market demand.Therefore, the issue price of the shares of UHRL to be issued through IPO hasbeen set at BDT 115/- at 37.80% discount to the weighted average pricederived from the above methods.Risk factors & Management’s perceptions about the risksa. Interest Rate RiskInterest rate risk is the risk that company faces due to unfavorable movements in theinterest rates. Changes in the government’s monetary policy, along with increaseddemand for loans/investments tend to increase the interest rates. Such rises ininterest rates mostly affect companies having floating rate loans or companiesinvesting in debt securities.Management Perception:Since the <strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong> has not borrowed funds at flexible rate,hence, the increase in interest rate in the money market will not increase thecompany’s financial cost. However, in case the interest rate comes down, thecompany can prepay the previous debts and avail itself new debt facility at a lowerPage 15 of 18

cost, if required. The company has been repaying borrowed funds on a continuousbasis to reduce such interest risk.b. <strong>Exchange</strong> Rate Risk<strong>Exchange</strong> rate risk occurs due to changes in exchange rates. As the Companyimports equipment from abroad and also earns revenue in foreign currency,unfavorable volatility or currency fluctuation may affect the profitability of theCompany. If exchange rate is increased against local currency opportunity will becreated for generating more profit.Management Perception:<strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong> changes the price of their services in accordance withthe change in exchange rate to mitigate the affect of unfavorable volatility inexchange rate on the company’s earnings.c. Industry RisksIndustry risk refers to the risk of increased competition from foreign and domesticsources leading to lower prices, revenues, profit margins, market share etc whichcould have an adverse impact on the business, financial condition and results ofoperation.Management Perception:The Company continuously carries out research and development (R&D) to keep pacewith the customer choices and fashions.d. Market RisksMarket risk refers to the risk of adverse market conditions affecting the sales andprofitability of the company. Mostly, the risk arises from falling demand for theproduct or service which would harm the performance of the company. On the otherhand, strong marketing and brand management would help the company increasetheir customer base.Management Perception:The company’s brand “Westin” has a very strong image in the local and internationalmarket. Westin Asia Management Co. (a fully-owned subsidiary of Starwood <strong>Hotel</strong>and <strong>Resorts</strong> Worldwide Inc.) also has the reputation of providing quality hotelmanagement services. Moreover, the demand for five star hotels in the country isincreasing while there are very few five star hotels to meet the demand. Strongbrand management and quality service has enabled the company to capturesignificant market share in the sector. And the company is continuously penetratingthe market and upgrading the quality of their service to minimize the risk.e. Technology Related RisksTechnology always plays a vital role for each and every type of business. Bettertechnology can increase productivity and reduce costs of production. Firms areexposed to technology risks when there are better technologies available in themarket than the one used by the company which may cause technologicalobsolescence and negative operational efficiency.Page 16 of 18

Management Perception:The Company is aware of technological changes and has adopted new technologyaccording to its needs. Furthermore, routine and proper maintenance of theequipment carried out by the Company ensures longer service life for the existingequipment and facilities.f. Potential or Existing Government RegulationsThe Company operates under the Company Act 1994 and other related regulations,Income Tax Ordinance 1984, Income Tax Rules 1984, Value Added Tax (VAT) Act1991 and Value Added Tax (VAT) Rules 1991. Any abrupt changes of the policiesmade by the regulatory authorities may adversely affect the business of theCompany.Management Perception:Since The Company Operates in hospitality sector, the Government regulations aremostly investment-friendly. However, unless any policy change that may negativelyand materially affect the industry as a whole, the business of the Company isexpected not to be affected. As it is an emerging sector, it is highly unlikely that theGovernment will frustrate the growth of the industry with adverse policy measures.g. Changes in Global or National PoliciesThe performance of the Company may be affected due to unavoidable circumstancesboth in Bangladesh and worldwide, such as war, terrorism, political unrest in thecountry or customer countries. Changes in global or national policies may alsoadversely affect the economy in general.Management Perception:The risk due to changes in global or national policies is beyond control of anycompany. The management of the company is always concerned about the prevailingand future changes in the global and national policy and shall response appropriatelyand timely to safeguard its interest. The company’s strong brand image andworldwide customer base will enable it to withstand any such potential threats.h. History of Non-Operation, if anyThere is no history of non-operation in the case of The Company.Management Perception:To overcome these uncertainties, the Company has its own power backup, scientificinventory management and continuous market promotion systems, which reduce thenon-operating risk.i. Operational RisksNon-availabilities of materials/equipment/services may affect the smooth operationalactivities of The Company. On the other hand, the equipment may face operationaland mechanical failures due to natural disasters, terrorist attacks, unforeseen events,lack of supervision and negligence, leading to severe accidents and losses.Page 17 of 18

Management Perception:The Company is equipped with power backup and security (CCTV) systems, whichreduce operational risk. Besides, the equipment is under Insurance coverage in orderto get reasonable compensation for any damages. Apart from these, routine securitycheck and proper maintenance of the equipment also reduce/eliminate theoperational risk.j. Ownership of Land Properties Related Risk:The company purchased the land of 24.1 katha in Plot No 1, CWN (B), Road No 45Gulshan-2, <strong>Dhaka</strong>-1212 (where the hotel premise is located) from Borak Travels(Pvt.) Ltd. The land was leased by the then <strong>Dhaka</strong> Improvement Trust (DIT) atpresent Rajuk to Late Dr. A. Khaleque for a period of 99 years starting from 30thOctober, 1962. Borak Travels (Pvt.) Ltd. purchased the land from Dr. A. Khaleque on18th August, 1993 for an amount of BDT 92.5 million. The land was later transferredto <strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong> in 2005 which was approved by the Rajuk onAugust 9, 2005. But no sale of agreement was executed between Borak Travels(Pvt.) Ltd. and <strong>Unique</strong> <strong>Hotel</strong> & <strong>Resorts</strong> <strong>Limited</strong>.The company owns another land situated at Plot No 2, CWN (B), Road No 45Gulshan-2, <strong>Dhaka</strong>-1212. The land was allotted to Mr. SK Anwar Ali by the then<strong>Dhaka</strong> Improvement Trust (DIT) now Rajuk for a period of 99 years lease (absoluteand 16 annas owner) under a provisional letter of allotment bearing Memo No.DIT/Gulshan/998- dated 06.09.1960.The lands acquired by the company as mentioned above are leasehold land givenlease by the Rajuk for a period of 99 years. The period of lease for plot no. 1 will beexpired on 30th October 2061 and for plot no. 2 on 06.09.2059.Management Perception:The company has proper title deeds for the lands it acquired. The lands are leaseholdgiven lease by the Rajuk for a period of 99 years.Page 18 of 18