LSI INDUSTRIES LIMITED - Dhaka Stock Exchange

LSI INDUSTRIES LIMITED - Dhaka Stock Exchange

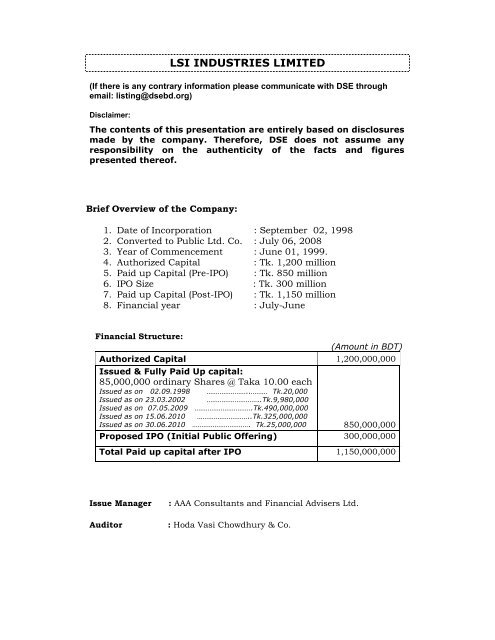

LSI INDUSTRIES LIMITED - Dhaka Stock Exchange

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Principal ProductsThe company has been set up to produce garment accessories like metalbutton, metal buckle and d-ring, metal alloy item, plastic item of garmentaccessories, special yarn-dyed tape, rubber badges, zipper series and belt &other caps accessories. During the period the Company added a new productline for manufacturing and selling mould & dices, brass wire, zinc alloy rawmaterials.Market of the Products<strong>LSI</strong> Industries Limited is a 100% export oriented garment accessoriesmanufacturing Company that exports their products to garments industrieslocated in <strong>Dhaka</strong> & Chittagong Zone. Around 4,500 listed industries aretheir potential buyers. About more than 600 garments factories areimporting the accessories from them.Relative Contribution of the Product/Services Contributing Morethan 10% of Total RevenuesThe Company has 6 main products contributing more than 10% of totalrevenue are as below:Sl Producers Percentage (%)1. Metal Button series 332. Metal Zipper 103. Belt 104. Zinc Alloy series 125. Nylon & Vislon Zipper 156. Brass wire & Mould 10Associates, Subsidiary/ Related Holding Company<strong>LSI</strong> Industries Limited has 3(three) subsidiary companies as under as peraudited accounts:Shareholding byPercentageName of Subsidiary <strong>LSI</strong> IndustriesCore Area of Business(%)Ltd.Lasting Spring MetalManufacturing, selling of296,555 77.00industries Limitedplastic products for

6. Dekko AccessoriesSources and Availability of Raw Materials and the Name of the PrincipalSuppliers:Basic raw materials like Copper, Zinc, Yarn, Electroplating Chemicals etc.used for production process are procured from mainly foreign sources asfollows:Sl. No.Name Of Suppliers1 E-Home Lace Industries Co. Ltd.2 Zhejiang Sunflow Holding Group Co. Ltd.3 Tennant Metal Pty4 Everprosperous International Industries Ltd.5 Grauer & Weil(India) Ltd.6 Tianmeng Agricultural Materials Chain Co. Ltd.7 Tong Horng Metal Industrial Co., Ltd.Sources of and requirement for power, gas & water:All required utility facilities are available at the project site and those arestated below:Power & Gas:Total requirement of power of the project is about 2,882 KW, entireconsumptions is met up from Rural Electrification Board (REB).There are6(six) diesel generators made in Japan, Mitsubishi of different capacities likeGenerator # (1) 300 KVA, (2) 250KVA, (3) 250KVA, (4) 250 KVA, (5) 152 KVA& (6) 65KVA.Water:Demand of water is met up through BEPZA water supply.Contract with Principal Suppliers/Customers:There is no contract with principal suppliers or customers other than thenormal course of business.Material Patents, Trademark, Licenses or Royalty Agreements:The Company has no Material Patents, Trademark, Licenses or RoyaltyAgreements.

Directors and their Involvement with other Organizations:NameLee KueiTzuDesignationwith <strong>LSI</strong>Entities where they have InterestPositionChairman Su Jin Industries Ltd ChairmanTsai Pi Feng Director Su Jin Industries Ltd ShareholderWuChuanChenTingChenLiLiWeiChinLasting Spring Metal Ind. Ltd.Su Jin Ind. Ltd.Jin Su Ind. Ltd.M.D.M.D.M.D.DirectorYoung Zhen Metal Industries Ltd. M.D.Perfect Beverage & Food (Bangladesh)Ind. Ltd.ChairmanForever Prosperity InternationalCompany Ltd.DirectorDirector Su Jin Ind. Ltd.; DirectorJin Su Industries Ltd.ChairmanYoung Zhen Metal Industries Ltd. ChairmanDirectorLasting Spring Metal Ind. Ltd.Chairman&Perfect Beverage & Food (Bangladesh)ManagingInd. Ltd.M.D.DirectorForever Prosperity InternationalCompany Ltd.M.D.Family Relationship among the DirectorsName of the DirectorPosition in theCompanyLee Kuei Tzu Chairman SelfRelationshipTsai Pi Feng Director Sister in LawWu Li Chuan Director Spouse of M.D.Chen Wei Ting Director Daughter of Tsai Pi FengChen Chin Li Managing Director Spouse of Wu Li Chuan

Sl.No.Ownership of the company securities (as on 31 December 2010)Name In Full Position Shareholding% ofShares1 Ms. Lee Kuei Tzu Chairman 23,265,132 27.37%2 Ms. Tsai Pi Feng Director 13,013,070 15.31%3 Chen Chin Li MD 19,639,168 23.10%4Ms. Wu LiChuanDirector 15,670,180 18.44%5 Chen I Hao Shareholder 4,415,140 5.19%6Ms. Chen WeiTingShareholder 3,300,000 3.88%7 Chen Kuan Wei Shareholder 3,300,000 3.88%8OtherShareholders2,397,310 2.82%Total 85,000,000 100.00%Performance at a Glance:(Tk. in million)Particulas 30.06.07 30.06.08 30.06.09 30.06.10 As on31.12.10AnnualizedTurn Over 560.74 836.97 888.35 763.11 574.19 1148.38(Sales)Growth 31.45% 49.26% 6.14% -14.10% 50.49%Cost of 409.99 595.10 639.99 455.1 372.55 745.1goods soldGrowth 15.74% 45.15% 7.54% -28.89% 63.72%Gross 150.75 241.87 248.36 308.01 201.64 403.28profitGrowth 108.30% 60.44% 2.68% 24.02% 30.93%Operating 103.08 61.68 79.29 81.31 50.29 100.58ExpenseGrowth 563.32% -40.16% 28.55% 2.55% 23.70%Operating 47.67 180.19 169.07 226.70 151.35 302.7ProfitGrowth -16.12% 277.99% -6.17% 34.09% 33.52%Nonoperating211.87 0.24 -0.02 5.47 0.3 0.6incomeGrowth 8583.20 -99.89% ---89.03%%108.33% 27450.00%Financial 13.32 18.61 27.31 13.28 12.4 24.8ExpensesGrowth -18.68% 39.71% 46.75% -51.37% 86.75%Net Profit 246.22 161.82 141.74 218.89 139.25 278.50before taxGrowth 474.07% -34.28% -12.41% 54.43% 27.23%

Particulars 30.06.07 30.06.08 30.06.09 30.06.10As on31.12.10Current Assets 529.5 812.05 796.66 1212.48 1418.12Current Liabilities 350.33 468.56 314.34 413.57 505.13Current Ratio 1.51 1.73 2.53 2.93 2.81Quick Ratio 0.40 0.62 0.83 1.08 1.29Current Asset-Inventories 139.75 289.14 259.47 447.19 650.33`Description of PropertyThe Company has set up its plant at plot # 61-72, <strong>Dhaka</strong> Export ProcessingZone (Extn. Area), Savar, <strong>Dhaka</strong> to run the operations and the Company’spresent registered office is situated at Jabbar Tower, 12th Floor, 42 GulshanAvenue , Gulshan-01, <strong>Dhaka</strong>-1212.The Company possesses the following fixed assets at written down value asper audited accounts:(Amount in BDT)ParticularsWritten down value as at 31 stDecember 2010Factory office building 103,783,016Plant and machinery 312,179,478Electric equipment 2,262,105Office equipment 13,312,914Furniture & fixture 3,337,844Motor vehicle 1,219,340Total 31 December2010436,094,696Total 30 June 2010 436,129,589Total 31 December2009458,124,6211. All Properties of the Company are mortgaged to the lendingInstitutions namely Prime Bank Ltd.and HSBC Limited. All themachines are purchased in brand new condition.2. Any of the above assets has not been taken on lease basis.3. The factory building is constructed on lease hold land at DEPZ.Material Commitment for Capital ExpenditureThe Company has a commitment on the implementation of software namedSAP ERP with Aspic Consulting Co. Ltd. amounting Tk. 2,741,711.00. Theproceeds from Initial Public Offering will be utilized for expansion of existingestablishment of the company and new project under subsidiary. The detailof the utilization of the fund in this respect is available under the head Useof Proceeds.

Loans taken from or given to its holding/parent or subsidiary companyThe company has given loan to its subsidiary concern as under:(Asper audited accounts)Name of related partyLasting Spring MetalIndustries LimitedSu Jin IndustriesLimitedRelationshipSubsidiarySubsidiaryNature oftransactionsLoanInterest on loanSales/ReceivableLoanInterest on loanTransactionsduring theperiod5,322,1062,661,78530,148,6801,016,000332,764Outstandingbalance as at31 December201091,845,18030,148,68012,440,913Perfect Beverage & Food(Bangladesh) Limited Subsidiary Loan payment 50,000 50,000Name ofBank &A/C No.Prime BankLtd.HSBCOperating LeaseThe company has established its head office and other offices on leasedaccommodation as under:Name of OfficePeriod of MonthlyArea (sft.) Rent per Sft.and AddressLease AmountFactory:61-72, DEPZ, 22,948.59 USD15-11-2000 to USDGanakbari, <strong>Dhaka</strong>- sqm 2.20/sqm(yearly) 14-11- 4,207.2413492030Corporate Office01-08-10Jabbar Tower (12 thBDT 75.00 toBDTFloor)8,000 sft(Monthly) 31-07- 6,00,00042 Gulshan Avenue,2015Gulshan-1, <strong>Dhaka</strong>Marketing Office57, As-Salam Tower(8 th Floor) AgrabadC/C, Chittagong7,200 sftBDT 35.00(Monthly)01-09-07to31-08-2012BDT2,52,000Financial Lease/ Loan commitmentThe company has entered in to following Financial Lease/ Loan commitmentduring last five years:Type ofloanLong TermLoanLong TermLoanAmount ofloanUSD270,000USD457,740Rate ofinterestLIBOR+3.5%SIBOR+4%SanctionDate05-March-08During2006-07Amount ofinstallment(Monthly)USD 11,250USDOutstandingBalance31.12.10NILNIL

Future Contractual Liabilities:The company has no plan to enter into any contractual liabilities within nextone year other than the normal course of business.Future capital expenditure:Capital expenditure has been planned to be incurred by the Company innear future for expansion of the project. The proceeds from Initial PublicOffering will be utilized for expansion of the project and Detail information inthis respect is available under the head Use of Proceeds & ImplementationSchedule of page no. 7 of the prospectus.VAT, Income Tax, Customs Duty or other Tax Liability:1. VAT: The Company pays VAT in times and submits returnaccordingly. The company has no VAT liability as on 31 December,2010 as per VAT clearance certificate.2. Income Tax: Year wise income tax status of the Company is depictedbelow:AccountingYearAssessmentYear2005-2006 2006-20072006-2007 2007-20082007-2008 2008-20092008-2009 2009-20102009-2010 2010-2011 Return submittedStatusAs per certificate given by DCT of Company circle-12, Zone-4, dated13.04.2011 there is no tax outstanding up to Income Tax year 2008-2009 from 1999-2000As per certificate given by DCT of Company circle-12, Zone-4, dated20.03.2011 income tax paid.3. Custom duty: The Company imports various Raw Materials i.e.Copper, Zinc, Yarn, Electroplating Chemicals etc. under bondedfacilities for export and there is no Custom duty liability in thisrespect.Revaluation of Company’s Assets & Summary thereof:The company made no revaluation of its assets and liabilities up to date.Certain Relationship and Related Transactions:The Company does not have any transaction during the last two years or anyproposed transaction between the Issuer and any of the following persons,except as mentioned below as per note no. 28 (Related Party Transaction) ofthe Auditors’ Report:

Name of relatedpartyLasting SpringMetal IndustriesLimitedSu Jin IndustriesLimitedPerfect Beverage &Food (Bangladesh)LimitedYoung Zhen MetalIndustries LimitedForever ProsperityInternationalCompany LimitedJin-Su IndustriesLimitedRelationshipSubsidiarySubsidiaryNature oftransactionsLoanInterest on loanSales/ ReceivableLoanInterest on loanTransactionsduring theperiod5,322,1062,661,78530,148,6801,016,000332,764Outstandingbalance as at31 December201091,845,18030,148,68012,440,913Subsidiary Loan payment 50,000 50,000CommonDirectorsCommonDirectorsCommonDirectorsLoanInterest on loanSales5,713,0031,291,911143,071,305LoanInterest on loan 155,080LoanInterest on loan 182,15248,691,555143,071,3055,324,3996,253,879Except the above the Company neither entered into any transaction norproposed any transaction during the last 02 (two) years between the issuerand any of the following persons:(a) Any Director or Executive officer of the issuer.(b) Any director or officer.(c) Any person owning 5% or more of the outstanding share of the issuer.(d) Any member of the immediate family (including spouse, parents,brothers, sisters, children, and in-laws) of any of the above persons.(e) any transaction or arrangement entered into by the issuer or itssubsidiary for a person who is currently a Director or in any way connectedwith a Director of either the issuer company or any of itssubsidiaries/holding company or associate concerns, or who was a Directoror connected in any way with a Director at any time during the last threeyears prior to the issuance of the prospectus.(f) The company did not take or give any loan from or to any Director or anyperson connected with any Director nor did any Director or any personconnected with any Director.(g) Any director holding any position, apart from being a director in theissuer company, in any company, society, trust, organization, orproprietorship or partnership firm.

(h) There were no facilities whether pecuniary or non-pecuniary enjoyed bythe Directors except the Managing Director as mentioned in note 25.1 of theaudited accounts.Shareholders Shareholding of 5.00 % or More of the Company:There is no shareholders shareholding of 5% or more except the followingshareholder of the company:NameDesignation ShareholdingPercentage(%)Chen I Hao Shareholder 4,315,140 5.07Net Tangible Asset per Share:Audited financial statements of the Company as at 31 December 201031 December 2010ParticularsTakaRepresented byShare capital 850,000,000Share Premium 175,000,000Retained earning 149,080,118Special reserve 346,987,7441,521,067,862Application of fundProperty, plant and equipment 436,094,696Investments 7,375,550Inter-company loans 164,605,926Current assetsInventories and consumables 767,786,968Goods in transit 20,805,345Trade receivables 483,726,496Advances and deposits 133,306,021Cash and cash equivalents 12,492,2881,418,117,119Less: Current liabilitiesTrade payables 32,746,410Other payables 62,807,422Current portion of long term loanShort term loan 169,415,300Bill finance 229,160,325Income tax liabilities 9,228,177Provident fund 1,767,795505,125,429Net current assets 912,991,6901,521,067,862

Net Tangible Assets per ordinaryShare(Tk.) 17.89From the above calculation it appears that Net Tangible Assets Value perShare is Tk.17.89 which is higher than the offering price.Determination of Offering PriceThe issue price at Tk. 30 each including a premium of Tk. 20 per share isjustified as details below:(I)Net asset Value Per Share (NAV)The offering price of the common stock of <strong>LSI</strong> Industries Limited hasbeen determined by assessing the Net Asset Value (NAV). The financialcalculations are presented from the audited accounts as at 31December, 2010.NAV is also equivalent to the Equity Based Value per Share which isdepicted below:ParticularsAmount(BDT)Share capital 850,000,000Share premium 175,000,000Retained earnings 149,080,118Special reserve 346,987,744Total Shareholders’ Equity 1,521,067,862Total number of shares 85,000,000Equity Based Value Per Share 17.89(II)Earning Based Value per sharePeriodNet ProfitAfter TaxEarningsPer ShareJuly 2010-December2010 133,702,829 1.572009-2010 215,203,031 2.532008-2009 140,113,799 2.802007-2008 116,822,652 161.822006-2007 246,198,306 246.202005-2006 42,890,306 42.89Average 62,714,713 83.24(Amount in BDT)The weighted average net profit after tax for the last 5.50 years stands at Tk.162,714,713 and the weighted average EPS stands at Tk.83.24. The PriceEarning Multiple (PE) at issue price of Tk. 30.00 each including a premiumof Tk. 20.00 per share stands at PE 0.36 as opposed to the present PE ofTextile Industry 52.44 (as per DSE record) as on 30.12.2010. On the basis ofprice earnings multiple of 52.44 of Textile sector as on 30.12.2010, theearning based value of shares of the Company stands at Tk.4365.10 (52.44 x83.24), a price much higher than the price offered.Convertismly, If we consider average EPS of the last 2.5 years 2.76(1.57+2.53+2.80/2.5) and PE 15 (though PE of Textile sector is 52.44 as on30.12.2010) the earning based value of shares of the Company standsTk.41.40 (15.00 x 2.76), a price higher than the price offered.

(III) Projected Earnings Based Value Per Share:Projected Earning PerPeriodShare(Amount in BDT.)June 30, 2011 3.45June 30, 2012 3.30June 30, 2013 4.21Average EPS 3.65The weighted average EPS for the next 3 years stands at Tk.3.65 If weconsider the share price of the Company on the basis of price earningsmultiple of 52.44 Textile sector as on December 30, 2010 the earning basedvalue of per share of the Company stands at Tk.191.40, a price much higherthan the price offered for rights shares.(IV)Average market price of similar stockMarket price per share at the last trading day of preceding 12 months(April2010 to March 2011) is given in the following table that remained far abovethe offer price of Tk. 30.00 each including premium Tk. 20.00 per share.From the above record it is very clear that average market price of similarstocks is 82.05. So, offer price of Tk. 30.00 each including premium Tk.20.00 per share of <strong>LSI</strong> Industries Limited is much lower than its expectedmarket price. Hence the offer price is quite justified.(V) Projected Equity Based Value/ Book Value per ShareProjected Equity Based Value/ Book Value per Share of Tk.30.00 eachincluding a premium of Tk.20.00 per share of the Company is as under:(Amount in BDT)PeriodEquity Based Value PerShareJune 30, 2011 19.78June 30, 2012 24.75June 30, 2013 26.71Average 23.74From the foregoing as summed up below the determination of the offer priceTk. 30.00 each including premium Tk. 20.00 per share is quite justified.Justification of Offering Price Under Different Methods BDTNet Asset Value per share 17.89Earning Based Value per Share 41.40Projected Earnings Based Value Per Share 191.40

material is competitive in China. The company will focus on getting directnomination from foreign master buyers especially from European and USmaster buyers to reduce slow season to make balance between supply anddemand, and the company also already increased production capacity andstabilize quality development. The company is continuing modernizationprogram of its machinery and equipments.(e) Potential or existing government regulationsThe Company operates under companies act, taxation policy adopted byNBR, Security and <strong>Exchange</strong> Commission (SEC)’s rule and rules adopted byother regulatory organizations. Any abrupt changes of the policies formed bythose bodies will impact the business of the Company adversely. Unlessadverse policies are taken, which may materially affect the industry as awhole; the business of the Company will not be affected.<strong>LSI</strong> management is very keen in investment plan and decisions, which isexpected to produce positive result. It can also be expected that theGovernment will not create any situation leading to abrupt losses ofinvestments, especially when industrial output is showing signs of rapidgrowth. Government is continuing focus on the growth of accessoriesIndustry to boost up the export of RMG.(f) Potential changes in global or national policiesThe Company’s product lines consist of metal brass and alloy button series,all kinds of zippers, belt, tape, elastic, Velcro tape, plastic products andother garment /cap/shoe accessories which are mostly based on importedraw materials. The scarcity of raw materials due to changes in internationalmarket could affect the production and profitability. Law and order situationand political unrest may also jeopardize Company’soperations and adversely affect profitability.The management of the company is always concerned about the prevailingand future changes in the global and national policy and shall responseappropriately and timely to safeguard the company's interest. The work forceof <strong>LSI</strong> is well trained, experienced and remunerated and most of them live inthe surrounding areas of the respective plants. Furthermore the companyitself produces main raw material (brass wire/zinc alloy) in the samepremise, and inventory is good for 90 days production demand Therefore,management believes that political instability will have a less force tohamper the key operations of the company.(g) Operational riskShortage of power supply, labor unrest, unavailability or price increase ofraw materials, natural calamities like flood, cyclone, earthquake etc. maydisrupt the production of the Company and can adversely impact theprofitability of the Company.The Company always provide competitive compensation package to itsemployees and maintain a healthy workers management relationship. The

project of the Company is situated at a high land and protected area ofBEPZA where there was no record of flood. The factory building has strongRCC foundation, RCC floor, pre-fabricated steel structure and RCC buildingsto withstand wind, storm, rain etc. along with good drainage facility. TheCompany’s products have a good reputation in the market and always takespragmatic steps to convince the customers to share a portion of theincreased burden of cost increase and company do not compromise withquality of the products. Risks from these factors are also covered throughInsurance.(h) History of non operation, if anyIs there any history for the Company to become non-operative from itscommercial operation?The Company is in commercial operation since 01 June 1999 and it has nohistory of non operation till now. The Company has an independent bodythat is operated by its Memorandum & Articles of Association and otherapplicable laws Implemented by the Government. Besides, the Company’sfinancial strength is satisfactory. It has very experienced Directors andManagement team to make the Company more efficient and stronger. So, thechance of becoming non-operative for the Company is minimal.