Information Document - Dhaka Stock Exchange

Information Document - Dhaka Stock Exchange

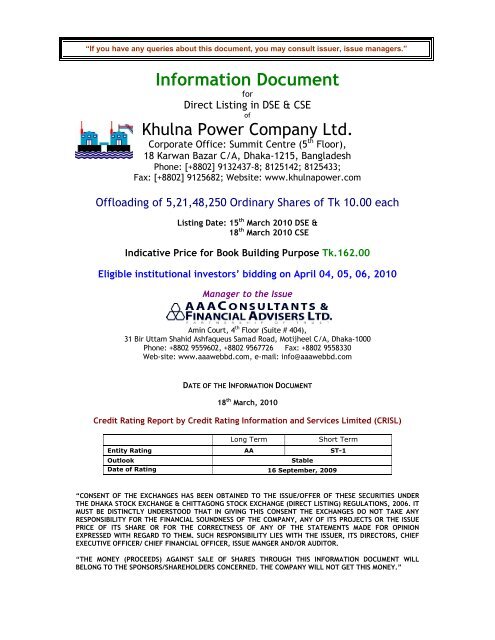

Information Document - Dhaka Stock Exchange

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2. Procedures to be followed for determining price under book building methodi) The indicative price which has been determined by the issuer in association with issuemanager and eligible institutional investors shall be the basis for formal price building with anupward and downward band of 20% (twenty percent) of indicative price within which eligibleinstitutional investors shall bid for the allocated amount of security;ii) Eligible institutional investors bidding shall commence after getting consent from thecommission for this purpose;iii) If institutional quota is not cleared at 20% (twenty percent) below indicative price, the issuewill be considered cancelled unless the floor price is further lowered within the face value ofsecurity;Provided that, the issuer’s chance to lower the price shall not be more than once;iv) No institutional investors shall be allowed to quote for more than 10 %( ten percent) of thetotal security offered for sale through book building method, subject to maximum of 5 (five)bids;v) Institutional bidding period will be 3 to 5 (three to five) working days which may bechanged with the approval of the commission;vi) The bidding will be handled through the uniform and integrated automated system of thestock exchanges;vii) The volume and value of bid at different prices will be displayed on the monitor of the saidsystem without identifying the bidder;viii) The institutional bidders will be allotted security on pro-rata basis at the weighted averageprice of the bids (within the cut off price) that would be clear the total number of securitiesbeing issued to them;ix) Institutional bidders shall deposit their bid with 20% (twenty percent) of the amount of bid inadvance to the designated bank account and the rest amount to settle the dues againstsecurity to be issued to them shall be deposited within 2 (two) working days prior to the dateof opening normal trade for general investors;x) In case of failure to deposit remaining amount that is required to be paid by institutionalbidders for settlement of the security to be issued in their favor, 50% (fifty percent) of bidmoney deposited by them shall be forfeited by the commission. The securities earmarked forthe bidder who defaulted in making payment shall be added to the investor quota.3. Indicative Price for Book Building PurposeBased on Indicative Price Offers received from seven Institutional Investors from amongst fourgroups of institutional investors referred in rule 8.B.(16)(4)(c) of the Securities And <strong>Exchange</strong>Commission (Public Issue) Rules, 2006; the Indicative Price for Book Building Purpose is fixed, inconsultation with the issue Manager and price offer from the eligible institutional investors throughproper disclosure, presentation, document, etc. at Tk 162.00 only as follows:-SI No Offered by Category IndicativePrice1 Standard Bank Ltd Financial Institution 1652 Continental Insurance Ltd Insurance company 1673 Swadesh Investment Management Ltd Merchant Banker 160Bangladesh Finance & InvestmentNon Banking1554 Company LtdFinancial Institution5 SAR Securities Ltd. <strong>Stock</strong>-Dealer (DSE) 1606 B & B Enterprise Ltd <strong>Stock</strong>-Dealer (DSE) 1657 Royal Capital Limited <strong>Stock</strong>-Dealer (CSE) 165Average 1622

The Indicative Price for Book Building Purpose is justified on the basis of the followingqualitative and quantitative factors:-A. Earnings Based Value per share (EBVPS) based on financial statement for the year ended31 December 2009A.1 Earnings per share (EPS) 2.79A.2 Average Market P/E of the sector 30A.3 Earnings Based Value Per Share (A.1x A.2) 83.7B. Earnings Based Value per share (EBVPS) based on projected financial statement for theyear ended 31 December 2010 to 2014B.1 Earnings per share (EPS) 6.62B.2 Average Market P/E of the sector 30B.3 Earnings Based Value Per Share (B.1x B.2) 198.6C. Net Asset Value Per Share(NAVPS) based on financial statements for the year ended 31December 2009C.1 Net Asset Value 3,865,314,106C.2 Number of Shares 208,593,000C.3 Net Asset Value Per Share (NAVPS) (C.1/C.2) 18.53D. Market Value Of similar share under Power industry:Company Name<strong>Dhaka</strong> Electricity SupplyCompany LtdFace Value(BDT)10*Six Month Avg.Price (BDT)166.08*Summit Power Limited 10* 129.46*Average 147.77* In equivalent face valueThese companies’ stock prices are greater than their issue prices and face value. The strongestreasons are the earning potential of the companies. Most of the companies are operating in theirfull capacity and they are consistent in their operating performance and market dominance.Qualitative factors: Rationales for fixing indicative price of KPCLA) CRISL has assigned “AA” (pronounced as double A ) rating in the Long Term and “ST-1” rating in theShort Term to Khulna Power Company Ltd. based on financials and other relevant quantitative andqualitative information. The above ratings have been done on the basis of its good fundamentals suchas sound equity based capital structure, sound debt repayment background, high quality plant,satisfactory profitability, government guarantee against power purchase, insignificant market risk ondemand, government supportive policies for power sector etc. Entities rated in this category areadjudged to be of high quality, offer higher safety and have high credit quality. This level of ratingindicates a corporate entity with sound credit profile and without significant problems. Risk factorsare modest and may vary slightly from time to time because of economic conditions. The short termrating indicates highest certainly of timely payment. Short-term liquidity including internal fundgeneration is very strong and access to alternative sources of fund is outstanding. Safety is almost riskfree like Government short-term obligations.B) Bangladesh Power Development Board (BPDB), off-taker of KPCL, acknowledges KPCL as the bestavailable and the most reliable power plant for its excellent track record in operation. It has beensuccessfully supplying reliable power to the national grid since 1998 without any interruption for asingle day. KPCL plant has also been recognized by the third party inspectors, surveyors andspecialists as the best maintained fuel oil operated power plant. The plant availability has alwaysbeen near to 100%.3

C) KPCL never compromises with the quality of operation, maintenance, safety of plant and personneland in that consideration, engaged Wartsila, Finland, a world renowned equipment manufacture (alsothe manufacturer of KPCL plant), for the operation and maintenance of KPCL plant. KPCL plantoperation has been certified by Bureau Veritas (BV) on :• Quality Management System (QMS) with ISO 9001 – 2008• Environmental Management System (EMS) with ISO 14001 – 2007• Occupational Health and Safety Administration System (OHSAS) 18001 – 2007D) KPCL plant engines are having the dual fired capability i.e it can be converted into natural gaswhenever gas will be available at the south-eastern region. Conversion into natural gas will enablethe company to earn more revenue as compared to running on furnace oil, since the gas tariffstructure as fixed by BPDB is more attractive than furnace oil based tariff structure.E) The strategic location of the KPCL plant at the south-eastern region is an added advantage for KPCL.There are only few power plants in that region and as such KPCL is required to meet major portion ofthe demand of that region. Therefore, the utilization of the entire capacity of KPCL plant through outthe year is almost certain.F) The useful life of KPCL plant is 30 years. Therefore, no further capital investment will be required forthe existing plant to carry out another extended term.G) BPDB is the only buyer of KPCL and thus the revenues are 100% realizable. Unlike DESCO or DESA,KPCL has no system loss or no bad or doubtful debt.H) In the context of Bangladesh economy, the demand for power or the demand of power sector isthriving and insatiable. At present, the demand and supply gap is 1,700 MW. In consideration ofcurrent generation capacity, also together with the future planning for generation of additionalcapacity, Bangladesh will not be able to meet the increasing demand for power. As a result, thepower sector will continue to rule as top most demanding and dominating sector in the economy andno other sectors enjoys such a high demand profile. Therefore, KPCL’s revenue earnings and itsfurther growth and future potential is highly certain beyond any doubt.I) The proposed expansion of KPCL plant will enhance the KPCL earnings almost three times higher thanthe existing one. There will be no further fixed operating expenditure except the variables for theadditional unit as the same will be run by the same management and production team. No furtherland will be required and the engines are likely to be more efficient for improved technology over theyears.J) KPCL’s long eleven years of experience in running liquid fuel power plant and proven record ofoperation will help KPCL management to run the expansion unit more efficiently and diligently and toachieve more optimization and economy of operation which will contribute to the enhancement ofKPCL’s earning.Extension for another term of the project and Expansion of the capacity for additional 100 MW(+/- 10 MW):Rationale:i) The Article 2.3 of PPA has a clear provision that the project is renewable for a further period, subject toagreement in writing by the parties at the latest twelve months prior to the expiry.ii) The KPCL plant is most reliable and efficient plant in the BPDB grid, available for 365 days of the year andwith its 19 generating units, it is the most flexible and capable to meet BPDB’s ever varying load demand.iii)iv)For dwindling natural gas production in the country, the natural gas based power plants are in deepcrisis. Natural gas is being used in 85% of total generation and due to short supply, a few of theexisting plants running on gas may face shut down in the near future. Taking the above intoconsideration, the Govt. has already adopted a policy to use liquid fuel for generation of electricity.Accordingly, the future power plants will be built based on liquid fuel operation. Therefore, theextension of the term of KPCL plant is the imperative for the BPDB to meet the shortage of power.KPCL plants runs on Furnace Oil, the least cost liquid fuel, shall be most viable commercially.v) The existing shortage in generation capacity of the country shall continue to exist much beyond theyear 2013, when the tenure of the current PPA expires. Even in the year 2013 many of the BPDB oldplants shall retire and many will face shut down or capacity reduction owing to gas shortageTherefore, the extension of current PPA with BPDB shall take place as a natural consequence.Currently maximum generation capacity of all public and private power plants together is about 4,300 MW butcountry’s peak demand is about 6,000 MW. There is a demand supply gap of 1,700 MW and it will be widenfurther as a result of the general increase of demand. Considering of the increasing demand of power and the4

govt.’s future planning for addition of new generation, yet the demand supply gap will be increasing like 2,648MW in 2011, 3,132 MW in 2012, 3,259 MW in 2013, 3,799 MW in 2014 and 4,362 MW in 2015. Most interestingly,in 1998 when KPCL plant was connected to the national grid, the demand supply gap was about 1,000 MW andover the last 11 years it has gone up to 1,700 MW. In order to minimize the shortage of power, initiatives arebeing taken by the Govt. to welcome private sectors to set up more power plants.KPCL is currently in negotiation with BPDB for its expansion for additional capacity of 100 MW (+/-10 MW). Inview of the above mentioned existing shortage, further worsening in future due to gradual increase of demandof the power and the short supply of natural gas, the Govt. has decided to offer the expansion of the capacityof existing power plants which are running on liquid fuel. KPCL plant is among the two plants that are runningon liquid fuel and thus proposed for expansion which is in process.Therefore, for the reasons stated above the Govt. of Bangladesh is strongly considering the expansion of KPCLplant capacity by another 100 MW (+/- 10 MW).Energy sector companies are strong player with huge operating profit and its shareholders have takenthe benefit of direct listing from the gain of offloading of shares. Superior asset management andearning potential, strong fundamental position, greater liquidity and technological soundness makethese companies better player in the stock market. KPCL is a peer company of these companieswhich also has a sound financial background and operational efficiency. So, it is optimistic toexpect that KPCL will perform better than its Competitors and Peer companies. Considering theaverage value and the fact that the company is renowned “Electricity generating company” havingwell known client’s base and brand image, so the indicative price is just and fair.4. The company has opened an Escrow account with BRAC Bank Limited “Khulna Power EII EscrowAccount” No. 1501100976943002 for collecting bid money from the eligible institutional biddersunder Book Building Method.ToThe Secretary<strong>Dhaka</strong> <strong>Stock</strong> <strong>Exchange</strong> Limited<strong>Dhaka</strong>Dear Sir,UNDERTAKINGToThe board of directorsChittagong <strong>Stock</strong> <strong>Exchange</strong> LimitedChittagongWe undertake, unconditionally, to abide by the Listing Regulations of the <strong>Dhaka</strong>/Chittagong <strong>Stock</strong><strong>Exchange</strong> Limited which presently are, or hereinafter may be in force.We further undertake:That our shares and securities shall be quoted on the Ready Quotation List and /or the Cleared Listat the discretion of the <strong>Exchange</strong>.That the <strong>Exchange</strong> shall not be bound by our request to remove the shares or securities from theready Quotation List and /or the Cleared List.That the <strong>Exchange</strong> shall have the right, at any time to suspend or remove the said shares orsecurities for any reason which the <strong>Exchange</strong> considers sufficient in public interest.That such provisions in the Articles of Association of our company or in any declaration or basisrelating to any security as are or otherwise not deemed by the <strong>Exchange</strong> to be in conformity withthe Listing Regulations of the <strong>Exchange</strong> shall, upon being called upon by the <strong>Exchange</strong>, be amendedto supersede the Articles of Association of our company or the declaration or basis relating to anysecurity; andThat our company and /or the security may be de-listed by the <strong>Exchange</strong> in the event of noncomplianceand breach of the Regulations and/or of this undertaking after giving an opportunity ofbeing heard to us.Yours faithfully,Sd/-Managing Director5

B. RISK FACTORS AND MANAGEMENT PERCEPTION ABOUT RISK:As with all investments, investors should be aware that there are some risks associated with aninvestment in the Company. The investors should carefully consider the following risks in additionto the information contained in the prospectus for evaluating the offer and taking decision whetherto invest in shares of the company.a) Interest Rate Risk:Interest/financial charge are paid against any kind of borrowed fund/ preference shares. Instabilityin money market and increased requirement for fund may put pressure on interest rate structure.Rising of interest rate increases the cost of borrowed fund and consequently it may impact on theprofitability.Management Perception: Currently, KPCL has working capital debt obligation from several banksand preference shares which are comprised with fixed financial charges. But the Company has solidrevenue source and is highly profitable. The rate for the financial charges are fixed so, KPCLdoesn’t have such risk.b) <strong>Exchange</strong> Rate Risk:KPCL imports mostly fuel against payment of foreign currency. Unfavorable volatility or currencyfluctuation may affect the profitability of the company.Management Perception: KPCL is fully aware of the risk related to currency fluctuation butpractically doesn’t possess any foreign exchange risk as 99% of the Other Monthly Tariff (OMT)isconvertible and fuel is being imported through L/C and the exchange rate Sonali Bank Ltd. isacceptable to BPDB under pass through payment process. Moreover, KPCL executes favorable andcompetitive foreign exchange rate from its bankers against its L/C payments.c) Industry Risk:The supply of electricity and alternative energy is not adequate than the demand of it. For thatreason organizations engaged in generating electricity can’t provide all required amount ofelectricity. Power companies mainly supply electricity to national power distributors to supplyelectricity.Management Perception: KPCL supplies electricity to BPDB in the south-western region ofBangladesh and it’s a dedicated power plant with a guaranteed payment from BPDB and GoB underthe PPA. So, possibilities of entering new power companies wouldn’t create any industry risk forthe company.d) Market and technology related Risk:Technology is related to generation, transmission, distribution, quantity measuring and maintainingof required electricity generation.Management Perception: The Company is operated by the plant manufacturer, Wärtsilä, theleading power plant manufacturer and plant operator in the world. Wärtsilä is technologicallyadvanced enough to keep KPCL plant out of such risk.e) Potential or existing Government regulation:The business activities of KPCL is fully controlled by policies, rules and regulation framed bygovernment, that is policies related to electricity price fixation, demand & supply and distributionis fully under the control of Government. So, government policies in this regard may impactbusiness operation of KPCL.6

Management Perception: The Power Purchase Agreement with BPDB safeguards KPCL from anychanges in government regulation. The PPA agreement is valid for 15 years till 2013 and can beextended upon the consent of both parties. Moreover, in case of PPA termination, KPCL will getcompensation under the agreement from BPDB or GoB. Additionally, the huge shortage of power inthe country minimizes the chances of terminating the PPA agreement that mitigates related risks.f) Potential changes in the global or national policies, natural calamities etc:The performance of the company may be affected due to unavoidable circumstances in Bangladesh,as such political turmoil, war, terrorism, political unrest in the country may adversely affect theeconomy in general. Moreover, natural disasters like Cyclone, Tide, and Earthquake may hampernormal performance of power generation.Management Perception: The risk due to changes in global or national policies is beyond controlfor any company. Yet the company is well prepared for adoption of policies and preventivemeasures as and when required to reduce the risk. The routine & proper maintenance of thedistribution network undertaken by BPDB reduces major disruption due to natural calamities. Butsevere natural calamities, which sometimes are unpredictable and unforeseen, have the potentialto disrupt normal operations of KPCL. But with prudent rehabilitation schemes and the veryeffective and quick repair and maintenance lessened the damages caused by such disasters.Political unrest leading to strikes, hortals etc. certainly plays negative impact in any business. Butelectricity service being considered a daily necessity & in consideration of its use by allirrespective of their political thoughts is always kept out of obstructions.Furthermore, all such above risks are covered under the insurance agreement with CODAN Marine(a subsidiary of RSA Group) to compensate the damages due to such uncertainties in extremecases. Thus, the risk due to natural calamities & political unrest is minimized.g) Operational Risk: Risk associated with limited tenure of the present Power Purchase Agreement:The tenure of the present PPA between the Company and BPDB is limited to 15 (fifteen) years fromthe date of commercial operation i.e. till 13 th October, 2013.Management Perception: On the backdrop of development need for the economy, powergeneration is one of the priority sectors of the government. With the existing deficit in powergeneration capacity, the government is expected to continue with the same policy level supportfor the sector. Dispute with any one operator may lead to adverse repercussions throughout theindustry. As such, no major dispute with the government is envisaged. There is a provision in thePPA for enhancement of the project life. BPDB and KPCL have been considering to expand thecapacity of the Berge Mounted Power Plant utilizing the area of its leasehold property, KPCL wantsto install additional 7 generation units with the capacity of 15 MW each to generate total 100 MW.The strategy is to generate and produce more electricity by using fewer big engines with higher fuelefficiency. Risk associated with single party exposure:The BPDB is the single buyer who purchases total electricity generated by the Company. TheCompany’s ability to service its both existing and future financial obligations rest on the BPDB’sability to meet the tariff payments under the PPA.Management Perception: KPCL is out of the single party risk exposure as it is guaranteed by BPDBfor the payment in case the plant runs lower than 50%. Moreover, L/C issued by BPDB for twomonths’ minimum guaranteed payment. Therefore, the Implementation Agreement signed by theGovernment through Ministry of Power, Energy and Mineral Resources is considered to beGovernment guarantee to protect the Company from single party risk exposure.7

Risk associated with tariff of electricity:The BPDB is the single buyer who purchases total electricity generated by the Company. In thesecircumstances usually it is the buyer who may determine the tariff value of the electricitygenerated by the Company.Management Perception: In this case no risk is associated as BPDB and the Company have predeterminedand contracted the terms and condition regarding the tariff of electricity, expressedunder two slabs – Other Monthly Tariff (OMT) and Fuel Tariff (FT) where OMT is based on deliveredMWh and FT is pass through. Tariff for each year is adjusted and indexed from time to time inaccordance with the PPA and the said Reference Tariff is used to calculate the Tariff in Effect forany Billing Month during the Term of the Agreement. Risk associated with supply of raw materials:The main raw material for generating electricity is Heavy Fuel Oil (HFO). Any interruption ofsupplies of the fuel to the power plants will hamper the generation of electricity, the only productof the Company.Management Perception: Kuo Oil Pte Ltd. Singapore has been supplying Heavy Fuel Oil (HFO) to theCompany through United Summit Coastal Oil Limited and the risk of price fluctuation in the globaloil market is automatically done by the very FT structure which is based on fuel cost as a passthrough item. Moreover, KPCL can source HFO from other sources if Kuo Oil is unable to supply. Risk associated with supply of spare parts:The power plants are dependent on timely supply of spare parts for smooth operation purpose. Anydisruption in supply flow of spares parts will put an adverse impact on power generation.Management Perception: Under the Operations & Maintenance Contract with Wartsila, theCompany has signed a Spare Parts Support Agreement (SPSA). Wärtsilä also maintains sufficientspares parts inventory for smooth operation of KPCL plants. In addition, KPCL maintains safetyspare parts stock of US$ 2 million. Risk associated with payment:There is an impending risk in the case of delayed payment from BPDB. In case of any dispute withBPDB or failure to comply with certain rules and regulations, BPDB may stop making payments toKPCL resulting into non-payment to its lenders.Management Perception: KPCL is getting the payment regularly from BPDB. Sometimes, there aredelays in payment but that is mainly due to administrative reasons. Till date, no payment has beendefaulted. As per the PPA with BPDB, there is a penalty clause and BPDB needs to ensure minimumguaranteed payment supported by Letter of Credit. .Additionally, GoB through the Implementation Agreement provides sovereign guarantee withregard to payments, hence possibly mitigating risk of any non-payments. Risk associated with systems failure and sabotage:System failure may take place resulting into damages for KPCL. Moreover, internal conflict amongthe workers and engineers may also disrupt operation.Management Perception: There is an agreement with the O & M Contractor and equipmentsupplier to provide maintenance and equipment support. Additionally, any equipment andmechanical support will be provided for in case the plant needs to be converted from a fuel basedto a gas based plant. In addition, the company has prudent insurance coverage with CODAN Marinewhich covers all risks package including Machinery Breakdown, Business Interruption, Third PartyLiability, Sabotage and Terrorism.8

C. DESCRIPTION OF THE BUSINESS:<strong>Information</strong> about the Company• BackgroundIn 1997 the Bangladesh Power Development Board (BPDB) was faced with the challenge to ease acritically short power supply in the South Western Zone of Bangladesh. The electrical demand hadbeen consistently higher than available capacity, and generation costs in the area had been veryhigh due to the low efficiency of existing equipment and the heavy use of expensive, lowavailabilityfuel. In October 1997, BPDB signed a Power Purchase Agreement with Khulna PowerCompany Ltd. for a 110 MW floating base load power plant at Khulna, to help ease the electricityshortage.• DescriptionKhulna Power Company Ltd. is a public limited company which was incorporated as a privatelimited company in Bangladesh on October 15, 1997. Its paid up capital is BDT 2085.93 million (US$44.10 million) It is the first independent 110MW barge-mounted power plant that commencedoperation in October 1998 under a 15 year PPA from the government (expiry 2013). Whenestablished, KPCL shareholders were Coastal Power Company (later Coastal was merged with ElPaso Corporation, USA) through its direct wholly-owned subsidiary El Paso Khulna Power ApS,Summit Industrial & Mercantile Corporation (Pvt.) Ltd. (Bangladesh), United Enterprises & Co Ltd.(Bangladesh) and Wärtsilä Development and Financial Services (Asia) Ltd. Now only localshareholders hold 100% ownership of the company. KPCL project was initially financed by the IFCand the sponsors’ equity with a debt-to-equity ratio of 54:46. The total initial project cost was USD96.07 millionThe principal activity of KPCL is to own and operate barge mounted power plants in Khulna andsupply electricity to the national grid of Bangladesh. The plant came into operation in October1998. Nine engines generators are mounted on one barge and ten on the other. The barges, shippedas deck cargo on a submersible dry tow ship, are moored in a closed basin. Each barge isapproximately 91 meters long and 24 meters wide. These two barge-mounted plants wereconnected to the national grid. The plant consumes about 600 MT of Heavy Fuel Oil daily togenerate 110 MW power by the 19 generators on the two barges located in Khalishpur, Khulna.The project was the first IPP implemented under the then new Government of Bangladeshguidelines for private power projects. As Bangladesh has enjoyed steady growth in recent years, theinfrastructure to supply electricity to the economy has not kept pace with this growth. Reliabilityof electricity supply, which has been a growing problem over the years, has now reached crisisproportions. Peak demand is about 5500-6000 MW, whereas available generation is about 4200-4500MW. The demand supply imbalance has now become a major bottleneck to economic growth. TheKhulna power project is a fast-track response to the power shortage.KPCL plant was designed to alleviate the severe power shortages in the Khulna and adjacent areas,identified as industrial growth Centres by the Government of Bangladesh, while improving theoverall reliability of the country's power supply. The facility displaced the generating capacity ofthe older, less efficient, and high-cost plants in the region. The plant conformed to all applicableenvironmental standards.The plant has already changed the economy of the adjacent region directly and positively. It hasprovided employment to over 110 people from the surrounding areas and many of the jobs aretechnical and managerial in nature. Significant numbers of jobs have been created at the fuelterminal, barges, restaurants, transportation services, and other ancillary businesses created toserve the needs of the plant. New industrial and commercial establishments have been opened totake advantage of the stable and reliable power, and existing establishments do not require backupgenerators. In addition, the plant has contributed significant funds toward social causes in theregion.10

• OwnershipThe ownership structure of KPCL is as follows:Summit Industrial and Mercantile Corporation (Pvt.) Ltd. 49.9832%United Enterprises & Co. Ltd. 49.9832%Others 0.0336%• Company At A GlanceCompany Name: Khulna Power Company Ltd. (KPCL)Registered Address: Summit Centre (5 th Floor), 18 Karwan Bazar, <strong>Dhaka</strong>-1215Plant Address: Goalpara, Khalishpur, KhulnaPaid Up Capital: Tk. 2,085,930,000.00 (Ordinary Shares)Tk. 1,100,000,000.00 (Preference Shares)Sponsors: Summit Industrial and Mercantile Corporation (Pvt.) Ltd.United Enterprises & Co. Ltd.Unique Client: Bangladesh Power Development BoardEPC Contractor: Wärtsilä NSD OY, FinlandNumber of Employees : KPCL has 10 and plant has 113 engaged by Wärtsilä O&M operatorTotal electric output: 110 MWElectrical efficiency : 43.5 %Engine type: 19 x Wärtsilä 18V32LNYear of Starting Operation : 13 th October 1998Annual General Meeting held in last 5 years:Year Date of AGM held Declared dividend2004 (7 th ) 3 May 2005 7% Cash2005(8 th ) 11 September 2006 Nil2006(9 th ) 24 July 2007 Nil2007(10 th ) 21 June 2008 57.53% Cash2008(11 th ) 23 June 2009 10% Cash12

Background of Past ShareholdersEL PASOEl Paso, North America’s leading provider of natural gasservices was a 73.9% shareholder in KPCL. The company hascore businesses in production, gathering, processing, andtransmission of natural gas, as well as liquefied natural gastransport and receiving, petroleum logistics, power generation, and merchant energy services. It isrich in assets and is fully integrated across in natural gas value chain and is committed todeveloping new supplies and technologies to deliver energy to communities around the world.El Paso Energy International pursues a low risk, power-oriented investment strategy, as a projectdeveloper. This strategy has helped the company build diversified project portfolios supported byfixed return contracts in countries around the world. These portfolios present significantopportunities to build robust businesses in selected markets where the right combination ofeconomic, regulatory and industry conditions exist. By focusing on regional business growth, El Pasocan export the broader skill set of the entire company to produce significant growth.WÄRTSILÄWärtsilä Corporation is the leading global ship power and powerplant supplier. Wärtsilä enhances the business of its customers byproviding them with complete lifecycle power solutions. It is amajor provider of solutions for decentralized power generation andof supporting services. Most of its IPP deliveries were directed toAsia, North America and all other continents.Wärtsilä plans to contribute to solving the global needs of sea transportation and power generationby developing equipment and services that convert fuels into power efficiently at the lowestpossible environmental impact. It has its own worldwide service network in 80 countries. Wärtsilätakes complete care of customers’ ship machinery and related equipment at every lifecycle stage.It plans to expand the business by providing innovative, reliable and valuable service, such as non-O&M service in key ports, scheduled and condition-based maintenance, as well as operations andmaintenance contracts.14

• The year 1999 marked one of the highest rates of growth in the company’s historythrough the formation of various companies in partnership with other majorcompanies and conglomerates both domestic and international. In 1999 SIMCLpartnered the United Group and Wartsila USA to form KPCL, the country’s first110 MW Barge Mounted power Generation plant. That year also led to theformation of USPCL, an LPG plant in Mongla, in association with the UnitedGroup. Finally, the year was rounded to a close, in terms of energy developmentthrough the formation of USCOL, an energy oil company, in conjunction with ELPaso USA and the United Group. The year 1999 also earmarks the establishmentand development of USSL, a shipping company, created with joint partnershipbetween Summit and United Group. In its year of conception it bought two Oceangoing tanker vessels and became the first ISO 9002 certified shipping company inBangladesh. Summit continued its extraordinary growth through the formation ofSummit Pipeco Limited in partnership with the Alliance Group. Summit Pipecoteamed up with Daquing a company based out of China to execute the EPC of 54Km Ashuganj- Hobiganj gas pipe line construction work in Bangladesh• In 2000 summit power limited (SPL) was established to set up ‘distributedpower’ in Bangladesh. Presently SPL has seven power plants providing electricityto 600,000 homes, generating 215 MWs of electricity with natural gas as its fuel.• In 2004, the company formed SAPL to expand its capacity and operations in thecontainer terminal field. SAPL is also traded and publicly listed in the <strong>Dhaka</strong> <strong>Stock</strong><strong>Exchange</strong> and Chittagong <strong>Stock</strong> <strong>Exchange</strong>. OCL and SAPL together deals with 15%of the country’s import cargo and 30% of the export cargos. The two companiesare both located in Chittagong port and helps facilitate port services, they over50 acres of freehold land and operates a streamlined modern container handlingand empty storage facility with a capacity of 4000 tones.• In 2006, the Summit acquired a <strong>Dhaka</strong> <strong>Stock</strong> <strong>Exchange</strong> membership (Membership #146) in the name of Cosmopolitan Traders (Pvt.) Limited a sister company ofSIMCL and substantial share of the following companies:i) National Housing Finance & Investments Limited.ii) IPDC of Bangladesh Ltd.iii) Bangladesh Commerce Bank Limited• In 2009, the company set up SCL (Summit Communications Limited) to break intothe telecommunication sector to provide much needed revitalization to theBangladesh’s telecommunications. Improvement in the telecommunicationssector is a move towards ingratiating Bangladesh into the larger globalcommunity. This project is yet another inference to the revolutionary nature ofSIMCL investment portfolio.SIMCL’s financial position at the end of the accounting year as of 31 st December 2009 was in a soundand stable position having a total of Taka 593.70 crores in total assets with a net worth of Taka560.32 crores. The total turnover for the year was Taka 198 crores with a net profit of Taka178.29crores after tax.Ocean Containers Ltd.Ocean Containers Limited (OCL) is a pioneer in the inland container depot and freight stations andis the largest privately owned land container port in Bangladesh. It is located at Patenga IndustrialArea of Chittagong on the international airport road, which is only 6 km from the country’s largestseaport, Chittagong Port.OCL owns 15 acres of custom bonded free hold land. Currently, OCL can stuff and de-stuff 50,000containers annually. It also has an empty storage facility for 6,000 TEUs. OCL is a custom bondedwarehouse. With the logistic support of its surface transport subsidiary in Ocean Transport16

Company, it can deliver containers anywhere in Bangladesh. The company currently operates afleet of 24 prime movers with 40 feet trailers.Government customs officers and OCL are working round the clock to keep our commitment. Ourfully computerized system allows us to keep track of all containers. OCL is an ISO 9001: 2000Quality Management Certified Company. It is the first company in Bangladesh to have the ISOcertification for Inland Container Depot (ICD) and container freight station (CFS) operators.OCL clienteles include Maersk-Sealand, Yang Ming Line, Happag-Lloyd, Kuhene & Nagel, Danzas,Zim Line etc. OCL is in discussion with APL-NOL to have long term contract for consolidating theirexport bound cargoes from Bangladesh. OCL already has similar arrangement with Maersk-Sealand.OCL currently caters to the 30% of the garment’s export bound cargoes. By the year 2004 OCL aimsto consolidate 50% export bound cargoes of Bangladesh.Summit Power LimitedSummit Power Limited (SPL), a concern of Summit Group is the first Bangladeshi IndependentPower Producer (IPP) in Bangladesh and until now the only local company in private electricitygeneration and supply business providing power to national grid. SPL was incorporated inBangladesh on March 30, 1997 as a Private Limited Company. On June 7, 2004 the Company wasconverted to Public Limited Company under the Companies Act 1994. SPL’s shares are quoted onboth DSE and CSE. SPL is the first company signing PPA with BPDB to build small size power projectin private sector with the objective of providing electricity to PBS through national Grid.SPL has so far successfully established seven power plants and is supplying total 215 MW ofelectricity to the national grid. SPL’s power plants comprises as follows:i) Ashulia plant - 44.75 MWii) Chandina plant -24.50 MWiii) Madhabdi plant-35.30 MWiv) Rupganj plant -33 .00 MWv) Jangalia plant- 33.00 MWvi) Maona plant -33.00 MWvii) Ullapara plant -11.00 MWConsidering the immense opportunities, the company is striving to establish more power plantsaround the country. The company is also planning to explore energy markets in Sri Lanka andVietnam.Cosmopolitan Traders (Pvt.) Ltd (CTL)Cosmopolitan Traders (Pvt.) Ltd (CTL) is a holding company involved in port related businesses suchas container depot, liquid storage terminal, gas terminal, shipping and other businesses.Summit Shipping Ltd. (SSL)Summit Shipping Limited (SSL), a private limited company was incorporated in 2nd June 1998 tooperate in transportation of liquid products. Cosmopolitan Traders (Pvt.) Ltd., a sister concern ofSummit Group, is the major shareholder of the shipping company. Subsequent to its incorporation,SSL executed a 15-year ‘Transportation Agreement’ with United Summit Coastal Oil Limited(USCOL). Presently SSL operates two tankers with a load capacity of 1,800 MT and 1,200 MTrespectively.Expansion plans of the company include procurement of ocean going tankers for transportation offurnace oil, edible oil and LPG from international market to Bangladesh. SSL has also implementedISO 9002 Quality Management System (QMS) in 2001. This was the first ISO 9002 certified shippingcompany in Bangladesh.17

United Summit Coastal Oil Ltd. (USCOL)United Summit Coastal Oil Ltd. (USCOL), a joint venture between Summit, United and El PasoInternational, USA, is the first private sector energy oil management company of Bangladesh. Thiscompany was formed with the goal of managing the furnace oil requirements of the country’semerging private sector power generation companies. Leveraging on the expertise of a majorintegrated oil company El Paso International USA, USCOL actively participates in sourcing, tradingand supplying energy oil in Bangladesh. The principal client of USCOL is Khulna Power CompanyLtd., which requires furnace oil to fire its generators. USCOL also actively markets its expertise toother barge mounted power plants operational in Bangladesh, to other power producers whorequire oil-based fuel for power generation.Summit Alliance Port Ltd.Located on both sides of the Beach road which is 7 km away from the multipurpose berths of theChittagong port, Summit Alliance Port is currently spread over an area of 17 acres. The port has a40,000 sft warehouse capable of handling CFS stuffing upto 1,000 TEUs monthly and ICD withhandling capacity of about 4,500 TEUs for storage of empty containers at any time.SUMCYNETSUMCYNET is an innovative Web Design and Software Development company. The company iscomposed of team of talented, experienced professionals, inspired by life, to generate the bestquality work. The excellence of work supported by the company is reflected in the client'ssatisfaction. With extended experience and comprehensive knowledge, Sumcynet believes to have afull understanding of its client's requirements and how to attend to them in the best way possiblewithin their specific time frame.The customers are presented with top of the range, user-friendly, striking and interactive updatedwebsite. The focus is to make sure that the client’s business is SEEN! The web designs/pages are100% originals and are designed to the highest standards. The company ensures that clients receivepersonalized care round the clock. Everything at Sumcynet Web Design is done in-house. Thecompany strives to create professional website for businesses at affordable price.UNITED ENTERPRISES & CO. LTD – UNITED GROUP OF BANGLADESHUnited Group has grown into one of the leading business houses in Bangladesh since its inception in1978. United Group focuses in providing value added services and fostering business includingprovision of total solutions to an increasingly developing economy of Bangladesh. United Group’sfundamental strength is its commitment and enthusiasm to provide an excellent service forcustomers. Since the beginning of the last decade the objectives of the group has been toparticipate and take up investment opportunities in selected key infrastructure sectors and enablesit to meet the challenges of the new century. From its inception the group’s focus has been toinvest in key infrastructure areas. The key sectors where the group is currently engaged are powergeneration, civil & hydro engineering, real estate developments, land port services on a build, ownand operate basis, international university, multi specialty hospital, shared banking ATM network,textile mills, polymer industries, heavy construction equipments division, passenger lift &escalators, turnkey solutions etc. The key sector in which it is engaged includes:• Manufacturing• Energy& Power generation• Broadcasting and communications• Port & Maritime transportation• Textile mills• Real Estate and Constriction• Healthcare and Hospital• Education18

United Enterprises & Company LimitedUnited Enterprises & Co. Ltd. was established in mid-July 1978. The company expanded its areas ofbusiness covering power generation, sub-stations, broadcasting and telecommunications, maritimetransportation and freights and the turnkey solutions and system management. United Enterprisesparticipated in various nation-building tasks of the GOB.NOVO Healthcare & Pharma Ltd.NOVO Healthcare & Pharma Ltd. started its journey in 2004 and has since gone on to become one ofthe most trusted brands by doctors across the various fields of medical practice. Keeping in linewith the norm at United Group, NOVO is also a pioneering company among the other key players inthe field of pharmaceutics. With its cutting edge technology, NOVO has been successfullymanufacturing bulk drugs (RTF Pellets) since its inception. As a matter of fact, it is the firstcompany in Bangladesh which has been approved by the Drugs Authority (DA) for producing suchbulk pellets. Through rigorous research and development and thorough dedication, they arecurrently manufacturing very specialized pellets of PPIs, Hematinics, etc. As a matter of fact, asignificant quantity of this is presently being used by a large number of local pharmaceuticalcompanies on a daily basis. This alone is a testament to how the company has heralded a new erain the Bangladesh Pharmaceutical sector with its ever-evolving portfolio of powerful and precisiontunedpharmaceutical products that help people to live healthier lives.NOVO's concern for quality is reflected in every aspect of its products – from raw materials topackaging materials. Utilizing quality ingredients in our manufacturing processes, fully equippedquality control laboratories and state of the art production plants, the firm has been organized withmodern sophisticated technology that is continuously upgraded and standardized to meet thehighest level of international standards. In fact we are one of the few companies in Bangladesh whohave received the World Health Organization (WHO) certification for Current Good ManufacturingPractices from the Drug Directorate. In the analytical and the micro biological laboratories; young,energetic and skilled professionals are working with a great sense of responsibility to ensure qualityof all the products that leave through the factory gates. Along with various commonly acceptabledosage forms like tablets, capsules, liquid, cream & ointment (LCO) as well as Powder forSuspension (PFS), a wide range of life saving antibiotics and other pharmaceutics are predominantin NOVO's product line.United Hospital LtdUnited Hospital Ltd was born out of a vision to provide a complete and one-stop healthcare solutionto the people of Bangladesh. Opening its doors in August 2006 and situated besides the picturesqueGulshan Lake, this hospital is one of the largest private sector healthcare facilities in Bangladesh.With a capacity to house over 450 patients and established across a total covered area of over400,000 sft, the hospital has 11 state of the art operation theatres to cater to the needs of ourvaried patient base.Departments of cardiology, gynaecology, orthopaedic and paediatrics of United Hospital are staffedby the most esteemed doctors in their respective fields. As an example, a glimpse at our cardiologydepartment would reveal that till date we have conducted over 2300 open heart surgeries and over8300 angiograms and angioplasty operations. That’s over 12 heart related surgeries per day alonesince our inception. With its technology and expertise, and with the support of very friendly staff,United Hospital strives each day to be the number one healthcare provider, not only withinBangladesh but within the Asia-Pacific region.Malancha Holdings LtdIn January 2007 Malancha Holdings Ltd. was born out of the necessity for uninterrupted, qualitypower supply to the industries housed within the Export Processing Zones (EPZ) of Bangladesh.Currently operating a 35 megawatt unit in <strong>Dhaka</strong> EPZ and a 44 megawatt unit in Chittagong EPZ,this company allows its clients to concentrate only on their core business rather than worrying19

about their energy requirements. The total project cost of the plants stand at Tk. 3750 million andis powered by the latest Wartsila gas engines with the ability to produce 8.73 megawatts ofelectricity each. High voltage 33/11 KV substations comprising of two 16/25 MVA, 11/33 KV powertransformers along with required length of 11 KV distribution lines have been built by MHL undereach of the two project sites. Thus MHL has constructed multidisciplinary infrastructures like powergeneration, high voltage transmissions and distribution and high/low pressure gas pipelines for theproject. In effect, this makes us the only true independent power generation and distributioncompany in all senses of the term. It is a model that we plan to replicate across all the EPZs of thecountry. On top of this unique achievement, MHL has been regularly providing its surplus energy tothe Rural Electrification Board (REB) of Bangladesh, thus lighting up thousands of homes across thenation. We can only hope that one day our approach to power generation will make our country ashining beacon within the Asian region.Comilla Spinning Mills Ltd.In a country where the textiles industry is one of the major contributors to the GDP and indeed oneof the largest earners of foreign exchange, Comilla Spinning Mills Ltd. has managed to make itsmark as a maker of high quality cotton, polyester and mixed yarns. Established in 1996, the factoryis nestled in the heart of Burichong, Comilla, spread over 13 acres of land, with 1100 full-timededicated workers managing and operating the plant around the clock. With 18,000 spindlesinitially, it was projected to go under a progressive expansion program and methodicaldevelopment through scientific research, design and creative plan of operation. As it stands now,the plant has almost 50,000 functioning spindles being complimented by other high-end Europeanmachineries producing roughly 14 tons of yarn a day. A fun fact – that is almost enough high qualityyarn to cover over a 1000 kilometres a day. However, we have no plans of stopping now. In the nearfuture, we hope to increase this capacity to almost 70,000 spindles.United International UniversityProper education solidifies the backbone of a nation – the youth who are destined to lead thecountry into the future. In 2003, United Group ventured into this noble professional sector byuniting together some of the finest academic minds in the nation under the banner of UnitedInternational University.With an excellent library, well equipped laboratories, proper classrooms and student recreationalfacilities, it is an ideal place to excel in learning. It was surprising that even after a decade ofoperations; similar educational institutions were yet to achieve the same. UIU believes that only byproviding the right environment could the desired results it achieved. Having such a campus wasthus an absolute necessity.Even now the faculty is engaged in designing new disciplines that are relevant for the Bangladesheconomic context. They would of course include Accounting, Textile Engineering, Pharmacologyand Nursing departments, to name a few. With plans of opening a new major campus to evergrowingstudent base and faculty, steadily but surely it plans on becoming the largest privateuniversity in the country within the next few years.Neptune Land Development Ltd.Neptune Land Development Ltd. began its commercial operation as a premium real estate companyin 2003 with United City being its flagship project. Imagine a scenic landscape where all the beautythat nature has to provide resides in perfect harmony with the excellence of Man’s creativity in thefield of architecture. Imagine wide open fields echoing with children’s laughter, a lake besidewhich to sit and while an evening away, and the absolute tranquility of suburbia. It will be the mostbeautiful setting within one of the largest metropolitan cities in the world. Located a stone’s throwdistance away from the US Embassy in Baridhara, it can simply be described as a piece of heaven in<strong>Dhaka</strong>, where families can start their lives anew, secure in their knowledge that they reside in oneof the finest of localities in the capital.With over 300 acres currently under development in United City and 650 plots already handed overto a most excellent clientele, the main goal of NLDL is to become the premier and most trusted20

developer of real estate projects in the nation. To back up the claim, it only sells land that isabsolutely undisputed and owned by the company. This project has been developed according tofull compliance with RAJUK guidelines, thus becoming one of the only such real estate ventures tobe fully approved by this government body.United Property Solutions Ltd.Over the years United Group has profitably ventured into various segments of the real estateindustry. It is currently involved in the construction and development of residential plots andhouses as well as commercial properties, which include some of the best known buildings of thecity today. Notable examples would includes, the United Hospital, United House and the UnitedInternational University buildings. While these projects have been completed under severaldifferent company banners, the Group has decided to go by its namesake and bring all thesedifferent projects under one roof. Thus, United Property Solutions Ltd. was born.Providing total real-estate involvement from designing to construction and finally to management,this company is dedicated to be a comprehensive one-stop solution for people interested to investin us, thus further simplifying things for them.Hafez Zamirudding Fisheries Ltd.In early 2009, United Group literally began treading new waters with Hafez Zamiruddin FisheriesLimited and their fleet of fishing trawlers. With ample capacity upwards of 140 tons, these vesselshave been assembled locally in their entirety, not only saving valuable foreign currency for thecountry but boosting the blossoming ship building industry.The maiden voyage of the ships saw them venturing into the ever grand Bay of Bengal, known forher abundant wealth of marine life. With nets and gears designed for white fishing, as opposed toshrimp fishing, they can remain out at sea for a month at a time returning only with their holdsfilled to the brim with some of the best fish that the Bay has to offer. And why not – we plan totake this company to export markets where such products are much sought after and buyers arequite often willing to pay a premium for quality.United Makkah Madina Travel & Assistance Co. Ltd.United Makkah Madina Travel & Assistance Co. Ltd. embarked upon its mission to be a facilitatorand guide for the hajjis during this holy duty. Recognized as one of the few registered travelagencies authorized to deal with all Hajj and Umrah matters, this company has been organizingsuch trips for nearly a decade now. By being fair and honest in its dealings and a strong adherenceto the Quran and Sunnah it have, by the Grace of the Almighty, become a market leader in thisprofession. A testament of this lies in the fact that almost all of its dedicated clients have chosenon referrals they get from pilgrims who have honored the company in the past by choosing to travelwith the company.United Polymers Ltd.Plastic is one of the core materials needed for many companies - from soda manufacturers topharmaceutical companies but there was a great lacking in quality plastic botling and other plasticmaterials Thus United Polymers Ltd. was born as a value-based manufacturing unit focused oninnovating, manufacturing, and marketing of polyethylene (PET) products, as well ascomprehensive liquefied material handling systems for the consumer and industrial bottles. As apioneer in this sector, we introduced this product to many businesses since our inception, who justhappen to be our dedicated customers even to this day. With effort and our culture of innovation,we have developed a full set of PET bottle products of high quality, which has been laudedespecially by the many pharmaceutical industries today.21

United Land Port Teknaf Ltd.United Land Port Teknaf Ltd is situated on 27 acres of land on the banks of the Naaf River at thesouthernmost point of Bangladesh; this is a port of transit for goods between our country andMyanmar. Winning a tender in 2006 from Bangladesh Land Port Authority has enabled to controloperations and management of the port while also signing Concession Agreement and Land LeaseAgreement with the same. Since then it has undergone both infrastructural and civil developmentof the area, including earth filling, boundary wall construction, making pontoons, warehouses,approach roads, a passenger jetty, cargo jetty and a rest house among other things. Throughsignificant ongoing investments, ULPTL plans to become a fully comprehensive port unit, providinga one-stop solution for exporters, importers and the government alike.22

(4) Distribution procedure of products or services:KPCL purchases Heavy Fuel Oil from Kuo Oil Pte Ltd. Singapore and generates electricity as its soleproduct and then sells to BPDB in bulk for electricity transmission through the national grid tosouth-western region of Bangladesh.(5) Competitive Condition of the Business:As power sector is a capital-intensive industry, huge investment will be required for generationcapacity addition. Public sector is not in a position to secure this huge investment for powergeneration. currently, at about 170 kWh per capita of energy consumption, Bangladesh ranks amongthe lowest countries in the world in terms of electricity consumption per capita. Its distributionnetworks currently serve only an estimated 43% of the total population of more than 150 million.The severe shortage of electricity supply is due in part to BPDB’s inadequate generation capacity,weak transmission and distribution systems, and operational difficulties at its existing power plants.In addition to the overall demand-supply imbalance, the power sector in Bangladesh is also affectedby a regional imbalance 85% of the country’s generating capacity is located in the eastern zone,where natural gas and associated infrastructure is available. The western zone, where the Plant islocated, has mostly smaller and less efficient power plants running on liquid fuel. The western zonepeak demand is about 1100 MW while its regional generating capacity is only about 600 MW.According to the Power Cell, the Bangladesh Power Development Board generated 3400 MW of thecountry’s 5245 MW of total commercial electricity, or about 64% of the total installed capacity.Over the past several years although the demand of power and gas grew in geometric progression,yet the power sector did not grow as per requirement and gas sector failed to explore its resourcesand developed its reserve. Since natural gas dominates the power sector in Bangladesh, 95% ofelectricity comes from conventional thermal power (primarily natural gas) and the remaining 5%through hydroelectric power. In January 2006, Bangladesh’s first coal-fired power plant begancommercial production at the 250-MW Barapukuria facility in Parbotipur.The installed generation capacity was about 5269 MW (as on June 2007) from a meager 88 MW in1960. Electricity generation grew at about 7% p. a. during last fifteen (15) years compared withaverage annual GDP growth rate of about 5.5%. Notwithstanding the progress made to date,Bangladesh's per capita electricity generation of 165 kWh p.a. is still among the lowest in theworld. About 43% of the population has access to electricity, which is also low compared to manydeveloping countries. This implies that there is scope for significant growth in power sector. Giventhe huge investment requirement for power development in the country, Bangladesh would belooking forward to various sources of finance. The Government has already opened the powersector for private investment and "The Private Sector Power Generation Policy" has beenformulated in 1996. The table bellow depicts power sector at a glance.GenerationInstalled Capacity(a) BPDB(b) IPP & Mixed Sector TotalTotalMaximum Demand ServedTotal3,872 MW1,397 MW5,269 MW3,785 MWNet Energy Generation23,267 MkWhTransmissionTransmission Line230 kV 1,467 Ckt km132 kV 5,578 Ckt kmTotal7,044 Ckt kmCapacity of Grid S/S230/132 kV 5,175 MVA132/33 kV 7,219 MVA23

DistributionDistribution Line2,71,142 km(33 kV, 11 kV & 0.4 kV)Total no. of Consumers10.42 MillionTotal no. of Agricultural Consumers 2 Lac 26 ThousandTotal no. of Village Electrified 50,360Access to Electricity 43%Per Capita Generation165 kWhSystem Loss (T&D) 19.30%Source: www.powercell.gov.bd (visited September 01, 2009)Currently, the GOB has no plans to have additional interconnection systems between the east andwest regions since it prefer to transport gas to the western region in order to build gas-fired plantsrather than transferring electricity. Natural gas availability in the western region is also likely tospur further socio-economic developments in the region.supplier of electricity of BPDB.Bangladesh Power Development Board:BPDB is responsible for generation anddistribution of electricity. Its distributionjurisdiction covers mainly urban areasexcept Metropolitan City of <strong>Dhaka</strong>. Thereare a number of Independent PowerProducers (IPP) who generate and sellpower to BPDB. BPDB's retail sale throughown distribution accounts for about 32%of total retail sales. KPCL is the leadingPower Grid Company of Bangladesh: PGCB, established under the Company's Act, 1994 is asubsidiary of BPDB. PGCB is responsible for operation of the grid network of 230kV and 132kVsystem. It is fully responsible for high voltage transmission as well as distribution.<strong>Dhaka</strong> Power Distribution Company (formerly <strong>Dhaka</strong> Electric Supply Authority): DPDC (formerlyDESA) is responsible for distribution of electricity in a part metropolitan <strong>Dhaka</strong> and a few adjacentareas. It purchases power from BPDB at 132 kV. DPDC's retail sale accounts for about 21% of totalsales.<strong>Dhaka</strong> Electric Supply Company Limited: DESCO, established under Companies' Act of 1994 isresponsible for distribution of electricity in Mirpur and Gulshan area of the Metropolitan City of<strong>Dhaka</strong>. DESCO's retail sale accounts for 9% of total national sales.Rural Electrification Board: REB is responsible for distribution of electricity in rural areas througha system of co-operatives known as Palli Biddyut Samities. It mainly purchases power from BPDBand DESA at 33 kV; it also purchases from IPPs to a small extent. BPDB's retail sale accounts forabout 38% of total retail national sales. Sixty seven (67) PBS's are operating at present in ruralareas.Ashuganj Power Company: Ashuganj Power Company is a generation subsidiary of BPDB created in2002. The installed generation capacity of APC is 728 MW comprising steam, combined cycle andgas turbine generating units. The gross energy generation is about 25% of total energy generation inpublic sector.West Zone Power Distribution Company: WZPDC is a distribution subsidiary of BPDB. WDPDC wascreated under Companies act 1994 to handle distributions in the South West part of the country.EA & CEI: The office of the Electrical Advisor and Chief Electrical Inspector has been establishedunder section 36 of the Electricity Act 1910. EA & CEI office performs the functions as specified inthe Electricity Act, Electricity Rule, Cinematograph Act to control and ensure safety of lives andproperties in electricity sector.24

(6) Sources and availability of raw materials and the names of the principal suppliers:The Khulna plant consists of two Wärtsilä floating baseload plants named Tiger I and Tiger IIIdesigned for continuous operation and intended for electricity production. Wärtsilä is also providingoperational and maintenance services for the Khulna plant during the duration of BPDB's powerpurchase agreement. The contract includes all aspects of operations and maintenance, which fixedthe long-term operations and maintenance costs for BPDB, and absorbed a good portion of theoperating risk as well enabling BPDB to concentrate on other aspects of their power business.The plant has 110 MW Heavy Fuel Oil fired Diesel engines with Dual fuel capability plant atgoalpara, Khalishpur, Khulna Wärtsilä provides 19 18V32LN Diesel Engines each of 6.5 MW capacitiesare installed on two power Berges. The Barges are permanently moored in manmade lagoonspecially created for the purpose and continuously generates electricity to the National Grid.The project has been in operation since October 1998, with heavy fuel oil as the primary fuel. Itwill use natural gas as it becomes available in the future. The Company is now the only IPP inprivate sector Company which is operated by heavy fuel oil. KPCL was entered into a 15 years FuelSupply Agreement with United Summit Coastal Oil Limited for sourcing, procurement and deliveryof Heavy Fuel Oil (HFO) to the plant. KPCL’s annual requirement of HFO is about 180000 Metric Tonat 80% dispatch. HFO is being procured from Kuo Oil PTE Limited, Singapore, one of the major oilsuppliers in Asia and transported to Chittagong in 17000 MT parcels. The HFO is stored atChittagong and transported to Khulna by Tanker Barges.(7) Sources of power, gas and water:Water: The Company uses close circuit cooling system for its generators and the cooling waterrequirement is very minimal which is supplied from bore well through demineralization plant.Power: The power requirement is met from company’s own generation; however any disruption ismet through supply from BPDB and is required for auxiliary use only.(8) Name of the customer who purchase 10% and more of the company’s products:Power generated by KPCL is sold in bulk to Bangladesh Power Development Board (BPDB) pursuantto the term of 15 years Power Purchase Agreement. BPDB has obligated to purchase the entireelectrical output generated by the Plant pursuant to a 15-year PPA. The revenues are based on atwo-part tariff structure, and are designed to cover fixed and variable costs including debt service,operations and maintenance expenses, fuel costs and a return to investors.BPDB has committed to a minimum take or pay requirement at 50%dispatch factor on a monthlybasis. BPDB’s payment obligations are supported by a letter of credit for two months minimumrevenues. BPDB’s payment obligations are also guaranteed by the Government of Bangladeshpursuant to an Implementation Agreement Revenues are based on a two-part tariff structure - aFuel Tariff (FT) Component, on a pass-through basis, and Other monthly Tariff (OMT) Component tocover all other fixed and variable costs, adjusted for foreign exchange variations.(9) Description of contract with suppliers and customer:• Implementation AgreementThe IA between KPCL and the GoB states that all the company’s transaction related to the projectthat require foreign exchange, including debt servicing and repatriation of earnings, will beinitiated through bank accounts in Bangladesh, however, any payments in foreign exchange toforeign parties may be paid directly through bank accounts of KPCL located outside Bangladesh.The company shall make available to the GoB the statements and accounts reflecting all suchpayments.The GoB ensures that the Bangladesh Bank gives KPCL and its contractors, consents for operatingFCY bank accounts inside Bangladesh (including, without limitation, the payment of all FCYreceived under the Financing Agreements or otherwise by the Company into such accounts and25

withdrawals there from). The GoB shall ensure that the Bangladesh Bank gives the Companypermission to maintain bank accounts outside Bangladesh, and transfer any funds from its accountsin Bangladesh to its accounts maintained outside Bangladesh as are necessary to implement andcarry out the project.GoB through the IA provides sovereign guarantee with regard to payments, hence possiblymitigating risk of any non-payments.• Power Purchase Agreement (“PPA”) with BPDBBPDB has agreed to purchase the entire electrical output generated by the Plant pursuant to a 15-year PPA. The revenues are based on a two-part tariff structure, and are designed to cover fixedand variable costs including debt service, operations and maintenance expenses, fuel costs and areturn to investors. The PPA commits BPDB to a minimum take-or-pay requirement of 50% dispatchfactor on a monthly basis. BPDB’s obligations under the PPA are guaranteed by the GOB pursuant toan Implementation Agreement (“IA”). Term - 15 years, from commercial operations BPDB commitment to a minimum purchase equivalent to 50% plant factor on a monthly basis Two-part tariff structureo Fuel Tariff (“FT”), with full cost pass through;o Other Monthly Tariff (“OMT), 99% of which is US$ indexed; Allows KPCL to source its own fuel supply Tariff invoices payable within 45 days of the delivery of invoice Payment Security back-up in the form of Letter of Credit covering two months of MinimumTariff Payments (and a Govt. of Bangladesh Guarantee) The Minimum Tariff Payment obligations continue through political Force Majeure Events Compensation Amount on Termination to cover 65% of the NPV of the Minimum Tariff Payment for the remaining term of the PPA, plus consequent termination paymentliability to KPCL in respect of the O&M Agreement and the Fuel Supply Agreement, plus taxes.• O&M Agreement with Wärtsilä, Finland‣ Term - 15 years‣ Operator guarantees an 85% availability rate. The Operator will pay the Company apenalty of US$ 15,000 for each percentage below the 85% availability rate to a maximum of13%.‣ The Company may terminate the O&M contract for convenience and without cause upon90 days of notice and six months fixed O&M fees• Fuel Supply Agreement with United Summit Coastal Oil Limited‣ The FSA is co-terminus with the PPA and can also be terminated upon conversion of Plantto natural gas based Plant.‣ Fuel price based on MOPS indexation and other costs as per the PPA provisions.(10) Description of any material patents, trademarks, licenses or royalty agreements:The company has not entered into any such agreement.(11) Number of total and full time employees:Number of full time employees KPCL Head Office is 10 people as on 31 December 2009 and in itspower plant has 113 employees of Wärtsilä Bangladesh Ltd., O&M Contractor, thus the total numberof employees of KPCL is 123.26

(12) Production capacity and current utilization:Currently, the power barge Tiger I and Tiger III consist of 19 Wärtsilä diesel engines capable ofproducing 114MW of electricity. Each barge is 91.5 meter long and 24 meter wide. The floatingtigers generate electricity for supply to the national grid.KPCL’s total installed gross generation capacity is 123.5 MW (19 Engine x 6.5 MW), and current netgeneration capacity is 114 MW. But KPCL has total licensed capacity of 110 MW. In 2009, its averagemonthly utilized capacity is 87.21% which is 12% more than that of 2008.The operator of KPCL Wärtsilä Bangladesh Ltd. has earned the unique distinction of receiving bothISO 9002 for quality management system (QMS), ISO 14001 certification for excellence inenvironment management system and OHSAS 18001 for occupational health and safety standard.D. DESCRIPTION OF THE PROPERTY(1) Location of the power plant and other property and condition of such property:Corporate office of the company is situated at Summit Centre (5 th Floor), 18 Karwan Bazar C/A,<strong>Dhaka</strong>-1215 and the power plant consists of 19 (Nineteen) 6.5 MW generating sets that are installedon Two Power Barges are situated at Goalpara, Khalishpur, Khulna. Such property is in goodoperating condition.(2) Ownership of property:Other than land, which is a leased property, the ownership of all the assets as per audited accountsfor the year ended 31 Dec, 2009, described below are in the name of the Company.ParticularsAmount in TakaPower plant 3,303,599,925.00Vehicles 3,038,494.00Building and construction 188,150.00Furniture and fixtures 47,400.00Office equipment 259,330.00Office renovation 33.00Total Written Down Value 3,307,133,332.00All the machineries imported were in brand new condition.(3) Lien on property:1. The company itself owns the entire fixed assets except the lease land.2. The Plant & machinery and other assets of the company are mortgaged against the workingcapital loan to the following banks:a) BRAC Bank Limitedb) Citibank NAc) Pubali Bank Limitedd) Shahjalal Islami Bank Limitede) Standard Bank LimitedThe leasehold land is approximately 4.7 Acres of land having border on the north by Bhoirab River,on the east Goalpara Power Grid Station of Bangladesh Power Development Board (BPDB), on thewest petroleum terminal of Padma Oil Co. The existing power plants are situated on the leaseholdland. Details of leasehold lands are as follows: Plant Address: Goalpara, Khalishpur, Khulna Owner of the land: Padma Oil Co. Ltd. Lessor: BPDB27

Rent payable: Taka 15.84 per square feet. Changes in Rent: Rent payment can be adjusted by 20% in each five years of the contract(4) Expiration date of Leasehold PropertyThe term of indenture is 17 years, from January 1, 1998 to January 1, 2015E.PLAN OF OPERATION AND DISCUSSION OF FINANCIAL CONDITION:(1) Internal and External Sources of cash:Sources of CashDEC 31, 2009 DEC 31, 2008InternalOrdinary shares 2,085,930,000.00 2,085,930,000.00Redeemable cumulative class 'A' preference 1,100,000,000.00 1,100,000,000.00sharesRetained earnings 668,492,911.00 294,437,827.00Total 3,854,422,911.00 3,480,367,827.00ExternalTerm Loan - net of current portion - 74,892,180.00(2) Commitment for capital expenditure:KPCL doesn’t have any commitment made for future capital expenditure as of 31 December 2009except of an Alternator for which procurement order was being initiated amounting to Euro 287,745but no shipment is being made.(3) Material change from period to period as per audited accounts:Particulars 2009Taka2008Taka2007Taka2006Taka2005TakaOperating revenues 6,393,267,345 8,160,423,118 5,698,208,430 6,311,059,931 4,243,767,556Operating expenses (5,718,431,301) (7,664,817,721) (5,154,663,159) (5,762,523,349) (3,714,256,610)General and(64,078,271) (61,504,226) (101,434,974) (92,377,904) (94,587,722)administrative expensesOther income 91,481,290 3,500,496 9,828,156 5,036,401 4,427,264<strong>Exchange</strong> gain/(loss) 2,174,414 8,784,292 5,427,197 (7,593,746) (5,897,306)Finance income 9,155,909 4,048,472 8,797,510 3,282,064 2,386,713Financial charges (17,483,802) (177,911,217) (156,986,251) (200,693,799) (195,604,754)Net profit for the year 696,085,584 272,523,214 309,176,909 256,189,598 240,235,141The material changes from period to period have been occurred due the change in Tariff in Effectand change of power generation.(4) Seasonal aspect:In general, there is no seasonal impact on the business because of serious dearth of electricity in allseasons. But in previous years winter season results lower demand for electricity than summer.(5) Known trends, events or uncertainties:Force majeure such as political unrest, hartal and natural calamities are generally known events thatmay affect the company business.28

(6) Changes in the assets used to pay off any liability:Cash disbursement of Tk. 13,894,196 was made during the accounting period ended 31 Dec, 2009 toreimburse portion of the term loan.(7) Loan taken from the holding/subsidiary company or loans given to those companies:KPCL did neither take any loan from nor give loan to any company for the last five years.(8) Future contractual liabilities:The company has no future contractual liabilities that may have impact on the company’s financialfundamentals.(9) Estimated future capital expenditure:The management of KPCL is currently in negotiation with BPDP for expansion of its existing plant foran additional capacity of 110 MW which is expected to be in operation by the end of year 2010.Other then above, there is no plan for capital expenditure in near future under caption ‘materialcommitment for capital expenditure’(10) VAT, income tax, customs duty or other tax liability:a) VATVAT is not applicable for the company for sale of electricity.b) Income taxAs per the Statutory Regulatory Order (SRO) 1999, SRO No. 114/99, the company is exempted fromincome tax for a period of 15 years from the date of commercial operation.c) Custom duty or other liabilityThe Company is exempted to import plant and machinery during construction and all other spareparts up to 10% of the plant & machinery cost without payment of customs duties. Duties and taxesare payable for other supplies as per provision of the Private Sector Power Generation Policy ofBangladesh.(11) Sources from which VAT, income tax, customs duty or other tax liabilities are to be paid:The payments of duties and taxes on spare part import, if payable, are to be made in the ordinarycourse of business.(12) Lease commitment:The company has signed lease agreement with BPDB for land usage for 17 years starting January 1, 1998, andthe lease commitment as above is being liquidated through repayment of monthly lease rental.(13) Lease Details:The company is obligated under non-cancelable lease for use of land leased out by BPDB that arerenewable on a periodic basis at the option of both lessor and lessee. During the period, rentalexpenses under non-cancelable operating leases aggregated Tk.3,355,293 The future minimumlease payments in respect of operating leases as at 31 Dec 2009 are as follows:31 Dec-09 31-Dec-08 31-Dec-07Amount due: Taka Taka TakaNot later than one year 3,242,955 3,242,955 3,242,955Later than one yearbut not later than five years 14,268,998 13,620,407 12,971,820Later than five years - 3,891,545 7,783,09029

(14) Personnel related schemes to make provision in future years:The Company has training schemes for human resource development and the following retirementbenefits for its employees:1. Provident FundThe Company operates a recognized Contributory Provident Fund for its permanent employees. Thefund is administered by a Board of Trustees and is funded by 10% contributions equally from theemployees and the company. The fund is managed separately from the company’s assets.2. GratuityThe Company also maintains non-funded Gratuity Scheme for confirmed employees of the company.(15) Break down of issue expensesThe breakdown of issue expenses related to direct listing is as under:Sl. Particulars Basis of calculation Amount1 Issue Management fee At actual 1,200,000.002 Underwriting Commission At actual NIL3 Application fees DSE & CSE At actual 20,000.004 Listing Fees DSE & CSE At actual 4,000,000.005 Annual Listing fees DSE & CSE At actual 200,000.006 CDBL Fees At actual 608,500.007 Registrar to the Issue Fees At actual 500,000.008 Printing and publication Estimated or At actual 2,000,000.00(16) Revaluation of Asset:KPCL didn’t revalue its assets.(17) Last five years’ transactions between the issuer company and its subsidiary/holdingcompany:No transactions have been made between the parties.(18) Auditors' certificate on allotment of shares to shareholders including promoters orsponsor shareholders for any consideration otherwise than for cashWe certify that as per the share register and other relevant records maintained by Khulna PowerCompany Ltd., no shares have been allotted to promoters or sponsor shareholders for anyconsideration otherwise than for cash.Sd/-Rahman Rahman Huq30