Information Document - Dhaka Stock Exchange

Information Document - Dhaka Stock Exchange

Information Document - Dhaka Stock Exchange

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

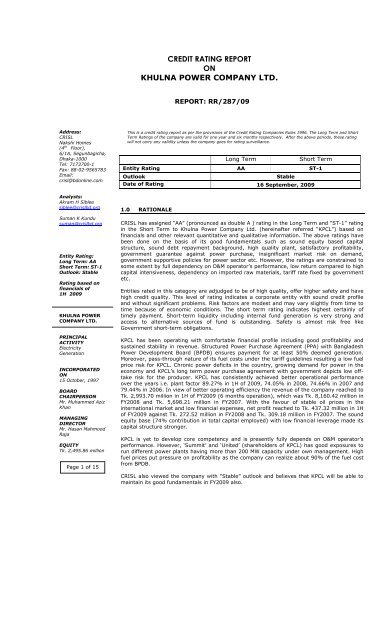

CREDIT RATING REPORTONKHULNA POWER COMPANY LTD.REPORT: RR/287/09Address:CRISLNakshi Homes(4 th Floor),6/1A, Segunbagicha,<strong>Dhaka</strong>-1000Tel: 7173700-1Fax: 88-02-9565783Email:crisl@bdonline.comThis is a credit rating report as per the provisions of the Credit Rating Companies Rules 1996. The Long Term and ShortTerm Ratings of the company are valid for one year and six months respectively. After the above periods, these ratingwill not carry any validity unless the company goes for rating surveillance.Long TermShort TermEntity Rating AA ST-1OutlookStableDate of Rating 16 September, 2009Analysts:Akram H Sibleesiblee@crislbd.orgSuman K Kundusuman@crislbd.orgEntity Rating:Long Term: AAShort Term: ST-1Outlook: StableRating based onfinancials of1H 2009KHULNA POWERCOMPANY LTD.PRINCIPALACTIVITYElectricityGenerationINCORPORATEDON15 October, 1997BOARDCHAIRPERSONMr. Muhammed AzizKhanMANAGINGDIRECTORMr. Hasan MahmoodRajaEQUITYTk. 2,495.86 millionPage 1 of 151.0 RATIONALECRISL has assigned “AA” (pronounced as double A ) rating in the Long Term and “ST-1” ratingin the Short Term to Khulna Power Company Ltd. (hereinafter referred “KPCL”) based onfinancials and other relevant quantitative and qualitative information. The above ratings havebeen done on the basis of its good fundamentals such as sound equity based capitalstructure, sound debt repayment background, high quality plant, satisfactory profitability,government guarantee against power purchase, insignificant market risk on demand,government supportive policies for power sector etc. However, the ratings are constrained tosome extent by full dependency on O&M operator’s performance, low return compared to highcapital intensiveness, dependency on imported raw materials, tariff rate fixed by governmentetc.Entities rated in this category are adjudged to be of high quality, offer higher safety and havehigh credit quality. This level of rating indicates a corporate entity with sound credit profileand without significant problems. Risk factors are modest and may vary slightly from time totime because of economic conditions. The short term rating indicates highest certainly oftimely payment. Short-term liquidity including internal fund generation is very strong andaccess to alternative sources of fund is outstanding. Safety is almost risk free likeGovernment short-term obligations.KPCL has been operating with comfortable financial profile including good profitability andsustained stability in revenue. Structured Power Purchase Agreement (PPA) with BangladeshPower Development Board (BPDB) ensures payment for at least 50% deemed generation.Moreover, pass-through nature of its fuel costs under the tariff guidelines resulting a low fuelprice risk for KPCL. Chronic power deficits in the country, growing demand for power in theeconomy and KPCL’s long term power purchase agreement with government depicts low offtakerisk for the producer. KPCL has consistently achieved better operational performanceover the years i.e. plant factor 89.27% in 1H of 2009, 74.05% in 2008, 74.66% in 2007 and79.44% in 2006. In view of better operating efficiency the revenue of the company reached toTk. 2,993.70 million in 1H of FY2009 (6 months operation), which was Tk. 8,160.42 million inFY2008 and Tk. 5,698.21 million in FY2007. With the favour of stable oil prices in theinternational market and low financial expenses, net profit reached to Tk. 437.32 million in 1Hof FY2009 against Tk. 272.52 million in FY2008 and Tk. 309.18 million in FY2007. The soundequity base (74% contribution in total capital employed) with low financial leverage made itscapital structure stronger.KPCL is yet to develop core competency and is presently fully depends on O&M operator’sperformance. However, ‘Summit’ and ‘United’ (shareholders of KPCL) has good exposures torun different power plants having more than 200 MW capacity under own management. Highfuel prices put pressure on profitability as the company can realize about 90% of the fuel costfrom BPDB.CRISL also viewed the company with “Stable” outlook and believes that KPCL will be able tomaintain its good fundamentals in FY2009 also.