Annual Report PDF - Carphone Warehouse Group plc

Annual Report PDF - Carphone Warehouse Group plc

Annual Report PDF - Carphone Warehouse Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

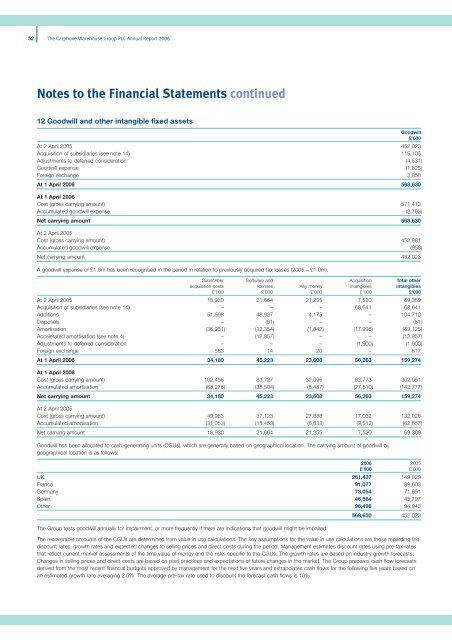

52The <strong>Carphone</strong> <strong>Warehouse</strong> <strong>Group</strong> PLC <strong>Annual</strong> <strong>Report</strong> 2006Notes to the Financial Statements continued12 Goodwill and other intangible fixed assetsGoodwill£’000At 2 April 2005 452,023Acquisition of subsidiaries (see note 14) 119,105Adjustments to deferred consideration (4,531)Goodwill expense (1,825)Foreign exchange 3,858At 1 April 2006 568,630At 1 April 2006Cost (gross carrying amount) 571,413Accumulated goodwill expense (2,783)Net carrying amount 568,630At 2 April 2005Cost (gross carrying amount) 452,981Accumulated goodwill expense (958)Net carrying amount 452,023A goodwill expense of £1.8m has been recognised in the period in relation to previously acquired tax losses (2005 – £1.0m).Subscriber Software and Acquisition Total otheracquisition costs licenses Key money intangibles intangibles£’000 £’000 £’000 £’000 £’000At 2 April 2005 18,930 21,664 21,255 7,520 69,369Acquisition of subsidiaries (see note 14) – – – 68,641 68,641Additions 51,598 48,937 4,175 – 104,710Disposals – (81) – – (81)Amortisation (36,931) (12,354) (1,842) (17,998) (69,125)Accelerated amortisation (see note 4) – (12,957) – – (12,957)Adjustments to deferred consideration – – – (1,900) (1,900)Foreign exchange 583 14 20 – 617At 1 April 2006 34,180 45,223 23,608 56,263 159,274At 1 April 2006Cost (gross carrying amount) 102,456 83,727 32,095 83,773 302,051Accumulated amortisation (68,276) (38,504) (8,487) (27,510) (142,777)Net carrying amount 34,180 45,223 23,608 56,263 159,274At 2 April 2005Cost (gross carrying amount) 49,983 37,123 27,888 17,032 132,026Accumulated amortisation (31,053) (15,459) (6,633) (9,512) (62,657)Net carrying amount 18,930 21,664 21,255 7,520 69,369Goodwill has been allocated to cash-generating units (CGUs), which are generally based on geographical location. The carrying amount of goodwill bygeographical location is as follows:2006 2005£’000 £’000UK 261,437 149,829France 91,077 89,603Germany 73,054 71,851Spain 46,564 45,797Other 96,498 94,943568,630 452,023The <strong>Group</strong> tests goodwill annually for impairment, or more frequently if there are indications that goodwill might be impaired.The recoverable amounts of the CGUs are determined from value in use calculations. The key assumptions for the value in use calculations are those regarding thediscount rates, growth rates and expected changes to selling prices and direct costs during the period. Management estimates discount rates using pre-tax ratesthat reflect current market assessments of the time value of money and the risks specific to the CGUs. The growth rates are based on industry growth forecasts.Changes in selling prices and direct costs are based on past practices and expectations of future changes in the market. The <strong>Group</strong> prepares cash flow forecastsderived from the most recent financial budgets approved by management for the next five years and extrapolates cash flows for the following five years based onan estimated growth rate averaging 2.5%. The average pre-tax rate used to discount the forecast cash flows is 10%.