Annual Report PDF - Carphone Warehouse Group plc

Annual Report PDF - Carphone Warehouse Group plc

Annual Report PDF - Carphone Warehouse Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

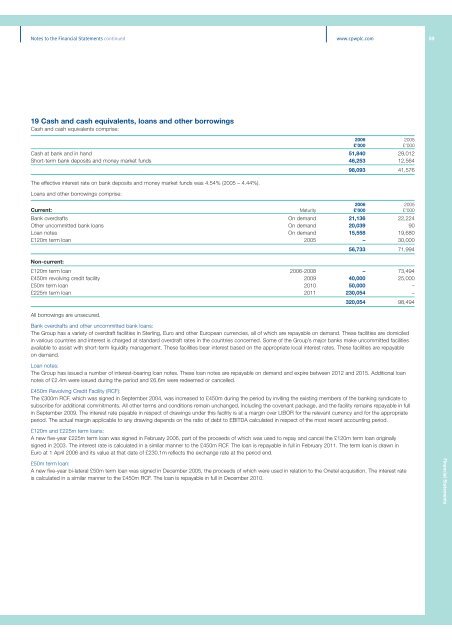

Notes to the Financial Statements continued www.cpw<strong>plc</strong>.com 5919 Cash and cash equivalents, loans and other borrowingsCash and cash equivalents comprise:2006 2005£’000 £’000Cash at bank and in hand 51,840 29,012Short-term bank deposits and money market funds 46,253 12,564The effective interest rate on bank deposits and money market funds was 4.54% (2005 – 4.44%).Loans and other borrowings comprise:98,093 41,5762006 2005Current: Maturity £’000 £’000Bank overdrafts On demand 21,136 22,224Other uncommitted bank loans On demand 20,039 90Loan notes On demand 15,558 19,680£120m term loan 2005 – 30,00056,733 71,994Non-current:£120m term loan 2006-2008 – 73,494£450m revolving credit facility 2009 40,000 25,000£50m term loan 2010 50,000 –£225m term loan 2011 230,054 –320,054 98,494All borrowings are unsecured.Bank overdrafts and other uncommitted bank loans:The <strong>Group</strong> has a variety of overdraft facilities in Sterling, Euro and other European currencies, all of which are repayable on demand. These facilities are domiciledin various countries and interest is charged at standard overdraft rates in the countries concerned. Some of the <strong>Group</strong>’s major banks make uncommitted facilitiesavailable to assist with short-term liquidity management. These facilities bear interest based on the appropriate local interest rates. These facilities are repayableon demand.Loan notes:The <strong>Group</strong> has issued a number of interest-bearing loan notes. These loan notes are repayable on demand and expire between 2012 and 2015. Additional loannotes of £2.4m were issued during the period and £6.6m were redeemed or cancelled.£450m Revolving Credit Facility (RCF):The £300m RCF, which was signed in September 2004, was increased to £450m during the period by inviting the existing members of the banking syndicate tosubscribe for additional commitments. All other terms and conditions remain unchanged, including the covenant package, and the facility remains repayable in fullin September 2009. The interest rate payable in respect of drawings under this facility is at a margin over LIBOR for the relevant currency and for the appropriateperiod. The actual margin applicable to any drawing depends on the ratio of debt to EBITDA calculated in respect of the most recent accounting period.£120m and £225m term loans:A new five-year £225m term loan was signed in February 2006, part of the proceeds of which was used to repay and cancel the £120m term loan originallysigned in 2003. The interest rate is calculated in a similar manner to the £450m RCF. The loan is repayable in full in February 2011. The term loan is drawn inEuro at 1 April 2006 and its value at that date of £230.1m reflects the exchange rate at the period end.£50m term loan:A new five-year bi-lateral £50m term loan was signed in December 2005, the proceeds of which were used in relation to the Onetel acquisition. The interest rateis calculated in a similar manner to the £450m RCF. The loan is repayable in full in December 2010.Financial Statements