Annual Report PDF - Carphone Warehouse Group plc

Annual Report PDF - Carphone Warehouse Group plc

Annual Report PDF - Carphone Warehouse Group plc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

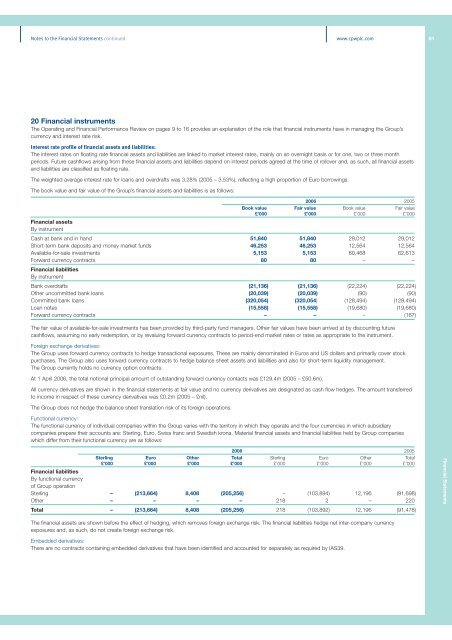

Notes to the Financial Statements continued www.cpw<strong>plc</strong>.com 6120 Financial instrumentsThe Operating and Financial Performance Review on pages 9 to 16 provides an explanation of the role that financial instruments have in managing the <strong>Group</strong>’scurrency and interest rate risk.Interest rate profile of financial assets and liabilities:The interest rates on floating rate financial assets and liabilities are linked to market interest rates, mainly on an overnight basis or for one, two or three monthperiods. Future cashflows arising from these financial assets and liabilities depend on interest periods agreed at the time of rollover and, as such, all financial assetsand liabilities are classified as floating rate.The weighted average interest rate for loans and overdrafts was 3.28% (2005 – 3.53%), reflecting a high proportion of Euro borrowings.The book value and fair value of the <strong>Group</strong>’s financial assets and liabilities is as follows:2006 2005Book value Fair value Book value Fair value£’000 £’000 £’000 £’000Financial assetsBy instrumentCash at bank and in hand 51,840 51,840 29,012 29,012Short-term bank deposits and money market funds 46,253 46,253 12,564 12,564Available-for-sale investments 5,153 5,153 60,468 62,613Forward currency contracts 80 80 – –Financial liabilitiesBy instrumentBank overdrafts (21,136) (21,136) (22,224) (22,224)Other uncommitted bank loans (20,039) (20,039) (90) (90)Committed bank loans (320,054) (320,054) (128,494) (128,494)Loan notes (15,558) (15,558) (19,680) (19,680)Forward currency contracts – – – (167)The fair value of available-for-sale investments has been provided by third-party fund managers. Other fair values have been arrived at by discounting futurecashflows, assuming no early redemption, or by revaluing forward currency contracts to period-end market rates or rates as appropriate to the instrument.Foreign exchange derivatives:The <strong>Group</strong> uses forward currency contracts to hedge transactional exposures. These are mainly denominated in Euros and US dollars and primarily cover stockpurchases. The <strong>Group</strong> also uses forward currency contracts to hedge balance sheet assets and liabilities and also for short-term liquidity management.The <strong>Group</strong> currently holds no currency option contracts.At 1 April 2006, the total notional principal amount of outstanding forward currency contacts was £129.4m (2005 – £50.6m).All currency derivatives are shown in the financial statements at fair value and no currency derivatives are designated as cash flow hedges. The amount transferredto income in respect of these currency derivatives was £0.2m (2005 – £nil).The <strong>Group</strong> does not hedge the balance sheet translation risk of its foreign operations.Functional currency:The functional currency of individual companies within the <strong>Group</strong> varies with the territory in which they operate and the four currencies in which subsidiarycompanies prepare their accounts are: Sterling, Euro, Swiss franc and Swedish krona. Material financial assets and financial liabilities held by <strong>Group</strong> companieswhich differ from their functional currency are as follows:2006 2005Sterling Euro Other Total Sterling Euro Other Total£’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000Financial liabilitiesBy functional currencyof <strong>Group</strong> operationSterling – (213,664) 8,408 (205,256) – (103,894) 12,196 (91,698)Other – – – – 218 2 – 220Total – (213,664) 8,408 (205,256) 218 (103,892) 12,196 (91,478)Financial StatementsThe financial assets are shown before the effect of hedging, which removes foreign exchange risk. The financial liabilities hedge net inter-company currencyexposures and, as such, do not create foreign exchange risk.Embedded derivatives:There are no contracts containing embedded derivatives that have been identified and accounted for separately as required by IAS39.