Checklist of Year End Time Sensitive Tasks to be Completed - CCIM

Checklist of Year End Time Sensitive Tasks to be Completed - CCIM

Checklist of Year End Time Sensitive Tasks to be Completed - CCIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

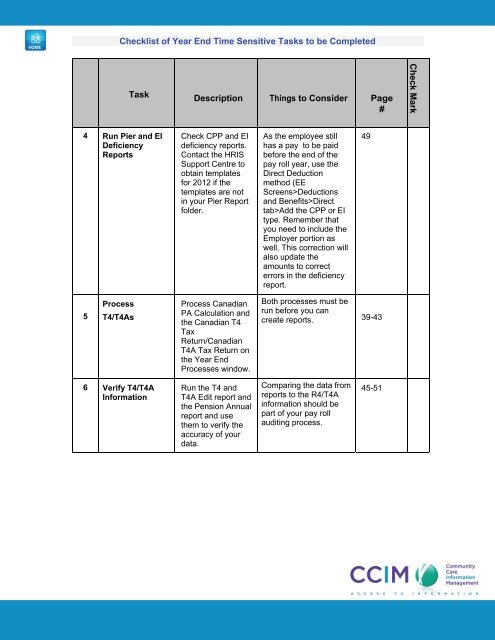

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>TaskDescription Things <strong>to</strong> Consider Page#Check Mark4 Run Pier and EIDeficiencyReportsCheck CPP and EIdeficiency reports.Contact the HRISSupport Centre <strong>to</strong>obtain templatesfor 2012 if thetemplates are notin your Pier Reportfolder.As the employee stillhas a pay <strong>to</strong> <strong>be</strong> paid<strong>be</strong>fore the end <strong>of</strong> thepay roll year, use theDirect Deductionmethod (EEScreens>Deductionsand Benefits>Directtab>Add the CPP or EItype. Remem<strong>be</strong>r thatyou need <strong>to</strong> include theEmployer portion aswell. This correction willalso update theamounts <strong>to</strong> correcterrors in the deficiencyreport.495ProcessT4/T4AsProcess CanadianPA Calculation andthe Canadian T4TaxReturn/CanadianT4A Tax Return onthe <strong>Year</strong> <strong>End</strong>Processes window.Both processes must <strong>be</strong>run <strong>be</strong>fore you cancreate reports. 39-436 Verify T4/T4AInformationRun the T4 andT4A Edit report andthe Pension Annualreport and usethem <strong>to</strong> verify theaccuracy <strong>of</strong> yourdata.Comparing the data fromreports <strong>to</strong> the R4/T4Ainformation should <strong>be</strong>part <strong>of</strong> your pay rollauditing process.45-51