Checklist of Year End Time Sensitive Tasks to be Completed - CCIM

Checklist of Year End Time Sensitive Tasks to be Completed - CCIM

Checklist of Year End Time Sensitive Tasks to be Completed - CCIM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

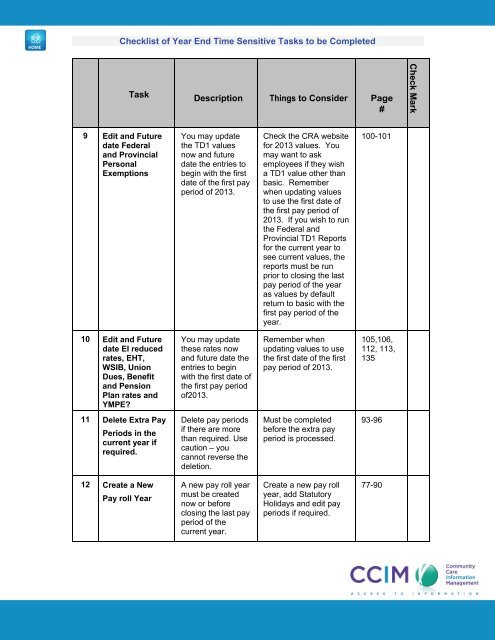

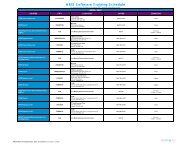

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>TaskDescription Things <strong>to</strong> Consider Page#Check Mark9 Edit and Futuredate Federaland ProvincialPersonalExemptionsYou may updatethe TD1 valuesnow and futuredate the entries <strong>to</strong><strong>be</strong>gin with the firstdate <strong>of</strong> the first payperiod <strong>of</strong> 2013.Check the CRA websitefor 2013 values. Youmay want <strong>to</strong> askemployees if they wisha TD1 value other thanbasic. Remem<strong>be</strong>rwhen updating values<strong>to</strong> use the first date <strong>of</strong>the first pay period <strong>of</strong>2013. If you wish <strong>to</strong> runthe Federal andProvincial TD1 Reportsfor the current year <strong>to</strong>see current values, thereports must <strong>be</strong> runprior <strong>to</strong> closing the lastpay period <strong>of</strong> the yearas values by defaultreturn <strong>to</strong> basic with thefirst pay period <strong>of</strong> theyear.100-10110 Edit and Futuredate EI reducedrates, EHT,WSIB, UnionDues, Benefitand PensionPlan rates andYMPE?You may updatethese rates nowand future date theentries <strong>to</strong> <strong>be</strong>ginwith the first date <strong>of</strong>the first pay period<strong>of</strong>2013.Remem<strong>be</strong>r whenupdating values <strong>to</strong> usethe first date <strong>of</strong> the firstpay period <strong>of</strong> 2013.105,106,112, 113,13511 Delete Extra PayPeriods in thecurrent year ifrequired.Delete pay periodsif there are morethan required. Usecaution – youcannot reverse thedeletion.Must <strong>be</strong> completed<strong>be</strong>fore the extra payperiod is processed.93-9612 Create a NewPay roll <strong>Year</strong>A new pay roll yearmust <strong>be</strong> creatednow or <strong>be</strong>foreclosing the last payperiod <strong>of</strong> thecurrent year.Create a new pay rollyear, add Statu<strong>to</strong>ryHolidays and edit payperiods if required.77-90