Checklist of Year End Time Sensitive Tasks to be Completed - CCIM

Checklist of Year End Time Sensitive Tasks to be Completed - CCIM

Checklist of Year End Time Sensitive Tasks to be Completed - CCIM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

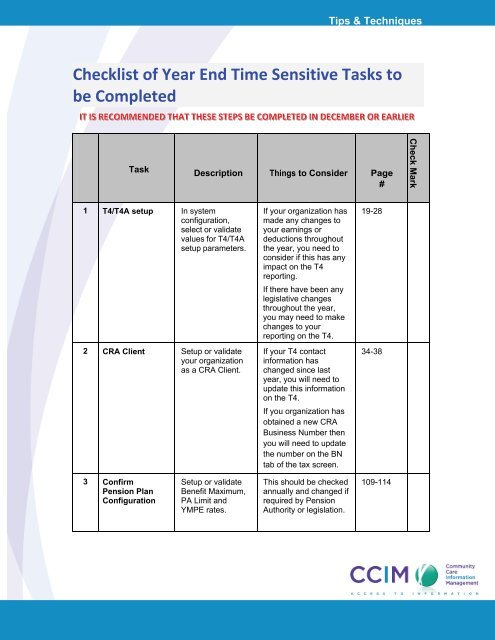

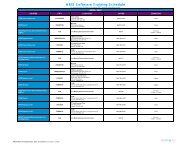

Tips & Techniques<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong><strong>be</strong> <strong>Completed</strong>ITT I ISS I RREECCOMMEENDEED TTHAATT TTHEESSEE SSTTEEPPSS BBEE CCOMPPLLEETTEED IN I DEECCEEMBBEERR ORR EEAARRLLI IEERRTaskDescription Things <strong>to</strong> Consider Page#Check Mark1 T4/T4A setup In systemconfiguration,select or validatevalues for T4/T4Asetup parameters.2 CRA Client Setup or validateyour organizationas a CRA Client.If your organization hasmade any changes <strong>to</strong>your earnings ordeductions throughoutthe year, you need <strong>to</strong>consider if this has anyimpact on the T4reporting.If there have <strong>be</strong>en anylegislative changesthroughout the year,you may need <strong>to</strong> makechanges <strong>to</strong> yourreporting on the T4.If your T4 contactinformation haschanged since lastyear, you will need <strong>to</strong>update this informationon the T4.If you organization hasobtained a new CRABusiness Num<strong>be</strong>r thenyou will need <strong>to</strong> updatethe num<strong>be</strong>r on the BNtab <strong>of</strong> the tax screen.19-2834-383 ConfirmPension PlanConfigurationSetup or validateBenefit Maximum,PA Limit andYMPE rates.This should <strong>be</strong> checkedannually and changed ifrequired by PensionAuthority or legislation.109-114

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>TaskDescription Things <strong>to</strong> Consider Page#Check Mark4 Run Pier and EIDeficiencyReportsCheck CPP and EIdeficiency reports.Contact the HRISSupport Centre <strong>to</strong>obtain templatesfor 2012 if thetemplates are notin your Pier Reportfolder.As the employee stillhas a pay <strong>to</strong> <strong>be</strong> paid<strong>be</strong>fore the end <strong>of</strong> thepay roll year, use theDirect Deductionmethod (EEScreens>Deductionsand Benefits>Directtab>Add the CPP or EItype. Remem<strong>be</strong>r thatyou need <strong>to</strong> include theEmployer portion aswell. This correction willalso update theamounts <strong>to</strong> correcterrors in the deficiencyreport.495ProcessT4/T4AsProcess CanadianPA Calculation andthe Canadian T4TaxReturn/CanadianT4A Tax Return onthe <strong>Year</strong> <strong>End</strong>Processes window.Both processes must <strong>be</strong>run <strong>be</strong>fore you cancreate reports. 39-436 Verify T4/T4AInformationRun the T4 andT4A Edit report andthe Pension Annualreport and usethem <strong>to</strong> verify theaccuracy <strong>of</strong> yourdata.Comparing the data fromreports <strong>to</strong> the R4/T4Ainformation should <strong>be</strong>part <strong>of</strong> your pay rollauditing process.45-51

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>TaskDescription Things <strong>to</strong> Consider Page#Check Mark7 MakeAdjustmentsAdjust deductionsand pension planvalues as required.Required adjustmentsmay <strong>be</strong> made at anytime in the pay roll yearup <strong>to</strong> processing yourlast pay period <strong>of</strong> theyear.Adjustments made afterprocessing the last payperiod <strong>of</strong> the year can <strong>be</strong>made on a special payprior <strong>to</strong> closing the payperiod. Once the last payperiod has <strong>be</strong>en closeadjustments can nolonger <strong>be</strong> made.53-558 Pay PeriodEventsIt is recommendedthat Pay PeriodEvents for the newyear <strong>be</strong> set up atthis time.Pay Period Events must<strong>be</strong> set up <strong>be</strong>fore youclose the pay periodand <strong>be</strong>fore the PayPeriod Event will occur.In other words, if anyrollovers will occur withthe first pay period <strong>of</strong>the year, you must setup the Pay PeriodEvent prior <strong>to</strong> closingthe last pay period <strong>of</strong>the year at the latest.82-86

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>TaskDescription Things <strong>to</strong> Consider Page#Check Mark9 Edit and Futuredate Federaland ProvincialPersonalExemptionsYou may updatethe TD1 valuesnow and futuredate the entries <strong>to</strong><strong>be</strong>gin with the firstdate <strong>of</strong> the first payperiod <strong>of</strong> 2013.Check the CRA websitefor 2013 values. Youmay want <strong>to</strong> askemployees if they wisha TD1 value other thanbasic. Remem<strong>be</strong>rwhen updating values<strong>to</strong> use the first date <strong>of</strong>the first pay period <strong>of</strong>2013. If you wish <strong>to</strong> runthe Federal andProvincial TD1 Reportsfor the current year <strong>to</strong>see current values, thereports must <strong>be</strong> runprior <strong>to</strong> closing the lastpay period <strong>of</strong> the yearas values by defaultreturn <strong>to</strong> basic with thefirst pay period <strong>of</strong> theyear.100-10110 Edit and Futuredate EI reducedrates, EHT,WSIB, UnionDues, Benefitand PensionPlan rates andYMPE?You may updatethese rates nowand future date theentries <strong>to</strong> <strong>be</strong>ginwith the first date <strong>of</strong>the first pay period<strong>of</strong>2013.Remem<strong>be</strong>r whenupdating values <strong>to</strong> usethe first date <strong>of</strong> the firstpay period <strong>of</strong> 2013.105,106,112, 113,13511 Delete Extra PayPeriods in thecurrent year ifrequired.Delete pay periodsif there are morethan required. Usecaution – youcannot reverse thedeletion.Must <strong>be</strong> completed<strong>be</strong>fore the extra payperiod is processed.93-9612 Create a NewPay roll <strong>Year</strong>A new pay roll yearmust <strong>be</strong> creatednow or <strong>be</strong>foreclosing the last payperiod <strong>of</strong> thecurrent year.Create a new pay rollyear, add Statu<strong>to</strong>ryHolidays and edit payperiods if required.77-90

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>TaskDescription Things <strong>to</strong> Consider Page#Check Mark13 Defining RetroDates for Prior<strong>Year</strong>In order for thesystem <strong>to</strong> correctlyprocess prior yearretro in the newyear, you mustsetup dates thatdefine what isconsidered "prioryear."This only needs <strong>to</strong> <strong>be</strong>considered if anychanges have <strong>be</strong>enmade <strong>to</strong> your retro date.This needs <strong>to</strong> <strong>be</strong> doneprior <strong>to</strong> running theretro.134TTO BBEE CCOMPPLLEETTEED AAFFTTEERR TTHEE LLAASSTT PPRROCCEESSSSI ING OFF TTHEE YYEEAARR AAND PPRRI IORR TTOCCLLOSSI ING TTHEE LLAASSTT PPAAYY PPEERRI IOD OFFTTHEE YYEEAARRTask Description Things <strong>to</strong> Consider Page#Check Mark14 Process PA, T4and T4AIt is recommended <strong>to</strong>process the PA, T4and T4A processesat this time.These processes must<strong>be</strong> run <strong>be</strong>fore you cancreate reports.39-4315 Verify T4/T4AInformationRun the T4 and T4AEdit reports and thePension Annualreport and use them<strong>to</strong> verify theaccuracy <strong>of</strong> yourdata.Compare <strong>to</strong>tals <strong>to</strong> theCRA Remittancereport, this should <strong>be</strong>part <strong>of</strong> your regularpay roll auditingprocess.45-51

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>Task Description Things <strong>to</strong> Consider Page#Check Mark16 MakeAdjustments <strong>to</strong>CPP or EIIf there are anyadjustments required<strong>to</strong> CPP or EI, theycan <strong>be</strong> processed atthis time under theSpecial <strong>Time</strong>cardprior <strong>to</strong> Closing thelast Pay Period <strong>of</strong>the year.Adjustments madeafter closing your lastpay period <strong>of</strong> the yearwill not <strong>be</strong> reflected inyour T4s.To use the Special<strong>Time</strong>card process:Special timecard,Transaction Type = EEDeduction +Transaction Type =Employercontributions. Thisshould include theEmployer portion aswell.This method will createan AccountsReceivable item thatyour organization willneed <strong>to</strong> determinewhether <strong>to</strong> absorb orrecover from theemployee.PayrollGuidepage 18417 MakeAdjustments <strong>to</strong>Earnings orDeductionsIf any adjustmentsare required, theycan <strong>be</strong> processed atthis time under theSpecial <strong>Time</strong>cardprior <strong>to</strong> closing thelast Pay Period <strong>of</strong>the year.Adjustments madeafter closing yourlast pay period <strong>of</strong> theyear will not <strong>be</strong>reflected in your T4sor the GL for thecurrent year.To use the Special<strong>Time</strong>card process:Special timecard,Transaction Type =Earnings or =Deductions.PayrollGuidepage 18418 ProcessT4/T4AsProcess CanadianPA Calculation andthe Canadian T4 TaxReturn/CanadianT4A Tax Return onthe <strong>Year</strong> <strong>End</strong>Processes window.Both processes must<strong>be</strong> run <strong>be</strong>fore you cancreate reports.39-43

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>Task Description Things <strong>to</strong> Consider Page#Check Mark19 Print T4s andT4AsRun the T4 reportand T4A report <strong>to</strong>print T4s and T4As.Use the Order By andFilter functionality inthe Report Tool. Forexample, orderalpha<strong>be</strong>tically and filter<strong>to</strong> run the T4s or T4Asby department orfacility.58-6420 Pay PeriodEvents for thefinal payperiod <strong>of</strong> theyearPay Period Eventsmay need <strong>to</strong> <strong>be</strong> setup at this time if thiswas not completedin Decem<strong>be</strong>r. IE:Rolling bankbalances, VacationRollovers.Pay Period Eventsmust <strong>be</strong> set up prior <strong>to</strong>closing the pay periodprior <strong>to</strong> when the PayPeriod Event willoccur. IE: If anyRollovers will occurwith the first payperiod <strong>of</strong> the year youmust set up the PayPeriod Event prior <strong>to</strong>closing the last payperiod <strong>of</strong> the year atthe latest.If any Pay PeriodEvents will occur laterin the new year theycan <strong>be</strong> set up now orprior <strong>to</strong> closing the payperiod prior <strong>to</strong> thosePay Period Eventsoccurring.82- 7

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>Task Description Things <strong>to</strong> Consider Page#Check Mark21 Edit and Futuredate Federaland ProvincialPersonalExemptionsIf this was notcompleted inDecem<strong>be</strong>r you maywish <strong>to</strong> do so now.You may update theTD1 values now andfuture date the entries<strong>to</strong> <strong>be</strong>gin with the firstdate <strong>of</strong> the first payperiod <strong>of</strong>2013.Or, you can also entervalues with your firstprocessing <strong>of</strong> the year.If you wish <strong>to</strong> run theFederal and ProvincialTD1 Reports for thecurrent year <strong>to</strong> seecurrent values, thereports must <strong>be</strong> runprior <strong>to</strong> closing the lastpay period <strong>of</strong> the yearas values by defaultreturn <strong>to</strong> basic with thefirst pay period <strong>of</strong> theyear.TTHEESSEE SSTTEEPPSS MUSSTT BBEE CCOMPPLLEETTEED NOW BBEEFFORREE CCLLOSSI ING YYOURR LLAASSTT PPAAYY PPEERRI IODOFFTTHEE YYEEAARR IFF I TTHEEYY WEERREE NOTT CCOMPPLLEETTEED IN I DEECCEEMBBEERR. .Task Description Things <strong>to</strong> Consider Page#Check Mark22 Create a NewPay roll <strong>Year</strong>23 Defining RetroDates for Prior<strong>Year</strong>A new pay roll year must<strong>be</strong> created now if notalready completed.In order for the system <strong>to</strong>correctly process prioryear retro in the new year,you must setup dates thatdefine what is considered"prior year."Create a new pay roll year, addStatu<strong>to</strong>ry Holidays and edit payperiods if required.This only needs <strong>to</strong> <strong>be</strong> consideredif any changes have <strong>be</strong>en made<strong>to</strong> your retro date and must <strong>be</strong>completed <strong>be</strong>fore running theretro.

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>24 Steps <strong>to</strong>Complete nowif done soPlease review tasks <strong>to</strong> <strong>be</strong>done in “Decem<strong>be</strong>r orearlier” above andcomplete them now if theywere not completed.TTO BBEE CCOMPPLLEETTEED AAFFTTEERR TTHEE QHRR HRRI ISS YYEEAARR EEND UPPGRRAADEE ON JAANUAARRYY J 1122, , 22001133AAND PPRRI IORR TTO PPRROCCEESSSSI ING AAND PPRRI INTTI ING YYOURR TT44SS, , TT44AASS. .Description Things <strong>to</strong> Consider Page#Check Mark25 Retire and Pullin new <strong>Year</strong><strong>End</strong> FormsClients new <strong>to</strong> HRIS in2012: You will need <strong>to</strong> pullin new year end forms.<strong>Year</strong> end forms include the formsapproval num<strong>be</strong>r from the CRA.Clients who were live for2011 year end: you willonly need <strong>to</strong> retire oldforms and pull in newforms if CRA makeschanges <strong>to</strong> the year endforms.26 ProcessT4/T4AsProcess Canadian PACalculation and theCanadian T4.Both processes must <strong>be</strong> run<strong>be</strong>fore you can create reports.39-43Tax Return/Canadian T4ATax Return on the <strong>Year</strong><strong>End</strong> Processes window.27 Verify T4/T4AInformationRun the T4 and T4A Editreport and the PensionAnnual report and usethem <strong>to</strong> verify the accuracy<strong>of</strong> your data.Comparing the data from reports<strong>to</strong> the R4/T4A information should<strong>be</strong> part <strong>of</strong> your pay roll auditingprocess.45-51

<strong>Checklist</strong> <strong>of</strong> <strong>Year</strong> <strong>End</strong> <strong>Time</strong> <strong>Sensitive</strong> <strong>Tasks</strong> <strong>to</strong> <strong>be</strong> <strong>Completed</strong>Description Things <strong>to</strong> Consider Page#Check Mark28 Adjustments -Edit T4 T4AInformationAdjustments after closingthe last pay period <strong>of</strong> theyear can only <strong>be</strong> made <strong>to</strong>the <strong>Year</strong> <strong>End</strong> Window.If any YTD adjustments need <strong>to</strong><strong>be</strong> made <strong>to</strong> the T4 or T4A theycan only <strong>be</strong> made in the <strong>Year</strong><strong>End</strong> Window. These adjustmentswill not <strong>be</strong> reflected in your GL.Values in the <strong>Year</strong> <strong>End</strong> Windowwill <strong>be</strong> overwritten if T4s andT4As are regenerated and if“Allow” Overwrite is selected.56-5729 Print T4s andT4AsRun the T4 report and T4Areport <strong>to</strong> print T4s andT4As.Use the Order By and Filterfunctionality in the Report Tool.For example, orderalpha<strong>be</strong>tically and filter <strong>to</strong> run theT4s or T4As by department orfacility.58-6430 Export T4 T4AInformationExport data using the T4and T4A Export inQuadrant by February 28,2013.If your employee count is 50 ormore, you must export your datain an XML format.You will need a Web Accesscode from the CRA <strong>to</strong> transmityour file electronically. If this isyour first year filing electronicallyyou may not have this code, youcan call CRA at 1-877-322-7849<strong>to</strong> request one.64-69