Download section (pdf) - Swiss Life - Online Report

Download section (pdf) - Swiss Life - Online Report

Download section (pdf) - Swiss Life - Online Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

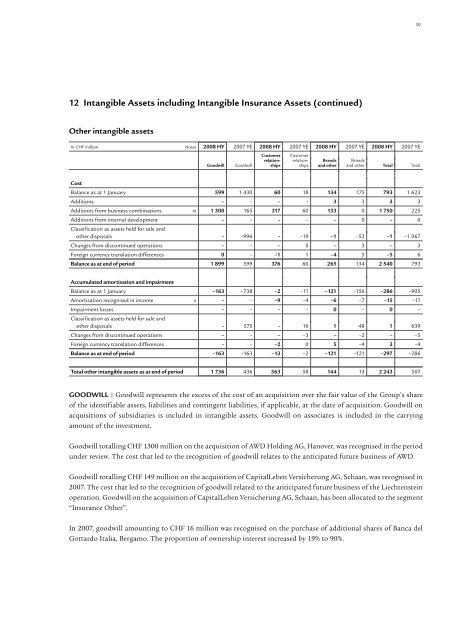

3012 Intangible Assets including Intangible Insurance Assets (continued)Other intangible assetsIn CHF million Notes 2008 HY 2007 YE 2008 HY 2007 YE 2008 HY 2007 YE 2008 HY 2007 YECustomer Customerrelation- relation- Brands BrandsGoodwill Goodwill ships ships and other and other Total TotalCostBalance as at 1 January 599 1 430 60 18 134 175 793 1 623Additions – – – – 3 3 3 3Additions from business combinations 19 1 300 165 317 60 133 0 1 750 225Additions from internal development – – – – – 0 – 0Classification as assets held for sale andother disposals – –996 – –19 –1 –52 –1 –1 067Changes from discontinued operations – – – 0 – 3 – 3Foreign currency translation differences 0 – –1 1 –4 5 –5 6Balance as at end of period 1 899 599 376 60 265 134 2 540 793Accumulated amortisation and impairmentBalance as at 1 January –163 –738 –2 –11 –121 –156 –286 –905Amortisation recognised in income 6 – – –9 –4 –6 –7 –15 –11Impairment losses – – – – 0 – 0 –Classification as assets held for sale andother disposals – 575 – 16 1 48 1 639Changes from discontinued operations – – – –3 – –2 – –5Foreign currency translation differences – – –2 0 5 –4 3 –4Balance as at end of period –163 –163 –13 –2 –121 –121 –297 –286Total other intangible assets as at end of period 1 736 436 363 58 144 13 2 243 507GOODWILL | Goodwill represents the excess of the cost of an acquisition over the fair value of the Group’s shareof the identifiable assets, liabilities and contingent liabilities, if applicable, at the date of acquisition. Goodwill onacquisitions of subsidiaries is included in intangible assets. Goodwill on associates is included in the carryingamount of the investment.Goodwill totalling CHF 1300 million on the acquisition of AWD Holding AG, Hanover, was recognised in the periodunder review. The cost that led to the recognition of goodwill relates to the anticipated future business of AWD.Goodwill totalling CHF 149 million on the acquisition of CapitalLeben Versicherung AG, Schaan, was recognised in2007. The cost that led to the recognition of goodwill related to the anticipated future business of the Liechtensteinoperation. Goodwill on the acquisition of CapitalLeben Versicherung AG, Schaan, has been allocated to the segment“Insurance Other”.In 2007, goodwill amounting to CHF 16 million was recognised on the purchase of additional shares of Banca delGottardo Italia, Bergamo. The proportion of ownership interest increased by 19% to 90%.