Download section (pdf) - Swiss Life - Online Report

Download section (pdf) - Swiss Life - Online Report

Download section (pdf) - Swiss Life - Online Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

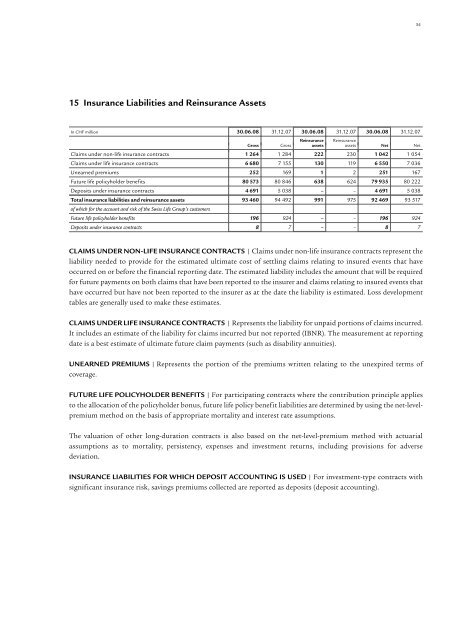

3415 Insurance Liabilities and Reinsurance AssetsIn CHF million 30.06.08 31.12.07 30.06.08 31.12.07 30.06.08 31.12.07Reinsurance ReinsuranceGross Gross assets assets Net NetClaims under non-life insurance contracts 1 264 1 284 222 230 1 042 1 054Claims under life insurance contracts 6 680 7 155 130 119 6 550 7 036Unearned premiums 252 169 1 2 251 167Future life policyholder benefits 80 573 80 846 638 624 79 935 80 222Deposits under insurance contracts 4 691 5 038 – – 4 691 5 038Total insurance liabilities and reinsurance assets 93 460 94 492 991 975 92 469 93 517of which for the account and risk of the <strong>Swiss</strong> <strong>Life</strong> Group’s customersFuture life policyholder benefits 196 924 – – 196 924Deposits under insurance contracts 8 7 – – 8 7CLAIMS UNDER NON-LIFE INSURANCE CONTRACTS | Claims under non-life insurance contracts represent theliability needed to provide for the estimated ultimate cost of settling claims relating to insured events that haveoccurred on or before the financial reporting date. The estimated liability includes the amount that will be requiredfor future payments on both claims that have been reported to the insurer and claims relating to insured events thathave occurred but have not been reported to the insurer as at the date the liability is estimated. Loss developmenttables are generally used to make these estimates.CLAIMS UNDER LIFE INSURANCE CONTRACTS | Represents the liability for unpaid portions of claims incurred.It includes an estimate of the liability for claims incurred but not reported (IBNR). The measurement at reportingdate is a best estimate of ultimate future claim payments (such as disability annuities).UNEARNED PREMIUMS | Represents the portion of the premiums written relating to the unexpired terms ofcoverage.FUTURE LIFE POLICYHOLDER BENEFITS | For participating contracts where the contribution principle appliesto the allocation of the policyholder bonus, future life policy benefit liabilities are determined by using the net-levelpremiummethod on the basis of appropriate mortality and interest rate assumptions.The valuation of other long-duration contracts is also based on the net-level-premium method with actuarialassumptions as to mortality, persistency, expenses and investment returns, including provisions for adversedeviation.INSURANCE LIABILITIES FOR WHICH DEPOSIT ACCOUNTING IS USED | For investment-type contracts withsignificant insurance risk, savings premiums collected are reported as deposits (deposit accounting).