Download section (pdf) - Swiss Life - Online Report

Download section (pdf) - Swiss Life - Online Report

Download section (pdf) - Swiss Life - Online Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

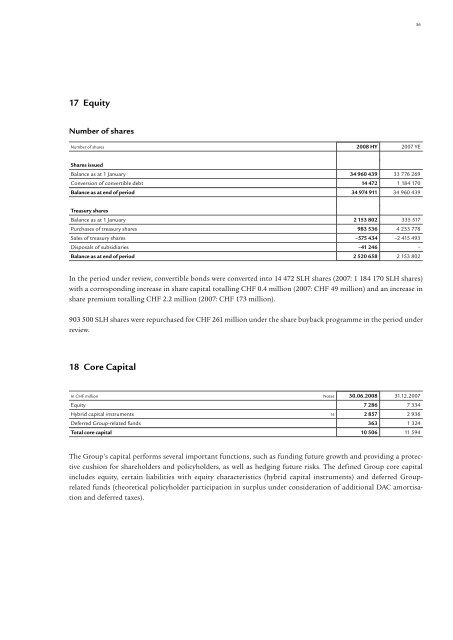

3617 EquityNumber of sharesNumber of shares 2008 HY 2007 YEShares issuedBalance as at 1 January 34 960 439 33 776 269Conversion of convertible debt 14 472 1 184 170Balance as at end of period 34 974 911 34 960 439Treasury sharesBalance as at 1 January 2 153 802 335 517Purchases of treasury shares 983 536 4 233 778Sales of treasury shares –575 434 –2 415 493Disposals of subsidiaries –41 246 –Balance as at end of period 2 520 658 2 153 802In the period under review, convertible bonds were converted into 14 472 SLH shares (2007: 1 184 170 SLH shares)with a corresponding increase in share capital totalling CHF 0.4 million (2007: CHF 49 million) and an increase inshare premium totalling CHF 2.2 million (2007: CHF 173 million).903 500 SLH shares were repurchased for CHF 261 million under the share buyback programme in the period underreview.18 Core CapitalIn CHF million Notes 30.06.2008 31.12.2007Equity 7 286 7 334Hybrid capital instruments 14 2 857 2 936Deferred Group-related funds 363 1 324Total core capital 10 506 11 594The Group’s capital performs several important functions, such as funding future growth and providing a protectivecushion for shareholders and policyholders, as well as hedging future risks. The defined Group core capitalincludes equity, certain liabilities with equity characteristics (hybrid capital instruments) and deferred Grouprelatedfunds (theoretical policyholder participation in surplus under consideration of additional DAC amortisationand deferred taxes).