Errors in good faith: recovering NICs

Errors in good faith: recovering NICs

Errors in good faith: recovering NICs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

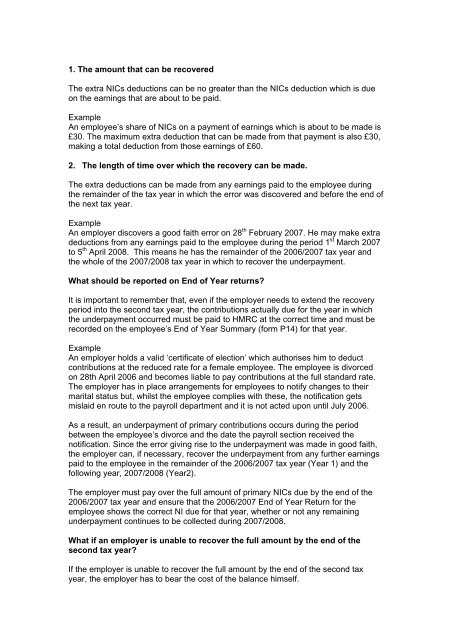

1. The amount that can be recoveredThe extra <strong>NICs</strong> deductions can be no greater than the <strong>NICs</strong> deduction which is dueon the earn<strong>in</strong>gs that are about to be paid.ExampleAn employee’s share of <strong>NICs</strong> on a payment of earn<strong>in</strong>gs which is about to be made is£30. The maximum extra deduction that can be made from that payment is also £30,mak<strong>in</strong>g a total deduction from those earn<strong>in</strong>gs of £60.2. The length of time over which the recovery can be made.The extra deductions can be made from any earn<strong>in</strong>gs paid to the employee dur<strong>in</strong>gthe rema<strong>in</strong>der of the tax year <strong>in</strong> which the error was discovered and before the end ofthe next tax year.ExampleAn employer discovers a <strong>good</strong> <strong>faith</strong> error on 28 th February 2007. He may make extradeductions from any earn<strong>in</strong>gs paid to the employee dur<strong>in</strong>g the period 1 st March 2007to 5 th April 2008. This means he has the rema<strong>in</strong>der of the 2006/2007 tax year andthe whole of the 2007/2008 tax year <strong>in</strong> which to recover the underpayment.What should be reported on End of Year returns?It is important to remember that, even if the employer needs to extend the recoveryperiod <strong>in</strong>to the second tax year, the contributions actually due for the year <strong>in</strong> whichthe underpayment occurred must be paid to HMRC at the correct time and must berecorded on the employee’s End of Year Summary (form P14) for that year.ExampleAn employer holds a valid ‘certificate of election’ which authorises him to deductcontributions at the reduced rate for a female employee. The employee is divorcedon 28th April 2006 and becomes liable to pay contributions at the full standard rate.The employer has <strong>in</strong> place arrangements for employees to notify changes to theirmarital status but, whilst the employee complies with these, the notification getsmislaid en route to the payroll department and it is not acted upon until July 2006.As a result, an underpayment of primary contributions occurs dur<strong>in</strong>g the periodbetween the employee’s divorce and the date the payroll section received thenotification. S<strong>in</strong>ce the error giv<strong>in</strong>g rise to the underpayment was made <strong>in</strong> <strong>good</strong> <strong>faith</strong>,the employer can, if necessary, recover the underpayment from any further earn<strong>in</strong>gspaid to the employee <strong>in</strong> the rema<strong>in</strong>der of the 2006/2007 tax year (Year 1) and thefollow<strong>in</strong>g year, 2007/2008 (Year2).The employer must pay over the full amount of primary <strong>NICs</strong> due by the end of the2006/2007 tax year and ensure that the 2006/2007 End of Year Return for theemployee shows the correct NI due for that year, whether or not any rema<strong>in</strong><strong>in</strong>gunderpayment cont<strong>in</strong>ues to be collected dur<strong>in</strong>g 2007/2008.What if an employer is unable to recover the full amount by the end of thesecond tax year?If the employer is unable to recover the full amount by the end of the second taxyear, the employer has to bear the cost of the balance himself.